Regulatory Easing: Staking Becomes the Safest Investment in Crypto

Author: Thejaswini M A

Source: TOKEN DISPATCH

Translation: Baihua Blockchain

In 1688, captains gathered at Edward Lloyd's coffeehouse in London, seeking those willing to insure their voyages. Wealthy merchants would sign their names beneath the details of the ships, becoming "underwriters," using their personal wealth to guarantee these high-risk journeys.

The more reputable the underwriter, the safer the voyage. The safer the system, the more business it attracts. It was a simple transaction: provide capital, reduce risk for everyone, and earn a share of the profits.

Reading the new guidance from the U.S. Securities and Exchange Commission (SEC), it is clear that cryptocurrency is merely digitizing the model invented by coffeehouse underwriters—people earn returns by putting assets at risk, thereby making the entire system safer and more trustworthy.

Staking. Yes, it’s back.

On May 29, 2025, everything changed. On that day, the U.S. government made it clear that staking would not land you in legal trouble. First, let’s review why this is so important right now.

In staking, you lock up tokens to help secure the network and earn stable returns.

Validators use the staked tokens to verify transactions, propose new blocks, and keep the blockchain running smoothly. In return, the network pays them with newly minted tokens and transaction fees.

Without stakers, proof-of-stake networks like Ethereum would collapse.

Of course, you can stake tokens, but no one knows if the SEC will come knocking one day, claiming you are conducting an unregistered securities offering. This regulatory uncertainty has left many institutions on the sidelines, enviously watching retail stakers earn annualized returns of 3-8%.

The Great Staking Boom

On July 3, Rex-Osprey Solana + Staking ETF officially launched, becoming the first fund in the U.S. to offer direct cryptocurrency exposure and include staking rewards. The fund holds SOL through a Cayman subsidiary and allocates at least half of its holdings to staking.

“America’s first staking crypto ETF,” announced Rex Shares.

They are not alone.

Robinhood has just launched crypto staking services for U.S. customers, initially supporting Ethereum and Solana. Kraken has increased Bitcoin staking through the Babylon protocol, allowing users to earn yields while holding BTC on the native chain.

VeChain has launched a $15 million StarGate staking program. Even Bit Digital has abandoned its entire Bitcoin mining business to focus on Ethereum staking.

What has changed?

Two Major Regulatory Breakthroughs

First, the SEC's May 2025 Staking Guidance.

It clearly states that if you stake your cryptocurrency to help run the blockchain, it is completely legal and not considered a high-risk investment or security.

This covers personal staking, delegating tokens to others, or staking through trusted trading platforms, as long as your staking directly supports the network. This will exclude most staking activities from the “investment contract” definition in the Howey test. It means you no longer need to worry about accidentally violating complex investment regulations by staking and earning rewards.

The only caveat is that anyone promising guaranteed profits, especially mixing staking with lending or using fancy terms like “DeFi bundled guaranteed returns” or “yield farming,” may run into issues.

Second, the CLARITY Act.

This is a bill introduced in Congress aimed at clarifying which government agency is responsible for regulating different digital assets. It specifically protects those running nodes, staking, or using self-custody wallets from being classified as Wall Street brokers.

The bill introduces a new category of digital commodity called “investment contract assets” and establishes standards for digital assets to be classified as securities (regulated by the SEC) or commodities (regulated by the CFTC). The bill also sets a process for the “maturation” of blockchain projects or tokens, allowing them to transition from SEC regulation to CFTC regulation, and sets time limits for SEC reviews to avoid indefinite delays.

So, what does this mean for you?

Now, you can stake cryptocurrencies in the U.S. with more confidence, thanks to the SEC's guidance. If the CLARITY Act passes, staking and participating in cryptocurrency will become simpler and safer.

Staking rewards still need to be taxed as ordinary income when you gain “dominion and control,” and if you later sell the rewards for a profit, you will owe capital gains tax. All staking income, regardless of the amount, must be reported to the IRS.

Who’s in the Spotlight? Ethereum.

No, the price is still around $2,500.

@Beeple

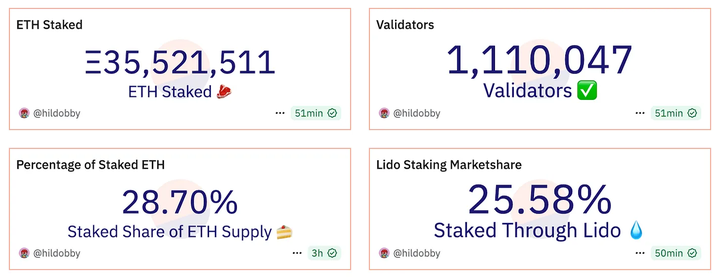

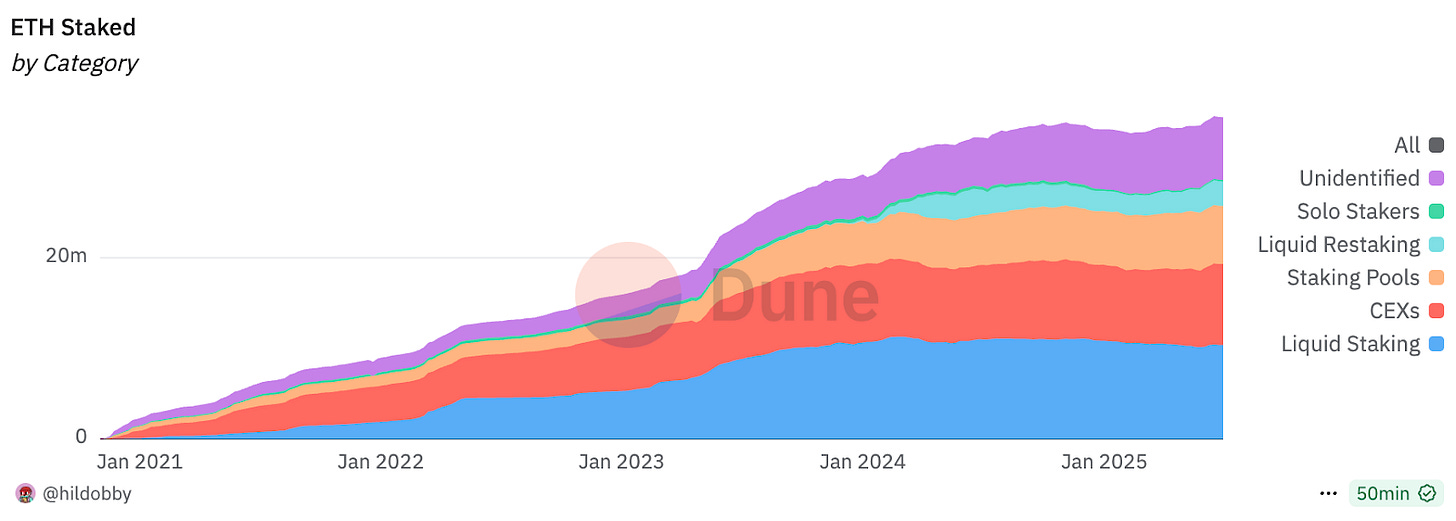

While the price isn’t stunning, Ethereum’s staking data shows a significant change. The amount of staked ETH has reached an all-time high, exceeding 35 million, accounting for nearly 30% of the total supply. Although this trend has been ongoing for months, the underlying infrastructure has suddenly become more important.

@Dune

What’s happening in corporate boardrooms?

BitMine Immersion Technologies has just raised $250 million to purchase and stake Ethereum, with Fundstrat’s Tom Lee serving as its chairman. The company bets that staking rewards combined with potential price appreciation will outperform traditional treasury assets.

SharpLink Gaming is doubling down on this strategy, expanding its ETH treasury to 198,167 tokens and staking 100% of its holdings. In just one week in June, they earned 102 ETH in staking rewards. Locking up tokens yields free capital.

Meanwhile, Ethereum ETF issuers are lining up for staking approvals. Bloomberg analysts predict a 95% chance that staking ETFs will receive regulatory green lights in the coming months. BlackRock’s head of digital assets called staking a “game changer” for Ethereum ETFs, and he may not be wrong.

If approved, these staking ETFs could reverse the outflows that have plagued Ethereum funds since their launch. Since you can gain both price exposure and yield simultaneously, why settle for just price exposure?

@VitalikButerin

Cryptocurrency Speaks Wall Street’s Language

For years, traditional finance has struggled to understand the value proposition of cryptocurrency. Digital gold? Perhaps. Programmable money? Sounds complicated. Decentralized applications? What’s wrong with centralized applications?

But yield? Wall Street understands yield. Of course, bond yields have rebounded from near-zero lows in 2020, with one-year treasury yields around 4%. But a regulated crypto fund that can generate 3-5% annualized staking yields while providing potential upside in the underlying asset? That looks very attractive.

This is about legitimacy. When pension funds can buy Ethereum exposure through a regulated ETF and earn yields by securing the network, it’s a big deal.

The network effects are already showing. As more institutions participate in staking, the network becomes more secure. The more secure the network, the more users and developers it attracts. As adoption increases, transaction fees rise, and staking rewards grow. It’s a virtuous cycle benefiting all participants.

You don’t need to understand blockchain technology or believe in decentralization to appreciate an asset that pays you for holding it. You don’t need to subscribe to Austrian economics or distrust central banks to appreciate a productive capital. You just need to understand that the network needs security, and those providing security deserve to be compensated.

That’s all for today. See you next week for another in-depth discussion.

Until then… hodl tight.

Article link: https://www.hellobtc.com/kp/du/07/5924.html

Source: https://www.thetokendispatch.com/p/wall-streets-staking-rush

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。