Compiled by: Jerry, ChainCatcher

Last Week's Performance of Crypto Spot ETFs

US Bitcoin Spot ETF Net Inflow of $769 Million

Last week, the US Bitcoin spot ETF had a net inflow of $769 million over three days, bringing the total net assets to $137.6 billion.

Eight ETFs were in a net inflow state last week, with inflows mainly from IBIT, FBTC, and ARKB, which saw inflows of $336 million, $248 million, and $160 million, respectively.

Data Source: Farside Investors

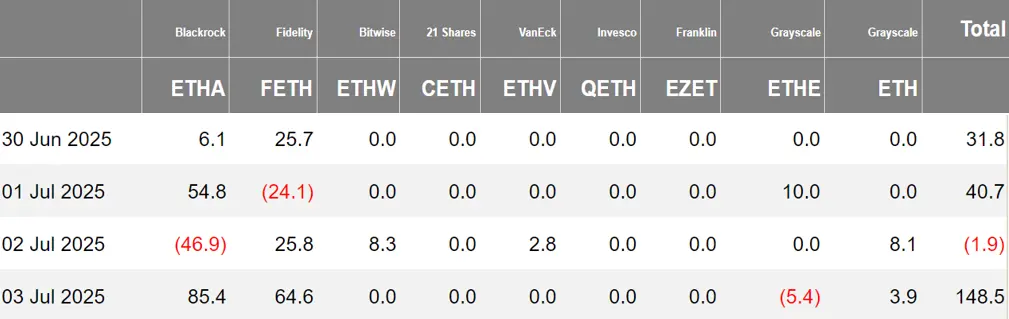

US Ethereum Spot ETF Net Inflow of $219 Million

Last week, the US Ethereum spot ETF had a net inflow of $219 million over four days, with total net assets reaching $10.83 billion.

The inflow last week mainly came from BlackRock's ETHA, with a net inflow of $99.4 million. Three Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Outflow of 18.97 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net outflow of 18.97 Bitcoins, with net assets reaching $45.1 million. The holdings of the issuer, Harvest Bitcoin, decreased to 293.41 Bitcoins, while Huaxia's holdings dropped to 2,220 Bitcoins.

The Hong Kong Ethereum spot ETF had a net inflow of 361.01 Ethereum, with net assets of $5.457 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of July 3, the nominal total trading volume of US Bitcoin spot ETF options was $1.12 billion, with a nominal total long-short ratio of 3.11.

As of July 2, the nominal total open interest of US Bitcoin spot ETF options reached $18.47 billion, with a nominal total long-short ratio of 2.06.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 43.93%.

Data Source: SoSoValue

Overview of Crypto ETF Dynamics Last Week

IBIT has now become BlackRock's third highest income ETF, standing out among 1,197 funds

According to Bloomberg senior ETF analyst Eric Balchunas, IBIT has now become BlackRock's third highest income ETF, standing out among a total of 1,197 funds, just $9 billion away from the top spot.

This is an astonishing achievement for an ETF that is only 1.5 years old (still in its infancy). The attached image shows the top ten funds by income under BlackRock.

Data: REX-OSPREY Solana Staking ETF's first-day trading volume reached $33 million

According to data provided by Bloomberg ETF analyst Eric Balchunas, the first Solana staking ETF (REX-OSPREY SOLANA ETF) SSK had a trading volume of $33 million yesterday, significantly outperforming the average performance of Solana futures ETFs, XRP futures ETFs, and regular ETFs, but still below the trading volume levels of Bitcoin and Ethereum spot ETFs.

US SEC has suspended Grayscale's Digital Large Cap Fund's conversion to ETF for further review

According to CoinDesk, the US Securities and Exchange Commission (SEC) has suspended the plan for Grayscale's Digital Large Cap Fund to convert into an exchange-traded fund (ETF) and has placed it under further review.

The fund was originally planned to be listed on the NYSE Arca platform as a spot ETF covering multiple assets, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple (XRP), and Cardano (ADA).

BlackRock's IBIT annual fee income has surpassed that of its S&P 500 Index ETF IVV

According to Fortune, BlackRock's iShares Bitcoin Trust ETF (ticker: IBIT), with a scale of approximately $75 billion, has attracted significant funds from institutional and retail investors, with inflows occurring for all but one month over the past 18 months.

Based on Bloomberg's rough calculations as of July 1, the fund's expense ratio is 0.25%, with estimated annual fee income of $187.2 million. This figure is slightly higher than the $187.1 million of BlackRock's iShares Core S&P 500 ETF (IVV), which is nearly nine times the size of IBIT, with assets of approximately $624 billion and an expense ratio of only 0.03%.

Bloomberg analyst James Seyffart stated on platform X that the first SOL staking exchange-traded fund REX-Osprey SOL + Staking ETF (SSK) had a good trading performance after listing, with a trading volume of about $8 million in the first 20 minutes.

Anchorage Digital appointed as the equity partner and custodian for REX-Osprey SOL spot ETF

According to The Block, federally chartered digital asset bank Anchorage Digital has been appointed as the exclusive custodian and equity partner for the newly launched REX-Osprey Solana + Staking ETF.

Unlike the numerous spot BTC and ETH ETFs recently registered under the 1933 Act, the new REX-Osprey ETF is governed by the more stringent Investment Company Act of 1940. This distinction means that qualified custodians must hold the assets, and Anchorage Digital is currently the only federally regulated bank authorized to both custody and stake digital assets. The ETF provides direct exposure to SOL and returns staking yields to investors.

Bitwise CIO: Ethereum ETF saw cumulative inflows of $1.17 billion in June

Bitwise CIO Matt Hougan stated that Ethereum ETFs saw inflows of $1.17 billion in June and are expected to accelerate significantly in the second half of the year. If this trend continues, the inflows for Ethereum ETFs in the second half could reach $10 billion.

According to Cryptoslate, public companies purchased a total of 245,510 Bitcoins in the first half of 2025, more than double the amount purchased by ETFs (118,424 BTC) during the same period.

This figure from the beginning of the year represents a 375% increase compared to the 51,653 BTC purchased by companies in the first half of 2024. In contrast, ETF purchases decreased by 56%, with ETFs purchasing as much as 267,878 BTC at the beginning of 2024.

Since each share of an ETF is backed by actual Bitcoins, the number created typically reflects demand from retail investors, hedge funds, and registered investment advisors. In contrast, corporate purchases reflect direct strategic decisions by management. Therefore, the widening gap indicates that boards are increasingly confident in Bitcoin as a reserve asset, comparable to the enthusiasm of retail and institutional investors.

Among them, the company "Strategy" alone purchased 135,600 BTC, accounting for 55% of all public company purchases. In the same period in 2024, this company accounted for 72% of corporate purchases. This indicates that by 2025, corporate demand for Bitcoin is no longer concentrated in a single leading company but has significantly diversified.

Italian bank UniCredit launches a five-year capital-protected product linked to a Bitcoin ETF

According to Bloomberg, Italian banking giant UniCredit SpA announced that it will offer an innovative structured product linked to BlackRock's iShares Bitcoin Trust ETF, providing 100% capital protection. This five-year product, denominated in US dollars, aims to allow investors to participate in the digital asset market while avoiding risks.

According to documents released by Bitcoin Magazine, the well-known design software company Figma recently disclosed that it holds nearly $70 million in Bitcoin exchange-traded funds (ETFs). Additionally, the company has been approved to purchase an additional $30 million in Bitcoin. This move demonstrates Figma's ongoing interest and investment in cryptocurrency as part of its asset allocation.

US SEC is Working on General Listing Standards for Cryptocurrency ETFs

According to crypto journalist Eleanor Terrett, the US Securities and Exchange Commission (SEC) is collaborating with various trading platforms to develop general listing standards for cryptocurrency ETFs, which is currently in the early stages.

Sources indicate that under this framework, if a particular token meets the established standards, the issuer can bypass the 19b-4 application process and directly submit an S-1 registration statement, allowing the trading platform to list it after a 75-day waiting period.

UniCredit Bank in Italy to Offer Structured Products Linked to BlackRock's Bitcoin Spot ETF

According to Bloomberg, UniCredit Bank in Italy will offer a structured product linked to BlackRock's Bitcoin spot ETF for its professional clients. The plan is to issue a five-year dollar-denominated investment certificate linked to the Bitcoin spot ETF, which will provide 100% capital protection at maturity, as confirmed by the bank's memorandum.

The memorandum states that the maximum return cap for this ETF is 85% of performance, with a minimum investment threshold of $25,000.

The First Solana Staking ETF to Begin Trading on July 2

The first Solana staking ETF (REX-Osprey Solana + Staking ETF, ticker $SSK) will begin trading on July 2. This ETF not only provides investment opportunities in Solana (SOL) but also generates native staking rewards through a unique regulatory structure, differing from traditional ETFs. It operates as a Class C company, circumventing regulatory challenges related to staking, thus providing investors with a compliant way to earn staking rewards. The issuance is coordinated with the SEC and may set a precedent for similar products on other PoS blockchains.

The price of Solana has risen over 5% due to expectations surrounding the ETF launch, but it faces resistance from SOL unlocks and token sell-off pressures. The launch of this ETF represents regulatory and structural innovation, and its success could lead to more applications related to PoS networks, pushing digital assets into mainstream portfolios and blurring the lines between on-chain and off-chain finance.

US SEC Delays Decision on Bitwise Ethereum ETF Staking Proposal

The US Securities and Exchange Commission (SEC) has delayed its decision on Bitwise's Ethereum ETF staking proposal and announced a new round of review while soliciting public comments. Previously, Bitwise proposed to add staking functionality to its Ethereum ETF, allowing investors to lock up Ethereum to participate in network security and earn rewards. Bitwise believes this could enhance investor returns without altering the ETF structure.

However, the SEC has expressed concerns about the investment risks and potential conflicts of interest associated with staking, stating that any modifications must ensure investor protection and fair trading. The SEC issued a statement on June 30, indicating the need for further assessment of the impact of staking on investors and establishing a public comment period.

Currently, Bitwise's Ethereum ETF will remain unchanged, holding only spot Ethereum. This decision may impact the staking functionality of similar ETFs in the future. If approved, other fund management companies may also attempt to incorporate staking features. Additionally, Rex-Osprey CEO Gregory King stated that its Solana staking ETF is expected to launch on July 2.

US SEC Confirms Receipt of Grayscale Digital Large Cap Fund's Conversion to ETF Amendment

SEC Approves Conversion of Grayscale Digital Large Cap Fund to ETF

Views and Analysis on Crypto ETFs

Analyst: SEC Standards May Be Lenient Enough to Allow Most of the Top 50 Coins to Be ETF-ified

Bloomberg senior ETF analyst Eric Balchunas commented on the SEC's move to establish general listing standards for cryptocurrency ETFs, stating, “(This is) reasonable, and it’s why we are so optimistic (with a 95% approval rate for most coins). The question is, what will the standards be? We believe these standards may be lenient enough that the vast majority of the top 50 coins could be ETF-ified.”

Bloomberg Analyst: US SEC May Approve Multiple Altcoin ETFs in the Second Half of 2025

Bloomberg ETF analyst James Seyffart released a prediction regarding the approval probabilities for crypto spot ETFs before the end of 2025, indicating that a wave of new ETF approvals is expected in the second half of 2025. Among them, LTC, SOL, and XRP have a 95% approval probability, while DOGE, HBAR, Cardano, Polkadot, and Avalanche are expected to have a 90% approval probability. SUI is projected to have a 60% approval probability, while Tron/TRX and Pengu are expected to have a 50% approval probability.

Analyst: High Probability of US SEC Approving XRP and LTC Spot ETFs This Year

Bloomberg ETF analysts James Seyffart and Eric Balchunas (who have been very accurate in most of their previous predictions) believe that the US Securities and Exchange Commission (SEC) has a 95% probability of approving LTC and XRP spot ETFs this year.

Crypto financial services platform Matrixport analyzed on platform X, stating that Bitcoin is testing recent resistance levels, but market reactions are relatively muted. Although ETF funds continue to flow in and US stocks are reaching new highs driven by retail investors, Bitcoin's upward momentum remains limited, with a weak trend.

As summer approaches, market activity tends to cool down, and such consolidation patterns are not uncommon during this time of year. Meanwhile, expectations regarding Federal Reserve policies are also changing. As more officials begin to question the sustainability of inflation brought about by tariffs, expectations for interest rate cuts are rising, and the Fed's stance is gradually turning dovish.

In this context, traders' attention may no longer be fixated on the progress of tariff negotiations but may shift to closely following stock market trends. The strong performance of US stocks has become a barometer, and the incremental funds brought in by Wall Street through ETFs may become a significant driving force behind a new round of Bitcoin price increases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。