This is not only a discussion on the feasibility of cryptocurrency going mainstream but also a new opportunity to reshape the flow of global capital and talent.

Written by: Deep Tide TechFlow

You project teams are quite bad, trying to trick me into staking?

But this time it seems a bit different.

On July 6, TON officially announced a collaboration with the UAE, starting to offer a 10-year UAE golden visa to TON token stakers. Currently, the application portal is live on TON's official website, where you can apply by filling in your email, full name, and TON wallet address.

In the past, staking was an important way for crypto players to participate in projects and gain benefits and rights.

However, in recent years, the rights associated with staking have gradually become illusory. After market education, participants have become more cautious in choosing to stake, fearing the opportunity cost of locking up their assets and being used as liquidity for others' exits.

Compared to the illusory voting rights and the potential loss of native currency yield from APR, exchanging tokens for a residency right backed by a country, opening a passport for living, working, and investing in the UAE, seems much more tangible.

To some extent, this also means that the "residency rights" of the real world can also be tokenized.

As the wave of tokenization sweeps through asset classes like real estate, government bonds, and stocks, residency rights clearly have no precedent; when "investment immigration" appears in another on-chain form, how operable is it?

$100,000 in tokens, 10-year visa validity

Let's first look at the details of the golden visa described on the TON official website.

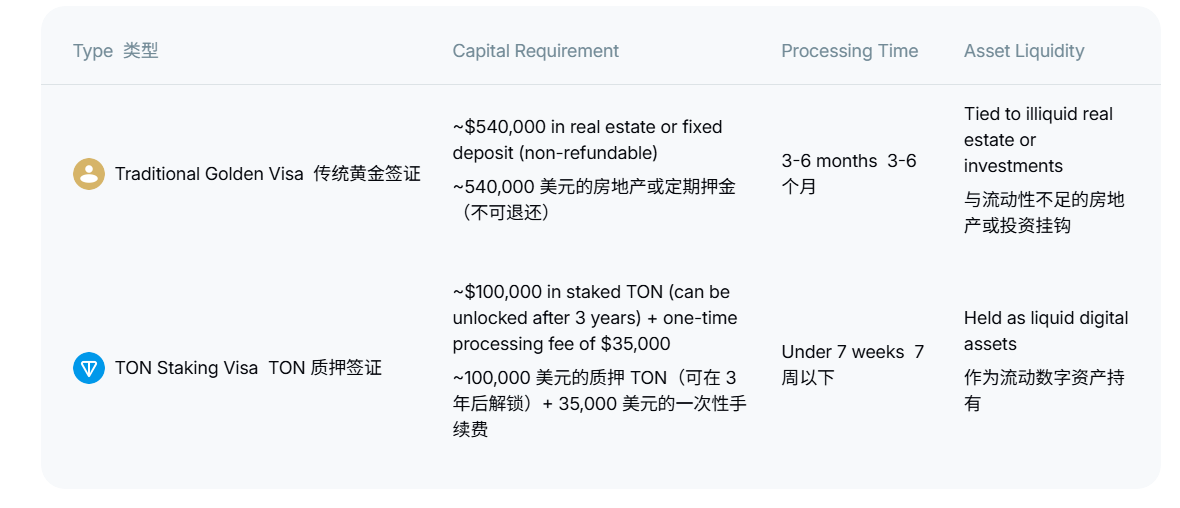

First, investors need to stake TON tokens worth $100,000 (calculated at the market price at the time of staking) and lock them through the Toncoin network's smart contract for 3 years (36 months), during which they cannot withdraw.

Additionally, applicants must pay a one-time fee of $35,000, covering the administrative approval and identity verification costs of the visa.

In other words, the investor's cost includes $135,000 and a 3-year lock-up period.

In terms of benefits, they can be roughly divided into three parts:

Token Yield: During the staking period, investors can earn an annualized yield of about 3-4%, paid in the form of TON tokens.

Residency Rights: Investors can obtain a 10-year golden visa for the UAE.

Family Benefits: The golden visa not only benefits the main applicant but also extends residency rights to their immediate family. Spouses, children, and parents can also be included in the family visa scope, similarly obtaining a 10-year golden visa.

In comparison, to obtain a golden visa through traditional routes, investors need to have at least $540,000 (2 million dirhams) in real estate or equivalent fixed deposits, and they cannot sell the property or withdraw the deposit during the visa application and after obtaining the visa, which is very strictly regulated.

The purpose of this requirement is to ensure that applicants have sufficient financial capacity to stay in the UAE and bring long-term investment to the local economy.

However, for investors, this means that funds are "locked up," losing liquidity and investment flexibility. In contrast, the $100,000 stake in Toncoin can be unlocked after 3 years, retaining higher asset liquidity, which is a key point of its appeal.

Moreover, the traditional route for visa applications also takes at least 3-6 months; TON has compressed this process to under 7 weeks, significantly lowering both the capital and time thresholds of the Toncoin staking plan.

What are the benefits of the golden visa?

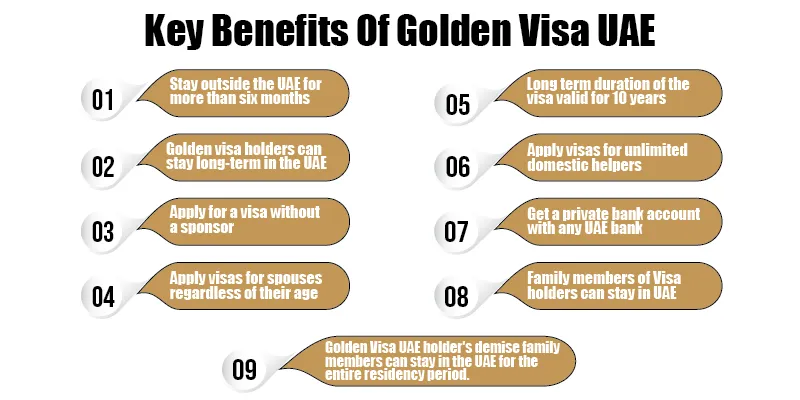

Since its launch in 2019, the UAE golden visa has attracted high-net-worth individuals globally with its flexibility and high added value. The benefits of this visa lie not only in long-term residency rights but also in the conveniences it brings to life, business, and wealth management.

First, the golden visa offers a 10-year validity period, which can be renewed, allowing holders to live, work, and study freely in the UAE. Starting in 2024, the requirement to reside for 6 months each year will be removed, making it suitable for globally mobile digital nomads.

Secondly, the UAE has no personal income tax, capital gains tax, or value-added tax, and foreign exchange flows freely, providing an ideal wealth management environment for both traditional and crypto investors.

From a geographical perspective, the UAE is located at the crossroads of Asia, Africa, and Europe, with Dubai and Abu Dhabi being global business and financial centers. Obtaining a local visa is also beneficial for business development.

Moreover, Dubai's free trade zones (such as DMCC) offer zero tariffs and 100% foreign ownership, making it suitable for crypto enterprises and blockchain startups to establish themselves.

For crypto players and investors, the golden visa is not just a residency right but also an asset allocation tool.

As mentioned earlier, compared to the traditional $540,000 non-liquid investment, the $100,000 stake in the Toncoin plan can be unlocked after 3 years, retaining the liquidity of digital assets. This allows investors to enjoy the tax benefits and business ecosystem of the UAE while flexibly adjusting their investment portfolios when the market rebounds.

Perhaps the appeal of the golden visa lies not only in its material returns but also in the window it opens for the crypto community to the global market.

However, it is important to note that the current description on the TON website states, "During the visa processing, our issuing partner in the UAE will review the application details and provide guidance," which also means that the visa rights provided by TON may not directly come from cooperation with the UAE government but are executed through intermediary agencies.

From illusory staking to tokenized residency rights

In the crypto industry, staking is often linked to voting rights or meager returns but often lacks substantial value.

Many project stakers not only fail to gain governance influence but also miss out on liquidity due to lock-up, becoming "bag holders" when VC tokens are debunked and the market declines. This "illusory" staking has led most players to question its significance:

What is often gained by locking up funds is merely hollow promises.

However, the Toncoin and UAE golden visa plan transforms the $100,000 TON stake into a 10-year residency rights passport.

Relying on Telegram's vast user base, TON has previously focused on social scenarios, but the performance of the token in this cycle seems unsatisfactory. This new play clearly has more topicality.

If the operational process is simple and compliant with regulations, it can be anticipated that a portion of high-net-worth individuals and on-chain big players in the crypto circle will be interested in this play, correspondingly increasing the demand for Toncoin.

Setting aside the $100,000 threshold and various legal systems, compared to other crypto projects, the latter two rights clearly elevate the benefits of staking to another dimension.

Of course, whether staking is worthwhile is subjective. However, even if TON goes to zero in 3 years, this would equate to spending $100,000 to obtain a 10-year residency right in the UAE; whereas if other project tokens go to zero, they might yield nothing.

Additionally, from a broader perspective, the UAE also has ambitions in crypto.

Dubai's "Blockchain Strategy 2020" has attracted over 200 companies to settle, and in 2024, Abu Dhabi will launch a crypto regulatory sandbox, further solidifying its position in the digital economy.

The golden visa plan may be an extension of this ambition; by attracting crypto capital, the UAE can not only enhance its economic competitiveness but also strive for a place in global digital asset governance.

The idea of granting residency rights to investors through staking tokens may have seemed sci-fi a few years ago, but it has now become a reality.

Since the beginning of this year, more companies and governments have begun to implement crypto reserve plans, indicating a trend of cryptocurrency being gradually accepted in more regions of the world. For individuals holding cryptocurrencies, "geographic arbitrage" is also becoming easier.

Imagine a future where there might be a "digital nomad identity market"? Investors could bid for residency rights on-chain, and even some radical countries might tokenize citizenship.

This is not only a discussion on the feasibility of cryptocurrency going mainstream but also a new opportunity to reshape the flow of global capital and talent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。