Over $400 million in financing accumulated, processing $40 trillion in tokenized RWA, how has Canton become the "behind-the-scenes blockchain" of institutional finance?

Written by: KarenZ, Foresight News

This article was first published on July 1.

Updated on July 4: YZi Labs announced an investment in Digital Asset.

On June 24, Digital Asset, the developer of the privacy-focused blockchain Canton, completed a $135 million Series E funding round, led by DRW Venture Capital and Tradeweb Markets. The lineup of investors includes heavyweight players from both traditional finance and the crypto space, such as BNP Paribas, Circle Ventures, Citadel Securities, DTCC, Virtu Financial, Goldman Sachs, IMC, Liberty City Ventures, Optiver, Paxos, Polychain Capital, QCP, Republic Digital, 7RIDGE, and Virtu Financial.

Digital Asset stated that this round of financing will accelerate the implementation of institutional and decentralized finance on the Canton Network and its integration with RWA, further consolidating its extensive deployment across diverse asset classes such as bonds, money market funds, alternative funds, commodities, repos, mortgages, life insurance, and annuities.

It is worth noting that Digital Asset has been established for 11 years, with total financing exceeding $400 million. So, what exactly are Digital Asset and the Canton Network? What are the characteristics of its core technology? Why has it attracted the attention and adoption of multiple traditional financial institutions? What is the background of the core team? Additionally, what is the current progress of Canton, and where is it headed in the future?

Company Positioning and Journey

Digital Asset was founded in 2014 and is headquartered in New York, dedicated to unlocking the potential of cryptocurrency and the ongoing integration of decentralized finance with traditional finance. Its core products include the Canton Network and the DAML smart contract language, which together form an institutional-grade blockchain infrastructure. Digital Asset's total financing has exceeded $400 million.

The Canton Network is an open-source privacy Layer 1 blockchain designed specifically for financial institutions and enterprise applications. Canton achieves cross-application interoperability through the DAML language and the Canton protocol, supporting multi-subnet atomic transactions while ensuring privacy protection, independent scalability, and compliance.

Here is the development timeline of Digital Asset over the past 11 years:

Reference: Digital Asset official website

Team Background

Digital Asset's leadership team has a strong background in finance, technology, and blockchain.

Co-founder and CEO Yuval Rooz: Before founding Digital Asset, Yuval managed the electronic algorithm trading department at DRW, later joined DRW Investment Group, and was also a trader and developer at Citadel. Yuval is also a board member and CFO of the Global Synchronizer Foundation. Notably, Yuval was a member of the Digital Asset Markets Subcommittee of the CFTC's Global Markets Advisory Committee.

Co-founder Don Wilson: Don founded the diversified trading company DRW in 1992, leading DRW to grow to over 2,000 employees globally, expanding into crypto assets (through Cumberland), real estate investment (Convexity), venture capital (DRW VC), and carbon financing solutions (Artemeter).

Co-founder and Network Strategy Officer Eric Saraniecki: Before joining Digital Asset, Eric built a trading platform focused on illiquid commodity markets at DRW Trading and co-founded Cumberland Mining.

Co-founder and Chief Operating Officer Shaul Kfir: Previously served as CTO at two startups in Tel Aviv, with a background in cryptography research.

Chief Technology Officer Ratko Veprek: Co-inventor of the DAML language, joined Digital Asset after its acquisition of Elevence in 2016, and served as the Director of Engineering for Canton before being promoted to CTO.

Canton Network: A Three-Dimensional Breakthrough in Privacy, Scalability, and Compliance

The Canton Network is a global blockchain network designed for financial institutions, equipped with privacy protection features that can connect multiple independent applications built using Digital Asset's smart contract language Daml, thereby linking traditional finance with DeFi and helping traditional financial institutions achieve real-time synchronization of assets, data, and cash across different applications. At the same time, the Canton Network allows each application provider to define the privacy, scalability, permissions, and governance of their applications.

The core positioning of the Canton Network is as a "network of networks," dedicated to providing a more suitable decentralized infrastructure for financial institutions and enterprise applications.

Technical Foundation:

Daml Language: A functional smart contract language with built-in permission management and modular design, supporting cross-application workflow combinations.

Canton Protocol: Implements the ledger model of Daml, coordinating transaction order through synchronization domains, supporting multi-subnet atomic transactions.

Core Features:

- Privacy and Selective Transparency

Achieves default confidentiality of data through the Daml smart contract language, visible only to authorized parties, meeting the privacy needs of financial institutions and enterprises.

Supports "sub-transaction privacy," where different participants can only view the transaction parts relevant to them.

- Independent Scalability

Applications do not need to compete for global resources and can scale independently, avoiding network congestion caused by high load from a single application.

Utilizes sharding technology, where each participant only stores the ledger view relevant to them, enhancing overall network throughput.

- Flexible Governance, Interoperability, and Composability

Application providers can customize governance rules, permissions, and fee structures while supporting atomic transactions across subnets.

Achieves interconnection of heterogeneous networks through "synchronization domains," similar to the open architecture of the internet.

4. Privacy-Enhanced Proof-of-Stakeholder Consensus

Canton employs a "Proof-of-Stakeholder" layered protocol (transaction validation layer and ordering layer). The first phase is a two-phase commit protocol that replicates contracts to relevant stakeholders, allowing parallel verification of transactions; the second phase is the ordering protocol, which timestamps transactions. The ordering protocol operates using Byzantine Fault Tolerance (BFT) algorithms, ensuring the determinism of transaction processing and consensus on transaction order and state among nodes in the network.

5. Compliance Design

Supports data storage and pruning to comply with regulations such as the EU's General Data Protection Regulation (GDPR), while ensuring the immutability of historical data through cryptographic commitments, retaining key audit proofs.

Canton Global Synchronizer and Canton Coin

As mentioned earlier, blockchain applications within the Canton network can achieve atomic transactions across sovereign blockchains using the Global Synchronizer without sacrificing privacy or control. The Global Synchronizer is a decentralized and transparently managed interoperability service of the Canton Network, designed to meet the financial industry's demand for a unified infrastructure to connect, drive liquidity, and unlock the full potential of tokenized assets.

In July 2024, the Linux Foundation established the Global Synchronizer Foundation (GSF) entity to coordinate the governance of the Global Synchronizer and lead the development of the Global Synchronizer ecosystem, with other GSF foundation members including Digital Asset, Broadridge, Cumberland SV, and SBI Digital Asset Holdings. Additionally, the Hyperledger Foundation, hosted by the Linux Foundation, has established a new lab called Splice, allowing anyone in the Canton network to launch their own version of a synchronizer to meet their interoperability needs.

To further promote the adoption and practicality of the Canton Network's Global Synchronizer, organizations running decentralized services voted to introduce a native utility token called Canton Coin. Canton Coin is used to incentivize application builders, users, and infrastructure providers to utilize the Global Synchronizer, rewarding cross-application connectivity.

Canton Coin employs a unique "burn-mint balance" mechanism to ensure that the token supply dynamically adjusts according to actual network demand. The core idea of this mechanism is:

Users destroy Canton Coin to pay fees, reducing the circulating supply.

Service providers (such as validators and application providers) can only mint new tokens by providing practical functionality to the network, increasing the supply.

The long-term goal is to balance the number of Canton Coins burned and minted (stabilizing at 2.5 billion annually), thereby maintaining the stability of the token's value.

It is worth emphasizing that validators and super validators (composed of a validator and a Canton synchronizer node, participating in the Global Synchronizer) earn the right to mint Canton Coin by running nodes and maintaining network security. Early super validators receive a higher proportion of token allocation to encourage network launch. Additionally, application providers can earn Canton Coin by providing services to users, with "Featured Apps" (which require a vote from super validators) eligible for minting rewards of up to 100 times the amount burned (early ecosystem incentives), while non-featured apps can mint a maximum of 80% of the fees into Canton Coin.

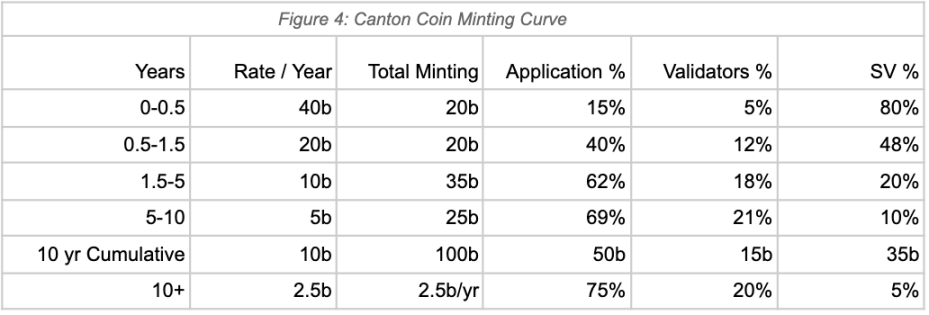

Canton Coin has a fair launch, with no pre-mining or pre-sale. In the first 10 years before the Global Synchronizer operates, the total minting amount of Canton Coin is set at 100 billion, with a distribution ratio of 50% for infrastructure providers and 50% for application providers. After ten years, the annual minting amount will decrease to 2.5 billion, gradually leaning towards application providers. Its economic model ensures long-term stability of token value by dynamically adjusting the supply.

Source: Canton Coin White Paper

From Pilot to Processing $40 Trillion in RWA

Canton is suitable for scenarios requiring high privacy and high concurrency, such as finance, and has successfully supported the on-chain and trading of various asset classes, including bonds, money market funds, and repos.

At the initial disclosure in May 2023, the announced participants included 3Homes, ASX, BNP Paribas, Broadridge, Capgemini, Cboe Global Markets, Cumberland, Deloitte, Deutsche Börse Group, Digital Asset, DRW, Eleox, EquiLend, FinClear, Gambyl, Goldman Sachs, IntellectEU, Liberty City Ventures, Microsoft, Moody's, Paxos, Right Pedal LendOS, S&P Global, SBI Digital Asset Holdings, The Digital Dollar Project, Umbrage, Versana, VERT Capital, Xpansiv, and Zinnia.

In March 2024, Canton completed a comprehensive blockchain pilot. This pilot project provided participants with distributed ledger applications for asset tokenization, fund registration, digital cash, repos, securities lending, and margin management transactions, all of which were able to interoperate through the Canton Network testnet. The pilot brought together 15 asset management companies, 13 banks, 4 custodians, 3 exchanges, and 1 financial market infrastructure provider. BNY Mellon, Broadridge, DRW, EquiLend, Goldman Sachs, Oliver Wyman, and Paxos provided market expertise to the working group throughout the project. Other pilot participants included: abrdn, Baymarkets, BNP Paribas, BOK Financial, Cboe Global Markets, Commerzbank, DTCC, Fiùtur, Generali Investments, Harvest Fund Management, IEX, Nomura, Northern Trust, Pirum, Standard Chartered, State Street, Visa, and Wellington Management, with Deloitte serving as an observer and Microsoft as a supporting partner.

According to Digital Asset, since the mainnet launch of the Canton Network, there have been over 400 ecosystem participants, with tokenized RWA exceeding $40 trillion and monthly trading volume reaching $2 trillion.

According to the latest RedStone report, since 2022, more than half of digital bond issuances have been executed through Canton applications. HSBC's Orion, Goldman Sachs' digital asset platform GS DAP, BNP Paribas' Neobonds, and Broadridge's DLR have all adopted Canton technology for development. In January of this year, Circle announced plans to provide native USDC support on the Canton Network when acquiring Hashnote, the issuer of USYC incubated by Cumberland Labs, enabling private trading and the use of USDC and USYC in the TradFi market.

Summary

The Canton Network fills the gap in existing public chains, combining smart contract functionality with privacy features, providing a viable solution for tokenizing traditional assets. Canton allows financial institutions to achieve asset tokenization while retaining control through its "selective decentralization" design. This architecture makes it an ideal springboard for the digital transformation of traditional financial institutions. For financial institutions seeking digital transformation but constrained by the rigidity of existing systems, Canton offers a progressive path to on-chain integration, with the potential to become a hub connecting traditional finance and decentralized finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。