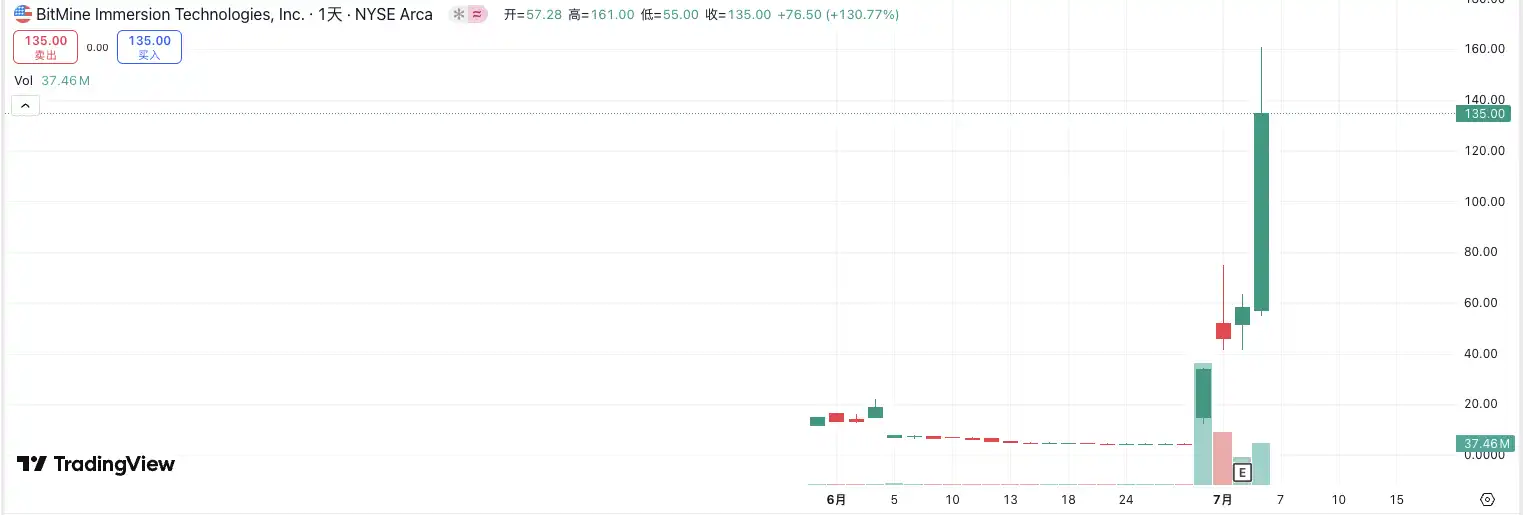

On July 3, Bitcoin mining company BitMine (stock code: BMNR) saw its stock price rise over 130% in a single day. Since the company announced on June 30 that it would raise funds primarily to increase its holdings of ETH, the stock price skyrocketed from $4 to $135 in a short period, an increase of more than 30 times. This astonishing trend not only drove up the stock prices of several related companies such as SharpLink (stock code: SBET) and Bit Digital (stock code: BTBT), but also hinted at a new market trend emerging—the rise of Ethereum's decline strategy, which is gradually sweeping the U.S. stock market.

Why Ethereum

BitMine, a company that once focused on Bitcoin mining, recently announced the completion of a $250 million private placement, issuing 55,555,556 shares at a price of $4.50 per share. The deal was led by MOZAYYX, with participation from well-known investment institutions such as Founders Fund and Pantera. The transaction is expected to close around July 3, 2025, and the funds raised will be used to increase ETH holdings, which will be treated as a core reserve asset. At the same time, the company will continue its mining operations. Before the financing, the company already held $16 million worth of Bitcoin.

Why did this Bitcoin mining company choose ETH as its strategic reserve asset?

This decision reflects the profit pressures faced by Bitcoin mining and the technological transformation of the crypto industry. With the Bitcoin halving in 2024, mining profitability has significantly declined. Bitcoin's PoW (Proof of Work) mechanism is known for its strong security and decentralization, but it comes at the cost of massive energy consumption, consuming between 67 to 240 terawatt-hours annually, with an energy cost of about 830 kilowatt-hours per transaction. This not only brings environmental issues but also forces miners to bear high electricity costs and investments in specialized hardware.

In contrast, Ethereum's shift to a PoS (Proof of Stake) mechanism after the "merge" has demonstrated remarkable energy efficiency. The PoS system eliminates energy-intensive computing demands by allowing validators to stake tokens to participate in network security and transaction validation. As a result, Ethereum's energy consumption has decreased by 99.95%, with the energy cost per transaction only 50 kilowatt-hours. Additionally, the PoS mechanism offers a more attractive profit model: stakers earn passive income by contributing to network security, similar to bank deposit interest. The annualized yield for Ethereum staking typically ranges from 4% to 7%, providing companies with a more stable and predictable cash flow. The emergence of liquid staking derivatives (LSDs) has further improved efficiency, enhanced capital efficiency, and lowered the barriers to entry for staking, significantly increasing the appeal of the Ethereum ecosystem to institutional capital.

With the rapid growth of stablecoin operations on the Ethereum blockchain, a significant portion of the fees generated has come from stablecoin transactions, further driving market demand for ETH. BitMine's decision to make ETH a core reserve asset is based on this advantage.

This transformation aligns with Bit Digital's strategic adjustment. On June 26, Bit Digital announced a complete shift from Bitcoin mining to "Ethereum staking." In the first quarter of 2025, the company produced only 126.5 Bitcoins, an 80% year-on-year decline, facing similar profit challenges as Bitcoin mining companies. However, unlike BitMine, Bit Digital stated it would gradually shut down its Bitcoin mining operations, convert all its Bitcoin holdings into Ethereum, and redeploy net proceeds into ETH assets. Bit Digital has been laying the groundwork for Ethereum staking since 2022 and claims to have established "one of the largest institutional-grade Ethereum staking infrastructures globally."

However, after completing a $150 million public offering, Bit Digital's stock price plummeted 15% at one point, with a cumulative decline of 19% over five days, reflecting market concerns about its abandonment of Bitcoin operations. But as BitMine led the "Ethereum micro-strategy" in early July, Bit Digital's stock price quickly rebounded by 50%, recovering all previous losses.

"ETH Micro-Strategy" Spreads in U.S. Stocks

SharpLink Gaming (stock code: SBET)

Listing Date: May 1997 | Exchange: NASDAQ | Stock Code: SBET | Market Cap: Approximately $600 million

SharpLink Gaming is an online technology company operating in the sports betting and online casino gaming sectors, connecting sports fans with licensed online sports betting operators and providing personalized betting offers. The company's performance has not been ideal, with consecutive years of losses. In 2023, the net profit was -$14.2432 million, and total revenue for 2024 was -$4.5712 million.

On May 27, SharpLink Gaming issued 69,100,313 shares of common stock or equivalent securities to investors at a price of $6.15 per share, expecting total proceeds of approximately $425 million. The funds raised will be used to purchase Ethereum as the company's primary treasury reserve asset. The lead investor for this private placement was Consensys Software Inc., with participation from ParaFi Capital, Electric Capital, Pantera Capital, Galaxy Digital, and others.

After the announcement, SBET's stock price surged over 650% in a single day, with a cumulative increase of 17.56 times over three days, reaching a peak price of $120. Subsequently, the company submitted an S-3 registration statement to the SEC for future securities sales. Although the company clarified that the news was actually misunderstood and did not imply immediate share dilution, the stock price still fell significantly, nearly erasing all recent gains.

Between June 23 and June 30, SharpLink spent approximately $22.8 million to increase its holdings of 9,468 ETH, with an average purchase price of $2,411. The company's total Ethereum holdings have now increased to 198,167 ETH, all of which are staked. Since the strategy began on June 2, approximately 222 ETH staking rewards have been earned. In early July, after stabilizing, the stock price experienced a new round of rebound, reflecting the market's renewed attention and confidence in the "ETH micro-strategy" sector.

Related Reading: "What are 'Coin Stocks' Trading? An Overview of the Hottest Cryptocurrency Concepts in U.S. Stocks"

BTCS Inc (stock code: BTCS)

Listing Date: September 2021 | Exchange: NASDAQ | Stock Code: BTCS | Market Cap: Approximately $53 million

Blockchain technology company BTCS focuses on operating blockchain infrastructure, primarily laying out verification nodes for Ethereum and BNB Chain, crypto asset staking, and on-chain data analysis. On May 14, the company announced a convertible bond financing agreement with ATW Partners, aiming to raise up to $57.8 million, all of which will be used to increase ETH holdings. The first phase of $7.8 million in bonds has been issued, and the remaining $50 million will be advanced in batches depending on negotiation progress. As of June 2, BTCS has invested $11.05 million to purchase 4,450 ETH, increasing its total holdings to 13,500 ETH.

This significant increase in ETH holdings not only further solidifies its strategic position in the PoS ecosystem but is also seen by the market as a strong bet on Ethereum's long-term value. Following the announcement, the company's stock price rose over 50% within half a month.

Conclusion

The "ETH micro-strategy" is becoming a new narrative in the U.S. stock market's crypto sector. The explosive growth of individual stocks like BitMine and BTBT shows that the market is beginning to recognize this model, and the logic of ETH as a reserve asset is taking shape. The stable income, low energy consumption, and stronger capital efficiency brought by Ethereum staking provide companies with a new growth curve. However, whether this wave of growth can be sustained and whether there are speculative elements behind it still requires time and market further verification.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。