Robinhood's approach is somewhat similar to USDC, while Kraken is more aligned with USDT; one is institutional, the other grassroots.

Author: XinGPT

Recently, publicly listed companies in the U.S. like Robinhood and cryptocurrency exchange Kraken have launched stock token services. Let's explore what stock tokens are and why they are worth market attention with XinGPT Research.

Robinhood Leads the Stock Token Innovation Wave

Financial technology giant Robinhood has recently launched its highly anticipated stock tokens in the EU market, aiming to provide European users with a new way to trade stocks. This innovative service allows users to buy and sell derivatives that track stock prices denominated in USD, with Robinhood automatically handling the euro conversion in the background, charging a 0.1% exchange fee.

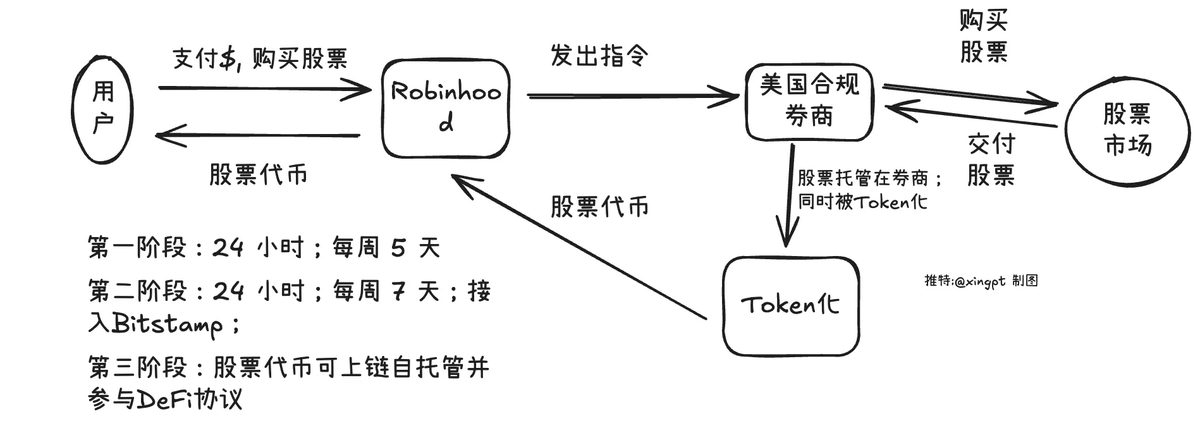

The stock tokenization process is illustrated below:

- Custody and Mapping Mechanism

The core mechanism of Robinhood's stock tokens lies in its unique custody and mapping approach. These tokens are derivatives that track prices (note that they are not mapped securities), with the underlying assets securely held in Robinhood's European accounts by a U.S.-licensed institution. Robinhood Europe is responsible for issuing these contracts and recording them on the blockchain. It is important to note that due to the derivative nature of stock tokens, the corresponding securities can only be held in Robinhood accounts, and users cannot redeem them directly.

- Regulatory Compliance under the EU MiFID II Framework

Robinhood's stock tokens are offered as derivative contracts under the MiFID II (Markets in Financial Instruments Directive II) framework. The Bitstamp exchange, acquired by Robinhood, holds an MTF (Multilateral Trading Facility) license, which complies with the EU's licensing requirements for companies providing derivative trading services. This means that Robinhood's services are subject to relevant regulations in the EU, providing users with a certain level of compliance assurance. However, it is important to note that Robinhood's stock tokens are currently only available in the EU and cannot be traded in the U.S.

- Trading Hours and Corporate Actions Handling

In terms of trading hours, the first phase of Robinhood's stock tokens is available for trading five days a week, from Monday 02:00 to Saturday 02:00 Central European Time/Summer Time.

For corporate actions (such as dividends, stock splits, etc.), Robinhood will execute on behalf of users:

Position Adjustments: For actions like stock splits, reverse splits, stock code changes, or spin-offs, the number of stock tokens in your account may be automatically adjusted to reflect changes in the underlying stocks.

Cash Distributions: For events like mergers, acquisitions, liquidations, or delistings, you may receive cash distributions denominated in euros based on the event.

Dividends: Cash dividends will be processed automatically. You will receive dividends paid in euros, which will appear as cash distributions in your transaction history. There are no exchange fees for dividend payments, but withholding taxes may apply based on your location.

In terms of fund turnover, proceeds from selling stock tokens can be used for trading immediately, with withdrawals available on T+1 days.

- Stock Tokens on the Blockchain

The issuance of Robinhood's stock tokens utilizes blockchain technology, initially based on the Arbitrum blockchain, with plans to migrate to Robinhood's self-built Layer 2 blockchain in the future. This indicates Robinhood's commitment to leveraging blockchain technology to enhance trading efficiency and transparency.

The launch of stock tokens by Robinhood undoubtedly provides European users with more diverse investment options. However, as a new type of derivative, users must fully understand its mechanisms, risks, and relevant regulatory provisions before participating in trading.

- Entering the Private Equity Market: Tokenization of OpenAI and SpaceX

As part of its broader cryptocurrency promotion plan, Robinhood has achieved access to private equity through blockchain technology, launching tokenized stocks of OpenAI and SpaceX for European users. This milestone is made possible by the EU's more flexible regulatory environment, allowing ordinary investors to access shares of these typically private companies that are usually only available to insiders and high-net-worth investors.

Kraken's Design is More Open and Crypto Native

- Custody and Mapping Mechanism

Custody Mechanism: xStocks are purchased and held by Backed Finance, which stores real stocks or ETF assets in compliant third-party custodians (such as U.S. Alpaca Securities, Switzerland's InCore Bank, and Maerki Baumann). Each xStocks token is 1:1 pegged to the underlying asset, and the custody process is strictly regulated to ensure asset safety and transparency. The official website emphasizes that Backed Finance's Proof of Reserves mechanism is regularly verified through Chainlink to ensure the matching of tokens with actual assets.

Mapping Mechanism: xStocks are SPL tokens based on the Solana blockchain, representing partial ownership of the underlying stocks or ETFs. The tokenization process is achieved through smart contracts, with prices synchronized in real-time with traditional markets via Chainlink oracles. Users can transfer xStocks to Solana-compatible wallets (like Phantom) and use them for trading, liquidity mining, or collateral in decentralized finance (DeFi) protocols (such as Raydium, Jupiter, Kamino). The official website specifically notes that xStocks can be redeemed at any time for the cash value of the underlying assets, with a fast and efficient settlement process.

Additional Details: xStocks support fractional ownership, with a minimum investment threshold as low as $1, making it suitable for retail investors. Tokenization eliminates the cumbersome processes of traditional brokers, reducing costs and delays for cross-border investments.

- Regulatory Compliance Licenses

Compliance Framework: Kraken and Backed Finance actively collaborate with global regulatory authorities to ensure that xStocks comply with local laws and regulations. The official website states that Kraken implements strict KYC and AML processes, requiring all users to undergo identity verification. The issuance and trading of xStocks are governed by Backed Finance's regulatory framework, with specific terms available in the Base Prospectus on backed.fi.

Regional Restrictions: xStocks are currently only available to non-U.S. customers, not supporting users from markets such as the U.S., Canada, the UK, the EU, and Australia. Target markets include parts of Europe, Latin America, Africa, and Asia. The official website does not explicitly mention users from mainland China, but X posts indicate that users from mainland China are not restricted from registering, pending further verification.

Regulatory Challenges and Outlook: The official website acknowledges that tokenized securities face a complex international regulatory environment. Kraken is in communication with regulatory authorities and plans to gradually expand the jurisdictions it supports, emphasizing its compliance-first strategy to mitigate legal risks.

Additional Details: Kraken holds a MiCA (Markets in Crypto-Assets) license in the EU, supporting its compliant operations in Europe and potentially laying the groundwork for future expansion of xStocks in parts of Europe.

- Trading Hours and Corporate Actions Handling

Trading Hours: xStocks support 24/5 trading (Monday to Friday all day), breaking the traditional U.S. stock market hours of 9:30 AM to 4:00 PM (Eastern Time). The official website confirms that xStocks can be traded on the Kraken platform or on the Solana chain through compatible wallets (like Phantom). On weekends and U.S. holidays, on-chain trading can still occur, with prices based on the last closing price provided by Chainlink oracles and market supply and demand, which may lead to price fluctuations similar to "prediction markets." Kraken plans to achieve 24/7 trading in the future.

Corporate Actions Handling: The official website clarifies that xStocks holders do not have the voting rights or participation rights in shareholder meetings that traditional shareholders enjoy. Dividends are indirectly distributed through a token price adjustment mechanism, equivalent to airdropping tokens of equal value to users based on their holdings. Other corporate actions (such as stock splits and mergers) are handled by Backed Finance, with the number or value of tokens adjusted accordingly to reflect changes in the underlying assets.

Additional Details: The official website emphasizes that on-chain trading of xStocks supports instant settlement (T+0), significantly improving efficiency compared to the traditional T+2 settlement cycle. Participation in the DeFi ecosystem (such as using them as collateral in Kamino Lend) further enhances the flexibility of xStocks, but liquidity pool depth may be limited during off-hours, necessitating caution regarding slippage risks.

- Supported Blockchains and Issuance Status

Supported Blockchains: xStocks are currently based on the Solana blockchain, using the SPL token standard. The official website states that Solana was chosen as the launch platform due to its high throughput (thousands of transactions per second), low transaction costs (approximately $0.01 per transaction), and mature ecosystem (supporting DeFi protocols like Raydium and Jupiter). Kraken and Backed Finance plan to expand xStocks to other high-performance blockchains (such as Ethereum or Arbitrum) in the future to enhance interoperability and market coverage.

Issuance Status: xStocks are issued by Backed Finance, with the first batch including 60 U.S. stocks and ETFs, such as Apple (AAPL), Tesla (TSLA), NVIDIA (NVDA), Microsoft (MSFT), Google (GOOG), and the SPDR S&P 500 ETF (SPY). The official website indicates that Kraken will launch xStocks on its platform starting June 30, 2025, and plans to continuously increase the variety of supported assets. xStocks are also tradable on Bybit and Solana DeFi platforms (such as Raydium and Kamino Swap), expanding market coverage.

Issuance Background and Ecosystem: Backed Finance was founded by the original core team of DAOStack and has received investments from institutions like Coinbase, focusing on tokenized financial assets. The issuance of xStocks is supported by partners such as Chainlink (price oracle), Raydium, Jupiter, and Kamino, forming the "xStocks Alliance" to provide liquidity, technology, and ecosystem integration for the tokens. The official website emphasizes that xStocks are not only an expansion of Kraken's business but also a milestone in the integration of traditional finance and blockchain.

Additional Details: The official website points out that the issuance volume of xStocks is dynamically adjusted and linked to the purchase and redemption of the underlying assets. Users can trade xStocks on the Kraken platform using fiat currency, cryptocurrencies, or stablecoins (such as USDT), with a low investment threshold of $1, making it suitable for retail investors worldwide.

In comparison, Robinhood has better compliance and coverage among mainstream audiences, and it offers access to non-public stocks; whereas Kraken covers more regions and supports native on-chain trading and DeFi protocols, making it more Crypto Native. To make a somewhat inappropriate analogy, Robinhood's approach is somewhat like USDC, while Kraken is more akin to USDT; one is institutional, the other grassroots.

For startup teams, participating in the issuance of new stock token assets may not necessarily compete with the two large companies, but currently, there are two types of opportunities:

Coverage of niche demographics or regions, similar to the logic of replacing Tiger Brokers, targeting areas and demographics that traditional brokers cannot reach but crypto can;

Financial product innovation, as stock tokens are included in asset pools, startup teams can offer new derivative assets and trading strategies to differentiate themselves from larger exchanges, such as high-leverage contracts, leveraged ETFs, etc.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。