Perpetual DEXs have matured.

Author: Launchy

Translated by: Shenchao TechFlow

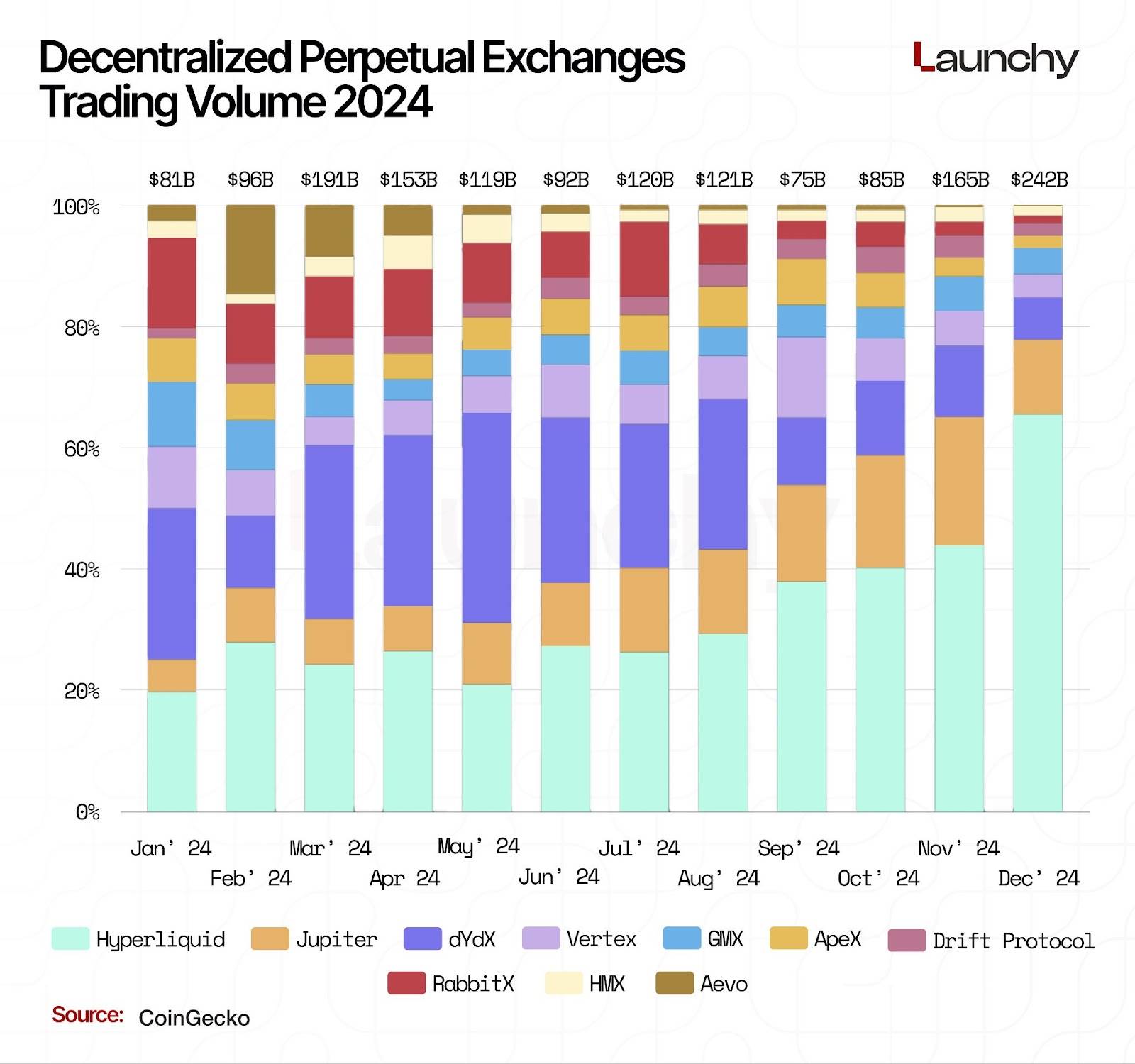

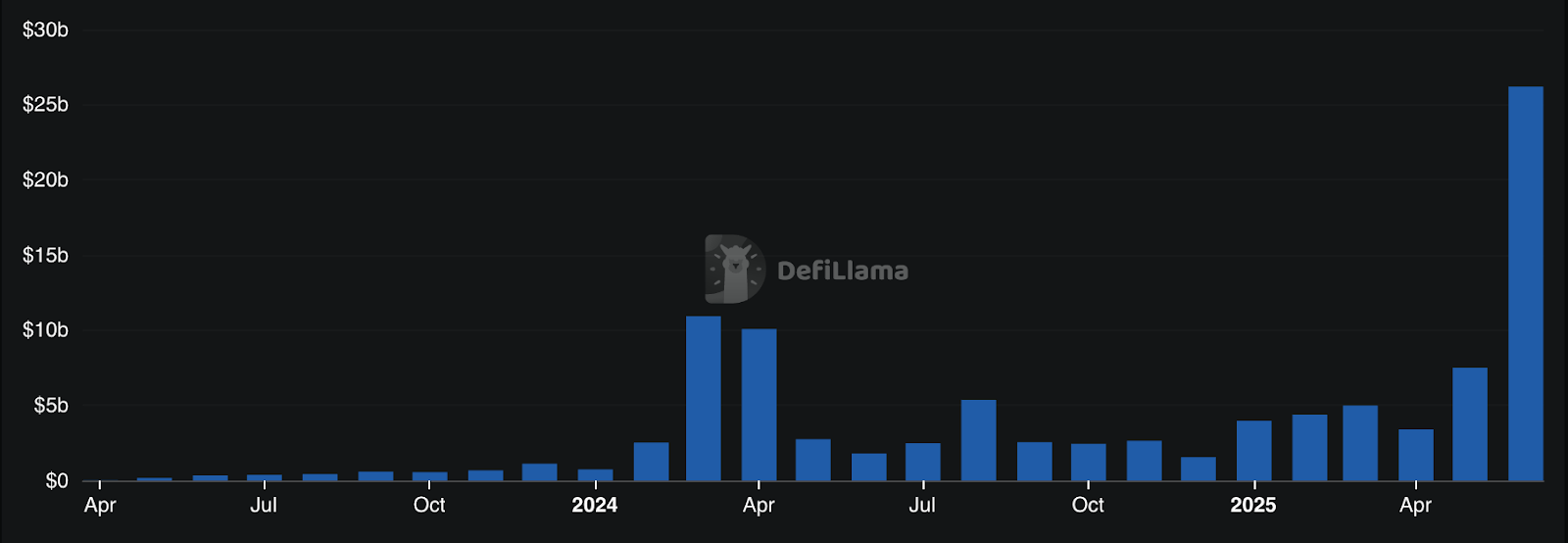

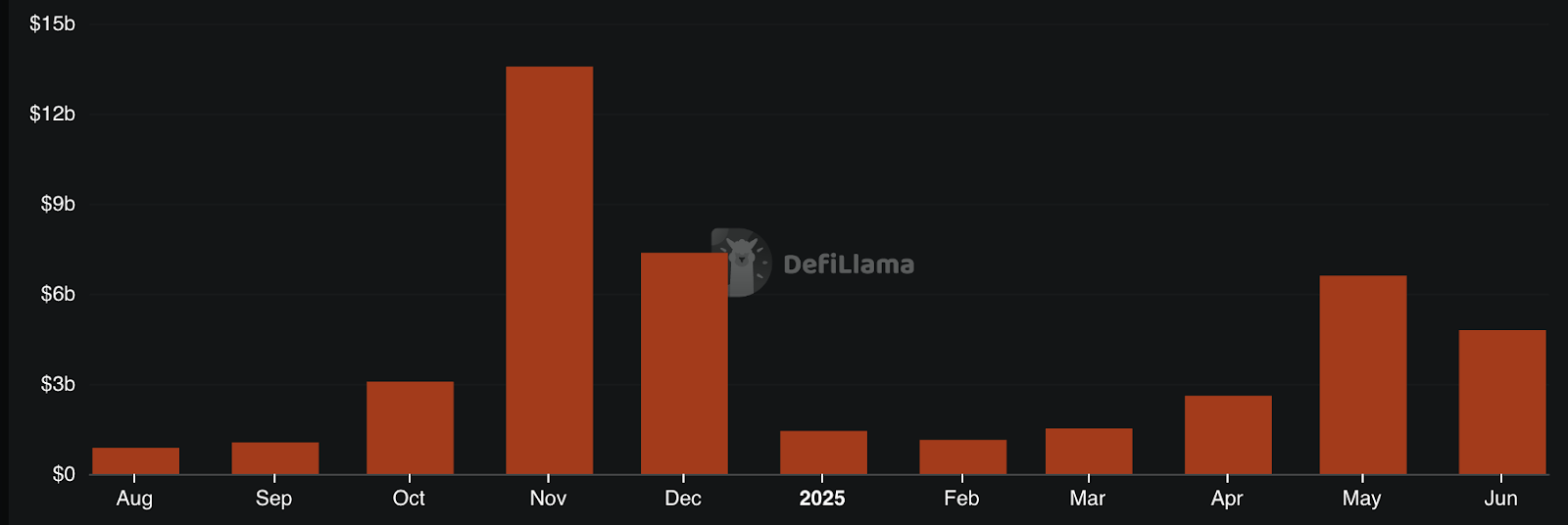

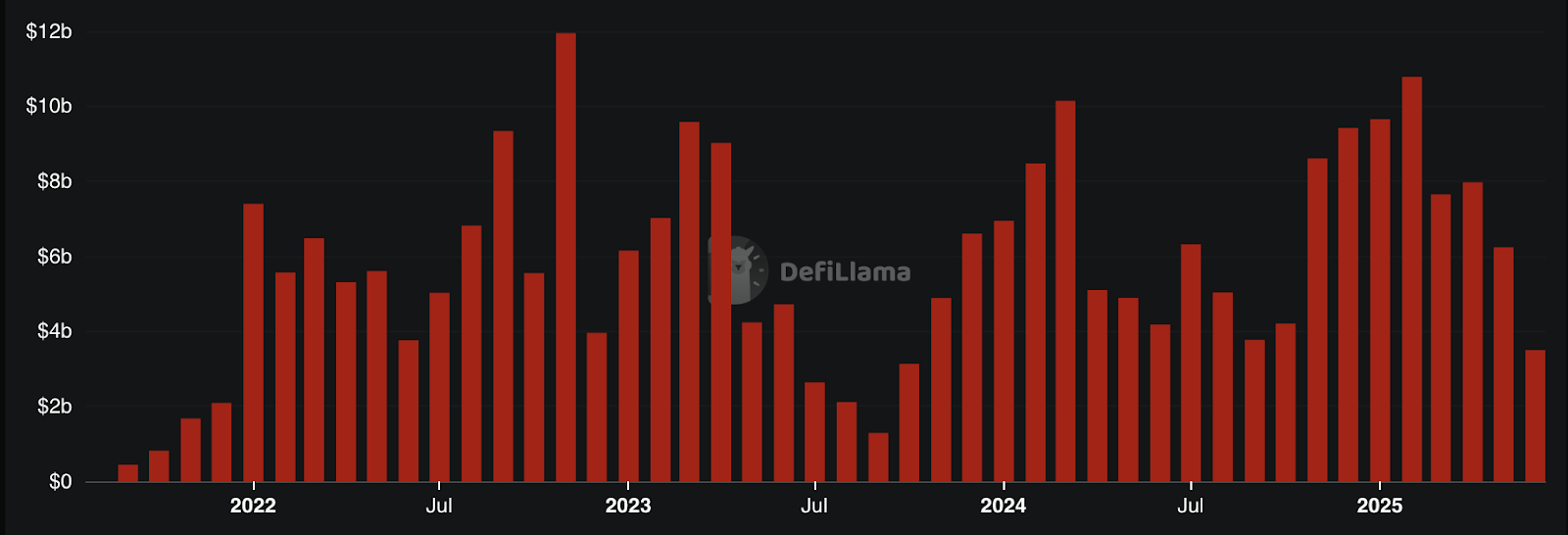

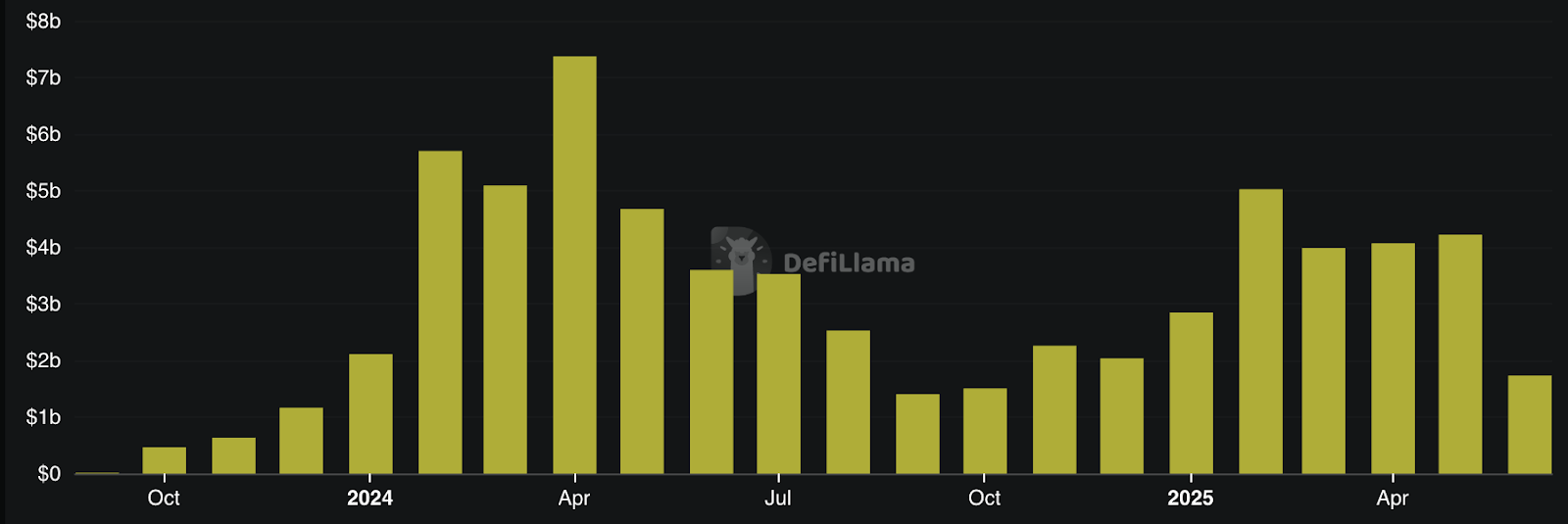

Perpetual decentralized exchanges (Perpetual DEXs) have rapidly evolved from experimental DeFi tools to significant competitors in the crypto derivatives market. In 2024, this sector experienced explosive growth, with total trading volume across Perp DEXs reaching $1.5 trillion, more than doubling from $647.6 billion in 2023. The trading volume in December alone soared to $344.75 billion, setting a new record for monthly trading volume.

Data Source: CoinGecko

This surge is primarily attributed to platforms like Hyperliquid. Hyperliquid's annual trading volume skyrocketed from $21 billion in 2023 to $570 billion in 2024, achieving a 25.3-fold increase. Drift and Jupiter also made significant breakthroughs, with annual trading volumes increasing by 628% and 5176%, respectively.

With innovations such as native order books, fast-finality chains, zk-enabled features, and app-specific ecosystems, 2025 lays the groundwork for the next phase of Perpetual DEXs—mainstream adoption.

This report explores the data behind this evolution, the leading platforms driving development, and the technologies and market trends that will shape the future of Perp DEXs.

Key Points

- Hyperliquid Dominates the DeFi Perpetual Trading Market:

Hyperliquid currently holds an 80% share of the decentralized perpetual DEX market, with monthly trading volume reaching $165 billion. Its retail-first token model has helped it achieve strong growth momentum without venture capital support.

- Surge in Perp DEX Trading Volume in 2024:

The market grew from $647.6 billion in 2023 to over $1.5 trillion in 2024. December alone saw trading volume reach $344.75 billion, indicating a rapid acceleration in user activity.

- Top Platforms Consolidating Market Share:

Currently, a few platforms dominate the activity in perpetual DEXs. Hyperliquid, Jupiter, ApeX, RabbitX, and MYX lead in trading volume and user base due to their excellent execution and network effects.

- Solana and Arbitrum as Major Support Forces:

These blockchains support the fastest-growing DEXs, offering low-latency and scalable infrastructure. Jupiter is based on Solana, while Hyperliquid is built on Arbitrum, showcasing the advantages of chain specificity.

- Centralized Exchanges (CEX) Still Dominate, but the Gap is Closing:

By May 2025, Binance's trading volume reached $1.7 trillion, but Hyperliquid's volume accounted for about 9% of that. As more traders lean towards self-custody and transparency, the pace at which DEXs are catching up is accelerating.

Overview of the Perpetual DEX Market

Entering 2025, the perpetual decentralized exchange (Perp DEX) market has reached historical highs in both usage and innovation. Trading volume increased by over 138% year-on-year, with total trading volume of top DEXs surpassing $1.5 trillion.

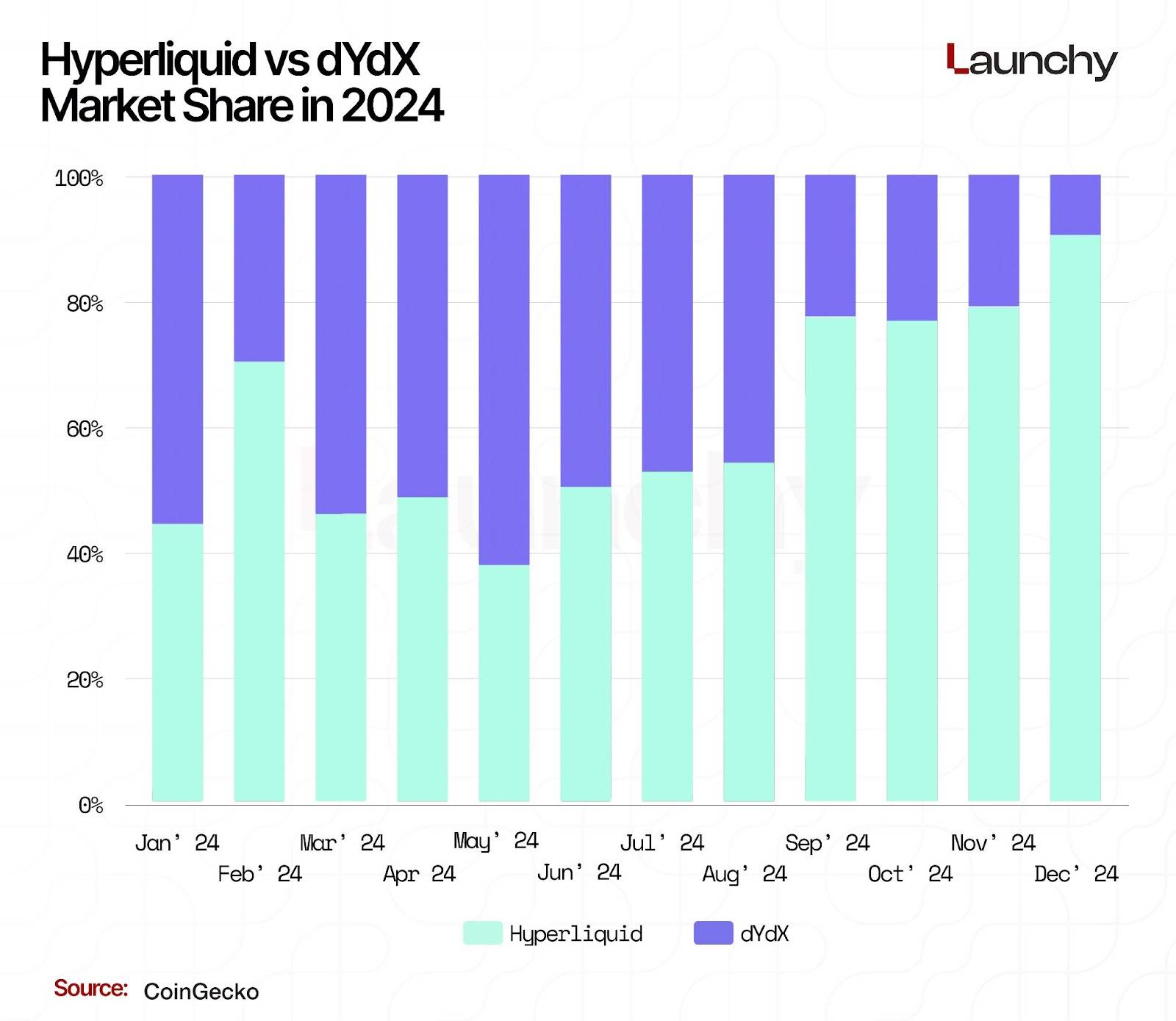

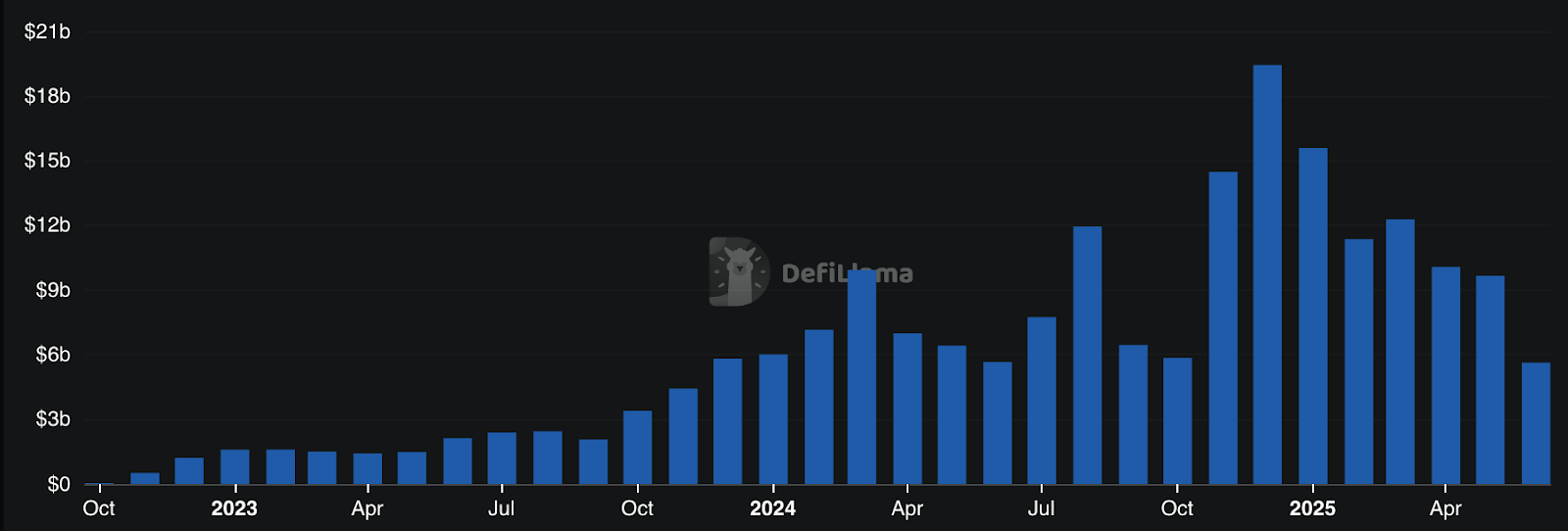

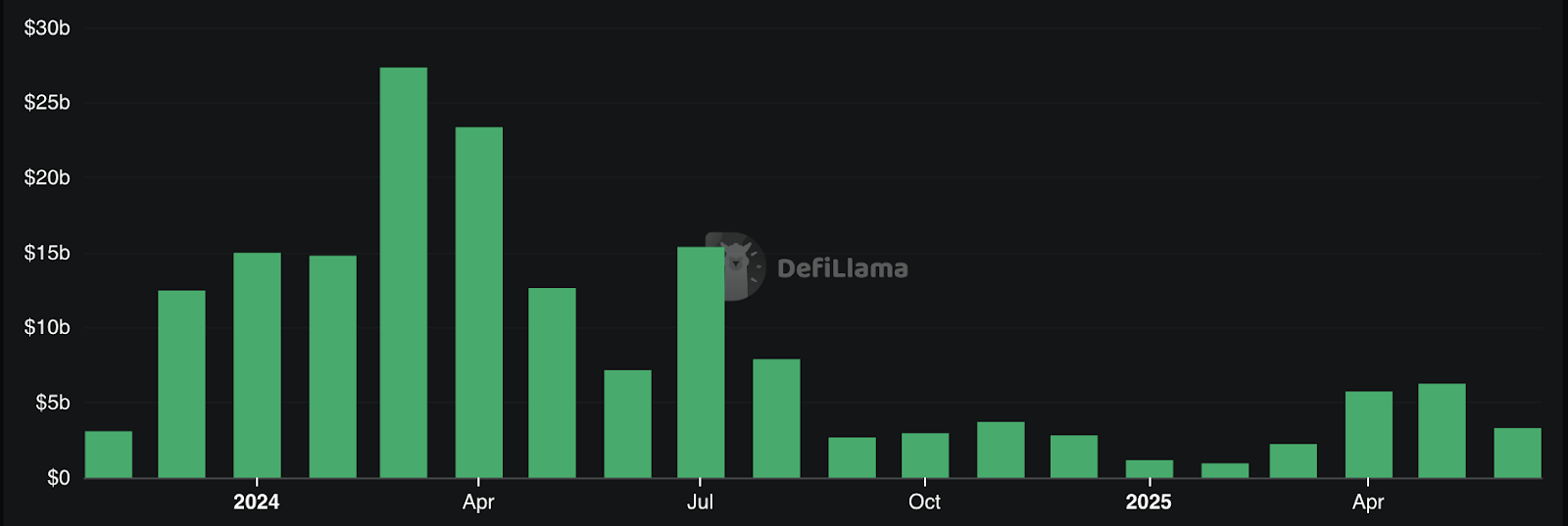

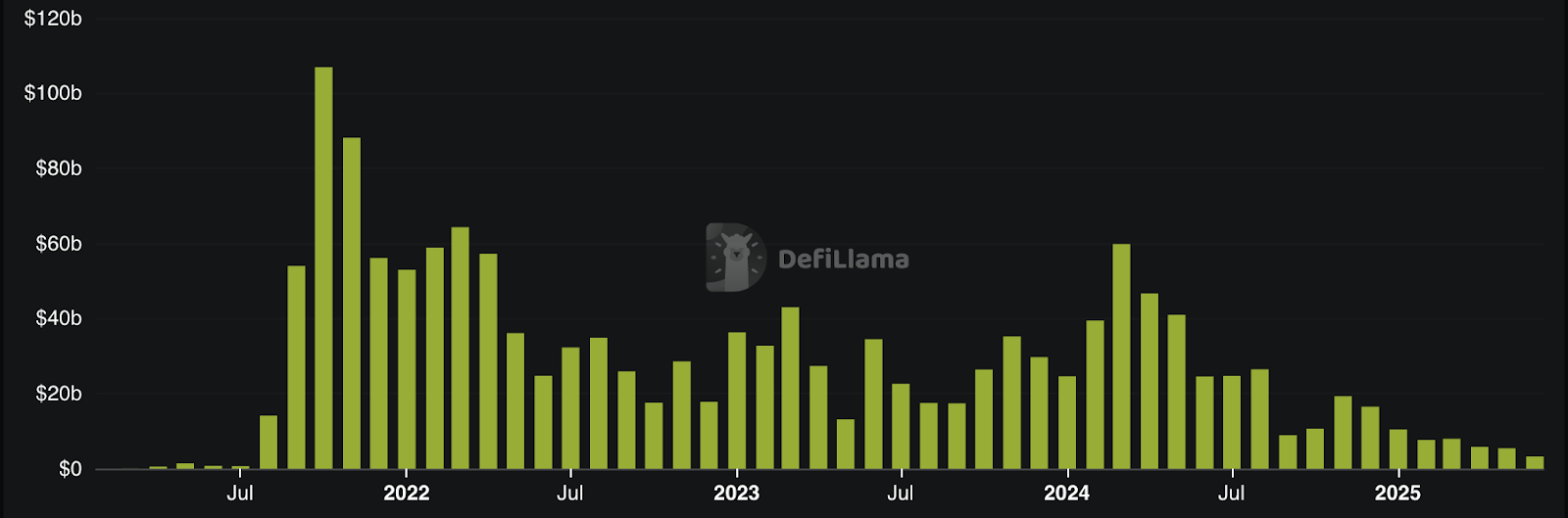

In the fourth quarter of 2024, Hyperliquid accounted for over 55% of trading volume, especially after a massive airdrop campaign in December, which saw its market share surge to 66%. Meanwhile, former market leader dYdX saw its market share plummet from 73% in January 2023 to 7% by the end of 2024. Jupiter, based on Solana, quickly rose to become the second-largest perpetual DEX, with Solana itself contributing 15% of Perp DEX trading volume.

As of November 2024, the total open interest in the centralized perpetual market surpassed $100 billion, but decentralized platforms are rapidly closing the gap. Perpetual DEXs are currently competitive in terms of liquidity, execution speed, and composability, with 2025 expected to be a key year for the transition from centralized to decentralized derivatives trading.

Current Landscape

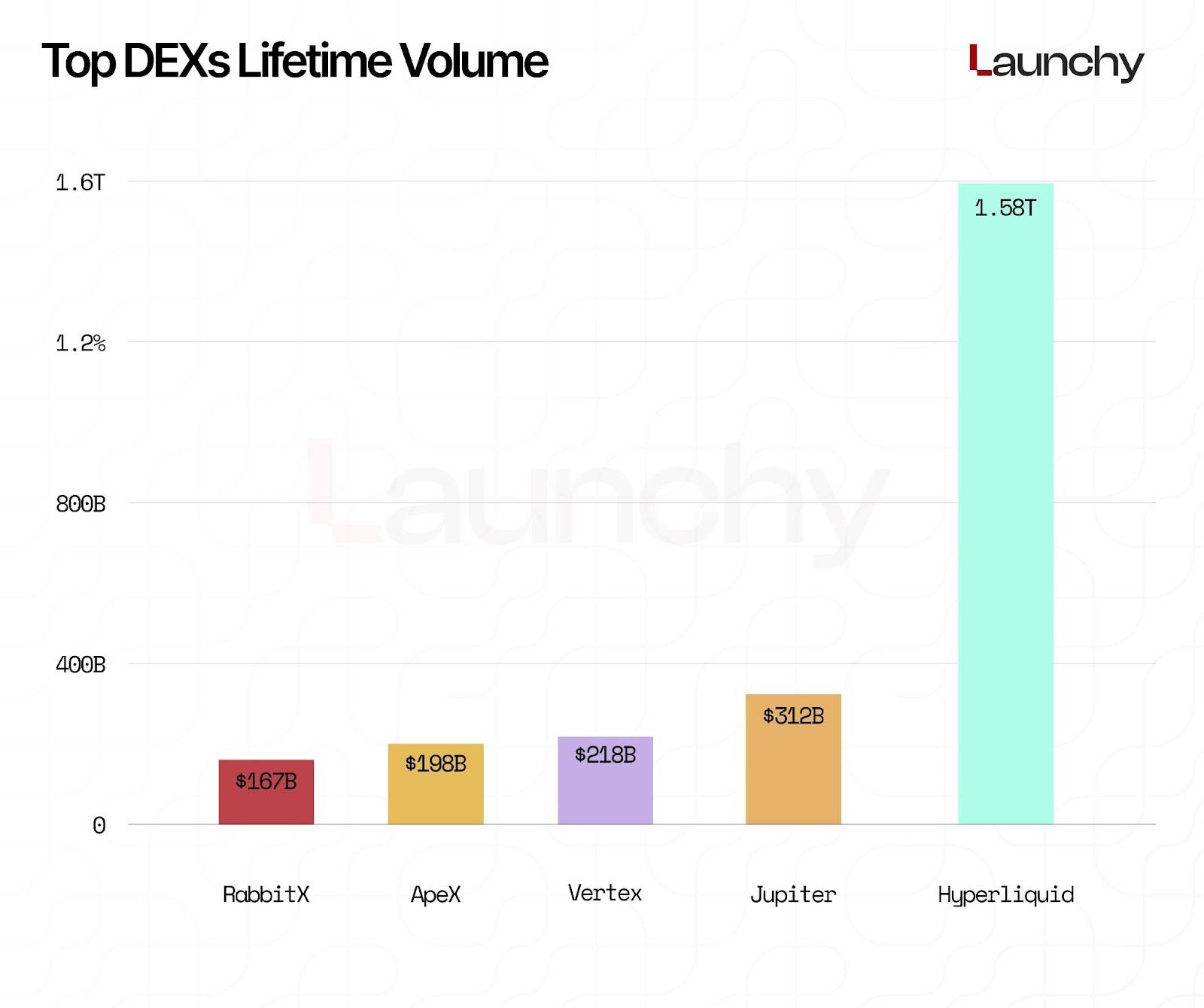

By mid-2025, the market landscape for perpetual DEXs is concentrating around a few dominant platforms, with Hyperliquid leading the way. Currently, its 24-hour trading volume stands at $11.25 billion, with a cumulative trading volume of $1.58 trillion, far exceeding its closest competitors. This growth is attributed to its robust infrastructure, extensive support for 130 assets, and its Arbitrum-based platform advantages.

Following closely is Jupiter, the leading perpetual DEX based on Solana, with a daily trading volume of $570.85 million and a cumulative trading volume of $31.213 billion, successfully carving out its market in Solana's low-latency environment. Other notable platforms include Vertex (cumulative trading volume of $21.791 billion), ApeX ($19.799 billion), and RabbitX ($16.695 billion). Many of these platforms support multi-chain deployments, expanding user access and liquidity depth.

In terms of leverage competition, DEXs have also become more aggressive. Gains Trade offers up to 500x leverage across 230 assets; ApolloX provides 1001x leverage, while Equation offers 150x leverage, attracting high-risk traders. Meanwhile, platforms like RabbitX and Drift emphasize cost efficiency for active users by offering 0.00% maker and taker fees.

Solana and Arbitrum remain the most common underlying chains, with multiple platforms (such as SynFutures, GMX, and Drift) leveraging the scalability of Rollups or app-specific L1 chains. Although dYdX's market dominance has declined, its cumulative trading volume still reached $1.49 trillion, operating across five major chains.

As liquidity deepens, multi-chain expansion accelerates, and competition around user incentives intensifies, the perpetual DEX space is rapidly evolving. The focus of market competition has shifted from "who launches first" to "who can scale quickly, execute reliably, and provide the best trading experience."

Top Ten Perpetual DEXs by Trading Volume

As of mid-2025, the perpetual decentralized exchange (Perp DEX) space is dominated by a few leading platforms, with trading activity increasingly concentrated among the top ten protocols. The following rankings are based on current 24-hour and cumulative trading volumes, showcasing the scale and competitiveness of each platform.

- Hyperliquid

30-Day Trading Volume: $254.81 billion

Cumulative Trading Volume: $1.58 trillion

Supported Chains: 1 (Arbitrum)

Hyperliquid continues to hold an absolute lead in the perpetual DEX market, thanks to its high-performance Arbitrum-native infrastructure, support for 130 trading pairs, and a highly active user base. Its cumulative trading volume has surpassed $1.5 trillion, with daily trading volume even exceeding that of many centralized exchanges (CEX).

- Aster

30-Day Trading Volume: $28.16 billion

Cumulative Trading Volume: Unknown

Supported Chains: 4 (BNB Chain, Ethereum, Solana, and Arbitrum)

Aster is the largest newcomer on the list, rising to second place with strong multi-chain support. Its rapid ascent indicates growing interest among traders for alternatives that offer broader access capabilities.

- Jupiter

30-Day Trading Volume: $19.61 billion

Cumulative Trading Volume: $31.213 billion

Supported Chains: 1 (Solana)

Jupiter remains a major force on Solana, focusing on a limited number of trading pairs and providing deep liquidity. Although its 30-day trading volume has decreased compared to other platforms, its long-term growth momentum remains strong.

- ApeX Protocol

30-Day Trading Volume: $8.98 billion

Cumulative Trading Volume: $19.799 billion

Supported Chains: 1 (Ethereum-compatible Layer 2 based on StarkWare)

Despite ApeX focusing solely on a single chain, its strong liquidity, support for 20 tokens, and streamlined user experience (UX) still result in considerable trading volume.

- RabbitX Fusion

30-Day Trading Volume: $5.84 billion

Cumulative Trading Volume: $16.695 billion

Supported Chains: 1 (StarkNet)

RabbitX remains competitive with its zero-fee structure and institutional-grade infrastructure, particularly favored by cross-exchange arbitrage traders.

edgeX

edgeX Perps Data / DefiLlama

30-Day Trading Volume: $7.52 billion

Cumulative Trading Volume: Unknown

Supported Chains: 1 (Ethereum-compatible Layer 2 based on StarkWare)

As a dark horse, edgeX has shown strong trading data in its early stages, thanks to its simplified user experience and single-chain deployment.

MYX Finance

MYX Finance Perps Data / DefiLlama

30-Day Trading Volume: $7.5 billion

Cumulative Trading Volume: Unknown

Supported Chains: 4 (Arbitrum, BNB Chain, Linea)

MYX diversifies risk through multi-chain expansion and captures liquidity across different ecosystems. Its flexibility is particularly notable during market volatility.

GMX

GMX Perps Data / DefiLlama

30-Day Trading Volume: $6.02 billion

Cumulative Trading Volume: $26.191 billion

Supported Chains: 3 (ARB, AVAX, etc.)

As a veteran player in the perpetual DEX space, GMX continues to hold its ground in fierce competition, backed by community trust and a solid liquidity foundation.

dYdX

dYdX Perps Data / DefiLlama

30-Day Trading Volume: $5.42 billion

Cumulative Trading Volume: $149 billion

Supported Chains: 2 (ETH, Cosmos)

dYdX remains one of the most mature platforms. Its shift to a Cosmos-based proprietary chain (V4) has reduced latency, but its relative trading volume share has declined.

Paradex

Paradex Perps Data / DefiLlama

30-Day Trading Volume: $3.35 billion

Cumulative Trading Volume: Unknown

Supported Chains: 1 (Paradex Chain)

Paradex has quickly entered the top ten as a newcomer, with rapidly growing usage. Its single-chain setup simplifies the execution process while concentrating liquidity.

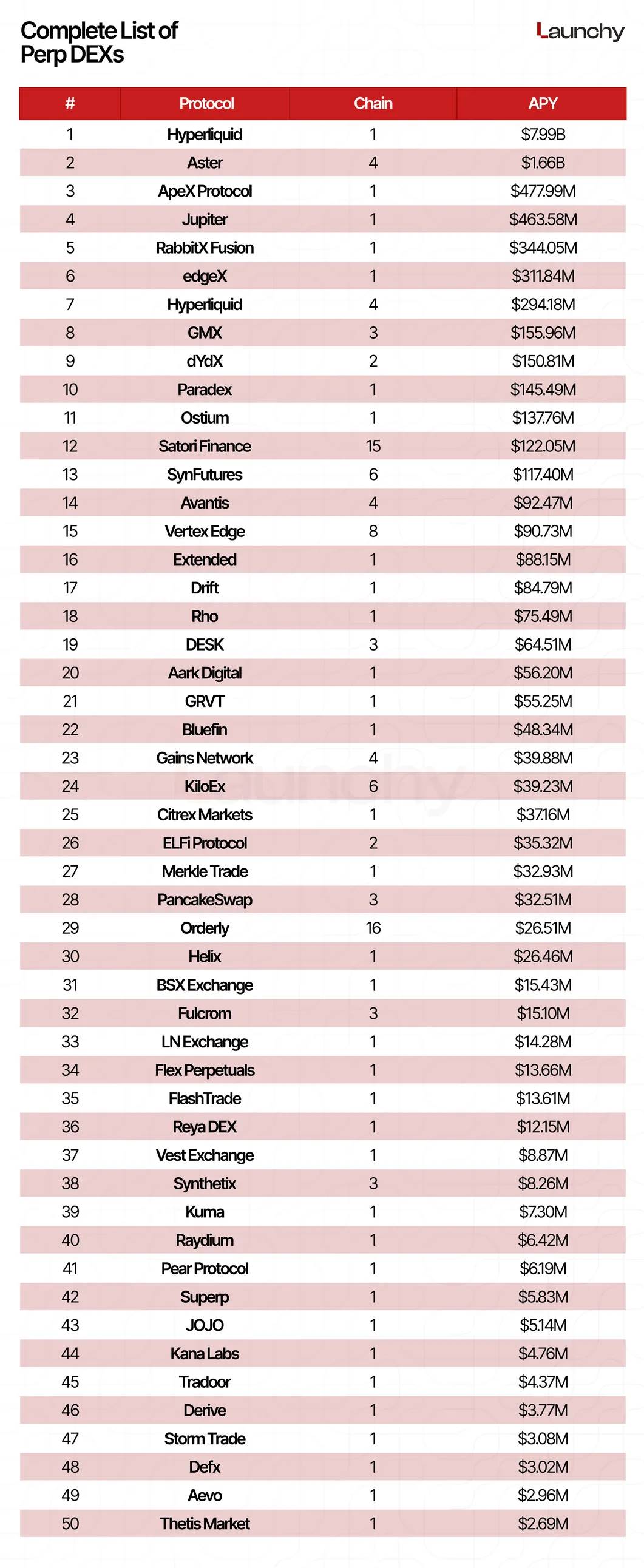

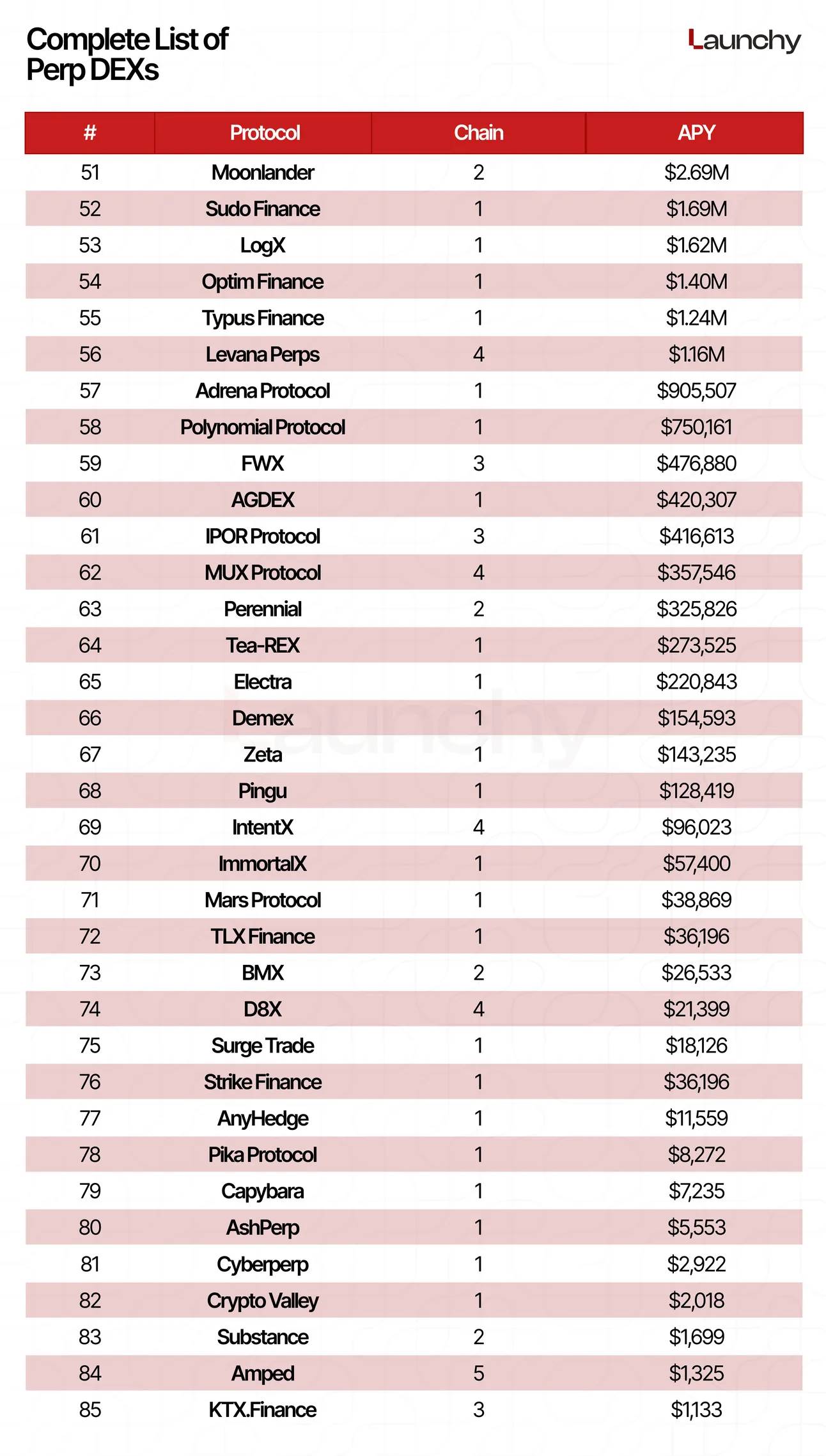

Complete List of Perp DEXs

CEX vs. DEX Market Share Battle

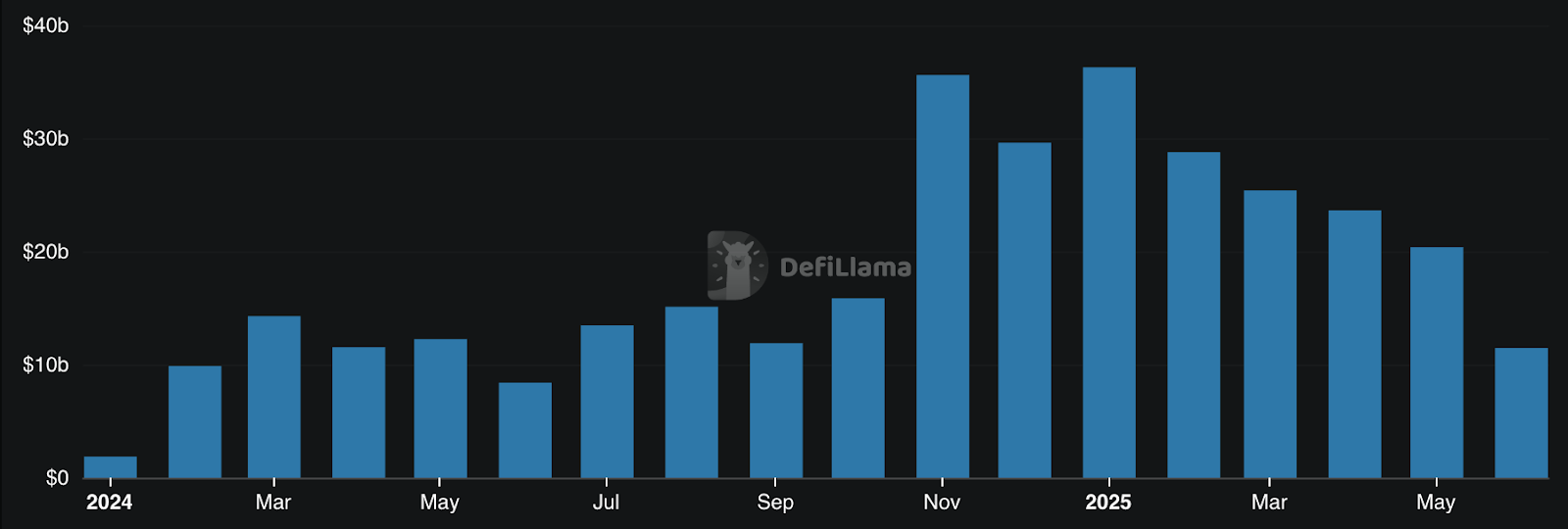

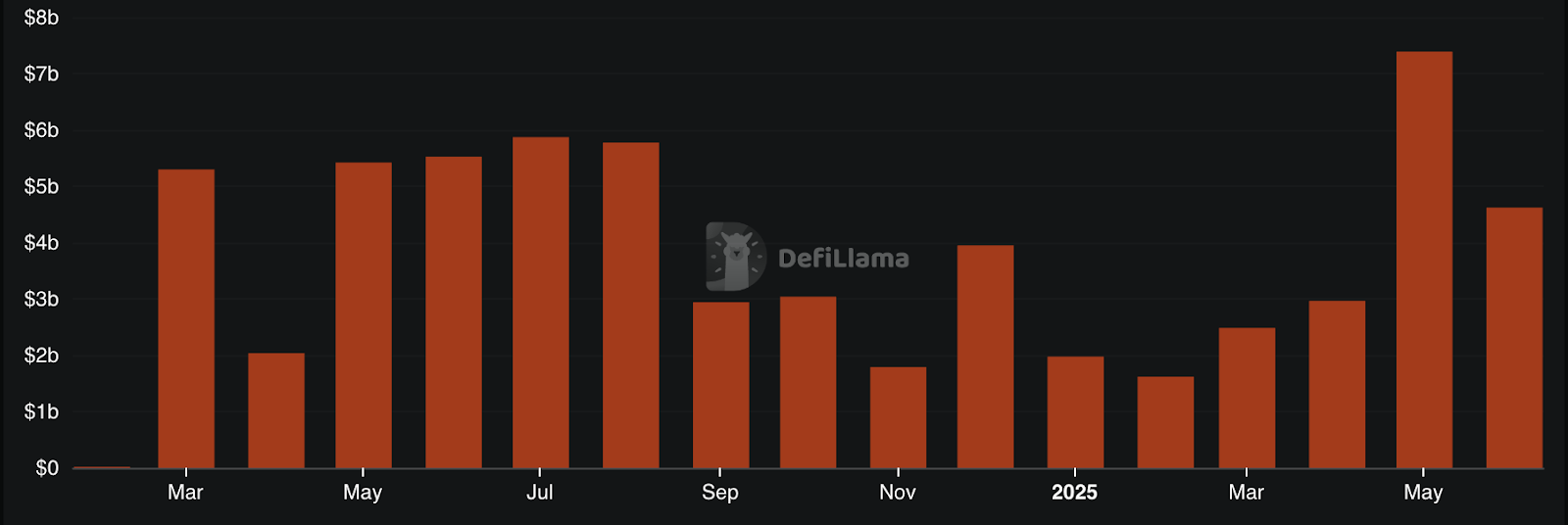

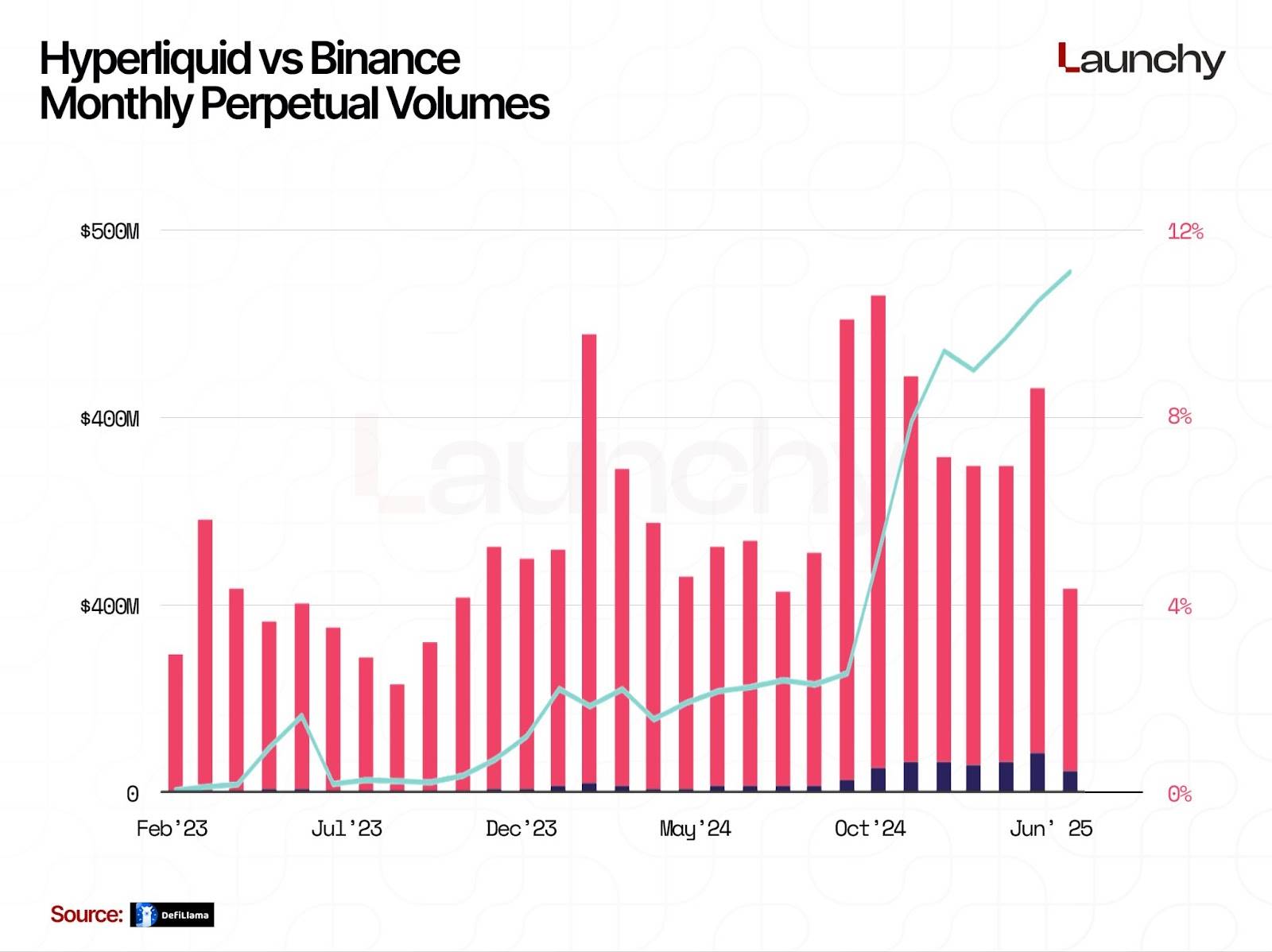

For a long time, centralized exchanges (CEX) like Binance, OKX, and Bybit have dominated the perpetual contract market, with monthly trading volumes consistently in the trillions. However, decentralized perpetual exchanges (DEX) are gradually rising, with one protocol leading the charge: Hyperliquid.

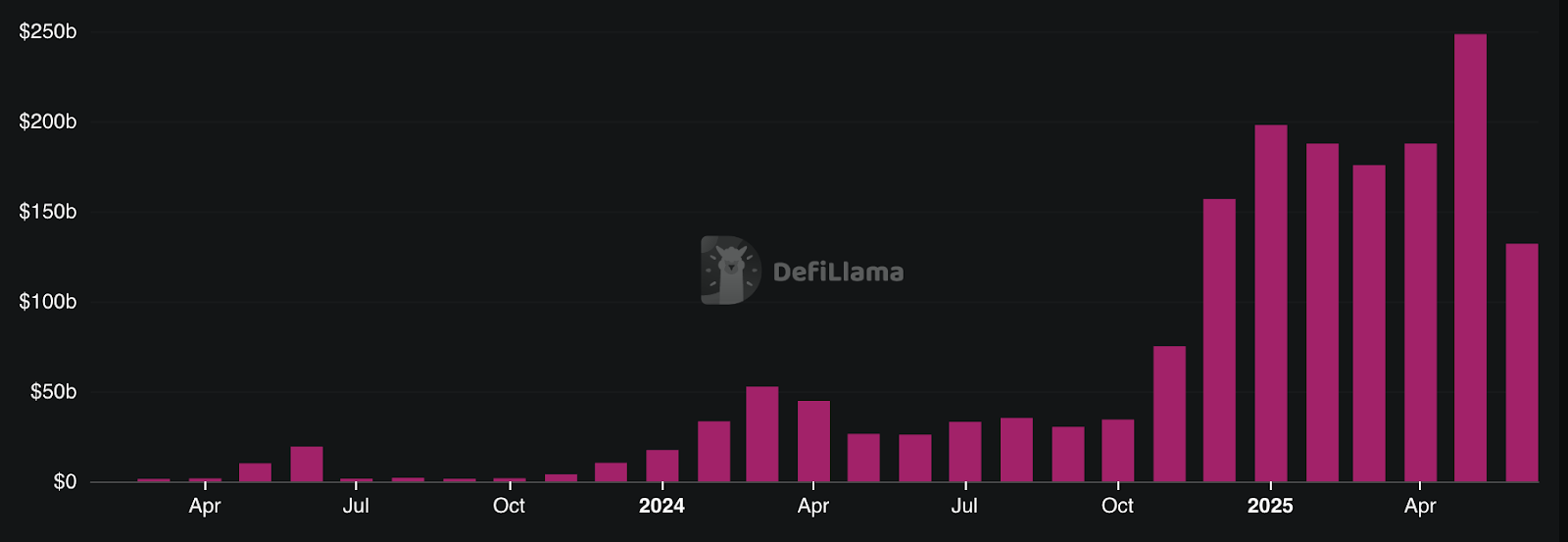

As of May 2025, Hyperliquid holds an 80% share of the decentralized perpetual market. This figure has significantly increased from 30% in November 2024. In just six months, the protocol's market share has more than doubled, reflecting the growing demand from users for platforms that support self-custody, permissionless access, and minimal counterparty risk.

Hyperliquid is not an ordinary DEX. Unlike many projects launched through venture capital funding, it has developed independently without VC support. As a result, all token holders (including institutions) must purchase HYPE through the open market. This model avoids common issues associated with token unlock schedules, facilitating a more organic, retail-driven growth path.

Although Hyperliquid dominates the DEX space, its share of the overall perpetual market remains small. In May 2025, the protocol's trading volume was $165 billion, while Binance's trading volume was $1.7 trillion. Hyperliquid's scale is only about 9% of Binance's, but this ratio is steadily increasing.

Overall, Binance still holds a significant advantage in the centralized market, but the gap is narrowing. According to the latest data, Hyperliquid's trading volume has reached 12% of Binance's, gradually rising from nearly zero at the beginning of 2023.

As regulatory pressures on centralized exchanges increase and traders demand more control and transparency, DEXs like Hyperliquid are becoming viable alternatives. If current trends continue, the lines between centralized and decentralized perpetual markets will further blur in the coming months.

Conclusion

Perpetual DEXs have matured. From their initial niche in DeFi, these protocols now have a realistic possibility of challenging centralized giants. Hyperliquid's model and performance demonstrate that as long as the user experience of decentralized platforms is competitive enough, users are willing to shift to this new option.

As centralized platforms face regulatory uncertainties, decentralized technology is advancing rapidly, and the momentum in the industry is shifting.

The competition in 2025 is not just about innovation; it is about scale, reliability, and user experience. The next generation of crypto traders may no longer need to engage with centralized exchanges.

Disclaimer: This article and its associated content are for educational purposes only and should not be considered or construed as financial, legal, investment, or any other form of advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。