Hammack Says No Case for September Fed Rate Cuts, Odds Crash to 34%

The debate around the Fed Rate Cut in September 2025 just took a dramatic turn. According to Kalshi, the odds of no cut have surged to 34% — the highest since August 1.

Federal Reserve Member Hammack fueled the shift, stating she sees “no case for a September move” after recent data. With inflation sticky, jobs holding steady, and housing activity collapsing, the real question emerges: is the central bank misjudging America’s breaking point?

Source: The Kobessi Letter X Post

Inflation Stubbornly High Despite Slowdowns Elsewhere

Based on US Bureau of Labor Statistics CPI data July 2025 report makes one thing clear, prices are not cooling fast enough.

Compared to July 2024:

-

Food at home is up 2.2%.

-

Meats, poultry, fish, and eggs jumped 5.2%.

-

Eggs soared between 16–27% year-over-year (per USDA & BLS).

-

Beef prices climbed nearly 10%.

These numbers prove that US inflation vs jobs data isn’t just a chart battle, it’s felt daily in grocery aisles. While employment remains stable, food inflation is hammering households.

That reality explains why many federal reserve members back holding rates steady and why a September Fed rate cut news today feels increasingly distant.

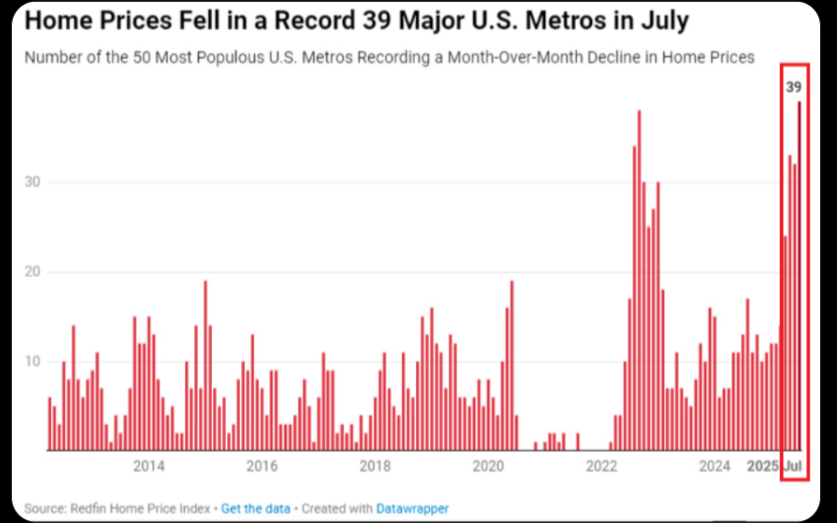

Housing Market Signals a Hidden Economic Freeze

At the same time, the US housing slowdown is alarming. In July, homes sat on the market for 43 days — the slowest pace for this month in a decade.

By comparison, July 2021 homes moved in just 16 days. Pending home sales fell -1.1% MoM, their weakest since November 2023.

For many, housing is the canary in the coal mine. Rising mortgage costs, paired with expensive essentials, point to a financial squeeze. Can the Fed really afford to wait longer, or will this slowdown spiral without a fed rate cut in September ?

Fed Members Split: Inflation Hawks vs. Market Realists

Hammack is not alone. Most policymakers argue that without weak payrolls, easing now could reignite price increase.

The Kobessi Letter summarized bluntly: “Without job weakness, Sept cuts are fantasy.” But economists like Fabian Wintersberger counter, saying “prices and PMIs show greater risk of elevated inflation than outright recession .”

This split underscores the uncertainty. Is the Federal reserve avoiding recession fears at the expense of consumers crushed by rising bills? Or are they wisely protecting credibility by refusing to jump the gun?

September or October: What Happens Next?

The critical question now dominates markets: will the U.S. rate cut September odds rise or October take the place? Probability has shifted, but the pain points remain.

Price rise in food and housing continues, the labor market is still strong, and credibility is on the line. If inflation holds, a no Fed rate cut in September scenario becomes reality.

But if the housing freeze worsens or layoffs start appearing, the FED rate cut October window may be the last chance before cracks widen. Either way, the final decision will define whether the Federal reserve is remembered for caution or for waiting until it was too late.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。