Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhang_web3)

Currently, the RWA sector is accelerating its evolution with vigor, and the level of industry compliance has also significantly improved. Notably, last night Robinhood officially announced that it will launch U.S. stock and ETF trading services based on its own Layer 2 blockchain for EU users. These assets, referred to as "Robinhood Stock Tokens," will enjoy zero commissions, and holders can receive dividends through the broker's application.

Robinhood's active exploration of the European and American markets brings more positive signals to the RWA industry. Similarly, Jarsy is making strides in the innovative direction of Pre-IPO tokenization. What differentiated advantages does its unique Pre-IPO tokenization layout contain? What unknown entrepreneurial narratives lie behind it? The breakthrough path of this emerging sector is provoking deep reflections on the digital transformation of real assets in the market.

In the traditional financial system, Pre-IPO investment was once the exclusive domain of high-net-worth individuals, with funding thresholds often reaching hundreds of thousands of dollars, effectively excluding ordinary investors. Against this backdrop, Jarsy was born with the mission of "making investment accessible to the masses, allowing participation in Pre-IPO investments for as low as $10, and providing opportunities to invest in high-growth value companies." By tokenizing shares of high-growth private companies like xAI, Anthropic, and Stripe, Jarsy enables both ordinary investors with little knowledge of cryptocurrency and seasoned players in the crypto space to participate and enjoy the potential returns of equity investments.

Recently, Odaily Planet Daily contacted Jarsy CEO Han Qin for an in-depth conversation to analyze Jarsy's competitive advantages, operational mechanisms, risk management, business model, and entrepreneurial philosophy. Below is the record of the interview, with some content edited for brevity.

Odaily: I heard you just completed your seed round, congratulations! Can you briefly introduce your financing background and project advantages?

Han Qin: Thank you for your attention. Yes, we raised $5 million in this seed round, led by Breyer Capital, and we also received support from excellent angel investors including Karman Venture, Nathan McCauley (CEO of Anchorage), and Evan Cheng (CEO of Mysten Labs). We chose Breyer because of their track record in leading very early investments in outstanding companies, such as their lead in Facebook and Circle's Series A; since our team comes from Uber, we chose Karman because it is a boutique VC funded by Uber founder Travis Kalanick and executives from Palantir, OpenAI, Anduril, ScaleAI, and Anthropic.

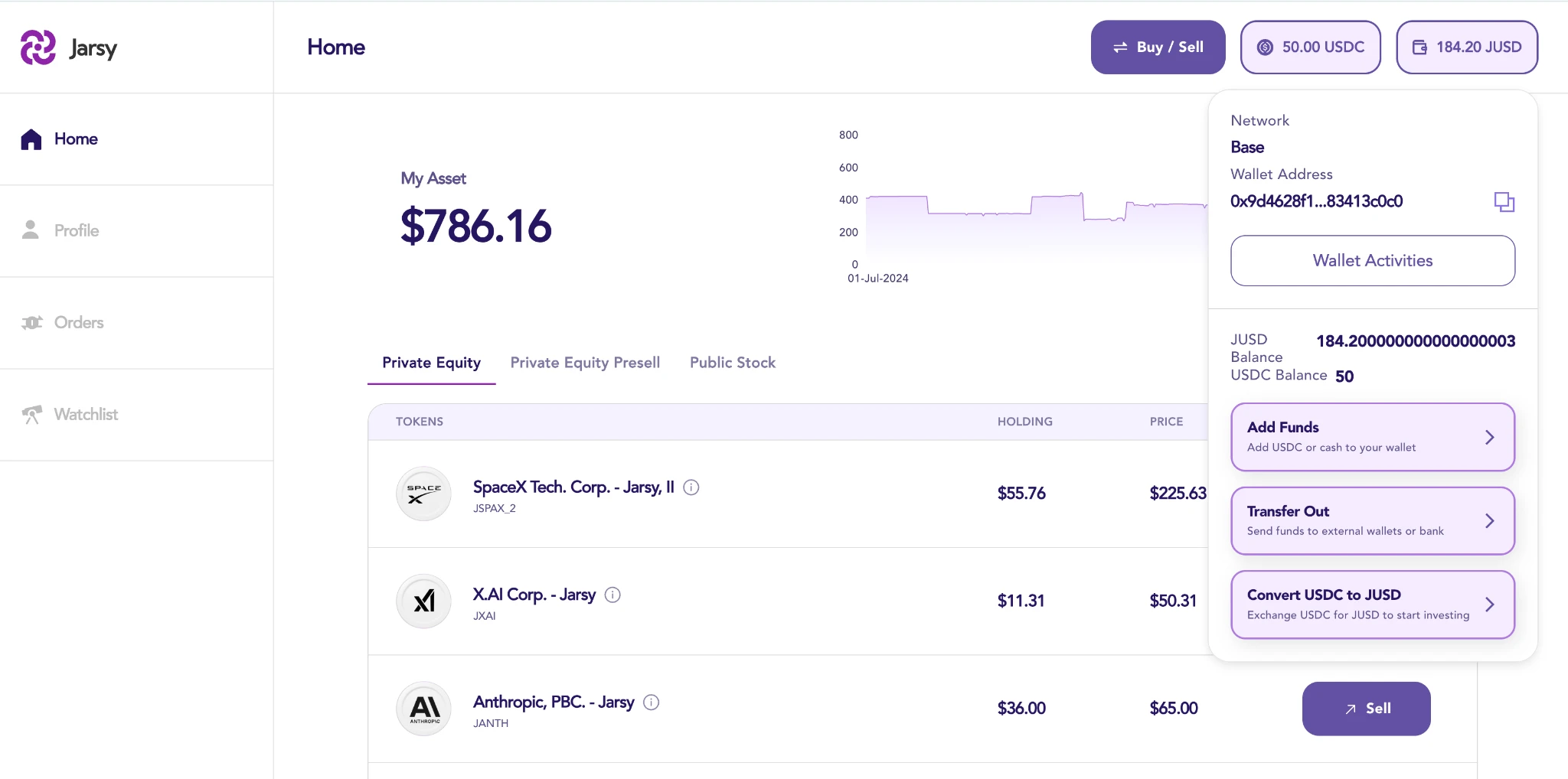

At the same time, we insist on being customer-oriented. To provide users with a more simplified interaction method and reduce the learning costs for non-expert users, our team has redefined and addressed the complexities of blockchain technology, ensuring a seamless connection from login to order placement. Jarsy will charge local cryptocurrency users in stablecoin USDC and cash USD for non-crypto users, achieving seamless cross-industry capital flow.

Additionally, Jarsy's asset-backed tokens are guaranteed by a 1:1 real company equity, with the equity held by a Delaware-registered limited liability company managed by the platform, and we regularly publish equity proof documents to minimize platform credit risk.

Odaily: What are Jarsy's selection criteria and listing processes for unlisted or listed companies to ensure the quality and potential of the companies selected and listed?

Han Qin: This is a very good question and a topic of great concern for users. Our selection logic is divided into three levels: First, in terms of industry and growth, we focus more on high-growth sectors such as AI, aerospace, and fintech, for example, SpaceX, xAI, Anthropic, etc.; second, regarding valuation health, we prioritize later-stage unicorns, such as Stripe, which has maintained over 25% revenue growth for eight consecutive years; third, we conduct our own due diligence loop. The Jarsy team, leveraging Silicon Valley resources, can easily interview company executives and early investors to verify the stability of the equity structure, ensuring the reliability and growth potential of the investment targets.

Moreover, in terms of project listing, Jarsy will clearly define the economic rights tokens, which are supported by underlying assets (such as company shares), and publish economic rights agreements for equity ownership to ensure the entire process complies with U.S. laws and regulations, protecting investors' rights.

Odaily: How does the asset value anchoring mechanism work, and how is investment value guaranteed?

Han Qin: Jarsy works closely with private equity firms, venture capital funds, and brokers to acquire shares of selected private companies. Once shares are obtained, Jarsy will hold these shares through an independent limited liability company (LLC) registered in Delaware, and then issue asset-backed tokens corresponding to the number of shares held.

For the value anchoring of these platform asset-backed tokens, we base it on the latest tender offers (equity quotes) from the company for each round, and based on this, there may be slight premiums or discounts depending on supply and demand in the secondary market. This mechanism ensures that the token value is closely linked to the company's latest valuation dynamics, and investors can also receive real-time returns from market valuation changes. Of course, if the company performs poorly in the private secondary market after completing its funding round, our repurchase price will also be adjusted downward accordingly.

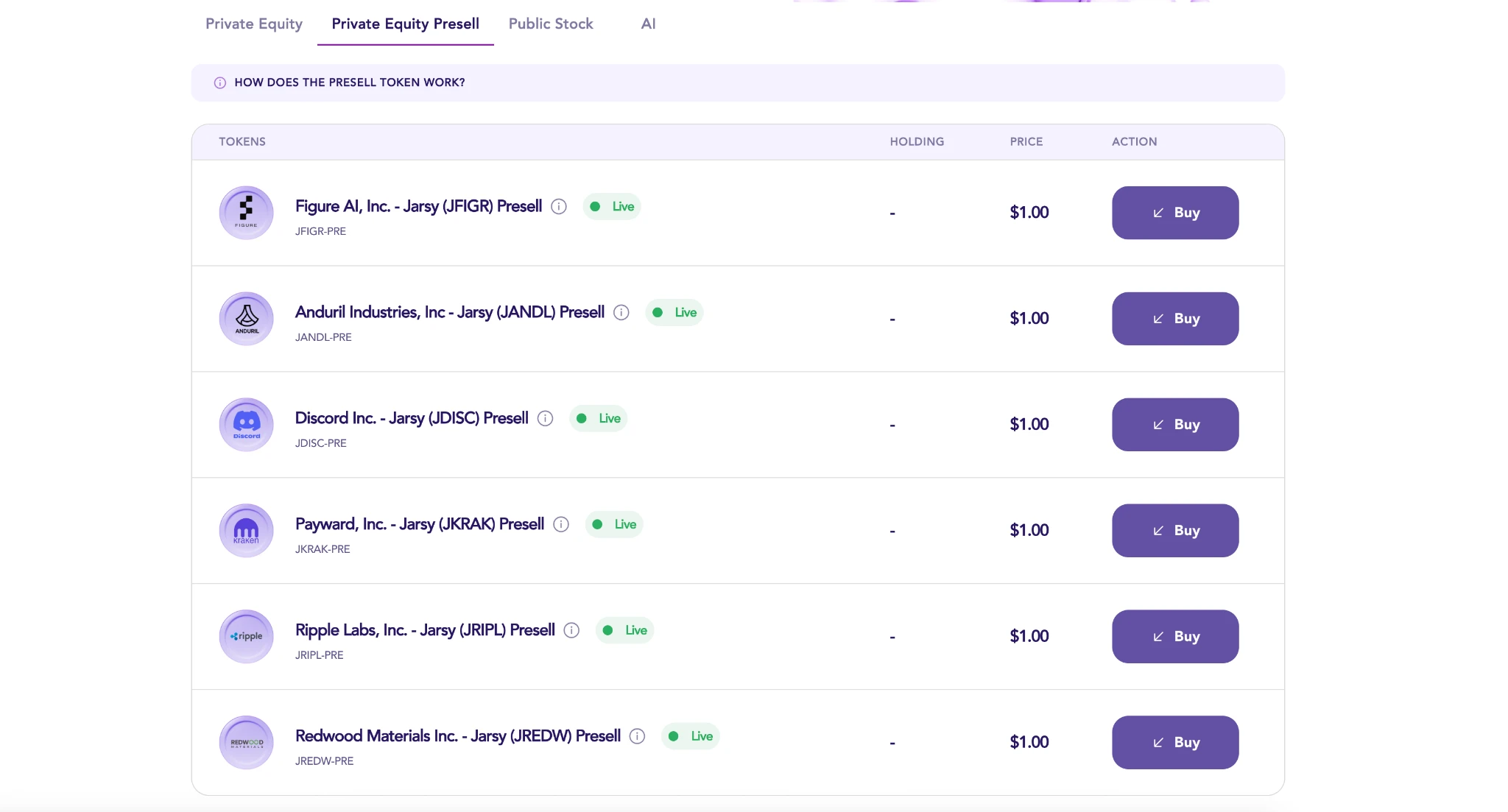

Additionally, it is worth mentioning that we have also issued Jarsy's presale tokens, which allow holders to have priority in purchasing asset-backed tokens for specific companies on the platform. Each presale token is backed by $1, similar to our own stablecoin. Once Jarsy acquires the corresponding company shares and issues asset-backed tokens, these tokens will be allocated to presale token holders on a first-come, first-served basis.

In the allocation process, presale tokens are exchanged for asset-backed tokens at the current asset-backed token price plus conversion cost fees. After all presale tokens have been allocated, the remaining asset-backed tokens will be offered to other investors.

It is important to note that if a user is optimistic about a particular presale investment target and purchases the presale token for a specific company, if the platform fails to complete the settlement within a specified time, meaning it does not timely procure the company's Pre-IPO stock, Jarsy will fully refund the user, so users will not bear any losses from failed transactions.

Odaily: How is Jarsy's business model set up?

Han Qin: We do not charge management fees; Jarsy's main profit model relies on one-time transaction fees, which is also our competitive advantage compared to peers. All fees incurred during the investment period are transparent, but similar to traditional investments, there may be rare carry fees, but this fee is not Jarsy's profit, rather it is the holding cost for popular companies charged by some large funds. For example, for the popular investment project xAI on the platform, investors only incur transaction fees for a single transaction, with no other hidden fees, allowing users to retain the maximum investment returns.

Odaily: Are there any restrictions for users participating in Jarsy investments?

Han Qin: Considering our global market positioning, Jarsy's global accessibility currently covers users from the U.S., China, Singapore, Japan, South Korea, and North America, and we will expand to more regions in the future. Jarsy is committed to serving market users who meet regulatory requirements, requiring investors to qualify as accredited investors, and regional users need to go through the corresponding KYC certification to ensure compliance with local regulatory requirements. Additionally, due to our considerations regarding KYC control, the platform does not currently open DeFi trading or external secondary markets to ensure compliance and investment safety.

Odaily: As an equity tokenization project, what regulatory risks does Jarsy face? How does the platform respond?

Han Qin: This question is crucial for most companies in the crypto industry. The development of the crypto industry, including Robinhood's recent series of announcements, is driving the U.S. to provide clear policy legislation (such as stablecoin legislation), so this is both a challenge and a once-in-a-lifetime opportunity for tokenizing private investing. As a company registered in the U.S., Jarsy faces regulatory challenges from the U.S. SEC and EU MiCA regulations. However, because our team is rooted in Silicon Valley and has participated in the growth of Silicon Valley giants like Uber, we are very familiar with and skilled at how to comply with regulatory policies as they gradually clarify. We will actively embrace and cooperate with regulations, strictly implement compliance measures, such as accredited investor reviews for U.S. users and clarifying definitions of token economic rights, to ensure long-term stable operations.

We believe that only by demonstrating to regulatory authorities our proactive compliance with laws and regulations can we ensure the platform's long-term operation. A platform that can withstand the test of time will earn the trust of investors.

Odaily: What are Jarsy's asset token liquidity and exit rules? What are the holding period regulations?

Han Qin: This is key to our credit value manifestation. We currently offer two exit mechanisms:

The first is that if a Pre-IPO company has gone public, users can choose to sell the corresponding assets through the Jarsy platform to receive equivalent cash.

The second is that regardless of whether the company is listed or not, you can sell the tokens back to the Jarsy platform, but whether this can be successfully sold or priced depends on supply and demand.

Jarsy's asset-backed tokens provide holders with economic benefits related to the company's stock. If the token's value changes, users can buy or sell the tokens based on the new price, and Jarsy will pay users the corresponding amount in dollars or USDC as economic benefits at face value. Of course, users need to conduct due diligence on which company to invest in. For compliance and simplification, the corresponding asset-backed tokens cannot be exchanged for equivalent stocks; they can only be cashed out. Even if the underlying asset company goes public, users cannot withdraw stocks from Jarsy.

Odaily: According to the investment process, how long does it take for investors to receive tokens from placing an order?

Han Qin: Jarsy mainly has two models. One is the spot model, where it usually takes 1 business day from placing an order to receiving tokens. The second model is the presale model, which is the presale token method mentioned earlier. From placing an order to receiving tokens, there will be a waiting period until the project funds are raised. However, it will not be an indefinite wait; we will inform users of a clear timeline before placing an order.

Odaily: Finally, can you talk about Jarsy's entrepreneurial philosophy? How did the team come together to develop the project?

Han Qin: Our team conducted research and deeply understood the difficulties faced by the younger generation in accessing quality assets in an environment of high housing prices, challenging employment, and slowing traditional stock market returns. In response to these issues, there is still a need for innovation in the industry. We believe we should create quality investment opportunities for young people and open pathways for the general public to access quality investment opportunities through technological innovation, achieving true financial freedom.

The team has worked with successful entrepreneurs like Mark Zuckerberg and Travis Kalanick, and influenced by these entrepreneurs, we prefer to create fundamentally innovative products that address people's pain points rather than seeking high returns through token issuance in the short term. We aim to build a long-term platform that can serve the general public, which is why our founders share the same vision.

Of course, we also understand that the road is not easy. There have been competitors doing similar businesses in the past, but they only handle on-chain assets without truly pledging Pre-IPO shares as assets; they merely gamble on valuations. That is unsustainable and can easily lead to failures, encountering issues with price discovery and price transparency, as well as the risk of decoupling from the underlying assets. We hope to align with Circle, which is fully backed by the dollar as a stablecoin, with reserve proof and compliance as a U.S. company. Therefore, if we want to operate sustainably, we have many operational and regulatory challenges to overcome. This is not a project for quick profits, but once scaled, it has a significant story, and we are looking forward to it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。