Selected News

Deutsche Bank plans to launch crypto asset custody services in 2026

Fragmetric's first quarter airdrop of FRAG is now open for claims

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

COINBASE

Coinbase has become the focus of discussion today due to several significant developments. First, the U.S. Supreme Court ruled that the IRS can obtain Coinbase user data, sparking widespread attention. At the same time, Coinbase is actively advancing its strategic layout, including obtaining a MiCA license in Luxembourg, announcing the launch of perpetual contract trading in the U.S., and collaborating with Shopify and Stripe to accelerate stablecoin adoption. Additionally, the competition between Coinbase and Robinhood in the Ethereum Layer 2 and U.S. stock tokenization space is also a hot topic, with many discussing its impact on the crypto market. Overall, Coinbase's recent developments and strategic partnerships further solidify its important position in the crypto space.

XRP

XRP is in the spotlight mainly due to several key advancements. The XRPL EVM sidechain has gone live on the mainnet, allowing developers to use XRP as gas to build Ethereum-compatible decentralized applications, enhancing its utility and interoperability. Meanwhile, Bloomberg has raised the approval probability for an XRP spot ETF to 95%, greatly stimulating market interest. Additionally, the U.S. Securities and Exchange Commission (SEC) has accepted Grayscale's proposal to convert its digital large-cap fund into an ETF, which also includes XRP. These factors, along with XRP's price trends and its integration on platforms like Injective, have made it a hot topic of market discussion.

HYPERLIQUID

Discussions about Hyperliquid focus on its strong recent market performance, with a return rate of up to 300% since April, and it is considered to have a competitive advantage over Robinhood and Coinbase due to low fees and robust infrastructure. The platform's dominance in the decentralized perpetual contract market is particularly notable, with an annual trading volume reaching $1.571 trillion. There are also speculations that Robinhood may adopt Hyperliquid's infrastructure. Furthermore, the community is exploring the potential impact of Hyperliquid's rapid growth on the overall crypto market landscape.

BYBIT

Today's discussions about BYBIT mainly center on its collaboration with xStocks and Backed Finance to launch U.S. stock and ETF tokenized assets. This initiative allows users to trade U.S. stocks like AAPL, TSLA, and NVDA on-chain, marking a significant advancement in the integration of traditional stocks and DeFi. Meanwhile, BYBIT is partnering with Chainlink to provide oracle infrastructure and has launched these tokenized stocks on platforms like Solana and Kraken, further strengthening its role in the tokenized asset ecosystem. Discussions also touch on the broader impact of this initiative on the crypto market, as well as the potential increase in trading volume and improved accessibility it may bring.

RAY

Today's discussions about RAY focus on its launch of tokenized stock trading features on Solana, supported by Raydium. Users can now trade stocks like Nvidia and Tesla on-chain, gaining liquidity around the clock and entering a no-intermediary DeFi stock market. This integration includes support from platforms like Chainlink, Kraken, and Bybit, marking an important step towards an "Internet capital market." The discussion's intensity stems from this model's potential to break down traditional financial barriers for retail investors, further highlighting Raydium's key position in this field.

Featured Articles

This month in theaters, Brad Pitt's "F1: The Movie" grossed $56 million in its opening week in North America, with global box office earnings surpassing $144 million, becoming the first true blockbuster in Apple's film history. This nearly $300 million film has garnered widespread attention not only for its IMAX real-life filming and real team participation but also for attracting the crypto community's gaze. During the film's promotion, lead actor Brad Pitt personally test-drove the McLaren MCL60 car from the 2023 season, completing his first F1 driving experience, while the logo on Brad Pitt's racing and driver suit is a familiar sight to the crypto community—OKX.

Can a brokerage disrupt not only the commission system but also the underlying architecture of global asset trading? Robinhood seems to have provided its answer. At the recently concluded launch event in Cannes, France, this giant that stirred the U.S. securities industry with zero commissions presented an imaginative vision: to fully push stocks, derivatives, and even private equity onto the blockchain through tokenization, ultimately creating a new Layer 2 public chain—Robinhood Chain—that can support global real assets. This launch event is not just a product list; it is Robinhood's declaration of its vision for the next decade. Different breakthrough points have been delineated for the European, American, and global markets, yet they resonate with each other, collectively painting a new order of around-the-clock trading driven by tokenized assets. This article will be divided into three parts, combining information from Robinhood's live event and the broader industry context to deeply analyze this "on-chain brokerage" grand strategy.

On-chain Data

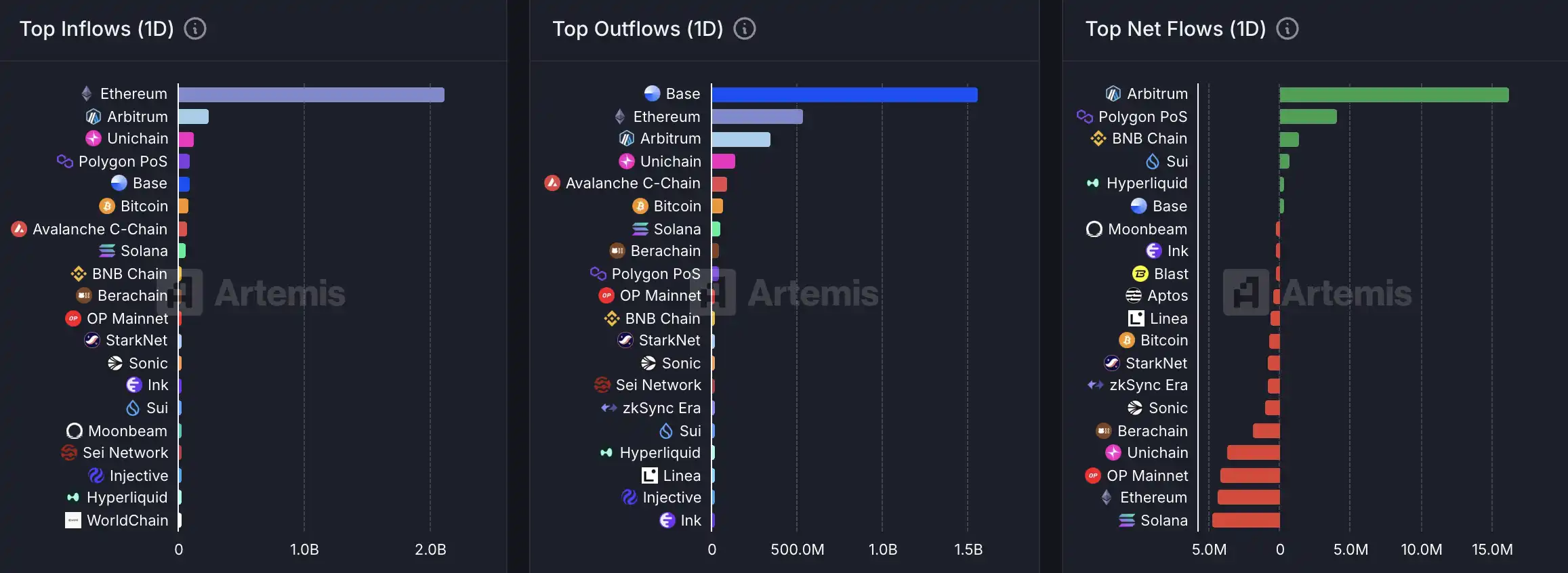

On-chain capital flow situation for the week of July 1

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。