原创 | Odaily星球日报(@OdailyChina)

作者 | Ethan(@ethanzhang_web3)

RWA板块市场表现

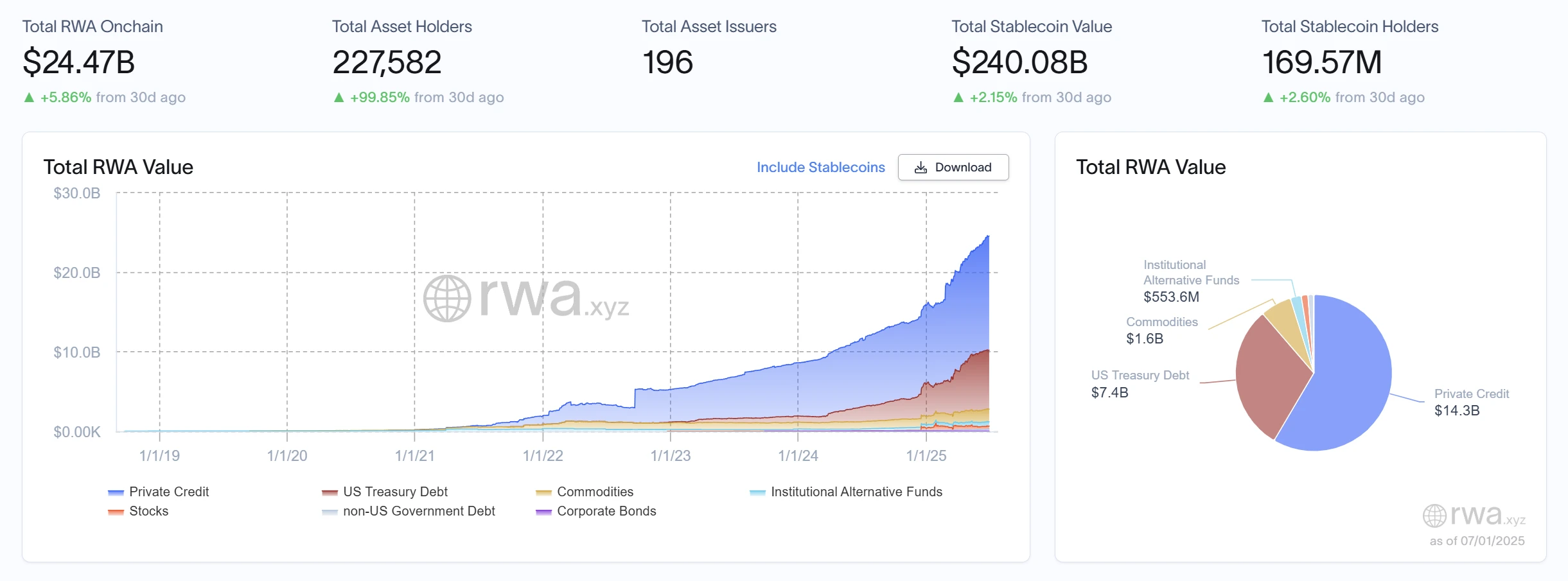

根据 RWA.xyz 最新数据显示,截至 2025 年 7 月 1 日,RWA 链上总价值达 244.7 亿美元,较 6 月 24 日的 242.9 亿美元增长 0.74%,延续温和上行态势。链上资产持有者数量由 209,678 人增长至 227,582 人,单周净增近 1.8 万人,增幅达 8.55%,连续三周用户周增速超过5%,市场参与热情持续升温。资产发行数量由 194 个增长至 196 个。稳定币总价值由 2389.9 亿美元上升至 2400.8 亿美元,上涨 0.46%;稳定币持有者数量亦由 1.6865 亿人增长至 1.6957 亿人,增长 0.55%。

从资产结构来看,私人信贷继续维持RWA资产中的核心地位,本周从 142 亿美元增长至 143 亿美元。美国国债保持平稳,总值仍为 74 亿美元,显示其“防御型资产”的基础地位依旧稳固,市场对稳健型资产的配置需求持续存在。商品类资产稳定在 16 亿美元,无明显变化;机构另类基金则从 5.43 亿美元增至 5.536 亿美元,虽增幅有限,但表现出多元资产仍旧持续受到青睐。

有何趋势(对比上周)

链上总市值持续小幅抬升,用户增长明显提速:总资产较上周小幅上涨,但更值得关注的是资产持有者总量逼近 23 万,说明 RWA 正吸引更广泛的市场用户参与,生态扩散效应逐步显现;私人信贷与美国国债继续构成主轴,延续“高收益+稳健防御”结构:私人信贷作为高收益资产继续扩容,市场风险偏好保持稳定;与此同时,美国国债总值维持在高位,显示出当前宏观环境下防御性配置依旧受欢迎;多元资产组合稳步上升,结构更趋平衡:商品与另类基金维持增长态势,说明投资者对于多元资产组合和风险对冲的策略认同度在持续提升;资产发行端略有扩容,或为后续品类拓展预热:资产发行方由 194 增至 196,有新协议、新资产即将上线,有望为链上资产结构带来新的增量空间。

整体来看,本周 RWA 市场保持“稳中扩容”的运行节奏:市值缓步增长、用户规模快速扩大、资产类别结构稳中有进。高收益与低波动资产协同构成配置基础,多样化资产如商品、另类基金等则作为灵活补充。同时建议关注平台在股票类资产等新兴赛道的动态披露与结构扩容,做好中长期布局准备。

重点事件回看

当地时间周六,美国参议院在关键程序性投票中以 51 票比 49 票的微弱优势通过推进特朗普税改法案,增加了该法案在未来几天内通过的可能性。“大而美”税收与支出法案是特朗普第二任期核心议程,在经历数小时延迟后,除两名共和党议员外所有共和党人都投下赞成票。由于部分议员坚持要与共和党领导层协商,这场原定 15 分钟的投票持续开放超过三小时。这项利用“预算协调”特殊程序推进的法案允许共和党以简单多数通过立法,但需确保条款符合参议院议事规则。

韩国八大银行筹建合资公司拟发行韩元稳定币,正探讨两种发行模式

据韩国《经济评论》报道,韩国八家主要银行正在筹备成立合资公司,计划发行韩元稳定币。参与机构包括国民银行、新韩银行、友利银行、农协银行、韩国产业银行、水协银行、花旗银行韩国分行及渣打银行韩国分行。该项目由银行联合开放区块链与去中心化标识符协会、韩国金融电信与清算院共同推进,目前仍在就底层基础设施进行讨论。

若监管批准,该合资公司有望于今年底或明年初正式上线。项目团队目前正考虑两种发行模式:其一为信托模式,即先将客户资金独立信托后再发行稳定币;其二为存款代币模式,将稳定币与银行存款直接挂钩。

美SEC与纽交所就加密规则改革展开磋商,推动代币化资产纳入主流市场

据报道,美SEC加密资产特别工作组于6月24日与纽约证券交易所举行闭门会议,讨论代币化资产如何在现有金融框架下获得合规接纳。双方重点探讨传统与加密市场间的监管碎片化问题,并就区块链发行的传统证券与现货加密ETF的通用上市标准交换意见。此次会谈被视为推动代币化资产加速登陆交易所的重要信号,体现监管机构与主流市场共同致力于推动合规创新的意愿。

纳斯达克 Calypso 平台接入 Canton 网络,支持区块链化抵押品管理

纳斯达克宣布其资本市场平台 Calypso 已集成区块链项目 Canton Network,实现全天候的自动化抵押品与保证金管理。此次整合由 QCP、Primrose Capital Management 与 Digital Asset 共同推动,支持在加密衍生品、固定收益和场外衍生品等多资产类别中进行实时资本流动和抵押品调配。Digital Asset 旗下的 Canton 技术已被 Broadridge 和 Equilend 等机构用于构建抵押品管理方案,成为该领域的重要基础设施。

Chainlink与万事达合作支持30亿用户链上购买加密货币

Chainlink 与万事达卡达成合作,允许超 30 亿 Mastercard 持卡人直接通过链上服务购买加密货币。此次集成由 Chainlink 跨链协议提供底层支持,联合 zerohash、Swapper Finance、Shift4 Payments、XSwap 和 Uniswap 共同实现,将传统支付世界与DeFi打通。

该服务依托 Chainlink 安全的互操作性基础设施与万事达卡的全球支付网络,用户可通过银行卡法币支付,最终在链上完成加密资产兑换。zerohash 提供合规流动性与托管支持,Shift4 处理银行卡支付,XSwap 搜寻并接入 Uniswap 等 DEX 流动性,Swapper Finance 则整合各方资源,构建统一便捷的使用体验。

Chainlink 联合创始人 Sergey Nazarov 表示,此次合作标志着传统金融与 DeFi 的融合迈出重要一步。万事达卡也表示,将继续探索安全合规的链上支付方式,推动加密资产在全球更广泛的应用。由 Chainlink 赋能的平台 Swapper Finance 已于今日上线。

Grove 推出机构级 DeFi 信贷基础设施,Sky 生态向链上 CLO 战略配置 10 亿美元

Grove 宣布正式推出其面向机构的 DeFi 信贷基础设施协议,并获得 Sky 生态系统(原 MakerDAO)10 亿美元的初始资金配置,用于支持 Janus Henderson 与 Centrifuge 合作推出的 Anemoy AAA CLO 链上策略(JAAA)。这标志着首个全链上的 AAA 级 CLO 策略正式落地。Grove 的非托管协议旨在作为 TradFi 与 DeFi 之间的资本通道,为协议提供可访问的、具备合规性的高质量信用资产。该协议由 Steakhouse Financial 子公司 Grove Labs 孵化,计划推动 RWA 多样化与链上信贷市场的发展。

Midas 联合 Fasanara、Morpho、Steakhouse 推出链上私募信贷产品 mF-ONE

链上资产代币化平台 Midas 宣布推出新型私募信贷产品 mF-ONE,该产品追踪 Fasanara 的 F-ONE 基金,涵盖金融科技应收账款、SME 贷款、房地产抵押信贷及中性策略。合格投资者可在 Morpho 市场中以 mF-ONE 抵押,借出由 Steakhouse 策划的 USDC 金库提供的稳定币流动性,提升资本效率。该项目获得 Stake Capital、GSR 等机构支持,标志着 DeFi 信贷代币化进一步推进。

热点项目动态

Plume Network

一句话介绍:

Plume Network是一个专注于现实世界资产(RWA)代币化的模块化 Layer 1 区块链平台。它旨在通过区块链技术将传统资产(如房地产、艺术品、股权等)转化为数字资产,降低投资门槛并提高资产流动性。Plume 提供了一个可定制的框架,支持开发者构建 RWA 相关的去中心化应用(dApp),并通过其生态系统整合 DeFi 和传统金融。Plume Network 强调合规性和安全性,致力于为机构和零售投资者提供桥接传统金融与加密经济的解决方案。

最近动态:

6月24日,Plume Network发布了一份新白皮书,概述其如何符合欧盟的加密资产市场监管框架(MiCA)。白皮书已于6月19日通过荷兰金融市场管理局(AFM)审查并在欧洲证券与市场管理局(ESMA)注册,符合欧盟2023/1114号法规。

6月30日,Plume宣布已有超过10万人持有其平台上的RWA资产,总价值超过1亿美元。资产类型从国债扩展到私募信贷和机构基金,体现出Plume生态系统的多样性和增长。

TunaRWA(TUNA)

一句话介绍:

TunaRWA 是一个专注于稀缺自然资源权益代币化的 Web3 项目,致力于将全球渔业捕捞权等真实世界资产引入链上。项目以澳洲南方蓝鳍金枪鱼等高价值渔业资源为基础,通过确权、租赁与智能合约分红机制,为用户提供由实体资产支持的稳定收益机会。TunaRWA 结合区块链的可追溯性与透明性,实现资源投资的数字化、碎片化和全球化参与。其原生代币TUNA用于权益证明、租金分红分配与社区治理。TunaRWA 的目标是推动稀缺自然资源投资的“民主化”,构建连接实体经济与去中心化金融的新型基础设施。

此前动态:

4 月 28 日,TUNA 获韩亚-浙大上海高等研究院数字新金融联合实验室关注并将设立专项研究课题。该联合实验室由浙江大学上海高等研究院与韩亚金融共同创立,专注区块链、元宇宙、大数据、资产加密等前沿技术研究。

5 月 9 日,据官方消息,TUNA 核心成员现身贝莱德旧金山总部。此前,全球资管巨头贝莱德(BlackRock)近期宣布,已完成 1500 亿美元资产的链上映射,涵盖房地产信托、大宗商品等多元领域。这一案例被视为 RWA 商业化的里程碑,验证了技术落地的可行性。市场猜测双方可能在5月官宣具体合作方案,受此影响,TUNA 代币短时拉升 32%。

相关链接

《RWA周报系列》

梳理RWA板块最新洞察及市场数据。

本文将解析当前最具发展潜力的 RWA 细分赛道,并盘点各领域最具代表性的领跑项目。

《Cobo|RWA 的 DeepSeek 时刻将至:发展趋势、落地路径与机构最佳实践全景解析》

本文根据 Cobo Lily Z. King 2025 年 6 月 10 日在香港君合律师事务所的 RWA 活动上为多家券商基金稳定币机构和家办所做的主题为“不确定世界中的现实世界资产实践”的演讲内容整理。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。