Author: Nancy, PANews

Robinhood, which once attracted a new generation of retail investors to trade MEME stocks through the "retail battle against Wall Street," has officially unveiled its ambitions in the cryptocurrency space. With stock tokenization becoming a new battleground in the crypto market, Robinhood has announced the launch of tokenized stock trading, covering over 200 U.S. stocks and ETFs, and has introduced a dedicated Layer 2 blockchain for RWA based on Arbitrum.

As a result of this news, Robinhood's stock price rose over 12.7% to $93.6 by the close on June 30, reaching a historic high at one point. Meanwhile, the Arbitrum token ARB experienced a slight pullback during the day, mainly because the earlier positive news had already been priced in by the market.

Official Launch of U.S. Stock Tokenization in the EU, Joint Development of Official L2 with Arbitrum

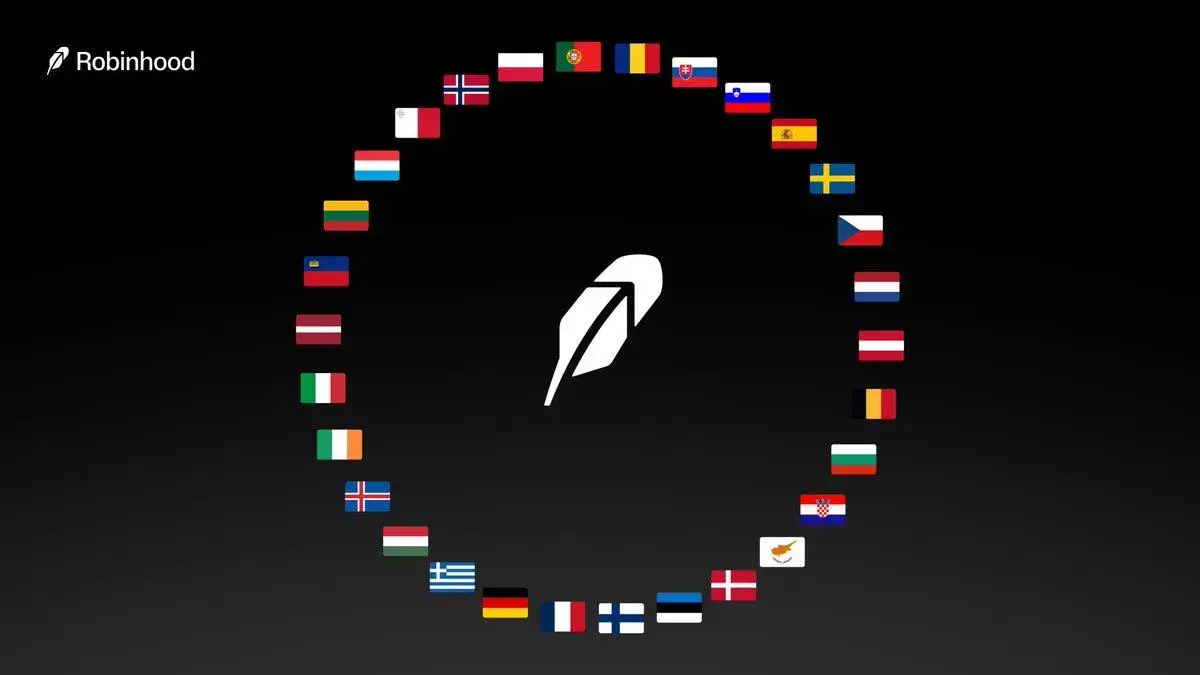

On the evening of June 30, at a press conference in Cannes, France, Robinhood announced that it would offer stock tokenization trading services to EU users, now supporting over 200 U.S. stock assets for on-chain trading 24 hours a day, five days a week, including tokens for OpenAI and SpaceX, with plans to expand to thousands by the end of this year.

Currently, Robinhood EU is giving away the first batch of private company stock tokens for free. If you are a Robinhood EU user and meet the eligibility criteria, you can claim the tokens in the app, with a deadline of July 7.

It is reported that this product only charges a 0.1% foreign exchange conversion fee to reduce the high intermediary costs for European investors accessing the U.S. market. In the future, users will be able to achieve self-custody of tokenized stocks and ETFs through Robinhood's crypto wallet, or choose a simplified operational experience without managing private keys.

Moreover, Robinhood stated that it is developing its own Layer 2 blockchain specifically designed for RWA based on Arbitrum, tentatively named Robinhood Chain, with its availability depending on applicable regulations and future launch timing. Johann Kerbrat, General Manager of Robinhood Crypto, mentioned that the design of this new chain began several years ago, focusing on RWA, aiming to break down the "walled garden" of traditional finance and achieve a more open and transparent asset trading experience.

In fact, Robinhood's launch of stock token products has been anticipated for a long time. In May of this year, Bloomberg cited insiders revealing that Robinhood is actively developing a blockchain-based platform that allows European retail investors to trade U.S. tokenized stocks, thereby expanding its business footprint in the European market.

According to insiders, this joint venture may start by partnering with a digital asset company, with Arbitrum and Solana vying to become partners in the project. Negotiations between the two parties are still ongoing, and no final conclusion has been reached.

In the same month, a job posting from Robinhood also confirmed this business layout, as the company was looking for a product manager to build a new crypto product architecture that supports cross-chain scalability from scratch. This position has since closed for applications.

To advance this business layout, Robinhood obtained a brokerage license in Lithuania in April of this year, qualifying it to provide investment services across the EU. Meanwhile, Robinhood acquired the established cryptocurrency exchange Bitstamp for $200 million, further solidifying its technological and compliance foundation in the European market.

On the technical cooperation front, multiple signs have indicated that Arbitrum has become a core partner in Robinhood's tokenized stock project. For instance, the Robinhood website entry appeared alongside Arbitrum's promoted Stylus technology on the homepage of the Arbitrum Portal; Robinhood announced it would release important crypto business updates at the EthCC conference in Cannes and would participate in a fireside chat with senior members of the Arbitrum development team. The market has already reacted positively to this news, with the Arbitrum token ARB achieving double-digit growth recently, rising over 25% in the past week. This is not the first collaboration between Robinhood and Arbitrum; as early as March of last year, Robinhood Wallet announced it had integrated Arbitrum to provide improved token exchange services for its users.

It is worth mentioning that in addition to launching U.S. stock tokenization products, Robinhood also announced a series of crypto asset features, including allowing European users to trade crypto perpetual contracts with up to 3x leverage (no expiration date), while U.S. users can stake ETH and SOL in compliant areas. Additionally, Robinhood will launch a credit card that supports crypto cashback, a personalized AI assistant called Robinhood Cortex, provide a temporary 1% reward on crypto deposits, and introduce a "tax lot" feature to help users achieve better tax strategies when selling crypto assets.

More Players Enter Tokenized Stocks, Robinhood Submits Policy Proposal Calling for Regulatory Reform

In recent months, several crypto institutions have made securities tokenization an important part of their strategic expansion. For example, Kraken has allowed non-U.S. customers to trade stocks in token form, launching 60 tokenized U.S. stocks in Europe, Latin America, and Africa; Coinbase is seeking SEC approval to launch tokenized stock services, which, if approved, would allow it to compete with other brokers in stock trading; Gemini has also announced a partnership with Dinari to launch tokenized stock trading services for EU users, with the first supported asset being Strategy (MSTR), and plans to continue launching more tokenized stocks and ETFs; the U.S. stock trading service startup Dinari has obtained broker-dealer registration for its subsidiary, making it the first tokenized stock platform in the U.S. to receive such approval.

For traditional brokers, which are heavily constrained by compliance and clearing systems, securities tokenization, with its low barriers, flexibility, and combinability, is gradually disrupting the traditional landscape. As a company that started with retail securities trading, Robinhood has faced growth pressures in its traditional business in recent years, and its zero-commission model for stock trading has struggled to maintain a competitive edge. Therefore, it has also begun to diversify its crypto business layout, achieving good results. In the first quarter of this year, Robinhood's total revenue grew by 50% year-on-year, with crypto business revenue doubling year-on-year to $252 million.

The disruptive potential of tokenization is another crypto track that Robinhood is vying for. In fact, Robinhood CEO Vlad Tenev has publicly expressed support for securities tokenization, stating that expanding retail investors' access to private market investment channels is one of the company's "most important policy priorities."

In January of this year, Tenev wrote in The Washington Post that companies like OpenAI and SpaceX are still private enterprises, and only a small group of wealthy insiders with access and capital can enter at the early stages of these companies, often reaping returns of 1000 times or more on their initial investments, while ordinary investors have no opportunity to participate. This investment gap is becoming increasingly severe—today, the number of publicly listed companies in the U.S. is only half of what it was in 1996. Meanwhile, the so-called "accredited investor rule" restricts most private investment opportunities to individuals with a net worth of over $1 million or an annual income exceeding $200,000, excluding about 80% of American households.

Tenev believes that what crypto technology truly offers is a more equitable, flexible, and 21st-century financial system, which will initiate the most inclusive investment revolution since stock trading moved from trading floors to electronic platforms. This technology can flexibly split and distribute ownership, allowing it to be freely traded like stocks, requiring only minor modifications to existing corporate equity legal documents. Once private companies are tokenized, ordinary investors can participate in their early development stages instead of waiting until they are allowed to enter after being listed with valuations in the hundreds of billions. Companies can also access crypto retail funds from around the world without sacrificing the conventional governance mechanisms of private companies, such as employee options and share lock-ups.

However, Tenev also acknowledged that current U.S. private company equity is regulated by the SEC, but there are no clear guidelines on how to legally issue and trade tokenized securities on crypto platforms. In contrast, regions such as the EU, Hong Kong, Singapore, and Abu Dhabi have gradually established complete regulatory frameworks supporting the issuance of security tokens (STO) and digital exchanges.

He proposed that the U.S. should advance three key reforms to unlock the benefits of securities tokenization: first, abolish the accredited investor system based on wealth thresholds. In an era where everyone can freely buy and sell MEME coins, measuring investment eligibility by net worth is outdated and absurd. If thresholds must be set, they should be based on investment knowledge and self-assessment of risk, rather than account balances; second, establish a "securities token registration system" to provide small and medium-sized companies with new financing pathways beyond traditional IPOs, reducing costs and barriers; third, provide clear compliance pathways for crypto trading platforms both domestically and internationally, including centralized and decentralized exchanges, ensuring that securities token trading can be opened to the public legally and safely.

It is worth noting that in May of this year, Robinhood submitted a 42-page policy proposal to the U.S. SEC, which included a nine-page comment letter on asset tokenization, calling for the establishment of the world's first federal regulatory framework for RWA tokenization, and revealed plans to build the RWA trading platform Robinhood RWA Exchange based on Solana and Base.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。