Barclays Bank Crypto Ban Sparks Debate Over Its Bitcoin ETF Investment

They say actions speak louder than words—but in Barclays Bank’s case, their actions scream contradiction.

Just days after pouring $131 million into BlackRock Bitcoin ETF, Barclays Bank crypto limits made headlines again. Now they’ve told customers: “You can’t buy assets using our cards.”

That’s right. Starting June 27, 2025, Barclays crypto ban kicks in fully—blocking all related purchases using Barclaycard credit cards. While they label this move as “consumer protection,” the irony is hard to miss in today’s rapidly evolving digital assets cycle.

Barclays Says “No” to Retail, “Yes” to $BTC: Double Standard?

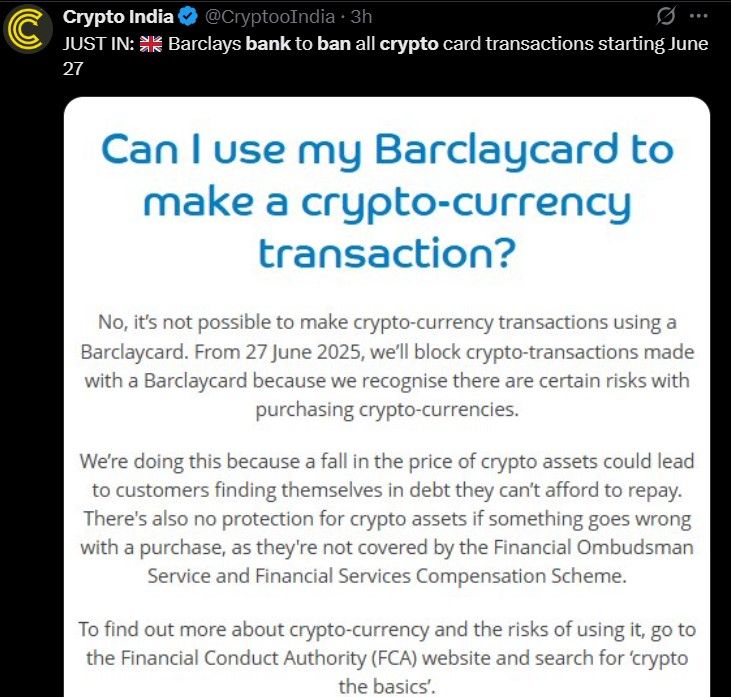

According to Barclays news today, this decision was confirmed on its official help desk page. When a user asked if they could use their Barclaycard for assets, the reply was short and clear:

“No, it’s not possible to make cryptocurrency transactions using a Barclaycard.”

Source: Crypto India X Account

In short, while Barclaycard restrictions hit retail users, the bank is doubling down on this token through a backdoor—by investing directly in Bitcoin ETF BlackRock products .

This dual approach screams of a widening institutional gap—rules for you, but not for them.

Behind the Ban: Consumer Protection or Power Play?

This Top-tier UK bank claims the ban is to ensure consumer safety and prevent people from overextending on risky assets. That may sound like responsible banking on the surface, but from another angle, it appears more like centralized gatekeeping.

Especially considering that, according to this X account, Barclays Bank Bitcoin ETF investment stands at $131 million, as shown in its latest 13F filing with the SEC.

Source: X

So while retail investors in the UK face a crypto credit card ban, the very bank restricting them is going deeper into the asset class—just through safer, more regulated, and exclusive channels.

Institutions Stack BTC While Retail Gets Blocked

Zoom out, and you’ll see this isn’t just a Barclays crypto news flash—it’s part of a broader trend across the banking sector.

The message is crystal clear: Institutions are buying this coin, while retail crypto bans in the UK limit ordinary users from participating.

It’s not the first time centralized finance (CeFi) has squeezed out the early believers in digital currency—and likely won’t be the last.

Why This Might Be Bullish for Bitcoin Price

Here’s the plot twist: this move might actually be bullish for this cryptocurrency in the long run.

With general user access limited, the Bitcoin price surge may be fueled quietly through this latest news and accumulation by large financial players like UK based instituion. This “quiet stacking” can set the stage for a controlled bull run, as institutions buying this token drive prices up behind the scenes—long before the FOMO kicks in again.

As of writing, BTC stands at $107,324.93, rising nearly 2% in 24 hours (source: CoinMarketCap). This stealth phase might become the fuel for the next explosive move upward.

“The Community Speaks”

The crypto community isn’t staying silent. In a recent post, Coin Bureau summarized the growing frustration:

“Retail blocked. Institutions stack.”

Source: Coin Bureau X Account

To many, it feels like an ecosystem designed to delay retail gains while giving institutions first access. The Barclays crypto ban becomes a symbol of that shift in power and timing.

Conclusion: This UK Based Financial Insitituion is Reshaping Access—But for Whom?

Whether this is really about consumer protection or simply institutional gatekeeping, one truth is undeniable: Access to Bitcoin is changing. Not disappearing—but evolving.

And as Barclays bank crypto limits retail, while it quietly builds a large position in a regulated Bitcoin ETF, the next rally might not be led by retail.

It’ll be shaped by those who were allowed to buy—whether with a card or ETF.

Also read: Tomarket Daily Combo 26 June 2025: Boost Your Earning免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。