InfoFi Prisoner's Dilemma: The Game Theory Dilemma of Profit Distribution under the Matthew Effect between Information Mining and Noise Vortex.

Written by: KarenZ, Foresight News

In 1971, psychologist and economist Herbert A. Simon first proposed the theory of attention economy, pointing out that in a world of information overload, human attention has become the most scarce resource.

Economist and USV managing partner Albert Wenger further revealed a fundamental shift in his book "The World After Capital": human civilization is undergoing a third leap—from the "scarcity of capital" in the industrial age to the "scarcity of attention" in the knowledge age.

Agricultural Revolution: Focused on solving food scarcity, but led to land disputes;

Industrial Revolution: Focused on solving land scarcity, but shifted to resource competition and capital accumulation;

Digital Revolution: Competing for attention.

The underlying driving force of this shift stems from two key characteristics of digital technology: the zero marginal cost of information replication and dissemination, and the universality of AI computation (but human attention cannot be replicated).

Whether it is Labubu's popularity in the trendy toy market or the live-streaming sales by top influencers, it is largely a competition for user and audience attention. However, in the traditional attention economy, users, fans, and consumers contribute attention as "data fuel," while excess profits are monopolized by platforms and scalpers. The InfoFi in the Web3 world attempts to overturn this model—through blockchain, token incentives, and AI technology, it aims to make the production, dissemination, and consumption of information transparent, attempting to return value to the participants.

This article will delve into the classification of InfoFi projects, the challenges they face, and future development trends.

What is InfoFi?

InfoFi is a combination of Information + Finance, focusing on transforming difficult-to-quantify, abstract information into dynamic, quantifiable value carriers. This encompasses not only traditional prediction markets but also the distribution, speculation, or trading of information or abstract concepts such as attention, reputation, on-chain data or intelligence, personal insights, and narrative activity.

The core advantages of InfoFi are reflected in:

Value redistribution mechanism: Returning the value monopolized by platforms in the traditional attention economy to the true contributors. Through smart contracts and incentive mechanisms, information producers, disseminators, and consumers can share the profits.

Information valorization capability: Transforming abstract concepts like attention, insights, reputation, and narrative activity into tradable digital assets, creating a trading market for information value that was previously difficult to circulate.

Low barrier to entry: Users can participate in value distribution simply by using their social media accounts for content creation.

Innovation in incentive mechanisms: Not only rewarding content creation but also including multiple aspects such as dissemination, interaction, and verification, allowing niche content and long-tail users to also receive rewards. High-quality content receives more rewards, incentivizing the continuous production of high-quality information;

Cross-domain application potential: For example, the introduction of AI provides advantages for content quality assessment, prediction market optimization, and more.

InfoFi Classification

InfoFi encompasses various application scenarios and models, which can be mainly divided into the following categories:

Prediction Markets

As a core component of InfoFi, prediction markets are mechanisms that use collective intelligence to predict the outcomes of future events. Participants express their expectations for future events (such as election or policy outcomes, sports events, economic forecasts, price expectations, product launch dates, etc.) by buying and selling "shares" linked to specific event outcomes, with market prices reflecting the collective expectations of the group. Polymarket is a representative application promoting the InfoFi concept.

Vitalik has been a loyal supporter of the prediction market Polymarket, stating in his November 2024 article "From Prediction Markets to Info Finance" that "prediction markets have the potential to create better applications in social media, science, news, governance, and other fields. I refer to these markets as info finance." Vitalik also pointed out the dual nature of Polymarket: one is a betting site for participants, and the other is a news site for everyone else.

Within the InfoFi framework, prediction markets are not merely speculative tools but platforms that uncover and reveal real information through financial incentive mechanisms. This mechanism leverages market efficiency, encouraging participants to provide accurate information, as correct predictions yield economic rewards, while incorrect predictions may lead to losses. Musk himself retweeted data stating "Trump leads with a 51% approval rating on Polymarket" a month before the 2024 U.S. election, commenting, "Due to the involvement of real money, this data is more accurate than traditional polls."

Representative platforms for prediction markets include:

Polymarket: The largest decentralized prediction market, built on the Polygon network, using USDC stablecoin as the trading medium. Users can predict events related to political elections, economics, entertainment, product launches, and more.

Kalshi: A fully CFTC-regulated prediction market platform in the U.S., which supports deposits in USDC, BTC, WLD, SOL, XRP, and RLUSD through collaboration with cryptocurrency and stablecoin infrastructure provider Zero Hash, but settles in fiat currency. Kalshi focuses on event contracts, allowing users to trade the outcomes of political, economic, and financial events. Due to regulatory compliance, Kalshi has a unique advantage in the U.S. market.

Yap-to-Earn InfoFi

"Yap-to-Earn" is a playful term used in the Chinese crypto community, referring to earning rewards by sharing insights and content. The core idea of Yap-to-Earn is to encourage users to post high-quality, crypto-related posts or comments on social platforms, mostly evaluated by AI algorithms based on the quantity, quality, interaction, and depth of the content, thereby distributing points or token rewards. This model differs from traditional on-chain activities (such as trading or staking) and places more emphasis on users' contributions and influence within the community.

Characteristics of Yap-to-Earn:

No need for on-chain transactions or high capital; participation is possible with just an X account.

Enhances community engagement by rewarding valuable discussions.

AI algorithms reduce human intervention, filtering out bots and low-quality content, ensuring more transparent reward distribution.

Points may be converted into token airdrops or ecosystem privileges, with early participants potentially receiving higher returns.

Current mainstream Yap-to-Earn projects or projects supporting Yap-to-Earn include:

Kaito AI: A representative platform for Yap-to-Earn, which has collaborated with multiple projects to evaluate the quantity, quality, interaction, and depth of crypto-related content posted by users on X through AI algorithms, rewarding Yap points for users to compete for token airdrops.

In this way, creators can effectively prove their influence and content value through Yaps, attracting precise high-quality attention; ordinary users can efficiently discover quality content and KOLs through the Yaps system; while project parties achieve the dual goals of accurately reaching target users and expanding brand influence, forming a virtuous ecosystem of mutual benefit.

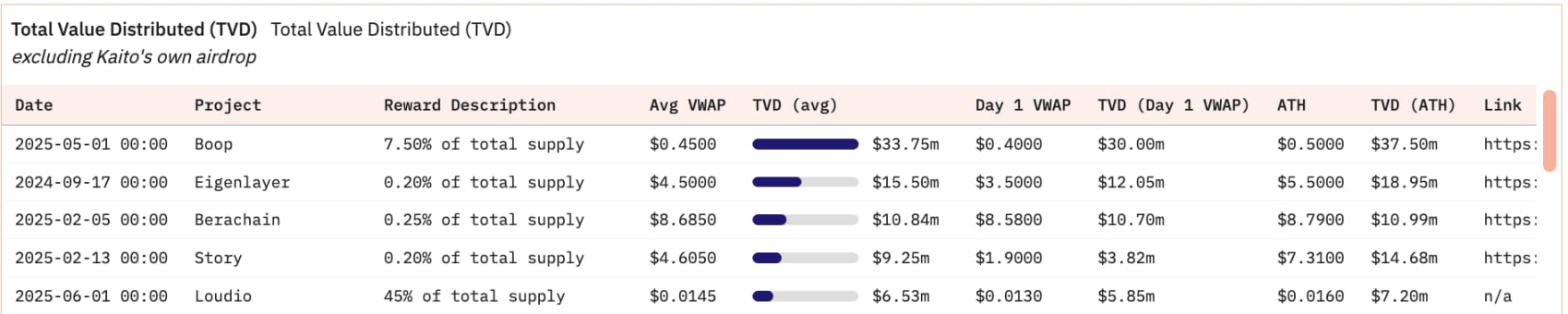

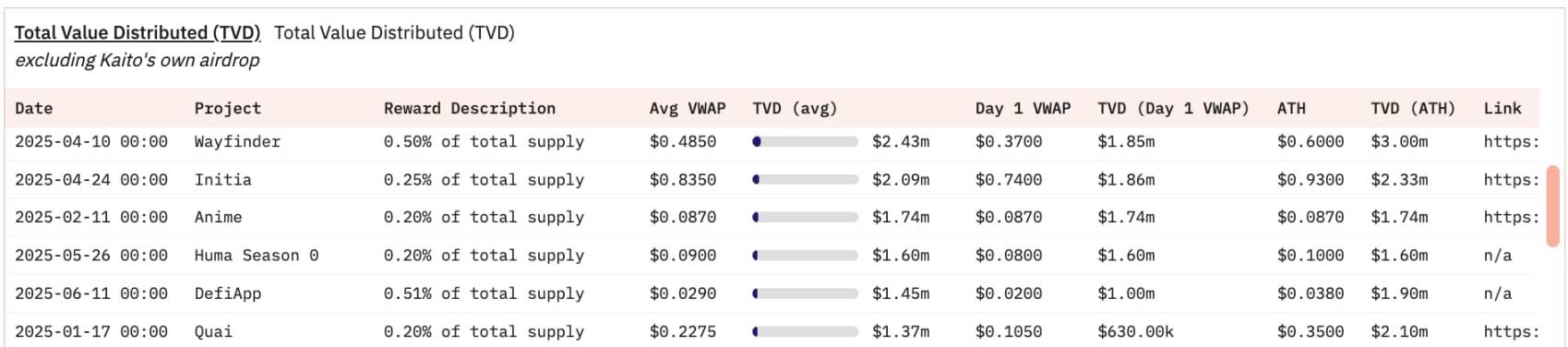

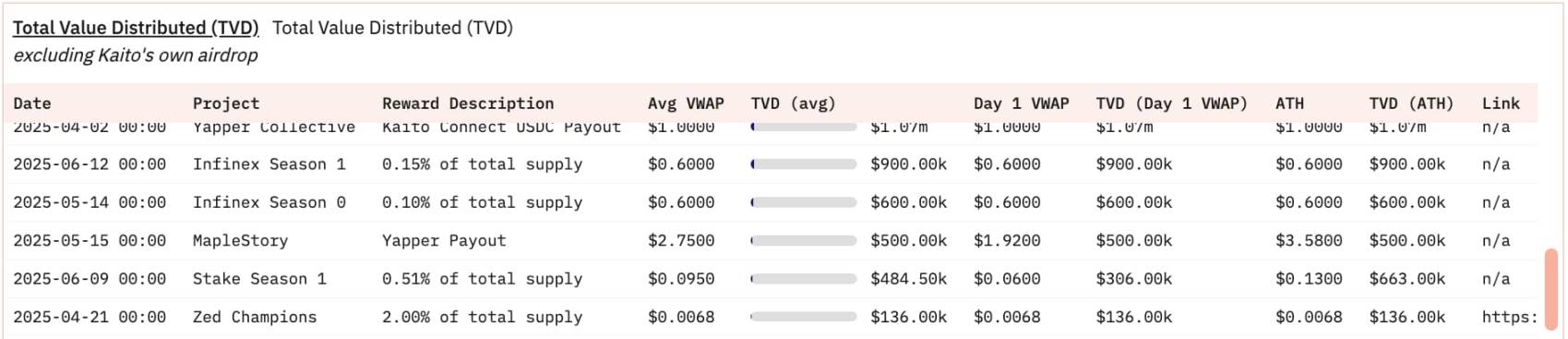

Kaito AI has distributed tokens worth over $90 million to various communities (excluding Kaito's own airdrops), with over 200,000 active Yappers each month.

Source: https://dune.com/queries/5088750/8397899

Cookie.fun: Cookie tracks the mindshare, interaction, and on-chain data of AI agents, generating a comprehensive market overview, and also tracks the mindshare and sentiment of crypto projects. Cookie Snaps has a built-in rewards and airdrop activity system, providing rewards to Cookie creators who contribute to project attention.

Cookie has collaborated with three projects to launch Snaps activities, namely Spark, Sapien, and OpenLedger. Among them, the Spark activity had over 16,000 participants, while the latter two projects had 7,930 and 6,810 participants, respectively.

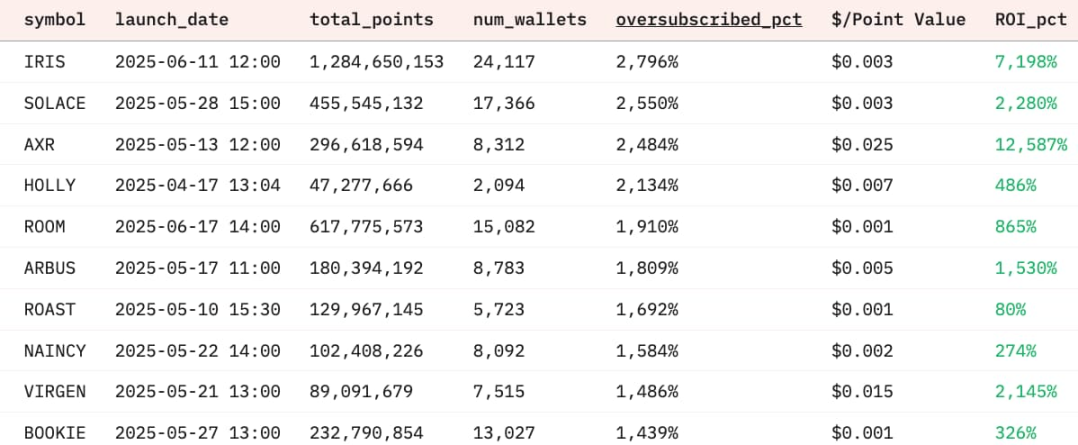

Virtuals: Virtuals is not a platform focused on Yap-to-Earn but an AI agent launch platform. However, in mid-April, it launched a new launch mechanism called Genesis Launch on Base, where one of the ways to earn points for participation includes Yap-to-Earn (supported by Kaito).

The top AI agent projects with high subscription rates on Virtuals, source: https://dune.com/queries/5195678/8548951

Loud: Loud, as an "attention value experiment" within the Kaito AI ecosystem, occupied over 70% of the Kaito attention leaderboard through Yap-to-Earn activities before officially launching its token through an Initial Attention Offering (IAO) at the end of May 2025. The LOUD operating mechanism also revolves around the "attention economy," with transaction fees collected after trading primarily distributed to the top 25 users on the attention leaderboard in SOL form.

Wallchain Quacks: Wallchain is a programmatic AttentionFi project based on Solana, supported by AllianceDAO. The Wallchain X Score evaluates users' overall influence, while Wallchain Quacks rewards high-quality content and valuable interactions. Currently, Wallchain Quacks' customized LLM evaluates creators' content daily, and valuable, insightful content creators will receive Quacks rewards.

Yap-to-Earn + Tasks / On-chain Activities / Verification: Multi-dimensional Contribution Valorization

Some projects also combine content contributions with on-chain behaviors (such as trading, staking, NFT minting) or tasks to comprehensively assess users' multi-dimensional contributions.

Galxe Starboard: Galxe is a Web3 growth platform, and its newly launched Galxe Starboard aims to reward real contributions in off-chain and on-chain actions. Projects can define multiple contribution layers; what matters is not just how many tweets were posted, but the value brought to the entire project, including post engagement, sentiment, viral spread, interaction with dApps, token holdings, NFT minting, or completing on-chain tasks.

Mirra: Mirra is a decentralized AI model trained on community-curated data, capable of learning from real-time contributions of Web3 users. Specifically, creators posting high-quality content on X equate to submitting AI validation data; scouts identify high-value content on X and tag @MirraTerminal in replies to submit insights, determining what content the AI learns from, helping shape intelligent AI.

Reputation-based InfoFi

Ethos is an on-chain reputation protocol entirely based on open protocols and on-chain records, combined with Social Proof of Stake (Social PoS), generating credibility scores through decentralized mechanisms to ensure the reliability, decentralization, and Sybil resistance of its reputation system. Currently, Ethos operates on a strict invitation basis. The core function of Ethos is to generate credibility scores, a quantifiable metric of users' on-chain trustworthiness. The scores are based on the following on-chain activities and social interactions: comment mechanisms (with cumulative utility), guarantee mechanisms (staking Ethereum to endorse other users).

Ethos has also launched a reputation market, allowing users to speculate on the reputation of individuals, companies, DAOs, or even AI entities by buying and selling "trust votes" and "distrust votes," essentially going long or short on reputation.

GiveRep: Primarily built on Sui, it aims to convert users' social influence and community participation on the X platform into quantifiable on-chain reputation, incentivizing user participation through rewards. Commenting on a creator's post and tagging GiveRep's official Twitter allows both the commenter and the creator to earn a reputation point. To limit abuse, GiveRep restricts users to a maximum of 3 such comment mentions per day (including the 3), while creators can receive unlimited points daily. Comments from Sui ecosystem projects and ambassadors will earn additional points.

Attention Markets / Predictions

Noise: A trend discovery and trading platform based on MegaETH, currently requiring an invitation code for access. Users can go long or short on a project's attention.

Upside: Upside is a social prediction market (investors include Arthur Hayes) that rewards discovering, sharing, and predicting valuable content and links, creating a dynamic market through a liking mechanism. Profits are proportionally distributed to voters, creators, and curators. To prevent manipulation of the prediction pool, the weight of likes is reduced in the last 5 minutes of each round.

YAPYO: An attention market infrastructure within the Arbitrum ecosystem. YAPYO states that the rewards in its coordination mechanism are not just profits but also lasting influence.

Trends: Allows tokenization of X posts, becoming a trend on the joint curve called "Trend it." Creators are eligible to receive 20% of the joint curve trading fees for each trend.

Token-gated Content Access: Filtering Noise

Backroom: Creators can launch tokenized spaces to provide curated content such as market insights, Alpha, and analysis without the need for management or social pressure; users can unlock low-noise, high-value information by purchasing on-chain Keys tied to each creator's space. Keys are not just for access—they are tradable assets with a demand-driven dynamic pricing curve. Meanwhile, AI processes chat data and signals into actionable insights.

Xeet: A new protocol on the Abstract network that has not yet fully launched, but has already introduced a referral program where inviting KOLs will earn reward points. Xeet's founder @Pons_ETH mocked that InfoFi has evolved into NoiseFi, stating, "It's time to reduce noise and enhance signals." Currently, the publicly available information is that Xeet will integrate with Ethos scores, but no further details have been disclosed.

Data Insight InfoFi

Arkham Intel Exchange: Arkham is an on-chain data query tool, intelligence trading platform, and exchange. Arkham Intel Exchange is a decentralized intelligence trading platform where "on-chain detectives" can earn bounties.

InfoFi Dilemma

Prediction Markets

Regulation and Compliance: Prediction markets may be viewed as markets similar to binary options or gambling, facing regulatory pressure. For example, Polymarket was deemed to be operating illegally by the CFTC in the U.S. for not registering as a designated contract market (DCM) or swap execution facility (SEF), resulting in a $1.4 million fine in 2022 and a requirement to block U.S. users. Investigations by the U.S. Department of Justice and FBI in 2024 further highlight its regulatory dilemmas.

Insider Trading and Fairness: Prediction markets may be affected by insider information. Large funds may distort prices in the short term. Designing fair rules and mechanisms is one of the key challenges for InfoFi prediction markets.

Liquidity and Participation: The effectiveness of prediction markets relies on sufficient participants and liquidity. Prediction markets often face the "long-tail liquidity problem" on niche topics, where insufficient participants lead to unreliable market information. The introduction of AI agents may partially address this issue, but further optimization is still needed.

Oracle Design: Polymarket has faced oracle manipulation attacks, resulting in significant losses for users betting on correct outcomes. In February 2025, UMA, Polymarket, and EigenLayer announced they were collaborating to research building prediction market oracles. Some research ideas include developing an oracle that can support multiple tokens to resolve disputes, with other features under study including dynamic binding, AI agent integration, and enhanced security against bribery attacks.

Yap-to-Earn

Information Noise Intensification, Proliferation of AI Content Ads, obscuring real signals. Users find it difficult to sift through vast amounts of content for value, leading to a decline in community trust and diminishing marketing effectiveness for projects. According to KOL Crypto Brave (@cryptobraveHQ), "Several project owners have complained about spending 150,000 USDT service fees on Kaito, distributing 0.5%-1% of Tokens to KOLs for Yap-to-Earn, only to find that a large portion of participation comes from AI content ad accounts. Project parties want to attract top KOLs and ICTs to participate, but have to pay extra, and then Kaito contacts top KOLs to get involved."

Most Yap-to-Earn projects' algorithms lack public explanations on how to assess content quality, interactivity, and depth, raising user concerns about the fairness of point distribution. If the algorithm favors specific accounts (such as big V or matrix accounts), it may lead to the loss of quality creators. Kaito has recently made some new upgrades to the algorithm based on community feedback, focusing on prioritizing quality over quantity by default, ensuring that posts without project insights and comments do not receive attention, and further combating interaction manipulation and group spamming behaviors.

Matthew Effect in Profit Distribution: In most cases, projects and KOLs benefit mutually, but tail content creators and retail participants still face low earnings and fierce competition. Kaito founder Yu Hu stated on June 8, "Of the approximately 1 million registered users on Kaito, fewer than 30,000 have ever earned yaps, which is less than 3%. The next growth phase of the network is to maximize conversion rates." Additionally, poor management of airdrop expectations can lead to community dissatisfaction. Magic Newton is a relatively successful case of Yap-to-Earn on Kaito AI, with Kaito ecosystem recommendations accounting for one-third of all Newton validation agents, and Yap-to-Earn users earning substantial rewards, but it also faces criticism for being unfriendly to retail participants. In contrast, Humanity has been accused by the community of "betraying users" and "extreme anti-Yap," leading to a trust crisis due to this distribution imbalance.

Yap-to-Earn activities initially attract user participation, but attention sharply declines after rewards are distributed, lacking sustainability. LOUD's token market cap approached $30 million on launch day, but has since fallen to less than $600,000.

Attention does not equal market cap share.

Reputation

Reputation InfoFi projects like Ethos adopt an invitation system to control user quality and reduce Sybil attacks. However, this mechanism raises the participation threshold, limiting new user onboarding and making it difficult to form widespread network effects.

Risk of malicious operations.

Issues with cross-platform recognition of reputation scores, as different protocols' scoring systems are difficult to interoperate, creating information silos.

InfoFi Trends

Prediction Markets

The Combination of AI and Prediction Markets: AI can significantly enhance the efficiency of prediction markets. For example, AI can provide more accurate predictions in complex scenarios by analyzing vast amounts of data; it can also explore AI agents to address long-tail issues.

The Combination of Social Media and Prediction Markets: Prediction markets have the potential to become the core infrastructure of the future information economy. On June 6, X officially announced a partnership with Polymarket, which became X's official prediction market partner. Polymarket founder and CEO Shayne Coplan stated, "Combining Polymarket's accurate, fair, and real-time prediction market probabilities with Grok's analysis and X's real-time insights will provide contextual, data-driven insights to millions of Polymarket users worldwide instantly."

Decentralized Governance: Prediction markets can be applied to the governance of DAOs, companies, and even society, known as "Futarchy." Vitalik stated in 2014 that Futarchy is a governance model proposed by economist Robin Hanson, with the core idea being "vote values, bet beliefs." The operation works as follows: the community votes to determine a metric for success (such as GDP, company stock prices, etc.); for specific policy proposals, two prediction markets are created (for and against). Participants trade these two tokens, with prices reflecting the market's expectations of whether the policy can optimize the goal; ultimately, the policy with the higher average price is chosen, and token rewards are settled based on actual results. The advantage of Futarchy is that it relies on data rather than political propaganda, personal charisma, or promotion.

Content and News Tools for Everyone.

Yap-to-Earn + Reputation-based InfoFi

Introduce social graph and semantic understanding technologies to enhance AI's accuracy in assessing content value, ultimately leaning towards high-quality content.

Incentivize quality long-tail creators.

Add reduction or penalty mechanisms.

Release of Web3-specific InfoFi LLM.

Multi-dimensional assessment of contributions.

Combine reputation-based InfoFi with DeFi, using reputation scores as credit for lending and staking.

Tokenization of abstract assets such as attention, reputation, and trends will give rise to more types of derivatives.

Not solely based on the X social platform.

Integration with more social platforms and news media to drive the formation of a tool for attention and Alpha discovery accessible to everyone.

Data Insight InfoFi

Combine data analysis charts with creator insights, while also adding incentive mechanisms related to creation and distribution.

Combine data analysis charts with AI analysis.

Summary

The core contradiction of the digital age is the disconnection between attention creators and value holders. This disconnection is the driving force behind the Web3 InfoFi revolution.

The core contradiction of InfoFi Yap-to-Earn lies in the inability to balance information value and participation incentives, which may lead to a repeat of SocialFi's "high opening and low closing" scenario. The key to InfoFi is establishing a "trinity" balance mechanism—information mining, user participation, and value return—to drive the formation of a better knowledge-sharing and collective decision-making infrastructure. This requires not only the technical realization of quantifying attention but also ensuring that ordinary participants can receive reasonable returns from information dissemination in the mechanism design, avoiding severe imbalances in value distribution.

More importantly, the revolution of InfoFi requires joint promotion from both top-down and bottom-up approaches to truly achieve fairness and efficiency in the attention economy. Otherwise, the Matthew effect of the profit pyramid will reduce InfoFi to a gold mining game for a few, contradicting the original intention of "universal access to attention value."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。