Bank of America believes that while Labubu and Moutai both possess social currency attributes, there are significant generational differences between them.

Written by: Ye Zhen, Wall Street Journal

The wildly popular Labubu has been jokingly referred to as "the Moutai for young people." So, what are the similarities and differences between the two?

According to news from the Trend Trading Desk, Bank of America recently released a report comparing this trendy IP with traditional liquor giant Moutai, attempting to clarify whether this is a historical replay of the consumption cycle or a profound paradigm shift.

Bank of America analysts Alice Ma, Chen Luo, and Lucy Yu pointed out that although both are social currencies, Labubu's social attributes are more based on the shared interests and values of the younger generation, while Moutai's social function relies more on power and hierarchical relationships. This difference reflects the essential distinction between "new consumption" and "traditional consumption."

Bank of America noted that, similar to Moutai, Pop Mart also faces the dual challenge of the IP cycle and investment attributes. If there is a long gap between Labubu and the next hit IP, the company's global growth may slow down.

Additionally, investors cannot ignore the two major risks of regulation and market crowding. The report warns that the current phenomenon of capital concentrating in the "new consumption" sector is quite similar to the previous capital rally around consumer blue-chip stocks represented by Moutai. The fragility of such crowded trades could have a significant impact on valuations.

Bank of America maintains a buy rating on Pop Mart, with a target price of HKD 275. According to statistics, Pop Mart's stock price has ranged from HKD 34.4 to HKD 283.4 over the past 52 weeks, closing at HKD 244.2 on Monday.

Generational Differences in Social Currency

The Bank of America research team believes that while Labubu and Moutai both possess social currency attributes, there are clear generational differences. Moutai's social function is more reflected as a "social/business lubricant" productivity tool, while Labubu represents the younger generation's pursuit of emotional value, providing consumers with an instant, nuanced, and affordable "dopamine" experience in the digital social media era.

Analysts point out that in a digital world where consumers face "meaninglessness" and increasing pressure, Labubu suggests that China is gradually shifting from an investment-driven model to a consumption-driven model. Moutai is deeply rooted in traditional Chinese culture, and its globalization process is still in the early stages, while Labubu, which aligns closely with the global zeitgeist, has already achieved significant global success.

Social Attribute Differences: Moutai's social attributes rely more on power and hierarchical systems, primarily serving business occasions; Labubu represents the younger generation's social interactions based on interests and values, emphasizing emotional value and instant gratification.

Consumption Motivation: Moutai can serve as a "productivity tool" (business lubricant), while Labubu meets the younger generation's pursuit of emotional value and "dopamine" consumption in a digital social environment, reflecting China's transition from investment-driven to consumption-driven.

Globalization Process: Moutai is deeply embedded in traditional Chinese culture and is still in the early stages of globalization; Labubu has already achieved significant success globally, aligning with global trends.

The Double-Edged Sword of IP Cycle Risks and Investment Attributes

While experiencing rapid growth, Bank of America also pointed out the similar challenges faced by Pop Mart and Moutai, namely the dual test brought by the IP lifecycle and product investment attributes.

Bank of America believes that whether Pop Mart's net profit in 2025 is RMB 8 billion or RMB 10 billion is not important, as it depends on Labubu's shipment speed. Instead, what matters is how to balance short-term growth and the IP lifecycle.

IP Lifecycle Risk: Moutai, with a century of historical accumulation and official endorsement, has proven its ability to navigate cycles. In contrast, Pop Mart and Labubu have histories of only 15 years and 10 years, respectively, making the IP lifecycle a core risk.

The report suggests that as an IP platform, Pop Mart's diversified IP portfolio can mitigate risks, but Labubu is crucial to its global success. If there is a long gap between Labubu and the next hit IP, its global growth may slow down. Additionally, the "mainstreaming" of subcultures may drive growth but could also dilute Labubu's unique social identity, thereby alienating its core consumer group.

Pros and Cons of Investment Attributes: Moutai's history shows that "investability" is a double-edged sword, acting as a booster in upward cycles and becoming an amplifier in downward cycles.

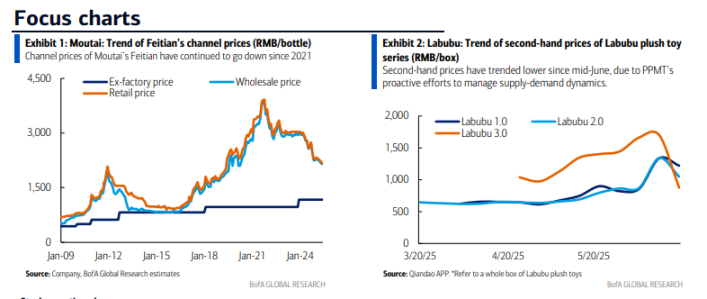

The report notes that Pop Mart is actively managing second-hand market prices to ensure its appeal to young consumers and create a favorable environment for the release of new IP and products. The recent decline in second-hand prices for Labubu plush toys is seen as a result of Pop Mart's proactive management of supply and demand dynamics.

Unignorable Regulatory and Market Crowding

The report concludes by emphasizing that regulation and market sentiment are two other risk factors that investors must confront.

Regulatory Risk: Moutai is always subject to price controls and anti-corruption policies. Similarly, Pop Mart is not in a regulatory vacuum. A recent article in the People's Daily warned of market-related risks. However, Bank of America analysts believe that as Pop Mart's consumer base becomes increasingly diverse, "mainstreaming" reduces its exposure to minors in the Chinese market. At the same time, the growing overseas business (expected to contribute over half of sales by 2025) also helps hedge against regulatory risks in a single market. However, this risk may still negatively impact the company's fundamentals or lead to "headline noise" that causes stock price volatility.

The Fragility of "Crowded" Trades: In every cycle of the capital market, dominant "crowded trades" may emerge. The influx of capital into consumer blue-chip stocks represented by Moutai from 2016 to 2021 is quite similar to the current concentration of funds in the "new consumption" sector centered around Pop Mart. Changes in capital flow and positions could have a significant impact on valuations—Moutai's forward P/E ratio was close to 60 times in early 2021, while it is currently only 18-19 times. Although recent changes in capital flows have put some pressure on "new consumption" stocks like Pop Mart, the report suggests that in the context of a scarcity of quality investment targets, this "crowded" situation may persist for some time. The real turning point may only come when meaningful turning points appear in high-frequency data from overseas markets or when a strong recovery in the Chinese economy provides investors with more options.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。