Hacken Token Plunge 99% After Private Key Hack: Can Trust Be Restored?

How could a top blockchain cybersecurity company like Hacken fall victim to the very vulnerabilities it warns people about? Over the weekend, Hacken — a Ukrainian Web3 cybersecurity company — suffered a crippling security breach that sent shockwaves through the crypto space. The attackers managed to mint nearly 900 million falsified HAI tokens through Ethereum and BNB Chain networks, and the token price collapsed straight away by almost 99%.

Given all these high-profile attacks, the crypto community finds itself again in disbelief, even more so in the account of heavier allegations on trust, security standards, and the future of Hacken.

How Did the Hacken Breach Happen?

In an X post , As Hacken attributed the breach to "human error," a most serious admission for a trusted blockchain security outfit. The attackers began their exploit when a private key for an account holding minting rights was compromised. This troubling instance gave the perpetrators the time to quickly mint and dump hundreds of millions of HAI tokens on DEXs.

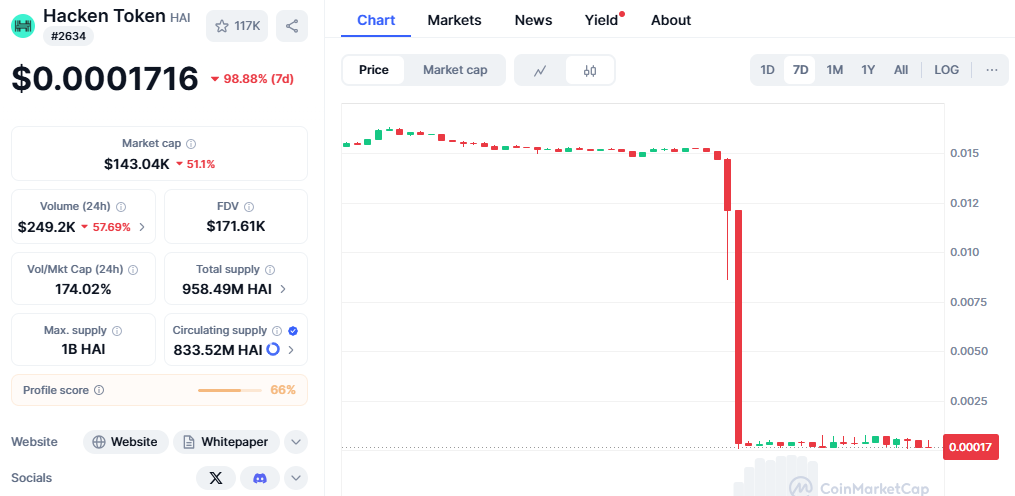

Since that time, the price took a turn from its highs of $0.015 down to $0.000056, started recovering since then, and was around $0.0001716 at the time of writing.

Source: CoinMarketCap

What the Attackers Stole — and Its Wider Impact

According to an official report from Hacken, a direct theft of HAI tokens worth approximately $250,000 did occur; however, the broader damage to the market was severe. The market cap for HAI plummeted from $12.7 million to $7.2 million while confidence in the token's stability took a serious dip.

The attackers minted some 900 million HAI tokens- almost double the total supply- which triggered panic selling and a massive downfall in token value across different trading platforms.

The Role of Bridge Infrastructure in the Breach

An interesting fact is that the private key compromise happened while the security changes were made to the infrastructure of the blockchain bridge. In other words, these finer adjustments were ironically meant for better security.

Hacken CEO Dyma Budorin took responsibility, having admitted to deliberately postponing the implementation of multi-sig bridge security for five years-plus, even in full knowledge of the risk involved. He said,

"Our bridge was designed when the market and technology were substantially different... Redesigning a deployed bridge means moving contracts — a complex legal and technical process."

Immediate Security Measures Taken

In a problematic situation that needed immediate curbing, the firm suspended all bridge transactions across the Ethereum and BNB Chain networks. The team also stressed the fact that the deployer wallet itself was not compromised, which allowed them to revoke access swiftly from the minted accounts that were compromised.

Bridge activity remains halted for the moment, with plans to rebuild the infrastructure under stricter security protocols.

What Will Happen to HAI Tokens Going Forward?

In a significant update for token holders, the firm announced that all HAI tokens bought on affected networks after the attack will not be considered in the upcoming tokenomics model. The company is now aiming to have HAI go from a token to a regulated security backed by Hacken’s equity, which should sustain value long-term and build investor confidence.

Current HAI holders will be invited to participate in a future token swap, with exact details promised in Hacken’s full incident report, to be released soon.

Why This Hack Matters for the Entire Crypto Industry

The breach underscores a disquieting truth — even security-centric Web3 firms are still vulnerable to human errors and process faults. Ironic really, since Hacken's very own Q1 2025 security report listed access control vulnerabilities as the top threat to Web3 and claimed that damages worth $1.6 billion had been incurred this year due to such vulnerabilities.

Another thing that makes this incident even more terrifying is that it joins the alarming spree of big 2025 crypto hacks that recently saw the Meta Pool exploit, wherein the hackers minted $27 million worth of tokens (and $132,000 was stolen from there).

The Hardest Hit: Hacken’s Reputation

While financial damages may have the potential to be recuperated further down the road, the reputation of Hacken may take a longer time to be restored." Budorin, the CEO, said:

"The cash loss is considerable, but the reputation hit is far worse. Yet, it is not a long-term problem: we will learn and bounce back."

This breach is a chilling reminder: no one, conferred so-called 'top-tier' cybersecurity company talks can escape through the myriad threats that envision the quickly advancing domain of blockchain.

And, as the dust settles, the crypto-world queries: Will the firm be able to restore trust after such a brutal blow? And will this very breach provide enough impetus for the Web3 ecosystem to impose stronger security standards?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。