Why Metaplanet’s 1,111 Bitcoin Buy Signals Growing Institutional Trust

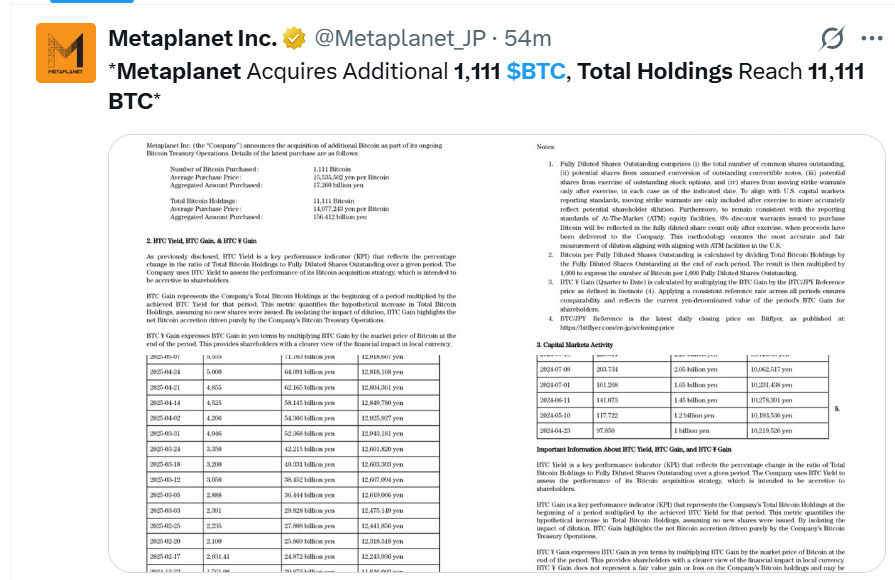

Metaplanet acquired 1,111 BTC for $118.2 million, achieving a 306.7% BTC Yield YTD 2025. As of 6/23/2025, they hold 11,111 BTC for $1.07 billion at $95,869 per bitcoin.

Source X

Simon Gerovich, describes Bitcoin as a robust safe-haven investment.

As the CEO of a publicly traded company in Japan, Simon Gerovich is not just another crypto supporter; his remarks reflect an increasing level of institutional trust in the cryptocurrency's place in the world financial arena. Gerovich boldly referred to BTC as "durable, borderless, and unstoppable" in a post on X, confirming what many in the cryptocurrency community have long held: this is a shield rather than merely an investment. Metaplanet has launched Asia's largest-ever equity raise dedicated to crypto currency, raising ¥770.9 billion (~$5.4B) and issuing 555 million shares via moving strike warrants in Japan. This follows the successful 210 Million Plan, raising ¥93.3B (~$650M) in 60 trading days and achieving a +189% BTC yield. Metaplanet aims to raise 100,000 BTC by end-2026 and 210,000 BTC by end-2027, aiming to become 1% of all that will ever exist.

Texas becomes first U.S. state to launch a Bitcoin reserve fund

Texas has become the first US state to allocate public funds to a stand-alone reserve for crypto, marking the establishment of the Texas Strategic Bitcoin Reserve. The state-managed fund will store crypto currency as part of the state's long-term financial assets, functioning independently of the general treasury system. The reserve aims to increase financial stability and act as an inflation hedge. Assets with a market valuation of at least $500 billion can be included, with BTC $101,293 currently meeting this requirement. The Texas Comptroller of Public Accounts will oversee the fund's administration, with three cryptocurrency investing experts serving as its advisory council.

Real-World Situation: The Reasons cryptocurrency Is Becoming More Trusted

Traditional assets are under pressure as a result of ongoing inflation, ongoing international wars , and central banks caught between rate hikes and recessions. Meanwhile, When the value of their native currency declined, people in Argentina started using digital currency. When inflation in Turkey skyrocketed above 50%, it provided stability. High interest rates haven't deterred institutional funds from using it as a hedge, even in the US. Long-term holders (HODLers) frequently outperform traditional investments during times of global instability, despite the fact that its price fluctuates significantly.

Is Bitcoin considered a "Digital Gold"?

Although this has previously been referred to as "digital gold," the macro narrative is more prevalent than ever. Investors now view it as an insurance policy rather than merely a speculative move. It has comparable scarcity to gold, but it is frequently easier to store, more accessible, and divisible. Cryptocurrency operates globally, on-chain, and around the clock, unlike fiat currencies that rely on central banks. Its potential to protect against inflation and geopolitical chaos has led to increased institutional support and decentralized strength.

Gerovich is not alone, either:

Larry Fink of BlackRock has referred to Bitcoin as an "international asset."

Fidelity has increased the range of services it offers customers linked to Bitcoin.

Bitcoin has even been incorporated into the policies of countries such as those in El Salvador and the Central African Republic.

Digital assets is being increasingly adopted by publicly traded firms, with Nakamoto Holdings and The Blockchain Group acquiring more digital asset through private placements in public equity and PIPE deals, respectively, following Michael Saylor's Strategy approach.

The digital and decentralised future is Right Here

When a CEO of a publicly traded corporation openly declares digital currencies "unstoppable," it's a signal, not just hype. Traditional finance is keeping an eye on it. Institutions are becoming warmer. And people are starting to awaken. Bitcoin is more than just a currency. It is a dialogue. a trigger. And perhaps the foundation for the next phase of financial independence. Metaplanet's swift BTC accumulation demonstrates its adaptability to the financial landscape, and as more companies follow suit, its role in the global economy is expected to grow, potentially igniting a new era of digital asset investment.

Also read: OKX Could Launch U.S. IPO Following Circle’s Stock Surge免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。