Coinbase launches Coinbase Payments, providing merchants with a new platform to accept stablecoins, further solidifying its position in the global payments market.

Authors: Sam Reynolds & AI Boost

Translation: Deep Tide TechFlow

Key Information:

South Korea's influence in the altcoin market continues to manifest, with the rise of the $USELESS token driven by key opinion leaders (KOLs) and retail investors.

President Trump supports the GENIUS Act, aimed at regulating stablecoins and enhancing the U.S. leadership in the digital asset space, but the bill's prospects in the House of Representatives remain unclear.

Coinbase launches Coinbase Payments, providing merchants with a new platform to accept stablecoins, further solidifying its position in the global payments market.

Good morning, Asia! Here are the latest updates on market dynamics:

Welcome to the "Asia Morning Brief," a daily summary covering important news and market dynamics during the U.S. trading session. For a more detailed overview of the U.S. market, please refer to CoinDesk's "Crypto Americas Diary".

South Korea has long been known for its significant influence in the altcoin market, from last year's frenzy that drove XRP prices up 400% to the current obsession with a token that calls itself "USELESS."

According to Seoul analyst Bradley Park from DNTV Research in an interview with CoinDesk, the $USELESS craze is closely related to South Korea's cryptocurrency key opinion leaders (KOLs).

At the center of it all is South Korean KOL and liquidity provider Yeomyung. He invested early in $USELESS and held on after a 50% pullback, now enjoying substantial paper gains.

I currently hold 2.8% of $USELESS, officially surpassing @theunipcs to become the largest holder.

However, I still won't sell.

The era of BONK and USELESS is about to arrive.

$pump has always been "useless."

——Yeomyung (@duaud9912)

"He made a fortune during the Trump coin craze, and with $USELESS, he also profited from early liquidity provision, now just holding and waiting," Park said in an interview with CoinDesk. "They are all waiting for the centralized exchange (CEX) launch because without it, there is no real exit channel."

Park has tracked Yeomyung's wallet activity and noted that his early conviction has inspired retail investors in South Korea to follow suit. Even wallets associated with insiders from Solana's Jupiter platform (JUP, current price $0.40957) are holding $USELESS. This phenomenon reflects a broader evolution of market behavior in South Korea.

"I genuinely believe that Korean users are no longer just 'greater fools' in this market," he stated. "They are starting to understand the market and gradually growing into real global players."

Another key figure in this story is Bonk Guy, an early promoter of BONK. With the rebound of $USELESS prices, he has resurfaced and is enthusiastically promoting it on Twitter. However, some Korean traders, including Park, have questioned his sincerity.

"Bonk Guy was the first to promote LetsBONK," Park said. "But after the price crash, he went silent. Now that $USELESS is rebounding, he suddenly shows interest again."

Park also mentioned that the rise of Hyperliquid, Kaia, and now Solana-based memecoins like $USELESS indicates that South Korea is no longer a secondary market.

Park stated that unlike the rise of XRP, which relies on clarity in U.S. law and the narrative of deregulation during the Trump era, the $USELESS craze is more of a genuine reflection of the current market's attention and fatigue, rather than mere chaos.

With no roadmap, no practical use, and no illusion of a larger vision, $USELESS represents a meme-driven disillusionment: a collective disregard for the promises of traditional cryptocurrencies and a sarcastic bet on "nothingness." Ironically, this bet seems more honest than many tokens that claim to change the world.

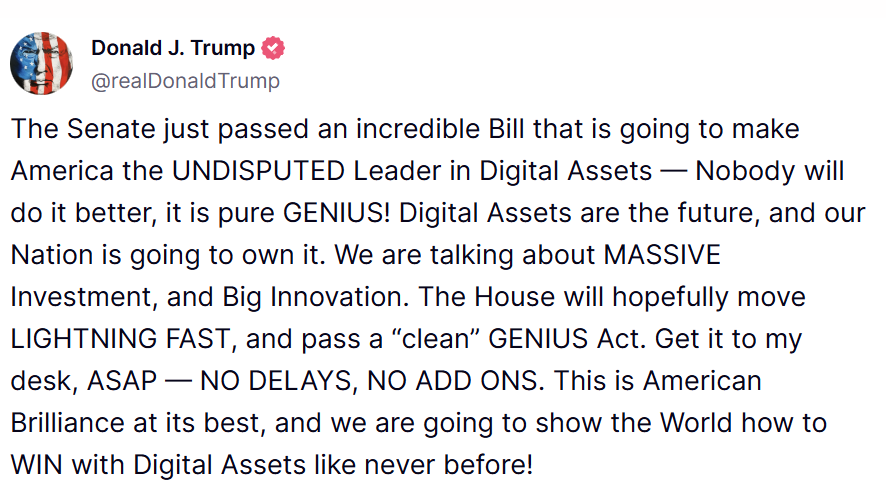

Trump Supports the GENIUS Act

On Tuesday, President Trump posted on Truth Social in support of the GENIUS Act. The bill had previously passed with bipartisan support in the Senate, and Trump called it an important step in promoting U.S. leadership in the digital asset space.

Trump urged the House to pass the bill "at lightning speed" and emphasized that no amendments should be made, demanding that the bill be sent to his desk for signing "without delay and without add-ons."

This statement demonstrates strong support from the executive branch for the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act). The bill introduces reserve and compliance requirements for issuers of dollar-backed stablecoins and becomes the first significant cryptocurrency legislation to pass the Senate.

Trump described the bill as key to driving "massive investment" and "significant innovation," believing it will help the U.S. secure global leadership in the digital asset space.

Despite the strong bipartisan support in the Senate, the bill's fate in the House remains uncertain.

Democratic lawmakers are considering possible amendments, including stricter regulations on foreign-issued tokens and restrictions on potential issuers.

However, the bill also faces criticism. In a recent CoinDesk editorial, Georgetown University finance professor James J. Angel pointed out flaws in the GENIUS Act, including fragmented oversight by 55 regulatory agencies, redundant processes, exclusion of interest-bearing stablecoins, and an inefficient joint rule-making mechanism.

Coinbase Launches Merchant Payment Platform

Coinbase (ticker: COIN) launched Coinbase Payments on Wednesday, a new merchant payment solution based on its Ethereum Layer 2 network, Base.

According to CoinDesk, the platform is designed for global e-commerce platforms like Shopify, allowing for 24/7 acceptance of USDC (U.S. dollar stablecoin) payments without requiring merchants to have blockchain expertise. Its features include gas-free stablecoin checkout, e-commerce API engine, and on-chain payment protocols.

Coinbase stated that the system aims to replicate traditional payment rails while reducing costs and providing around-the-clock settlement services. This move positions Coinbase at the forefront of competing with fintech companies like Stripe and PayPal, jointly modernizing payments through blockchain infrastructure.

Additionally, the launch of this product deepens Coinbase's partnership with USDC issuer Circle (ticker: CRCL). Following the announcement, Circle's stock rose 25%, while Coinbase's stock increased by 16%. Coinbase noted that the transaction volume processed by stablecoins reached $30 trillion last year, three times that of the previous year, betting that programmable, dollar-pegged payment methods will continue to disrupt the global financial system.

Market Dynamics:

Bitcoin (BTC): Despite escalating tensions between Israel and Iran, Bitcoin has shown a V-shaped rebound, with prices rising above $105,000. According to technical analysis data from CoinDesk Research, strong ETF inflows and a key support level at $103,650 highlight institutional investors' confidence amid market volatility.

Ethereum (ETH): Ethereum rose 4%, maintaining above $2,500, despite tensions in the Middle East, with record staking volumes and ongoing capital accumulation indicating growing investor confidence amid market fluctuations.

Gold: Gold fell 0.19%, priced at $3,383.11. The Federal Reserve kept interest rates unchanged at 4.25%-4.5%, with Chair Powell stating that there would be no policy adjustments in the near term, emphasizing that the economy remains strong despite trade tensions.

Nikkei 225 Index: Japan's Nikkei 225 index fell 0.27% on Thursday, with mixed performance in the Asia-Pacific markets, weighed down by the Fed's pause on interest rate hikes and the Israel-Iran tensions.

S&P 500 Index: The S&P 500 index dipped 0.03%, closing at 5,980.87 points. The Federal Reserve maintained interest rates, with Powell indicating a wait-and-see approach, while uncertainty remains regarding Trump's tariff policies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。