In the midst of strategizing, we can win from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

I wonder if everyone has been following the recent updates from the SEC. The approval of Solana's spot ETF has entered its final stage, and it is almost 100% likely to be approved.

Recently, Bloomberg disclosed that the SEC has requested all seven applicants for the Solana spot ETF to submit S1 update documents, asking them to include staking features in their ETF applications, which include top Wall Street giants like Grayscale, VanEck, Franklin, and Fidelity.

Moreover, you should know that this time the SEC proactively contacted them, rather than them wanting to add it themselves, which indicates that the SEC is indeed going to approve it, and it will be a direct approval of the ETF with staking. This will provide an additional 8% annual yield, greatly increasing the attractiveness of the Sol ETF. After all, traditional ETFs like the S&P or Nasdaq have an average annual yield of only about 8%, while Sol's spot ETF does nothing and still comes with an 8% yield, making it far more attractive than the initial non-staking ETF for ETH. When approved, Sol could potentially surge by 20% immediately, and then with Wall Street funds entering, it could rise further, which is a foreseeable situation.

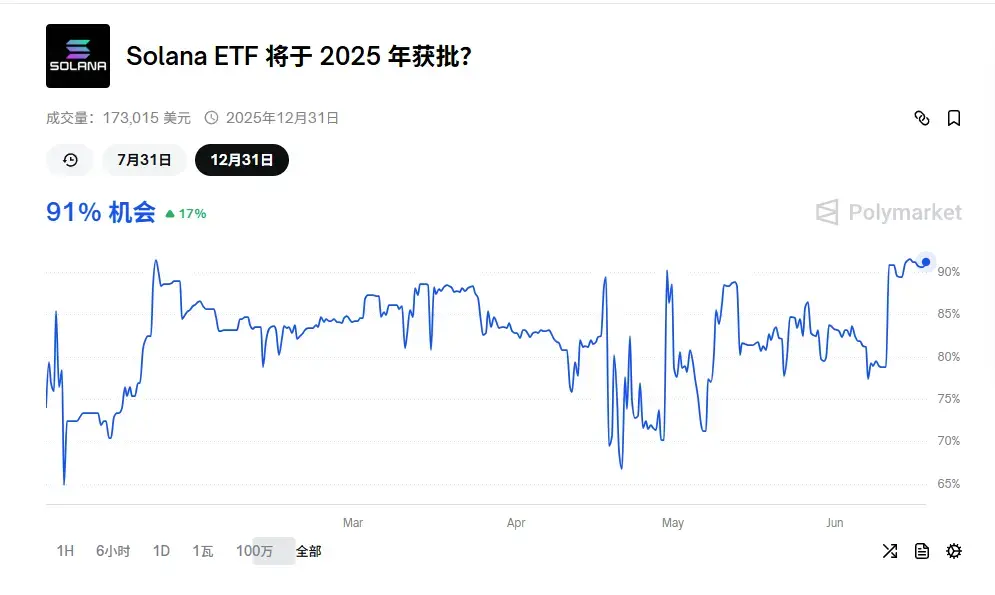

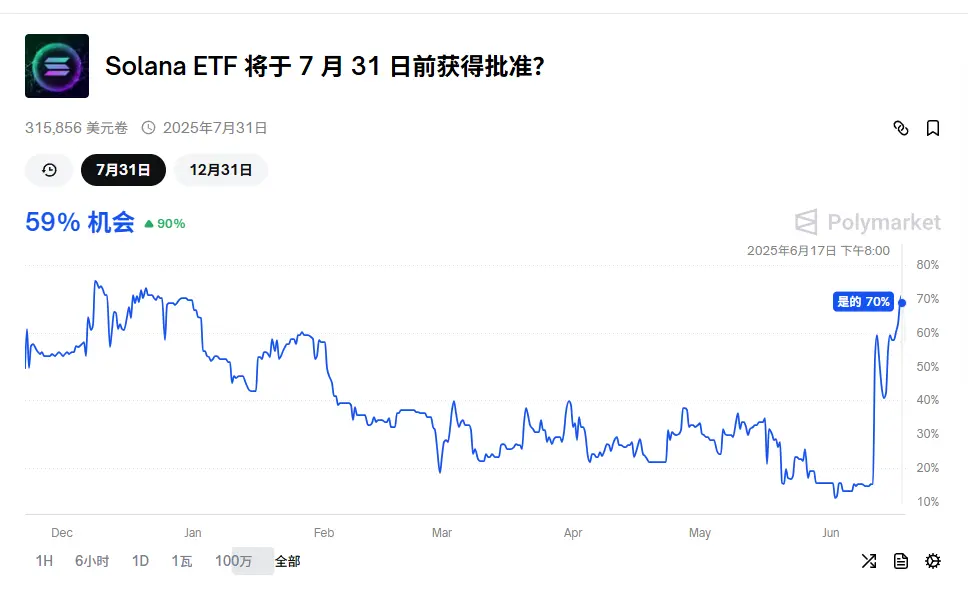

So when will Solana's spot ETF be approved? According to Bloomberg analyst James, he believes the Sol ETF should be approved in the second half of this year, with July being a possibility, but a higher probability is after September. Therefore, we are not in a hurry; we should focus on one important thing: wait for a pullback, wait for a pullback, wait for a pullback. According to Polymarket's predictions, the probability of SOL passing the ETF approval before August has increased to 59%, and the probability of passing the ETF review within 25 years has reached as high as 91%, which is almost just a matter of time.

Lin Chao has always emphasized to everyone that the period from June to September is a good time to enter the market. Currently, from the K-line perspective, SOL is indeed very cost-effective, having significantly pulled back from its high of 188 to 140, where there is decent support. However, if it can drop a bit lower and break the 140 support to create a waterfall effect, it is likely to reach around 120, and Lin Chao will continue to buy. If it breaks the support, I even think it would be a good opportunity to enter heavily. Entering during pessimism and exiting during euphoria is the behavior of a wise person. In contrast, ETH is currently very active, and I will only sell part of my holdings at this time. Lin Chao will write a specific article about ETH in the future.

Speaking of the final bottom, Lin Chao believes the overall bottom will arrive in July-August. From Bitcoin's market data, the last platform level was actually around $60,000, and since this year it has risen from $74,000 to a new high without breaking the $100,000 mark. Many people believe it has stabilized above $100,000, but Lin Chao does not agree. I believe that from June until the end of this quarter, it will be a period of oscillation and pullback, and there is still a lot of room for pullback. If the second half of the year really develops as Lin Chao speculates, there may be an upward trend, then this quarter will likely see a deeper pullback, possibly even breaking down to around $80,000. The indicators also suggest this; currently, Bitcoin's greed and fear index is still above 60, indicating greed. This month's volatility can at most be considered consolidation, and there has not been a real pullback yet. Yesterday, a user privately messaged Lin Chao asking if there is still an opportunity to bottom BTC and when to enter. I believe that if one tries to bottom now, it is likely to be halfway up the mountain; at least we should wait for a break of the double support before deciding whether to enter.

Additionally, Lin Chao is particularly concerned about the tariff news on July 8. The 90-day tariff suspension period initiated by Trump in April will end on July 8. If no agreement is reached before then, Trump will restore the initially exaggerated rates. In Lin Chao's view, although the verbal threats may be false, once the news is released, the market will indeed drop. If the directional judgment is wrong, it could lead to real losses due to false news. Even if the U.S. reaches an agreement with some countries, the cryptocurrency market and U.S. stocks may still experience a situation where good news is fully priced in and begins to pull back, which is not optimistic. For instance, Japan shows no signs of compromise, demanding the complete removal of tariffs by the U.S. The EU is also not backing down, infuriating Trump to threaten an additional 25% tariff, and there has been no progress so far. Therefore, these could become the fuse for an explosion on July 8. Lin Chao wants to remind everyone that my recent positioning has been a slight market test, and everyone should not blindly enter heavily.

Especially considering the rising inflation, increasing unemployment, and the likelihood that the Federal Reserve's interest rate cuts will be delayed until September, without fundamental support, it is very difficult to expect price increases. Smart capital will definitely reduce risk exposure rather than chase high prices, especially since Bitcoin is currently at historical highs.

Aside from that, the biggest focus this week is undoubtedly the Federal Reserve's interest rate meeting on Wednesday night and Thursday morning. Lin Chao feels that the situation is not very optimistic because the recent geopolitical conflict between Iran and Israel has caused oil prices to surge by 20%, and combined with the previous weeks' 20% increase, the total rise is 40%. As we know, oil is a significant component of inflation; with oil prices rising by 40%, inflation expectations will inevitably soar. Therefore, under these circumstances, the probability of negative news from the Federal Reserve meeting on Wednesday (June 18) is higher, and everyone should prepare in advance. Lin Chao's suggestion is to stay out of the market and wait for news. Here, I especially remind contract users to only engage in day trading today and not to hold positions overnight.

Lin Chao's Message

We must always maintain sensitivity to information in order to make the right decisions at the right time; riding the wind is the only opportunity for ordinary people. The biggest prison in the world is the consciousness of people. If you cannot earn money beyond your cognition, then learn to leverage.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier financial perspective.

For real-time consultation, please follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。