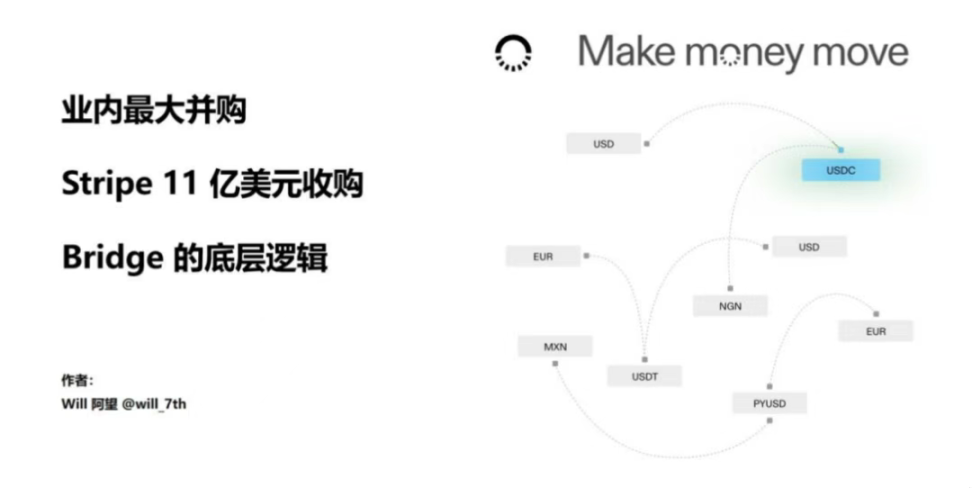

This acquisition is another significant bet by Stripe on the stablecoin market following its $1.1 billion purchase of the stablecoin service provider Bridge last October.

Written by: Will Awang

On June 12, American payment giant Stripe announced the acquisition of Privy, a popular embedded wallet infrastructure provider that helps platforms like Hyperliquid, OpenSea, Blackbird, and Toku integrate crypto wallets directly into the user experience, eliminating complexity for users and improving conversion rates.

Stripe is a payment platform serving half of the Fortune 100 companies and 78% of the Forbes AI 50 companies. Last year, Stripe processed $1.4 trillion in payment transactions, a 38% year-over-year increase. The revenue growth processed on Stripe is seven times that of S&P 500 companies, giving the platform significant influence in mainstream business. In other words, Stripe is the ideal choice to drive the development of stablecoins.

For Stripe, which is well-versed in the dynamics of capital flow, this acquisition is another significant bet on the stablecoin market following its $1.1 billion purchase of the stablecoin service provider Bridge last October. On the surface, this acquisition shows that Privy can help Stripe expand its on-chain wallet account capabilities, but behind the scenes, it may involve a game of strategy with banks and compliance. However, this does not hinder the immense potential of Web3 payments.

1. Privy: The Crypto Wallet Provider

Privy was founded in 2021 with the goal of enabling any developer to easily build better products based on crypto technology (Unlock Crypto Rails). Whether cryptocurrency is a core feature of an application or merely an add-on, a great crypto product should be user-friendly and convenient.

This is the original intention of Privy, dedicated to making cryptocurrency easy to use so that more people can benefit from it.

The starting point for all this is to create a better wallet.

Market Pain Point: Wallets are essential and scalable interfaces for owning and exchanging value online, and they should have the same level of craftsmanship as any internet application. However, when Privy was just starting out, despite the powerful features of early crypto wallets, their usage barriers were extremely high, limited to advanced users.

"Developers had to make users leave the platform to start using crypto services… This complexity fundamentally limited the types of products that could be built. It not only hindered user experience but also reduced user conversion rates. At the same time, this resistance fundamentally restricted the development of the cryptocurrency field."

——Henri Stern, Privy CEO & Co-Founder

( privy.io)

Solution: The emergence of Privy is precisely to eliminate this complexity by abstracting away the intricate technical details, allowing users to have an experience similar to other parts of the internet when using crypto products: simple and easy to use; intuitive and convenient; instant response.

Privy provides a simple and easy-to-use API and SDK that allows developers to embed crypto wallets directly into their applications. Unlike relying on standalone wallets (like Metamask or Phantom), Privy allows developers to integrate wallets directly into their applications, whether they are marketplaces, games, or fintech platforms.

Use Case: Today, Privy supports over 75 million accounts for more than 1,000 development teams and has facilitated billions of dollars in transactions between wallets, applications, and users, enabling users to easily earn, transfer, and use new assets online, such as:

- Hyperliquid: Creating a new type of trading experience platform.

- Blackbird: Helping restaurants accept digital assets from loyal diners.

- Toku: Enabling global teams to get paid in instant digital dollars.

- Farcaster: Building the future social graph based on crypto technology.

Privy's initial insight is clear and underestimated: wallets are the gateway to cryptocurrency, but this gateway is broken. Privy has changed this situation by pioneering embedded wallets, making the experience of using cryptocurrency as seamless as logging in with email.

Since Paradigm led the investment in 2023, Privy has grown from 1M wallets and 41 clients to now providing wallet process support for top teams like Hyperliquid, Jupiter, and Blackbird, quietly reshaping the way billions of dollars flow online, covering trading platforms, digital banks, remittance platforms, and payment applications.

——Caitlin, Paradigm Investment Partner

Funding Overview: Privy's previous valuation was $230 million, but discussions on X suggest its valuation has reached nine figures, with previous investors including Sequoia, Ribbit Capital, Paradigm, Blue Yard, Coinbase Ventures, Archetype, Electric Capital, and Protocol Labs.

After the acquisition by Stripe, Privy will continue to operate independently. Like the acquired Bridge, independent operation means Privy can be more agile, easier to launch more features, and provide better services to users, focusing more on its core business and user needs.

2. Strategic Synergy Between Privy and Stripe

In its 2024 annual letter, Stripe made a bold statement: "The Stripe platform will become the best way to build stablecoin applications." This acquisition indicates that they are rapidly executing this roadmap.

Funds must be stored somewhere, and Privy is building the world's highest quality programmable vault. In addition to our other stablecoin-related work, we look forward to contributing to the birth of a new generation of global, internet-native financial services. —Patrick Collison, Stripe CEO

2.1 Privy for Stripe

Privy is not just a set of APIs; it is a battle-tested product with a developer experience similar to Stripe, a customer-centric team, and strong credibility in the crypto builder ecosystem. Industry insiders unanimously emphasize its execution quality.

Just like other major internet companies developing their own technology, while some may think Stripe could develop this feature on its own, this overlooks the key point: developing the first version is easy, but perfecting the details—handling edge cases, adapting to customer needs, supporting production workloads—is not trivial.

Of course, this is not just a technical acquisition. Stripe chose to acquire to gain market responsiveness, brand credibility, and product-market fit, along with integrating more stablecoin business from Bridge.

Stripe gains:

- A top-tier team with native cryptocurrency product genes;

- A developer-centric embedded wallet platform;

- A broad native cryptocurrency customer base;

- Existing momentum, rather than waiting 18 months.

As Dr. Xiao Feng from Hashkey clearly stated: Blockchain is the next generation of financial infrastructure.

This is crucial, but I want to clarify: Blockchain is internet-based, and in the battle for the internet, speed is essential.

More importantly: The internet has network effects.

In this next-generation financial battle, Stripe is accelerating, and Privy can help them achieve this goal faster, while others are still discussing how to issue stablecoins.

2.2 Stripe for Privy

For Privy, Stripe brings significant enhancements in business coverage and resources:

- A wide distribution channel aimed at a large number of fintech and enterprise developers;

- A reputation for reliability and compliance on a global scale;

- Capital and support to continue operating independently.

2.3 Bridge: Backend Support for Stablecoins

Stripe acquired Bridge for $1.1 billion in October 2024, providing three core services that developers can access with just a few lines of code:

- Stablecoin orchestration: Enabling businesses to transfer, store, and accept various stablecoins, with Bridge handling compliance and regulatory requirements.

- Currency acceptance: Allowing businesses to convert local fiat currency into stablecoins.

- Transfer functionality: Supporting global fund flows and account creation in USD and EUR.

The practical applications of Bridge are already quite extensive. SpaceX uses Bridge through its parent company Starlink to repatriate earnings earned in Argentina in USD. Nigerian users pay for YouTube Premium and ChatGPT through Bridge's orbit, while small businesses in the U.S. can accept global stablecoin payments without worrying about the complexities of international banking.

Since the acquisition, Bridge has rapidly developed, with its stablecoin financial accounts now operating in 101 countries, allowing businesses to hold balances in USDC and USDB (Bridge's stablecoin) while receiving funds through traditional banks and crypto networks.

Additionally, Bridge recently partnered with Visa to launch the world's first stablecoin card issuance product. Through this collaboration, fintech and crypto companies (such as Ramp, Squads, and Airtm) have begun issuing Visa cards directly linked to stablecoin wallets, allowing cardholders to spend their stablecoin balances at Visa's 150 million merchants worldwide.

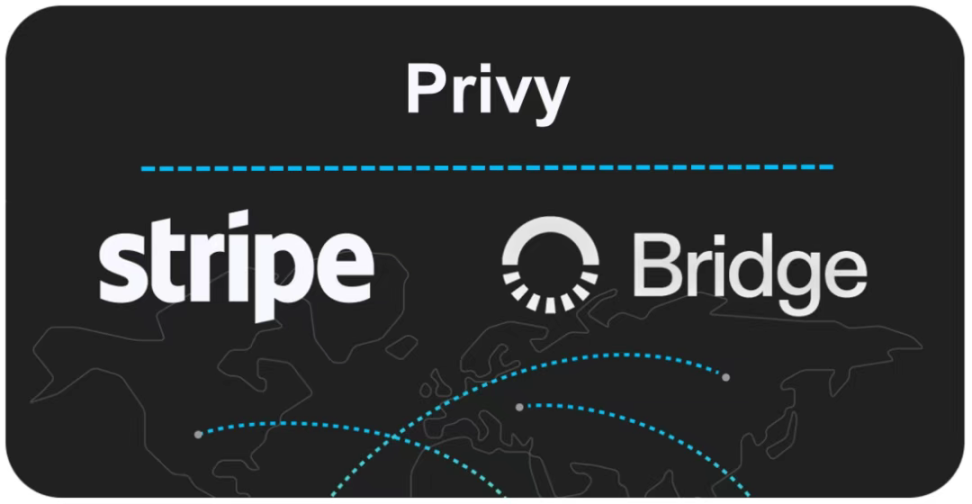

3. Integration of Bridge and Privy by Stripe

3.1 Comprehensive Adaptation of Fiat & Crypto Stack

For Stripe, the existing functionalities of Privy and Bridge form a perfect complement to its stablecoin strategy. Privy transforms the on-chain wallet infrastructure required for stablecoin payments into a plug-and-play feature similar to Stripe, providing on-chain support for all of Bridge's existing custodial stablecoin services.

In other words, Stripe can now offer tools at various levels of the Fiat & Crypto stack:

Bridge is responsible for providing compliant fiat entry and exit channels for clients from over 100 countries (through leading banks), as well as custodial services and payment channels for stablecoin value accounts;

Privy handles the non-custodial addresses for stablecoins and manages the complexities of on-chain wallets;

All of this is achieved through a Stripe-level developer experience, fully integrating the crypto payment track of stablecoins through its existing channels and markets.

Most people may miss the true significance of this combination: Stripe can provide users with crypto wallets (Privy) in any market, any fintech company can add stablecoin accounts (Bridge), and any platform can achieve second-level global settlement (Stablecoin, USDB), all completed through an API that developers already trust (Stripe).

3.2 Opening On-Chain Financial Markets Through Privy

Before Privy, both Stripe's payment network and Bridge's stablecoin payment network (which still required bank accounts for entry and exit) relied on custodial bank accounts. Bank accounts mean regulation, compliance, high costs, and restrictions.

Once more stablecoin business is integrated, due to regulatory compliance pressures, both stablecoin operations and custodial accounts will face significant limitations from banks, internal corporate compliance, and regulation. By acquiring Privy, Stripe can conduct stablecoin business through Privy's independent entity while also achieving significant compliance flexibility, cost control, and business possibilities through self-custodied wallets.

This opens up more possibilities for Stripe's stablecoin innovation business, especially in emerging markets and the global fintech space:

- Opening stablecoin accounts and settlements for offline merchant acquirers while controlling costs;

- Creating multiple wallets for online e-commerce sellers to manage;

- Seamlessly creating wallets for consumers for crypto payments;

- Facilitating access to on-chain democratized yield products;

Convenient cross-border remittance through the crypto payment track within the app.

The change here is:

Fiat to Stablecoin (Bridge) — More stablecoin scenario building (Stripe) — On-chain self-custody of stablecoins (Privy) — A programmable, permissionless world on-chain.

3.3 What Will Happen Next?

What is still missing in the stablecoin world built by Stripe? It is expected that Stripe will continue to complete the puzzle in three directions:

Digital asset licenses: Although Stripe already holds most fiat payment licenses, emerging digital asset licenses will broaden its stablecoin and cryptocurrency services globally.

More non-USD payment channels and currency acceptance channels for entry and exit: Bridge recently added Mexico, and more local payment channels will strengthen its global infrastructure advantage.

On-chain financial services: Stripe may embed credit, lending, and even cryptocurrency trading into its API-driven business account services—similar to Revolut Business.

Through these initiatives, Stripe will provide a programmable, borderless financial stack, forming a scalable, global on-chain financial market at a cost that is only a fraction of traditional banks.

4. In Conclusion

Stripe's cryptocurrency journey has seen ups and downs over more than a decade. The company tested Bitcoin payments in 2014 but stopped supporting them in 2018 due to price volatility issues. In 2019, Stripe joined Facebook's Libra project (which later evolved into Sui and Aptos) but subsequently withdrew.

Now, with Privy responsible for wallet infrastructure and Bridge providing stablecoin backend services, Stripe has mastered both ends of the stablecoin stack. Historically, the adoption of stablecoins has been limited by infrastructure gaps—businesses want to accept cryptocurrency payments but struggle to make it easy for users, while users want to use cryptocurrency payments but face the complexities of wallet operations.

But now, Stripe can eliminate these barriers for them, bringing an end to the dial-up internet era of cryptocurrency integration.

This could be a potential turning point for the adoption of stablecoins. Stripe's influence extends far beyond crypto-native applications, encompassing mainstream business, enterprise software, and global markets. By making the integration of stablecoin APIs as simple as adding a payment method, Stripe has the potential to accelerate the adoption of cryptocurrency in markets that still belong to niche areas, driving Crypto Mass Adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。