Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

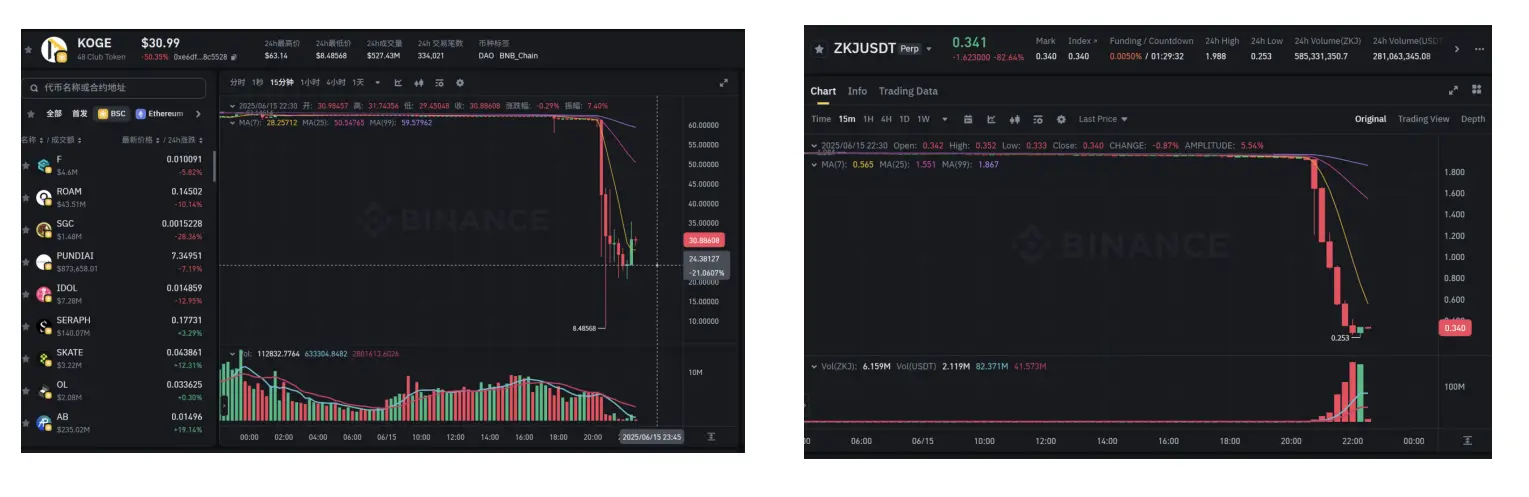

Last night was not a peaceful night. The hottest "massive liquidity mining" targets in Binance Alpha, ZKJ and KOGE, experienced a coordinated flash crash.

In just two hours, ZKJ plummeted from $2 to $0.29, a staggering drop of 85%. KOGE fell sharply from $57 to $24, even touching $8 at one point. Market capitalization vanished, and liquidity evaporated instantly.

The joint collapse of ZKJ and KOGE struck a heavy blow to the vulnerabilities of the Alpha model. Was it an unexpected loss of control for individual projects, or is the entire incentive mechanism approaching a critical point?

The Collapse of the "Liquidity Mining" Paradigm

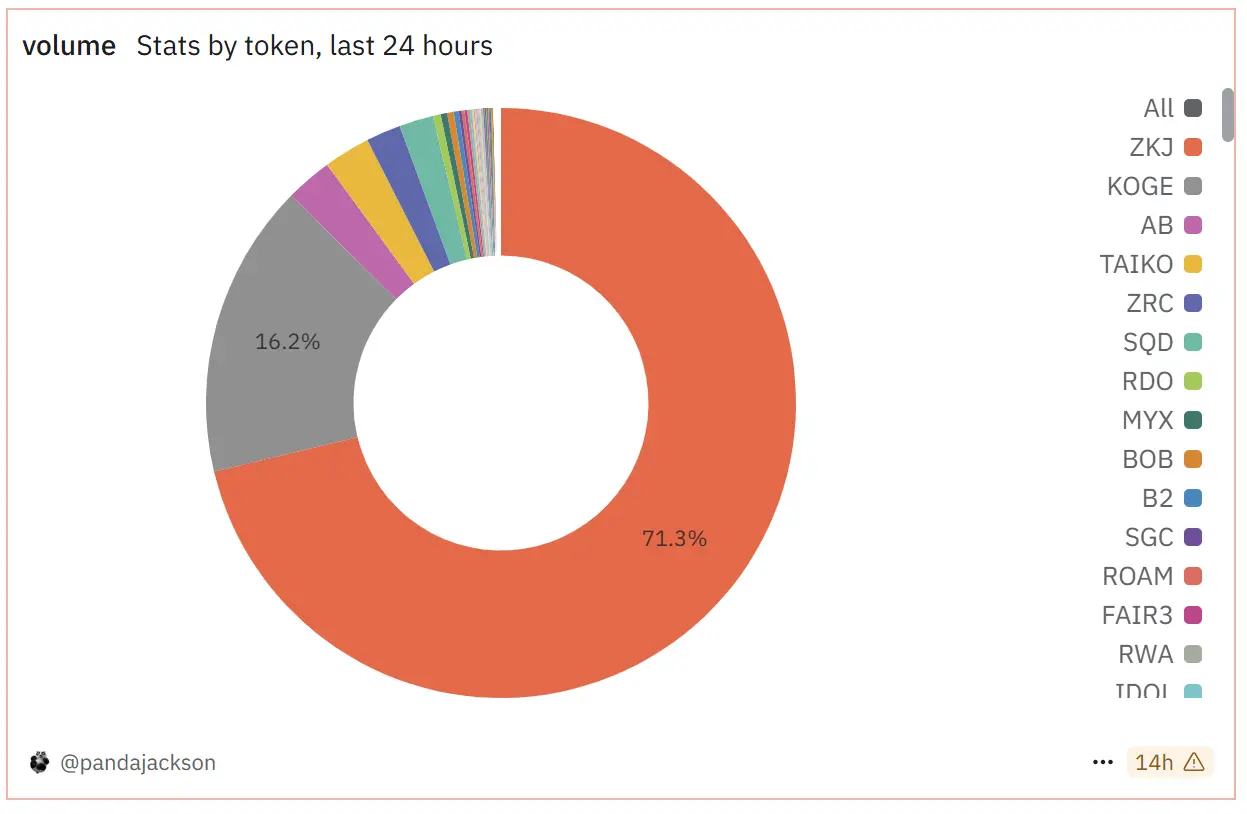

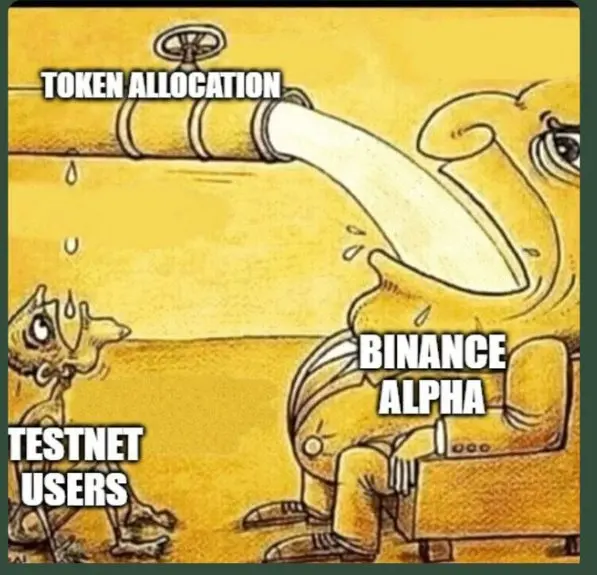

In the Binance Alpha game, users generally prefer to use tokens with "low wear" to boost volume, and ZKJ and KOGE are representative of such volume-boosting tools, accounting for over 87% of Alpha token trading volume, especially ZKJ, which has been used by users for volume boosting for over a month.

However, the chips for ZKJ and KOGE are highly concentrated, with the top ten addresses holding 93% of KOGE and nearly 80% of ZKJ. Behind the volume-boosting hype lies a liquidity risk that could be triggered at any moment by "whales."

Image source: gmgn

Sixteen days ago, ZKJ and KOGE jointly established a liquidity pool for ZKJ/KOGE on PancakeSwap, accumulating over $30 million in equivalent tokens. The community once spread rumors that ZKJ-KOGE had extremely low wear, attracting a large number of volume boosters, which laid the groundwork for today's flash crash.

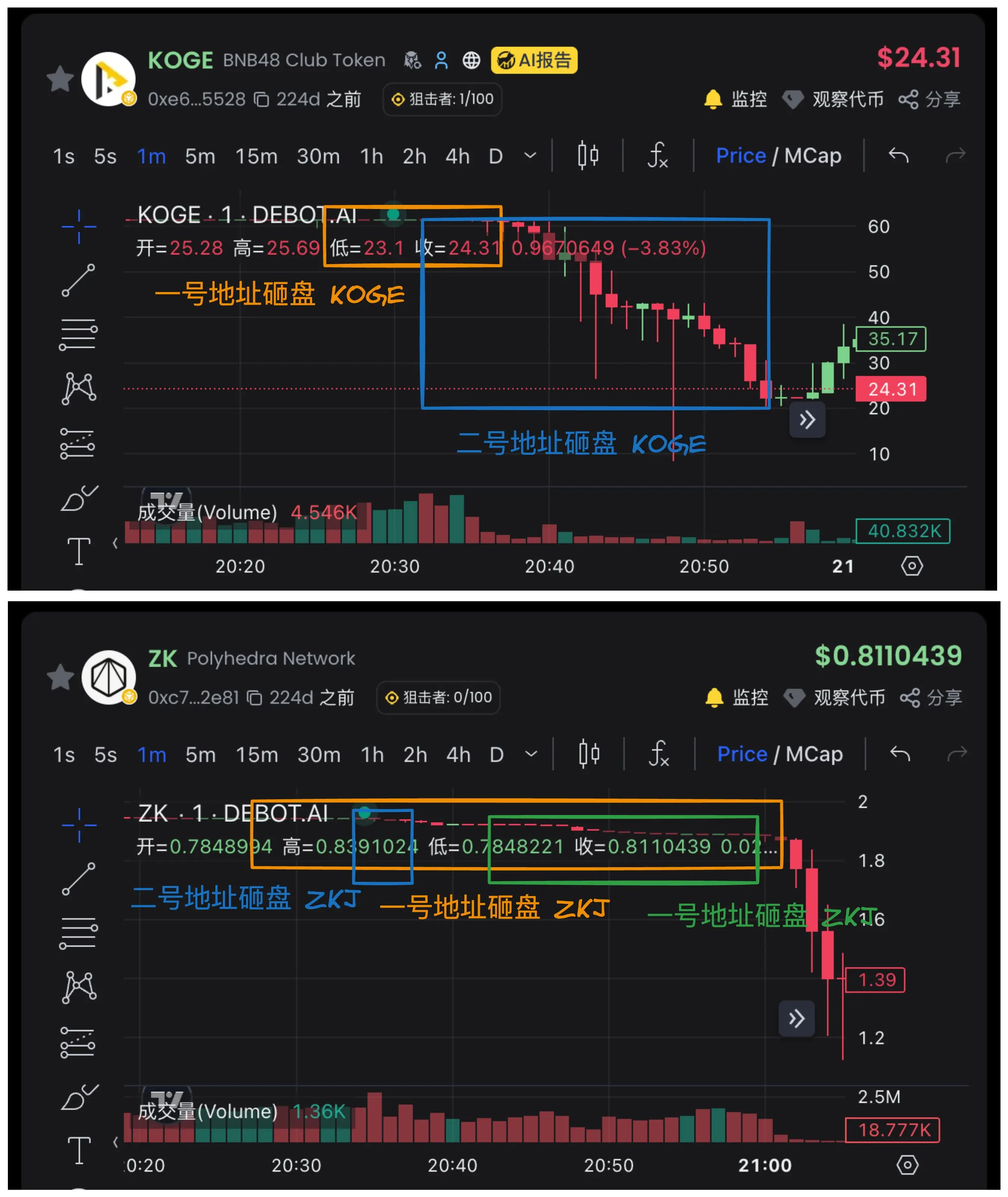

According to on-chain analyst Ai Yi, three major addresses exerted dual pressure through "large liquidity withdrawals + continuous selling," causing ZKJ and KOGE to crash in succession.

These three major addresses had clear roles, withdrawing millions of dollars in bilateral liquidity in sequence, then using KOGE to exchange for ZKJ and concentrating on selling ZKJ, creating a "relay-style suppression" that gradually triggered a cliff-like drop in token prices. KOGE fell sharply first, and after KOGE's price crash, it further catalyzed ZKJ's decline, completing the harvesting of both token LPs and holders.

Ai Yi pointed out that in addition to these three major players, there were also several "cooperating addresses" with hundreds of thousands of dollars participating simultaneously.

Image source: Ai Yi

Why Did Whales Suddenly Withdraw Liquidity?

In fact, just the day before yesterday, the KOGE token project party, 48 Club, released a "meaningful" announcement: "$KOGE has been fully released since day one, with no lock-up. 48 Club has never committed in any form to not sell treasury holdings. Just like Binance never said it wouldn't sell $BNB. Please do your own research, and take risks at your own discretion."

Once this announcement was made, it raised market awareness, leading to a slight decline in KOGE and ZKJ that night, with many community users viewing it as a "warning of a dump." Although crypto KOL BroLeon later revealed that the project party denied any connection to the dump, this "risk warning" tweet likely became one of the key catalysts for whales to withdraw liquidity. Once liquidity participants sensed signs that the project party might reduce holdings or withdraw liquidity, they would quickly take precautionary measures to withdraw from the pool to avoid losses from sudden declines.

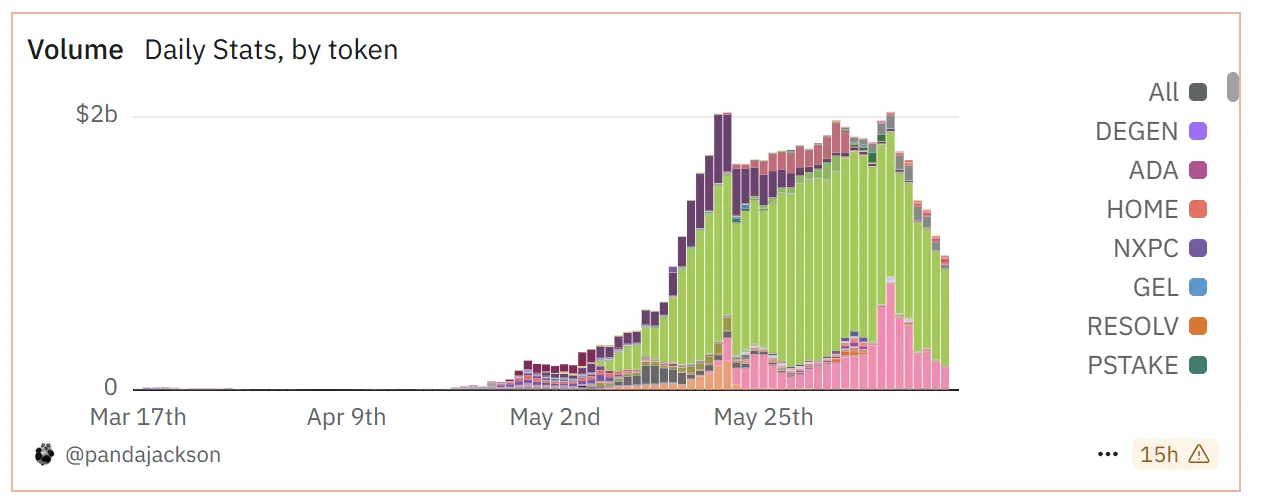

Meanwhile, ZKJ also faced a critical time point: on June 19, approximately 15.53 million tokens will be unlocked, accounting for 5.04% of the current circulating supply, with a market value of about $30.3 million. Coupled with the recent significant decline in overall trading volume from Alpha activities and weakened profit effects, liquidity providers would naturally reassess the cost-effectiveness of continued participation.

In addition, there are other speculations in the market. Crypto KOL danny stated that due to the extremely high initial APY of the KOGE-ZKJ pool, it attracted a large number of users to follow suit and quickly accumulated tens of millions of dollars in liquidity. After that, whales quietly established short positions for ZKJ on centralized exchanges. When the predetermined "detonation window" arrived, they began to exchange KOGE for ZKJ and quickly sell ZKJ back to USDT, achieving price suppression while earning contract profits, completing a dual harvest of "spot + contract."

Image: Binance Alpha token trading volume, Dune

How Long Can Alpha's Dividend Period Last?

Since the launch of the Binance Alpha points strategy, trading volume in Binance Wallet has surged, with market share exceeding 90%, driving overall wallet trading volume to soar by hundreds of times, and on-chain trading volume on the BNB Chain has also risen significantly.

On the surface, this is a successful case of "overall boosting" in platform user activity and on-chain ecology. However, when we peel back the layers of this data prosperity, it is not difficult to find that this is a "pseudo-activity" bubble driven by incentive rewards and user volume boosting.

The sudden collapse of ZKJ and KOGE was like a needle that burst this bubble ecology. These two projects exposed a series of structural issues such as the uneven quality of tokens on Alpha, the high degree of control over some projects, and fragile liquidity. The high trading frequency and high return expectations created by Alpha may not be based on a healthy and sustainable user participation logic.

At the same time, the threshold for Alpha points has been continuously rising, breaking the initial fantasy of "everyone can participate." Now, the Alpha score line has risen to 247 points, which is close to the breakeven point for many retail investors. Crypto KOL Ice Frog pointed out that whether it is the points consumption mechanism, fee adjustments, or the integration of points into financial products, Alpha's "dividend period" has actually come to an end. He stated: "In fact, this has never been a fair competition. Any incentive mechanism based on internal competition is essentially not 'encouraging participation,' but 'accelerating elimination.'"

After the incident, Binance Alpha introduced new regulations, announcing that trading pairs between Alpha tokens will no longer count towards points calculation. However, from the evolution of its rules over time, it seems that Alpha has always been "patching up," starting to fix issues whenever problems are exposed or controversies arise.

However, rather than constantly making corrections, we should perhaps ask from the beginning: What kind of incentive mechanism can truly serve the long-term interests of ordinary users? And what truly benefits the industry?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。