You are reading the free trial series of Web3Caff Research. Unlock all Web3 research reports and column content on this platform, and seek insights with more Web3 elites. You can click here to subscribe to PRO membership; if you need to switch between day/dark reading modes, please log in first.

RWA stands for Real World Assets. It refers to the transformation of physical assets in the real world (such as real estate, infrastructure, bonds, renewable energy facilities, etc.) into tradable digital tokens on the blockchain. The technological development can be traced back to 2017, evolving from the derivative concept of asset securitization[1] to the implementation of technology and applications, marking 8 years of development. Unlike the traditional mapping of real asset accounts in securitization, RWA, utilizing blockchain technology, provides new possibilities for reshaping the liquidity of global traditional assets through on-chain token technology. With its cutting-edge technological advantages, it aims to break through the boundaries of traditional assets and regulation. This article will systematically analyze the current global practices of RWA in core application tracks such as government bonds, real estate, and carbon credits based on the latest data and cases, exploring the breakthroughs and conflicts between technology and regulatory collaboration, and deducing potential "minimum pain point" development paths for the future. Globally, whether it is projects led by institutions and regulators or experimental, sandbox-like projects within Web3, development must seek a dynamic balance among technological efficiency, regulatory safety, and policy regulations. Currently, there are varying degrees of policy innovation in the United States, the European Union, and the Asia-Pacific region, with differentiated explorations in Hong Kong and mainland China providing valuable references. Coincidentally, during the writing of this report, both Hong Kong and the U.S. introduced and passed stablecoin regulatory frameworks, and this article will conduct a comprehensive in-depth analysis in conjunction with the most cutting-edge regulatory frameworks, while also focusing on the progress of future key directions such as standardized assets, physical asset RWA, and infrastructure service providers in the field of technology-regulation collaboration.

Author: Eddie Xin, Researcher at Web3Caff Research, Head of Technology Group at Logos Fund

Cover: Photo by Andrei Castanha on Unsplash

Word Count: The full text contains over 25,000 words.

Statement: The free trial series of Web3Caff Research allows for reprinting, and reprints must fully comply with the reprinting rules. Violators will be held accountable.

Table of Contents

Introduction: The Asset Revolution Under the Reconstruction of Value Internet

Global RWA Core Tracks and Representative Projects

Tokenization of Government Bonds: Compliance Experiments Led by Institutions

Tokenization of Real Estate: Challenges of Liquidity Reconstruction and Legal Adaptation

Tokenization of Carbon Credits: Compliance Games in Environmental Finance

Breakthroughs and Conflicts in Technology-Regulation Collaboration

Innovations in Compliance Architecture: Offshore SPVs and On-Chain Sandboxes

Technological Bottlenecks and Solutions

Liquidity Dilemmas and Market Differentiation

RWA Legal Compliance Framework and Case Analysis

Domestic Legal Challenges and Compliance Paths

Hong Kong Sandbox Mechanism and Cross-Border Compliance

Comparison of International Compliance Frameworks and Interoperability Dilemmas

Securitization Dominated: U.S. Regulatory Expansion and Judicial Penetration

Sandbox Experimental: Hong Kong Institutional Innovation and Cross-Border Collaboration

Unified Legislation: The Compliance Cost Paradox of the EU MiCA Framework

Emerging Experimental: Regulatory Arbitrage and Sandbox Effectiveness Boundaries

Interoperability Dilemmas: Technical-Institutional Causes of Compliance Islands

Future Path Deductions — Technology-Driven vs. Regulatory Priority

Technology-Driven (Singapore – Hong Kong Collaborative Paradigm)

Regulatory Priority (U.S., EU – Mainland, Hong Kong Benchmarking Paradigm)

Hybrid Path (Institution-Led Global Network)

RWA Market Anomalies and Risk Warnings

The Proliferation of "Air Tokens" and "Ponzi Schemes"

Compliance Arbitrage and Regulatory Loopholes

Technological Risks and Operational Traps

Conclusion: Insights from Global Practices of RWA

The Essence of Core Contradictions

Regional Ecological Characteristics

Future Strategic Directions

Risk Prevention and Control Processes

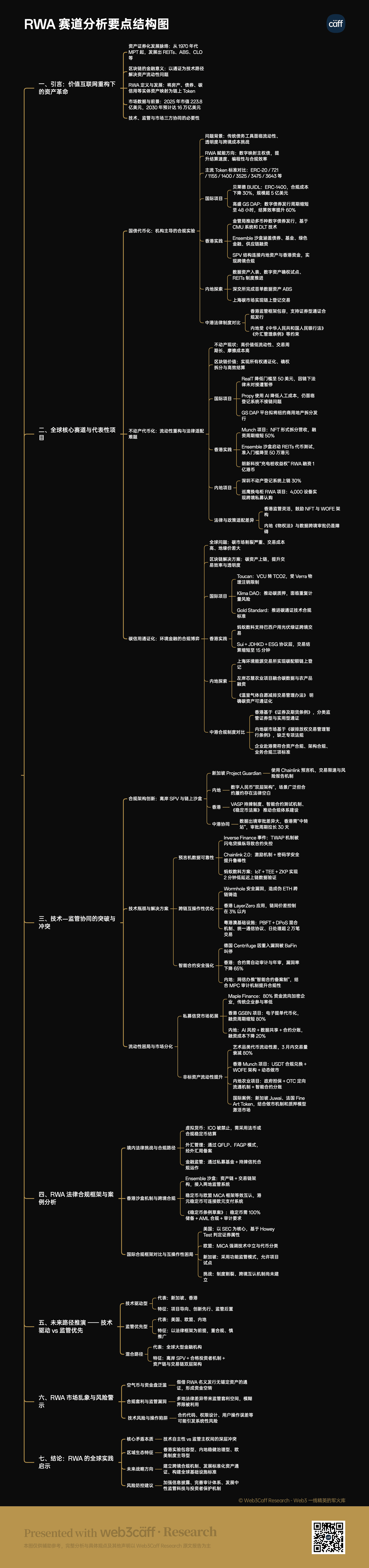

Key Point Structure Diagram

References

Introduction: The Asset Revolution Under the Reconstruction of Value Internet

Since 1970, when the U.S. Government National Mortgage Association first issued mortgage-backed securities based on a pool of mortgage loans — Mortgage Pass-Through Certificates (MPT) — and completed the first asset securitization transaction (Asset securitization refers to the process where creditors sell various contractual debts such as residential mortgages, commercial mortgages, auto loans, or credit card debts to third-party investors in the form of securities. Investors can collect principal and interest from the held debts as creditors), asset securitization has gradually become a widely adopted financial innovation tool and has developed rapidly, leading to the emergence of risk securitization products. Under the liquidity expansion framework based on Keynesian theory, the modernization of the financial industry is no longer satisfied with low liquidity of assets; thus, the modern financial industry has shifted its focus to "how to package illiquid assets into highly liquid targets," injecting continuous liquidity into the financial market. With the continuous evolution of technology, we have entered an era of the internet that naturally aligns with the technological rules of financial innovation — tokenization on the blockchain.

From the perspective of blockchain's technical characteristics, putting low-liquidity assets on-chain, combined with highly transparent and traceable transaction processes, almost perfectly solves this problem. RWA seems to be inherently prepared to become an important member of digital financial innovation tools. As the liquidity of global financial assets increases, the early implementation of asset securitization still seems unable to meet the liquidity injection needs of real-world assets. In recent years, innovations in asset securitization such as REITs (Real Estate Investment Trusts), ABS (Asset-Backed Securities), and CLOs (Collateralized Loan Obligations) have begun to include more real-world asset targets. For instance, in 2020, China began promoting the normalization of infrastructure REITs issuance, vigorously developing diversified liquidity injections for low-liquidity underlying assets such as logistics parks and highways. The traceability and transparency of blockchain technology have already entered the management processes of REITs. Against this backdrop of technological support and financial innovation development, RWA has emerged as a source of liquidity for diverse asset classes in the real world, driven by blockchain technology.

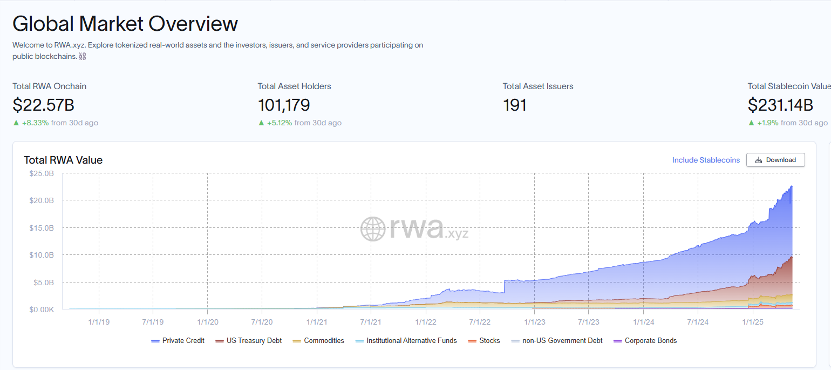

According to data from the RWA monitoring platform RWA.xyz, as of May 2025, the total market value of on-chain RWA has reached $22.38 billion, an increase of 7.59% compared to 30 days ago, with the number of asset holders reaching 100,941, a month-on-month growth of 5.33%. According to an internal report from Boston Consulting Group [1], it is predicted that by 2030, the global RWA market size will reach $16 trillion, accounting for 10% of global GDP.

Figure 1, Source: RWA.xyz

The growth curve of RWA is increasingly steep, coupled with the anchoring of diverse assets, whether it is innovative projects within the Web3 circle or sandbox experiments by traditional financial institutions, the emerging issues are becoming more pronounced. Current market anomalies such as "air tokens," "Ponzi schemes," "compliance arbitrage," and legal violations need to find a breakthrough in the dynamic balance between technological innovation and regulatory adaptation. Therefore, in-depth research on the global practices, technological challenges, and regulatory collaboration mechanisms of RWA is of great significance for promoting the healthy development of the industry. Next, let us start from the global core tracks and representative projects to deeply analyze the most cutting-edge new paradigms of RWA.

Global RWA Core Tracks and Representative Projects

Tokenization of Government Bonds: Compliance Experiments Led by Institutions

In the context of the macroeconomic environment characterized by "three lows and one high" (high debt, low interest rates, low inflation, and low growth), the traditional debt management framework faces multiple challenges such as insufficient liquidity, lack of transparency, and market fragmentation. Sovereign debt tokenization utilizes blockchain distributed ledger technology (DLT) to achieve the digital mapping of debt instruments, transforming sovereign debts like government bonds into divisible and programmable digital tokens. This innovation demonstrates technological empowerment in enhancing secondary market liquidity (e.g., real-time settlement achieved in U.S. Treasury tokenization pilots), optimizing price discovery mechanisms (e.g., smart contract applications in European digital green bonds), and reducing cross-border transaction friction costs (e.g., multi-currency digital bond issuance in Hong Kong). This innovation is not only a passive upgrade of financial asset forms but also involves profound changes in fiscal policy transmission mechanisms and the monetary financial system, reshaping the competitive landscape of global debt market infrastructure and becoming a strategic focus for countries vying for the formulation of digital financial rules and asset pricing rights. (Zhao Yao, 2025)[2].

Tokenization of government bonds is currently the most popular direction for RWA. The bond market has long been widely regarded as one of the safest investment targets in the global financial market, backed by sovereign credit, making it one of the most popular real assets on-chain. In the context of the sustained high interest rate environment in global markets in recent years, government bond yields, led by U.S. Treasuries, have maintained high returns. Blockchain technology-backed government bonds allow investors to increase their flexibility in participating in government bond trading, reduce costs through technology, enhance trading speed, and increase market transparency. Compared to traditional financial markets, RWA has significant growth potential in the low-risk environment of government bond trading.

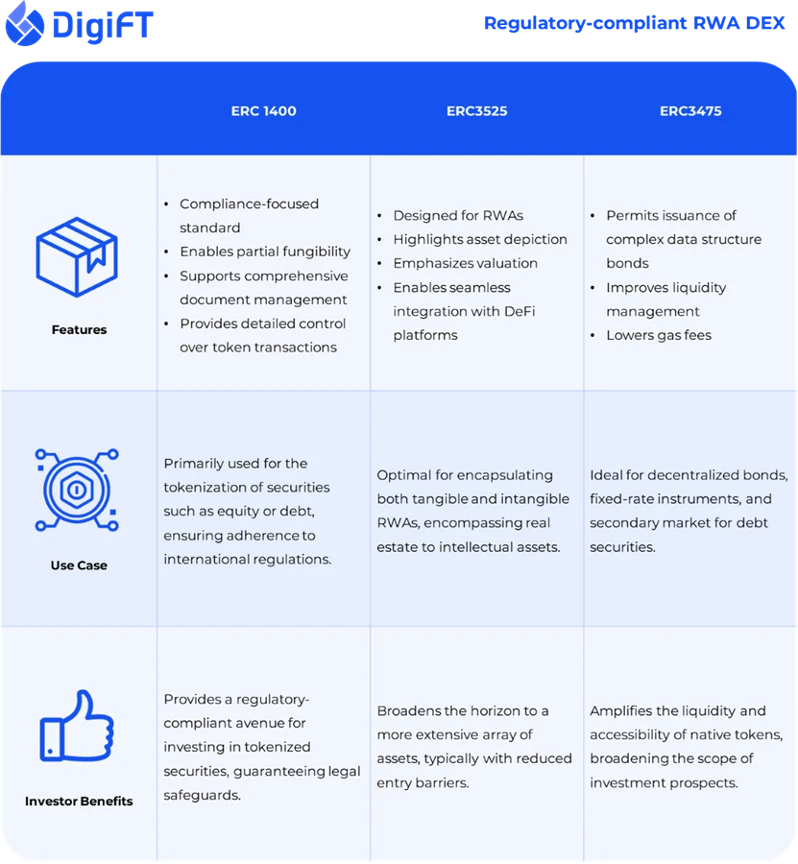

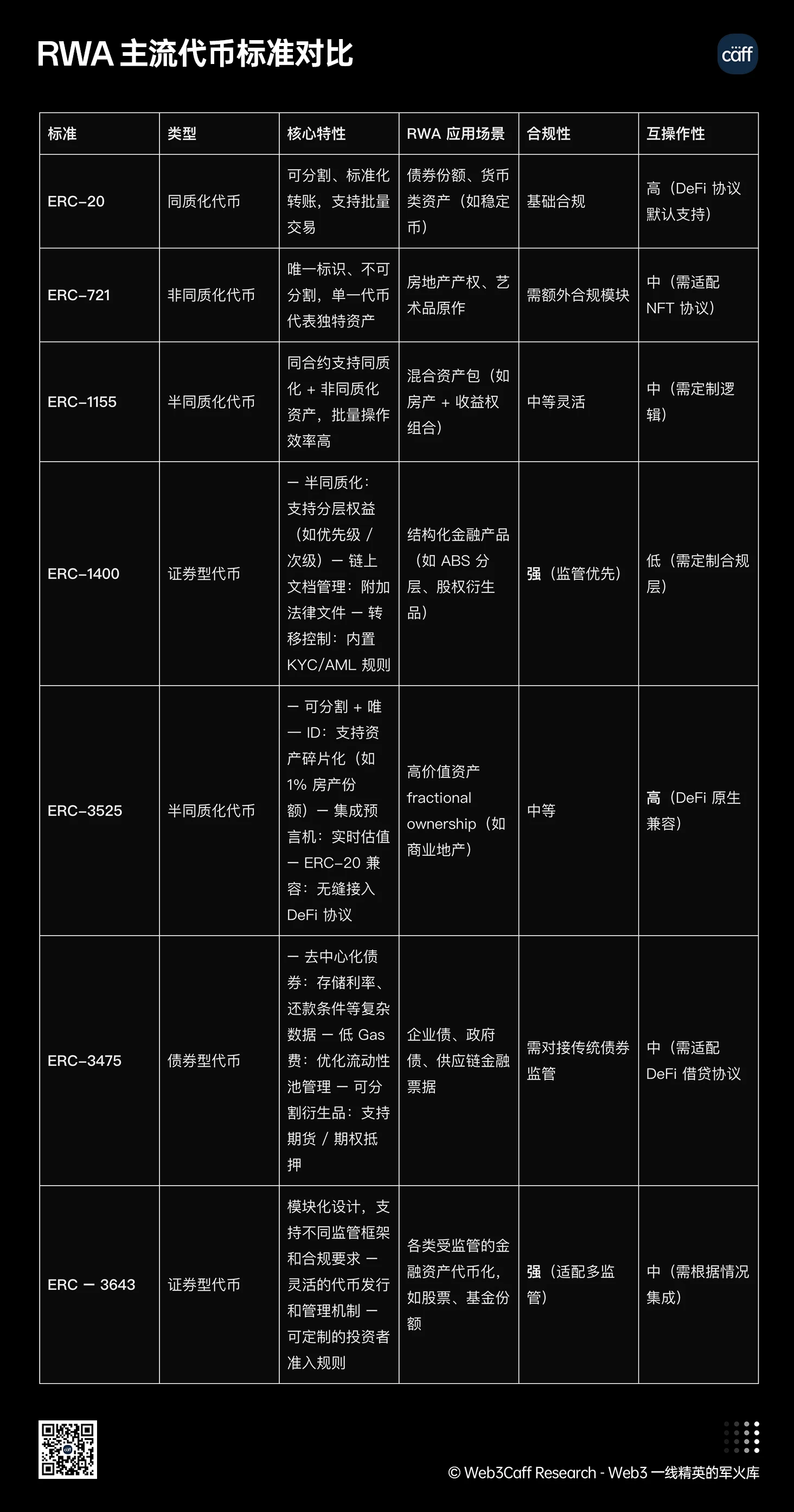

Since RWA maps different underlying assets, readers will first gain a basic understanding of the fundamental characteristics of RWA tokens before proceeding. The following image compares the mainstream token standards of RWA:

Figure 2, Source: DigiFT

Figure 3, Source: Web3Caff Research researcher Eddie Xin self-made (Comparison of mainstream RWA token standards)

- International Leading Projects

The European and American markets achieve automatic distribution of government bond yields and optimization of compliance costs through smart contracts. For example, in 2024, asset management giant BlackRock's BUIDL Fund adopted the ERC-1400 standard (characterized by semi-fungibility and support for layered rights, suitable for structured financial products such as ABS tranches and equity derivatives), reducing SEC compliance costs by 30%. Three months after issuance, the managed scale exceeded $500 million [3]. BlackRock issued a stable, asset-secured money market fund on-chain, allowing other institutions to bring real-world stable returns into the DeFi world by using BUIDL as the underlying material. The Goldman Sachs GS DAP[4] (Goldman Sachs Digital Asset Platform) is built on a solution developed by Digital Asset Company, aimed at meeting the complex liquidity needs of market participants in the digital capital market. In 2024, Goldman Sachs issued $12 billion in digital bonds through this platform. Compared to traditional bond issuance models, the average issuance cycle of digital bonds was significantly shortened from the original two weeks to 48 hours, with settlement efficiency improved by 60%, and settlement time reduced from the traditional T+2 model to nearly real-time settlement. In 2025, Goldman Sachs plans to focus on tokenized products in the U.S. fund industry and the European bond market, targeting large institutional investors. Additionally, Goldman Sachs is collaborating with the World Gold Council to test the tokenization of gold issuance, allowing users to view real-time audit reports of gold reserves and conduct transactions via blockchain.

Figure 4, Source: Goldman Sachs GA DAP Platform

- Practices in Hong Kong

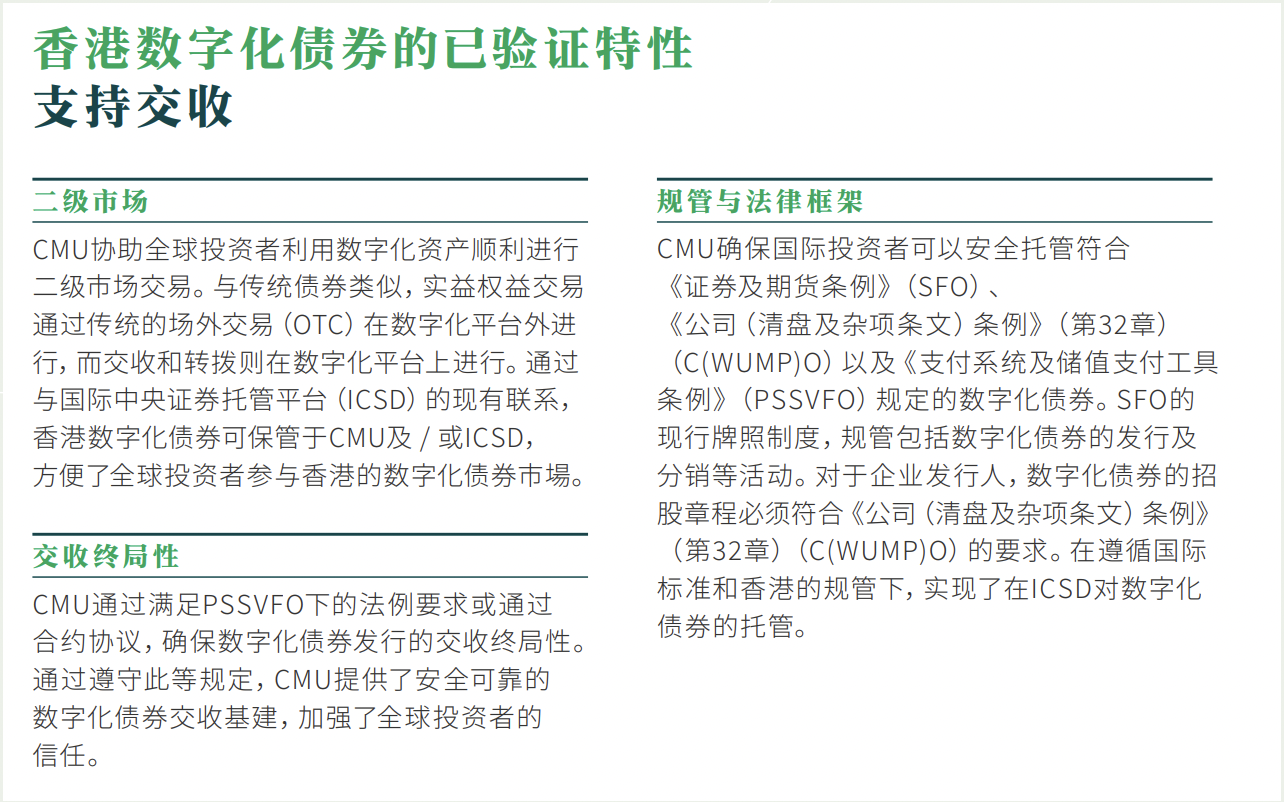

In Hong Kong, the Monetary Authority (HKMA) began its tokenization journey as early as 2021, testing tokenized bonds in collaboration with the Bank for International Settlements. In 2023 and 2024, approximately HKD 7.8 billion worth of digital bonds have been issued through the Central Moneymarkets Unit (CMU), including bonds in HKD, RMB, USD, and EUR. The HKMA's report manual mentions that tokenized bonds successfully digitize sovereign debt assets using distributed ledger technology (DLT), eliminating the need for physical verification, enabling real-time transfer of bonds and cash on a shared platform, and significantly enhancing operational efficiency for bond liquidity.[5]

Figure 5, Source: HKMA and CMU Digital Bond Report

At the same time, Hong Kong is also promoting the Ensemble Sandbox program (which aims to use experimental tokenized currencies to facilitate interbank settlements and focus on the study of tokenized asset trading. The first phase of the sandbox will cover the tokenization of traditional financial assets and real-world assets, focusing on four major themes: fixed income and investment funds, liquidity management, green and sustainable finance, and trade and supply chain financing.)[5], aiming to experiment with the tokenization of traditional finance and real-world assets. The first suggested use case in the announced application themes of "Fixed Income and Investment Funds" is bonds. The industry participants for the bond and fund use cases include five platforms: Bank of China (Hong Kong) Limited, Hang Seng Bank, HashKey Group, HSBC Hong Kong, and Standard Chartered Bank (Hong Kong).

Subsequently, in the bond use case, Hong Kong successfully issued HKD 800 million tokenized green bonds through the Goldman Sachs GA DAP platform, with HSBC as the custodian. This project utilized the rapid settlement characteristics of on-chain advantages, reducing costs by 40% compared to traditional settlement methods. In 2025, the scale of on-chain settlement pilots will expand to HKD 1.5 billion. At the same time, this project allows European and American institutions to participate through offshore SPVs (the SPV structure isolates risks and optimizes financing structures by establishing special purpose entities, commonly used in asset securitization and project financing scenarios, with the core being to create an independent legal entity for "bankruptcy isolation" to achieve credit enhancement and risk isolation for specific assets). This means that the project will achieve compliant connections between mainland assets and Hong Kong funds through the "asset chain + transaction chain" structure.

- Corresponding Explorations in Mainland China

Currently, there are no successful tokenized government bond projects in mainland China. The exploration is still at the level of asset securitization, with the main innovative tool being REITs. However, there has been a push for digital rights confirmation of diversified underlying assets. In 2024, mainland China passed the data asset inclusion policy, allowing digital assets such as corporate data assets to be presented in financial statements. This legislation, implemented in the same year, promotes the confirmation of corporate data rights, transforming assets from tangible to intangible at the trading end, with data asset confirmation being the first step. The push for data assets in mainland China can be seen as a barometer for digital asset development. Following the implementation of the legislation, the Shenzhen Stock Exchange completed the first data asset ABS, with an issuance scale of 320 million yuan, laying the foundation for data asset on-chain. Additionally, mainland China is synchronously promoting the data asset inclusion policy in alignment with International Accounting Standards (IAS 38), planning to open pilot cross-border trading of corporate data assets by 2026. Meanwhile, the Shanghai Environment and Energy Exchange has launched a blockchain carbon trading platform, successfully achieving on-chain registration and trading of national carbon market quotas, marking a significant step towards on-chain real assets.

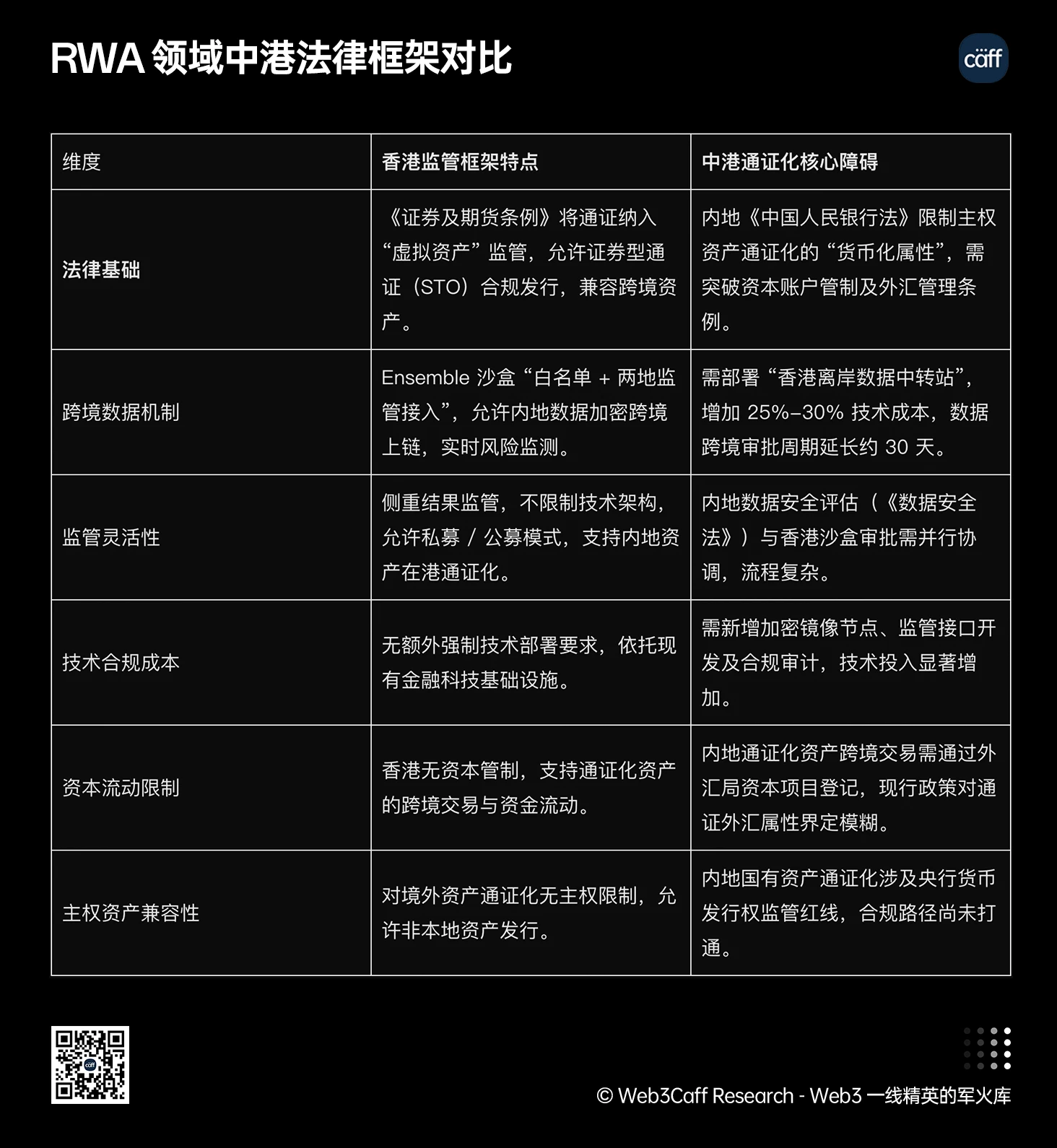

- Legal Comparison and Compliance Pathways

The Securities and Futures Ordinance in Hong Kong provides a flexible regulatory framework for the tokenization of asset shares. Its Ensemble Sandbox allows for the cross-border flow of mainland asset data onto the blockchain through a "cross-border data flow whitelist" mechanism, while also integrating the regulatory systems of both regions to enable real-time risk monitoring. However, due to cross-border controls, the cross-border transfer of mainland data must deploy encrypted mirror nodes through a "Hong Kong offshore data transit station." According to a comparison of the Memorandum of Cooperation on Promoting Cross-Boundary Data Flow in the Guangdong-Hong Kong-Macao Greater Bay Area, this process results in a 25%-30% increase in compliance technology costs and an extension of the approval cycle by about 30 days. Additionally, the tokenization of sovereign assets in mainland China is constrained by the regulatory framework of the "People's Bank of China Law" and foreign exchange management regulations, necessitating a breakthrough in capital account controls. Currently, the Hong Kong-Mainland China channel has not achieved a fully integrated process.

The institutional practices of government bond tokenization provide a compliant model for high liquidity assets in RWA. However, the tokenization of non-standard assets such as real estate faces more complex challenges in legal ownership adaptation and liquidity reconstruction, necessitating the exploration of innovative solutions that balance inclusivity and security.

Figure 6, Source: Web3Caff Research researcher Eddie Xin self-made (Comparison of Hong Kong and Mainland Legal Frameworks)

Real Estate Tokenization: Liquidity Reconstruction and Legal Adaptation Challenges

In the context of a slowing global economy and accelerated digital transformation, the traditional real estate market faces numerous challenges. According to data from the IMF's "Global Financial Stability Report" (Wind financial terminal access report), real estate is characterized by high value and low liquidity, with transaction cycles often exceeding several months. The friction costs of global real estate transactions (referring to fees and other related costs in financial transactions, which can be direct or indirect) account for 6%-10% of the total asset value, [6] with institutional costs (such as property registration and compliance review) exceeding 40%. The average transaction cycle lasts 12-16 weeks, severely hindering effective asset allocation and price discovery. According to data from the International Monetary Fund via the Wind financial terminal, the average transaction cost for global real estate accounts for 6%-10% of the total price. To stimulate the economy and optimize resource allocation, countries are actively promoting financial innovation, encouraging the integration of the digital economy with the real economy, and providing positive policy space for the development of real estate tokenization. On the technological front, blockchain technology has matured relatively well, and its efficient, low-cost, and tradable characteristics can accelerate the digital splitting, confirmation, and trading of real estate ownership.

- International Leading Projects

RealT in the United States has lowered the investment threshold for real estate to $50, but some transactions have been suspended due to mismatches between on-chain and off-chain ownership. In the EU, Propy has utilized AI-driven real estate transactions, saving 40% in labor costs, but the lack of integration between the real estate registration systems of EU countries and blockchain (e.g., the French land registry still uses paper records) means that EU buyers still need to verify off-chain legal contracts. Currently, a relatively successful case is the GS DAP platform mentioned earlier, which has partnered with Tradeweb to explore the tokenization of Real Estate Investment Trusts (REITs) and plans to split the rental income rights of commercial real estate in New York into ERC-3643 standard tokens. The Synthetix platform has also successfully tokenized commodity indices (such as oil, gold, and copper), with a total value of approximately $100 million, enabling price tracking via Ethereum and providing investors with indirect participation opportunities.

- Practices in Hong Kong

The Hong Kong Securities and Futures Commission allows for the tokenization of REIT shares. For example, in the Munch restaurant startup project invested in by NFTChina.hk, Munch collaborated with RWA.ltd to pilot the splitting of restaurant store revenue NFTs, reducing the financing cycle by 50%. The Ensemble Sandbox will launch REIT tokenization testing in 2025, aiming to lower the entry threshold for qualified investors from HKD 1 million to HKD 500,000 to activate participation from small and medium investors. Additionally, the Hong Kong pilot Munch project utilizes a "USDT compliant exchange + mainland wholly foreign-owned enterprise (WOFE) income rights registration" mechanism. According to data disclosed on its official website Munch Project, this move has increased the liquidity of restaurant revenue tokens by 35%.

As the underlying assets of real estate diversify, more business formats are being included. In 2024, Longshine Technology also collaborated with Ant Group to complete China's first RWA based on new energy real estate in Hong Kong, tokenizing the income rights of 9,000 charging piles. The project uses some of the charging piles operated on the platform as RWA anchor assets, issuing "charging pile" digital assets on the blockchain based on credible data, with each digital asset representing a portion of the income rights of the corresponding charging pile. It secured 100 million yuan in cross-border financing, with its data being uploaded to the Ant blockchain and integrated into the regulatory technology systems of both regions. Longshine Group's exploration of real-world assets provides a new financing idea for enterprises going overseas from Hong Kong and Mainland China. Previously, only a small number of overseas enterprises could complete overseas financing through local bank loans or venture capital (VC) support. Longshine Group's use of "charging piles" as RWA anchor assets demonstrates that traditional enterprises can still achieve cross-border and cross-regional credit and financing through physical assets corresponding to digital assets. (Securities Daily)[7]

- Corresponding Explorations in Mainland China

The Shenzhen real estate registration system is piloting blockchain technology, implementing 30% of property information on-chain to enhance ownership verification efficiency and transparency. The Shanghai Tree Blockchain Research Institute (Conflux), which has "Chinese roots," has also collaborated with Ant Group to complete the "Xunying Battery Swap Cabinet RWA" project, converting 4,000 offline devices into digital financial products, with Hong Kong Victory Securities serving as the compliance custodian. This project enables cross-border subscriptions by private equity institutions and successfully explores a new path for "REIT-like" asset securitization. The project aims to collect operational data from battery swap cabinets through IoT technology, forming RWA after being uploaded to the blockchain, attracting multiple private equity institutions for subscription.

- Legal Comparison and Compliance Pathways

Currently, the direction of real estate tokenization is prioritized structurally due to the underlying assets being mostly anchored to valuable, low-liquidity assets, combined with existing successful asset securitization historical experiences, transitioning to RWA and on-chain. The regulatory framework for digital exploration of such assets in Hong Kong, a region of financial innovation, is relatively flexible. However, in Mainland China, the lack of a judicial mutual recognition mechanism between property registration systems and on-chain data presents obstacles to cross-regional legal adaptation. Additionally, the restrictions imposed by the "Property Law" on asset splitting and capital control policies have limited real estate tokenization to equipment financing leasing and similar securitization models. For instance, while the Shenzhen real estate registration system's pilot of blockchain technology can enhance ownership verification efficiency, it has not yet resolved the legal status of on-chain data.

Figure 7, Source: Web3Caff Research researcher Eddie Xin self-made

Carbon Credit Tokenization: Compliance Game in Environmental Finance

As human civilization transitions towards ecological sustainability, the global economic system is also undergoing structural changes. The carbon credit market, as a key economic tool for ecological governance, is crucial for sustainable development. The global climate governance framework established by the Paris Agreement urgently requires market-based means to build a unified and efficient carbon resource allocation mechanism. However, the current global carbon market faces significant geopolitical fragmentation issues: regional carbon pricing mechanisms vary, trading rules lack coordination, and cross-border circulation is obstructed, leading to chaotic carbon asset pricing and even exacerbating resource misallocation risks. According to data mentioned in the 2022 Carbon Neutrality Roadmap for China's Energy System report provided by the International Energy Agency, the average transaction cost in the global carbon market accounts for 10%-15%, with some emerging markets exceeding 20%, severely undermining the effectiveness of climate policies. From a global governance perspective, countries are reshaping the green economy order with policy tools. The EU Emissions Trading System (EU ETS) continues to tighten quotas and strengthen carbon price discovery; China's "dual carbon" strategy promotes the national carbon market covering eight key industries, forming the world's largest carbon factor market. At the same time, jurisdictions such as Singapore and Switzerland are providing practical samples for global carbon market rule innovation through carbon asset tokenization legislation and digital asset regulatory sandboxes.

- International Leading Projects

Toucan Protocol is a blockchain-based carbon credit tokenization protocol that aims to enhance the liquidity and market transparency of carbon assets by converting traditional carbon credits (such as Verra-certified VCUs) into on-chain tokens (TCO2, BCT). It has accumulated a trading volume of $4 billion, but is constrained by Verra's physical retirement requirements, forcing it to adopt a "fixed" token model. This is because Verra (an international organization managing carbon credits and other environmental rights) stipulates that corresponding carbon credits must be completely removed from the system (similar to "physically destroying" a piece of paper) and cannot be split, transferred, or altered using ordinary digital tokens. Therefore, a "fixed" token model is used: these rights are made into a fixed number of digital tokens that cannot be arbitrarily split or modified, akin to bundling a pile of coins into a single bundle that can only be traded as a whole, thus meeting Verra's requirement of "must be completely retired." Klima DAO promotes emission reductions through a carbon credit staking mechanism but faces the risk of double counting carbon offsets, relying on third-party audits for verification. In June 2024, Gold Standard announced that it is developing reference standards for carbon credit tokenization, covering aspects such as technical security and operational compliance. These projects successfully reflect and activate the liquidity demand in the on-chain carbon market.[8]

- Practices in Hong Kong

The tokenization platform built by Ant Group in Hong Kong enables delivery versus payment (DvP) transactions for carbon credits and green bonds, completing cross-border blockchain green certificate transactions for a household photovoltaic project in Brazil in 2025 (initial scale of 220 million reais), successfully connecting the international carbon market with emerging economies [9]. The platform also supports the domestic first household photovoltaic RWA project, where GCL-Poly Energy and Ant Group tokenized 82MW of distributed power station assets in Jiangsu and Anhui. By using IoT devices to track power generation data in real-time, it can provide overseas investors with a stable annual return of 6.8%.

The Hong Kong Monetary Authority has included carbon credits in the core pilot areas of the Ensemble Sandbox, promoting compatibility with international carbon market rules. Based on the sandbox policy, JD Technology is also making significant strides into the Web3 ecosystem, launching the HKD stablecoin JDHKD to provide a low-friction channel for RWA cross-border settlement; the Sui public chain is collaborating with Ant Group to build an ESG asset protocol layer, achieving on-chain anchoring issuance of carbon reduction amounts and green bonds, reducing transaction settlement time from the traditional T+3 to 15 minutes.

- Corresponding Explorations in Mainland China

As a major proponent of carbon neutrality policies, China is also at the forefront of digital exploration in the carbon rights field. For example, the Shanghai Environment and Energy Exchange is launching a blockchain carbon trading platform (in 2025) to achieve on-chain registration and trading of national carbon market quotas. Notable institutional projects include the Left Bank Xinhui Agriculture RWA project, which integrates agricultural product data with carbon credits, completing 10 million yuan in financing through "blockchain + IoT" technology, exploring the integration path of agricultural carbon assets with the real industry. The "Management Measures for Voluntary Greenhouse Gas Emission Reduction Trading" clearly allows project-level carbon assets to be put on-chain, providing policy support for carbon credit tokenization. It is evident that Mainland China does not shy away from using blockchain settlement solutions in its management exploration of the carbon rights market. In these specific scenarios, as the passive demand for application scenarios increases, it is believed that Mainland China will continue to maintain an open attitude towards proactive exploration in the field of blockchain technology.

- Legal Comparison and Compliance Pathways

As a global financial innovation center, Hong Kong is better positioned to connect with global mainstream issuing platforms such as Verra and Gold Standard in cutting-edge fintech exploration. However, some international platforms still have process restrictions for cross-border tokenization (such as physical retirement requirements), increasing the complexity of compliance operations. Mainland China's carbon asset scale is globally leading, but the lack of international mutual recognition standards limits carbon credit tokenization to domestic closed-loop transactions, necessitating the promotion of coordination with international rules. For instance, while the Shanghai Environment and Energy Exchange's blockchain carbon trading platform can achieve on-chain registration, cross-border transactions still rely on traditional mechanisms.

The Mainland carbon credit market is primarily governed by the "Interim Regulations on Carbon Emission Trading," overseen by the Ministry of Ecology and Environment, which regulates trading behavior of key emission units through registration, quota allocation, and emission verification systems. However, in the field of carbon credit tokenization, no specific regulations have been issued, and compliance boundaries still need to be explored based on existing carbon market rules.

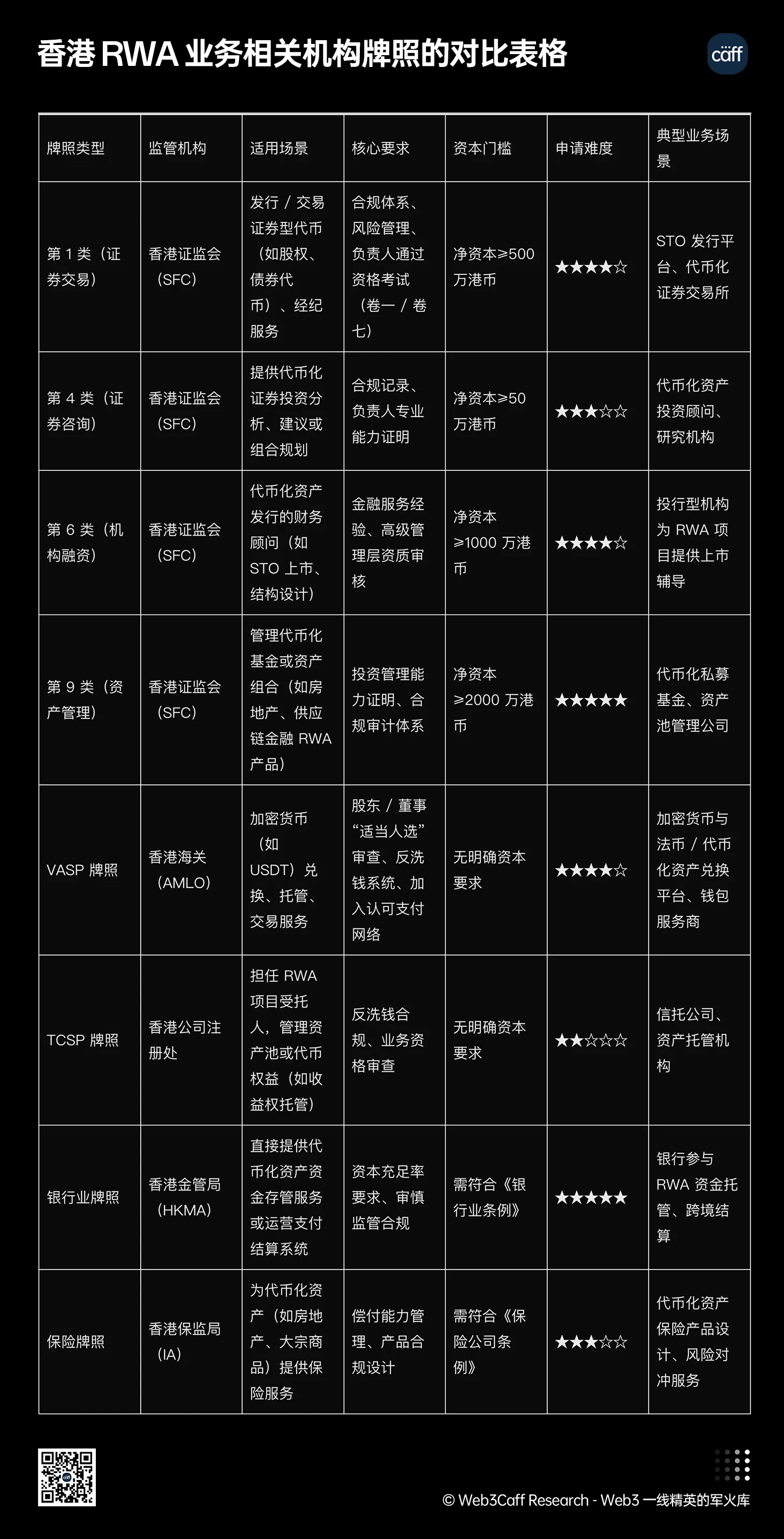

In contrast, Hong Kong relies on the Securities and Futures Ordinance to construct a flexible regulatory framework, adopting a functional regulatory model: if carbon credit tokens possess securities attributes (such as income rights certificates), they must submit a prospectus according to securities issuance procedures; if they are utility tokens, they must meet anti-money laundering (AML) and know your customer (KYC) requirements. The Hong Kong Monetary Authority provides a testing space for blockchain financial innovation through the "Ensemble Sandbox," promoting pilot projects for carbon credit tokenization under controllable risk conditions.

Mainland enterprises engaging in carbon credit tokenization in Hong Kong need to focus on three compliance points: first, asset compliance, selecting high-quality carbon assets such as CCER that are filed with the Ministry of Ecology and Environment; second, structural compliance, achieving cross-border fund compliance flow through the establishment of special purpose vehicles (SPVs) for ODI (Outward Direct Investment); third, business compliance, fulfilling corresponding approval procedures based on token attributes, employing blockchain technology that has passed security audits, entrusting licensed brokerages for underwriting, and following the Hong Kong Securities and Futures Commission's information disclosure requirements.

Figure 8, Source: Web3Caff Research researcher Eddie self-made (Comparison table of relevant institutional licenses for Hong Kong RWA business)

The ownership disputes in real estate tokenization reveal the sovereign game nature of mapping physical assets to on-chain value. Carbon credit tokenization further extends this contradiction into the field of environmental finance, forcing the market to seek breakthroughs between cross-border compliance and international standard mutual recognition.

Figure 9, Source: Web3Caff Research researcher Eddie self-made (Comprehensive comparison of carbon markets in Mainland China and Hong Kong)

Breakthroughs and Conflicts in Technology-Regulation Synergy

In the context of the digital economy reconstructing the global financial ecosystem, the dynamic game between technological innovation and regulatory frameworks has become the core engine driving the transformation of the financial system. Distributed technologies represented by blockchain and smart contracts pose systematic challenges to traditional financial regulatory penetration management, territorial constraints, and compliance review mechanisms by constructing decentralized value transfer networks. However, in cutting-edge fields such as sovereign debt tokenization, real estate asset tokenization, and carbon credit digitization, the improvements in transaction efficiency brought about by technological innovation (such as T+0 real-time settlement), risk diversification optimization (such as asset fragmentation trading), and the regulatory layer's core demands for maintaining market stability and preventing systemic risks present both opportunities for collaborative innovation and dilemmas of rule conflicts. This contradiction essentially reflects the paradigm differences between the underlying logic of technology and the top-level design of institutions— the former emphasizes the automated execution of code as law, while the latter relies on the authoritative constraints of bureaucratic rules. Analyzing the breakthrough paths and conflict focal points in the synergy process between technology and regulation is not only related to the compliant development of emerging financial businesses but is also a key proposition for constructing a new financial governance order that adapts to the digital economy era and achieving a dynamic balance between innovation incentives and risk control.

Compliance Architecture Innovation: Offshore SPV and On-Chain Sandbox

- Global Leading Practices

The Project Guardian led by the Monetary Authority of Singapore (MAS) serves as a benchmark project for global fintech regulatory sandboxes, focusing deeply on the application innovation of blockchain technology in cross-border financial transactions. This pilot project is led by JPMorgan, DBS Bank, and Marketnode, initially established as a digital asset joint venture by Temasek and the Singapore Exchange (SGX) in June 2022, with Deutsche Bank joining the project in May 2024 to explore asset tokenization applications. Moody's announced its participation in the Guardian project, planning to explore asset tokenization in 2024. In the project's practice, by introducing Chainlink oracles as a key technological component, a bridge connecting off-chain real-world data with on-chain smart contracts has been successfully built. Traditional cross-border settlements face lengthy processes and high costs due to multiple participants and information asymmetry, while Chainlink oracles, with their decentralized node network and data aggregation mechanism, can verify key information such as the status of goods and exchange rate fluctuations in trade financing in real-time, significantly reducing the costs of cross-border settlements and shortening transaction times from the industry standard "T+2" model (settlement on the second working day after the transaction) to minutes, greatly enhancing the efficiency and transparency of cross-border financial transactions. Meanwhile, high-frequency, large-scale on-chain transactions may trigger liquidity risks and even threaten financial market stability. To address this, the Monetary Authority of Singapore has adopted a dynamic regulatory strategy, innovatively setting transaction speed limit rules: when on-chain transaction volumes exceed daily thresholds, the system will automatically trigger smart contracts to limit the scale of individual transactions while requiring relevant financial institutions to submit additional liquidity risk assessment reports. The main goal of the Project Guardian pilot project is to build a framework for the cross-border issuance of tokenized securities. Due to differences in banking systems and regulatory restrictions, this framework is often complex. Executing tokenized assets through blockchain networks can make transactions easier, faster, and safer.

- Distinct Explorations in Mainland China and Hong Kong

In the wave of global fintech innovation, Mainland China and Hong Kong are conducting differentiated explorations in the field of technology-regulation synergy based on their respective policy systems and market foundations, showcasing both the vitality of innovative breakthroughs and exposing deep-seated contradictions in rule alignment.

Mainland China leverages the "regulatory sandbox" mechanism and top-level design advantages to achieve deep coupling of technology and regulation in the pilot of the digital renminbi (e-CNY). Through a "dual-layer operation" structure, the central bank leads the technical standards and underlying protocols, while commercial banks and technology companies are responsible for scene implementation, ensuring the centralization of currency issuance rights while utilizing blockchain distributed ledgers to achieve real-time traceability of transaction data. According to the latest report from Economic Daily, by the end of 2024, the pilot scenarios for digital renminbi have exceeded 150 million, with transaction amounts surpassing 8.7 trillion yuan, creating a positive cycle of "technology empowerment – regulatory compliance" in the retail payment sector. However, differences in cross-regional data governance standards and ambiguities in the legal recognition of smart contracts have led to regulatory arbitrage in some scenarios. For example, differing jurisdictions' recognition of the enforceability of smart contracts in cross-border trade creates compliance risks for automated settlement in supply chain finance.

In contrast, Hong Kong has carved out its own path in virtual asset regulation, relying on its common law system and status as an international financial center. The Anti-Money Laundering and Counter-Terrorist Financing (Amendment) Ordinance, effective in 2023, clarifies the licensing system for virtual asset service providers (VASPs), requiring trading platforms to use on-chain data analysis tools (such as Chainalysis) for KYC/AML monitoring, transforming the anti-money laundering capabilities of blockchain technology into regulatory effectiveness. In the field of security token offerings (STOs), the Hong Kong Securities and Futures Commission allows innovative projects to test smart contract-driven profit distribution mechanisms within a limited scope through a "regulatory sandbox + investor tiered protection" model. However, the Hong Kong Monetary Authority (HKMA) introduced the "Stablecoin Bill" in May this year, which imposes stringent regulatory requirements on stablecoins (such as 100% high liquidity asset reserves) that conflict with the low-threshold, high-leverage characteristics pursued by DeFi protocols, forcing some projects to adjust their technical architecture or even choose overseas markets.

In the collaborative exploration between Mainland China and Hong Kong, cross-border data flow has become the focal point of technological and regulatory conflicts. The Mainland's Data Security Law and Hong Kong's Personal Data (Privacy) Ordinance differ in standards for data exit and cross-border audit authority, making it difficult for blockchain-based cross-border carbon credit tokenization projects to achieve seamless on-chain data flow. However, the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone has launched a pilot for "cross-border data flow security assessment," exploring the use of "trusted computing + encrypted transmission" technology to achieve technical docking of the cross-border carbon market while ensuring data sovereignty, providing innovative ideas for breaking regulatory barriers. This dialectical relationship of "institutional differences driving technological innovation, and technological upgrades feeding back into regulatory optimization" is reshaping the new pattern of collaborative development in fintech between Mainland China and Hong Kong.

- Core Challenges

Disputes over regulatory jurisdiction have led to a general surge in compliance costs for global RWA projects, such as the U.S. SEC bringing decentralized platforms like Uniswap under securities regulation. In terms of regional institutional differences, Hong Kong follows APEC principles for cross-border data flow, while the Mainland implements a "data exit security assessment" system, requiring cross-border projects to undergo independent audits in both regions, increasing compliance complexity. Currently, the HKMA's stablecoin regulatory rules are equivalently recognized with the EU's MiCA framework, allowing licensed issuers to apply for EU EMT licenses based on their Hong Kong qualifications, which can reduce compliance costs. This mechanism has attracted institutions like Circle and Tether to establish Asia-Pacific operational centers, successfully promoting the cross-border flow of RWA.

While offshore SPVs and sandbox mechanisms provide institutional interfaces for cross-border compliance, the reliability of technological infrastructure remains a rigid constraint for large-scale implementation. The following will continue to penetrate underlying bottlenecks such as oracle delays and cross-chain interoperability, analyzing the priority of technology-regulation synergy.

Technological Bottlenecks and Solutions

Oracles serve as the "data bridge" of the blockchain ecosystem, playing a key role in securely transmitting off-chain real-world data (such as asset prices and IoT sensor data) to on-chain smart contracts. Their core technological principle is based on a decentralized node network that verifies data authenticity through consensus mechanisms: node operators obtain information from external data sources, encrypt the data using hash algorithms, and then write the data to the blockchain after ensuring that the majority of nodes have verified it through consensus algorithms such as Byzantine Fault Tolerance (BFT) or Proof of Stake (PoS). However, traditional single oracle architectures present significant risks—if the data source fails, experiences delays, or is maliciously tampered with, it will directly lead to incorrect execution of on-chain smart contracts.

- Oracle Data Reliability

International cases show that in 2022, the DeFi lending protocol Inverse Finance suffered a security incident due to a design flaw in its oracle TWAP (Time-Weighted Average Price) mechanism, resulting in the illegal appropriation of $14.75 million in on-chain assets. This incident exposed the core vulnerability of traditional oracles in dynamic markets: according to an analysis article by the Web3 security audit team Certik, the protocol's TWAP oracle time window only covered two adjacent blocks. Attackers manipulated the price of the INV-WETH trading pair on SushiSwap through flash loans, raising the INV price from 0.106 ETH (approximately $366) to 5.966 ETH (approximately $20,583) within 7 minutes, and then used the inflated price to collateralize 1,746 INV (fair value approximately $644,000) on Inverse Finance, borrowing assets such as 1,588 ETH, 94 WBTC, and 4 million DOLA, ultimately achieving fund transfer through cross-protocol arbitrage. This process exposed two core issues: first, the oracle time window was set unreasonably, unable to withstand short-term price manipulation; second, the protocol lacked real-time monitoring of collateral liquidity, allowing inflated assets to pass verification. Chainlink officially acknowledged afterward that its TWAP mechanism had design flaws in high-volatility markets and needed optimization by combining multiple data sources and machine learning algorithms.

This case reveals the core contradiction in oracle system design: it must ensure data real-time availability while preventing manipulation risks. According to the Chainlink 2.0 white paper, its decentralized oracle network significantly enhances system robustness by raising the cost of node malfeasance to over $980 million through economic incentives and cryptographic proofs. In the future, with the application of Trusted Execution Environments (TEEs) and AI verification layers, the reliability of oracle data is expected to reach financial-grade standards.

Ant Group in Hong Kong is exploring localized solutions in the "Langxin Project," innovatively deploying an "IoT terminal + multi-party secure computing" system for the tokenization of new energy charging pile assets. This solution is based on edge computing technology, with smart sensors embedded in charging piles to collect 12 core operational data points in real-time, such as current, voltage, and charging duration, and encrypting the data locally through TEE (Trusted Execution Environment) to ensure it is not tampered with before transmission. The data is then synchronized to three independent verification nodes (including testing agencies, power grid companies, and audit firms), where cross-verification is conducted based on homomorphic encryption and zero-knowledge proof technology, ultimately recording the data on-chain through hash value comparison. According to the measured results from Langxin Technology's report, this solution controls data latency to within 2 minutes, improving reliability fourfold compared to traditional single oracle solutions, providing a systematic solution of "hardware collection + multi-party verification + privacy computing" for on-chain data from off-chain scenarios, effectively avoiding contract default risks caused by data distortion.

- Cross-Chain Interoperability Optimization

In the context of fragmented global blockchain ecosystem development, cross-chain interoperability has become a core bottleneck restricting efficient asset circulation and value transfer. According to an event analysis report by the Shark team, the Wormhole cross-chain protocol suffered a security incident due to a smart contract vulnerability, resulting in direct losses of hundreds of millions of dollars, exposing technical shortcomings in verification mechanisms, asset custody, and risk hedging in cross-chain protocols. In this incident, attackers exploited a vulnerability in the protocol's guardian signature verification, minting 120,000 Wrapped ETH without actually depositing assets, and transferring them to other chains through cross-chain bridges to cash out, highlighting deep flaws in the security design of cross-chain protocols.

Moreover, the underlying architectural differences between heterogeneous blockchain networks exacerbate market fragmentation, significantly affecting the asset pricing efficiency of traditional cross-chain protocols due to liquidity fragmentation, leading to higher volatility in inter-chain price differentials compared to optimized models. Although specific token price differential data has not been explicitly disclosed in public reports, industry practices indicate that pricing deviations due to uneven liquidity distribution among similar assets across heterogeneous chains are common. It is well known that even for underlying real assets, such as real estate tokenization or data asset tokenization, enhancing the real effective liquidity of transactions still requires basic liquidity supply akin to traditional financial market makers. Cross-chain assets face pricing efficiency challenges in scenarios of dispersed liquidity. This fragmentation not only increases arbitrage costs for investors but also hinders the large-scale application of cross-chain assets.

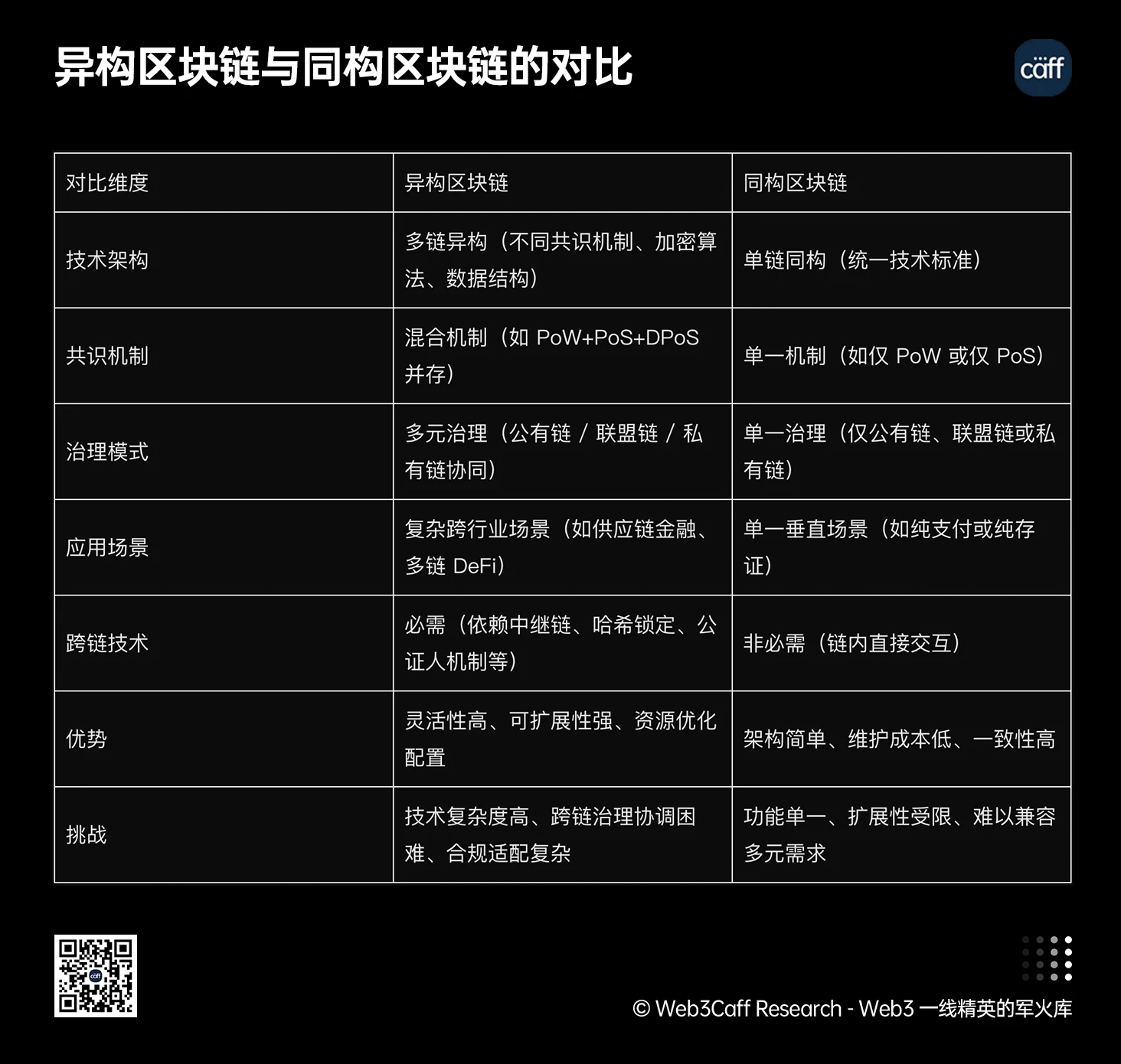

Figure 10, Source: Web3Caff Research researcher Eddie Xin self-made (Comparison of heterogeneous and homogeneous blockchains)

The Ensemble sandbox project led by the Hong Kong Monetary Authority (HKMA) constructs innovative solutions by introducing the LayerZero full-chain protocol. This protocol is based on a "light node verification + oracle collaboration" mechanism, enabling instant transmission and verification of cross-chain messages. At the same time, it relies on licensed custodians designated by the HKMA (such as HSBC and DBS Bank) to provide over-collateralization guarantees for cross-chain assets, strictly controlling inter-chain price fluctuations within 3%. For example, in the pilot cross-border carbon credit tokenization scenario, LayerZero supports the seamless transfer of carbon quotas between Ethereum and Binance Smart Chain, effectively avoiding the risk of cross-chain asset decoupling through real-time valuation and margin calls by custodians [11].

Mainland China, on the other hand, focuses on regional collaborative innovation through the "Guangdong-Hong Kong-Macao Greater Bay Area Cross-Chain Infrastructure" pilot. This project is based on consortium blockchain technology and achieves underlying technical compatibility among the blockchain platforms of Guangzhou, Shenzhen, and Hong Kong through a unified cross-chain communication standard (such as cross-chain hash locking protocol). At the consensus mechanism level, it adopts a hybrid model of "Practical Byzantine Fault Tolerance (PBFT) + Delegated Proof of Stake (DPoS)," ensuring transaction confirmation efficiency while enhancing system security through multi-center node governance. According to an article by Xie Baojian in the April 2025 issue of People's Forum and the report released by the China (Shenzhen) Comprehensive Development Research Institute titled “Digital ‘Chain’ Greater Bay Area – Blockchain Supporting the Integrated Development of Guangdong-Hong Kong-Macao Greater Bay Area Report (2022)”, comprehensive data shows that the pilot has successfully connected scenarios such as cross-border trade financing and supply chain finance, achieving cross-chain exchange of digital renminbi assets and Hong Kong dollar stablecoins, processing over 20,000 cross-chain transactions daily, and aiming to provide a replicable technical paradigm for national cross-chain ecosystem construction.

- Smart Contract Security Enhancement Update Reminder

Smart contracts, as the core execution units of the blockchain ecosystem, directly affect the reliability of asset transactions and business operations. The Federal Financial Supervisory Authority of Germany (BaFin) took emergency measures to suspend operations due to a reentrancy attack vulnerability in the smart contracts of the Centrifuge platform, which led to the illegal appropriation of user funds [12]. This incident exposed the limitations of traditional contract development that relies on manual audits—issues such as code logic vulnerabilities and missing boundary conditions are difficult to fully identify, prompting the industry to accelerate the introduction of Formal Verification tools. These tools are based on mathematical logic proofs, systematically verifying whether contract code meets predetermined attributes, such as controllability of fund flows and compliance of state transitions, fundamentally eliminating security risks caused by code defects.

Hong Kong has established a dual protection system of "technical testing + third-party auditing" in its regulatory practice. For real-world asset (RWA) tokenization projects, the Hong Kong Securities and Futures Commission explicitly requires that smart contracts undergo annual security audits by licensed auditing firms such as KPMG and Ernst & Young, covering aspects such as code logic review, vulnerability scanning, and stress testing. At the same time, the Hong Kong Securities and Futures Commission requires the introduction of automated auditing tools (such as Slither and MythX) for dynamic monitoring, tracking abnormal behaviors in contract operations in real-time. According to KPMG's audit report data, the occurrence rate of smart contract vulnerabilities in Hong Kong's RWA projects decreased by 65% in 2025 compared to 2023, significantly enhancing the security of asset tokenization businesses.

Mainland China, relying on the regulatory sandbox mechanism, has innovatively introduced a "smart contract filing system." In pilot areas, all on-chain contracts must pass security testing by the National Internet Emergency Center (CNCERT), covering 12 core indicators such as code compliance, cryptographic algorithm strength, and data access permissions. Additionally, a "whitelist" system has been established to grant on-chain execution permissions to contracts that pass the tests, requiring regular updates of filing information. Furthermore, some regions have introduced Multi-Party Computation (MPC) technology to achieve cross-institutional joint audits without disclosing contract code, ensuring both commercial privacy and enhancing audit efficiency. As of now, according to the 2023 White Paper on Cross-Border Data Flow Compliance and Technical Applications, the occurrence rate of security incidents involving smart contracts in pilot areas of the Mainland has decreased by over 50%, laying a solid security foundation for large-scale applications.

Liquidity Dilemma and Market Differentiation

- Expansion of Private Credit Market

In the context of increasing liquidity stratification in global financial markets, the digital transformation of the private credit market has become an important breakthrough for solving financing dilemmas. As a leading platform in the on-chain private credit field, Maple Finance has issued over $2 billion in loans through automated approval via smart contracts and decentralized funding pools, but its business structure shows a significant "crypto bias"—80% of funds flow to crypto-native institutions such as DeFi protocols, crypto mining companies, and stablecoin issuers. This imbalance stems from traditional enterprises lacking on-chain credit data accumulation, making it difficult to meet the stringent codified risk control standards of blockchain financing platforms. Coupled with legal compliance disputes regarding smart contracts, the penetration rate of traditional enterprises has long remained below 5%. According to comprehensive data from Mint Ventures report and Maple Finance, although Maple Finance's loan default rate is controlled at 1.2%, the proportion of financing from non-crypto enterprises is less than 1/5 of the total scale, highlighting the weak support for the real economy in the market.

Hong Kong has taken a differentiated path in promoting the integration of traditional industries with on-chain finance. The Global Shipping Business Network (GSBN), supported by the Hong Kong Monetary Authority (HKMA), reconstructs the cross-border trade financing model through a pilot project for electronic bill of lading (eBL) tokenization. The project collaborates with industry leaders such as HSBC and COSCO Shipping to transform paper bills of lading into blockchain-based digital assets, achieving instant financing with "bills of lading as assets." Relying on smart contracts to automatically execute goods delivery and fund settlement, the platform compresses the trade financing cycle from an average of 15 days to 3 days, while reducing fraud risk by 90% through a "multi-signature + evidence audit" mechanism. On the policy level, the Hong Kong Securities and Futures Commission has launched the "Green and Sustainable Finance Grant Scheme," providing up to 80% subsidies for compliance costs of eligible private credit tokenization projects, stimulating traditional enterprises' participation. By the end of 2024, the proportion of traditional enterprise clients on the platform increased from an initial 8% to 18%, completing over $50 million in cross-border trade financing, effectively alleviating liquidity pressure for small and medium-sized traders.

Mainland China, relying on a mature supply chain ecosystem, is building an inclusive on-chain financial service system. The blockchain supply chain finance platform of MyBank utilizes a "core enterprise credit penetration + blockchain evidence" mechanism to tokenize accounts receivable, warehouse receipts, and other assets, having served over 100,000 small and medium-sized enterprises. According to a report analyzing the MyBank platform by Guanyuan Data, the platform employs multi-party secure computing technology to achieve data sharing among supply chain upstream and downstream while protecting commercial privacy, combined with AI risk control models to automatically assess enterprise credit risk, shortening the financing approval time to 30 minutes. Additionally, through automated revenue sharing via smart contracts, the efficiency of fund circulation is increased fivefold, and financing costs are reduced by 20%. Through technological innovation and policy guidance, it effectively breaks down barriers between traditional finance and on-chain private credit, providing a new paradigm for solving liquidity dilemmas.

- Non-Standard Asset Liquidity Enhancement

In the global financial asset digital transformation process, the tokenization of non-standard assets (Non-Fungible Assets, NFAs, such as digital artworks, virtual land, and virtual power plants) faces severe liquidity challenges. Taking the tokenization of niche artworks as an example, its secondary market generally exhibits characteristics of "liquidity collapse": according to research data from TokenAnalyst, the average daily trading volume of art tokens declines by 80% within three months after initial issuance, significantly lower than the liquidity levels of standardized assets (such as stocks and bonds). This phenomenon stems from the unique attributes of non-standard assets—lack of unified valuation standards, insufficient information transparency, and dispersed trading demand, leading to a lack of market depth. Currently, the industry mainly relies on professional market-making institutions like Wintermute to provide liquidity support, maintaining bid-ask spreads through algorithm-driven quoting strategies. However, this model carries significant risk exposure: if market makers withdraw due to tight funding or deteriorating market conditions, it may trigger severe price fluctuations of assets, exacerbating liquidity crises.

Hong Kong demonstrates a synergistic advantage in institutional and technological innovation in the field of non-standard asset liquidity. The Munch project, as a benchmark case for the tokenization of real commercial revenue rights, constructs a dual-layer architecture of "compliant stablecoin exchange + cross-border revenue rights registration." At the compliance level, the project achieves a 1:1 compliant exchange of USDT stablecoin and Hong Kong dollars through licensed virtual asset service providers (VASP), opening up the channels for fiat and crypto asset inflows and outflows. Simultaneously, by utilizing the structure of wholly foreign-owned enterprises (WOFE) in Mainland China, the project legally certifies and blockchain-verifies the cash flow from restaurant store revenues, automating revenue distribution and implementing penetrating supervision through smart contracts. On the technical side, the project introduces a dynamic market-making algorithm, combining an order book with an automated market maker (AMM) hybrid model, increasing the average daily trading volume of restaurant revenue tokens by 35% and compressing the bid-ask spread to 2.8%. Additionally, the "Pilot Program for Tokenization of Unlisted Securities" launched by the Hong Kong Securities and Futures Commission allows eligible projects to apply simplified disclosure procedures, reducing the compliance costs of non-standard asset tokenization and accelerating market liquidity formation.

Mainland China, on the other hand, explores localized paths for enhancing non-standard asset liquidity through policy guidance and structured financial instruments. Taking the Shanghai Left Bank Xinhui Agricultural RWA project as an example, this project tokenizes agricultural supply chain revenue rights and employs a "government-guided fund + structured layering" mechanism to optimize the risk-return structure. Here, the government industrial fund acts as a priority investor, holding a 40% share and enjoying a fixed annual return of 6%-8% (this data reflects standard industrial investment return requirements), providing credit endorsement and risk buffering for the project; social capital, as subordinate investors, obtains excess returns, forming a mechanism for shared risk and shared benefits. In terms of technical implementation, the project builds a "production data on-chain + smart contract settlement" system based on a consortium blockchain, publicly disclosing core information such as agricultural product yield and sales channels in real-time, enhancing asset transparency and verifiability. At the same time, it constructs an over-the-counter (OTC) market through regional property rights trading centers, designing a directional circulation mechanism for tokens to achieve asset interchange among upstream and downstream enterprises in the agricultural industry chain, which is expected to improve the turnover efficiency of non-standard agricultural assets by 40%. This will effectively address the financing and liquidity challenges in the rural revitalization sector and provide a replicable policy-technology collaborative paradigm for the digitalization of non-standard assets.

Another typical case is Singapore's Juwai IQI real estate tokenization project. This project targets the poorly liquid commercial real estate in Southeast Asia by splitting property ownership into digital tokens. Through collaboration with SBI Digital Asset Holdings, it introduces blockchain technology to achieve transparency and automation in real estate transactions. To address liquidity issues, the project adopts a "dual-platform trading" model: on one hand, it conducts transactions on compliant security token trading platforms (such as DX Exchange) to meet the compliance needs of institutional investors; on the other hand, it enables small, high-frequency fragmented trading through decentralized trading platforms (DEX). Additionally, the project introduces local market makers in Singapore to provide liquidity support, combining smart contracts to automatically adjust the bid-ask spread, aiming to increase the trading frequency of property tokens to 20 times that of traditional real estate transactions and significantly improve the liquidity of non-standard real estate assets.

In the European market, France's Fine Art Token project focuses on the tokenization of high-end artworks. This project collaborates with auction houses like Christie's to conduct professional valuation and authentication of artworks, and records the provenance information and ownership change history of artworks through blockchain technology. To enhance liquidity, the project establishes an "art token liquidity pool," allowing investors to trade in token units and signing agreements with multiple European market makers to ensure that active buy and sell quotes are always present in the market. Additionally, the project launches a "token staking yield program," allowing investors holding tokens to earn returns through staking, further enhancing the attractiveness of the tokens. Within six months of its launch, the platform's art token trading volume exceeded 100 million euros, effectively activating the previously illiquid art investment market.

RWA Legal Compliance Framework and Case Analysis

Domestic Legal Challenges and Compliance Paths

- Virtual Currency Regulation

According to legal analysis by Han Kun Law Offices [13], domestic regulations explicitly prohibit initial coin offerings (ICO), classifying them as illegal public financing activities and bringing them under the supervision of the "Regulations on Preventing and Dealing with Illegal Fundraising." Therefore, domestic RWA projects must use fiat currency or compliant stablecoins for settlement, eliminating the participation of virtual currencies in value circulation.

- Foreign Exchange Regulation

RWA projects engaging in cross-border financing must comply with capital project management regulations. For example, Longxin Technology establishes a foreign investment equity investment management enterprise (FAGP) through the Qualified Foreign Limited Partner (QFLP) model to raise foreign dollar funds, which, after filing with the foreign exchange administration, injects cross-border equity investment into domestic project companies to acquire underlying assets. Some pilot areas (such as Hainan Free Trade Port) allow financing through cross-border asset securitization (ABS), but require special quotas from the foreign exchange administration.

- Financial Regulation

Even without issuing tokens, domestic RWA projects still need to adhere to financial regulatory requirements. Projects often raise funds through private fund managers' filings, using the private equity fund model under the "Securities Investment Fund Law," limiting the number of qualified investors and investment thresholds. On the asset operation side, they entrust licensed institutions such as trust companies and asset management companies to operate according to the "Measures for the Administration of Collective Fund Trust Plans of Trust Companies," avoiding risks associated with unqualified asset management.

Hong Kong Sandbox Mechanism and Cross-Border Compliance

- Ensemble Sandbox Practice

The Hong Kong Monetary Authority's Ensemble sandbox provides a compliant experimental environment for RWA projects. Taking Longxin Technology's charging pile RWA project as an example, it adopts an "asset chain + transaction chain" structure: the asset chain records operational data and revenue rights based on the Mainland's consortium blockchain, while the transaction chain connects to foreign funds through Hong Kong's licensed blockchain platform, simultaneously integrating the regulatory systems of both regions, adhering to APEC cross-border privacy rules and the Mainland's data exit security assessment system to ensure compliant cross-border data flow.

- Stablecoin Regulatory Equivalence Recognition

The stablecoin regulatory rules released by the Hong Kong Monetary Authority in 2024 are recognized as equivalent to the EU MiCA framework. Stablecoin issuers holding "Type 7 (Automated Trading Services)" and "Type 8 (Securities Margin Financing)" licenses in Hong Kong can directly apply for EU EMT licenses based on their qualifications to reduce compliance costs. For instance, the Hong Kong dollar stablecoin HKDT has accessed the EU payment system through this, aiming to be applied in cross-border trade financing RWA projects for real-time exchange between Hong Kong dollars and euros [14].

- Deepening Regulation with the Stablecoin Bill

The Stablecoin Bill, passed on May 21, 2025, requires that any issuance of fiat stablecoins or stablecoins pegged to the Hong Kong dollar in Hong Kong must apply for a license. Licensed institutions must maintain 100% cash, government bonds, and other high liquidity reserves, meeting anti-money laundering, information disclosure, and third-party audit requirements. This bill will promote the participation of institutions like JD.com and Standard Chartered in sandbox testing, accelerating the entry of traditional financial resources into the RWA field and consolidating Hong Kong's position as a cross-border business hub for RWA.

International Compliance Framework Comparison and Interoperability Dilemma

- Global Regulatory Paradigm Differentiation and Institutional Game

The international RWA regulatory system exhibits significant regional characteristics, with core differences stemming from the judicial classification of tokenized assets, investor protection logic, and the trade-offs of the principle of technological neutrality. The main regulatory clusters are as follows:

Securitization Dominant: U.S. Regulatory Expansion and Judicial Penetration

Regulatory Framework: In the U.S., the SEC (Securities and Exchange Commission) and CFTC (Commodity Futures Trading Commission) implement classified regulation based on asset attributes. The SEC enforces securitization regulation on RWA tokens that meet the Howey Test under the "Securities Act of 1933." If RWA tokens satisfy the four conditions of "investors invest funds, form a common enterprise, expect profits, and rely on others' efforts," they are classified as securities and subject to Reg D (qualified investors) or Reg A+ (small offering exemption) provisions. The CFTC oversees futures and options trading of commodity attribute tokens like Bitcoin and Ethereum, preventing market manipulation and fraud, exercising jurisdiction over commodity attribute tokens (e.g., BTC, ETH).

Regulatory Practice:

Securities Definition Generalization: In 2024, the SEC expanded its interpretation standards to include "any RWA project involving profit distribution or third-party management" within the securities category, with typical cases including penalties against the tokenized real estate platform Securitize (for unregistered securities issuance);

Compliance Burden: The BlackRock BUIDL fund is only open to qualified investors (net assets ≥ $1 million), mandating on-chain identity verification (based on the Circle Verite protocol), leading to increased operational costs.

Sandbox Experimental: Hong Kong Institutional Innovation and Cross-Border Coordination

Institutional Framework: The Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC) implement "technology-neutral" regulation under the "Securities and Futures Ordinance," allowing security tokens to break traditional rule restrictions within the Ensemble sandbox, achieving a sandbox mechanism of technological neutrality and regulatory flexibility;

International Cooperation: The Hong Kong Web3.0 Standardization Association released the "Real World Assets (RWA) Identification and Metadata Specification," promoting the standardization of global RWA asset registration and circulation. It collaborates with regulatory agencies in regions such as Indonesia and the EU to explore cross-border RWA compliance frameworks;

Core Mechanism:

Product Innovation: In February 2025, the SFC officially released the newly formulated "ASPIRe" roadmap, detailing Hong Kong's regulatory plans for the virtual asset market in the future, with core goals for product innovation including "launching more complex products for professional investors, such as new coin issuance, derivatives trading, and margin financing tools." This also marks the first time Hong Kong regulators indicated they would consider introducing virtual asset derivatives trading in the future;

Stablecoin Gateway: On May 21, 2025, the Hong Kong Legislative Council officially passed the "Stablecoin Ordinance," becoming the world's first comprehensive regulatory framework for fiat stablecoins. It only allows licensed institutions to issue Hong Kong dollar-pegged stablecoins (such as HKDG), stipulating that issuers must operate under sandbox regulation. The current focus of regulation is primarily on two types of activities: issuing designated stablecoins in Hong Kong; or issuing designated stablecoins outside Hong Kong that claim to be pegged to the value of the Hong Kong dollar. This design ensures that stablecoins pegged to the Hong Kong dollar are regulated while leaving some space for other stablecoins. Regulatory requirements mandate issuers to establish real-time verification mechanisms for reserves, automatically comparing balance sheets through blockchain smart contracts to ensure that the value of reserve assets equals the par value of circulating stablecoins. Additionally, the "Stablecoin Ordinance" introduces a "Consumer Protection Fund," requiring issuers to set aside 5% of transaction fees quarterly as a risk reserve to meet redemption demands during extreme market fluctuations;

Global Hub Positioning: Hong Kong attracts Web3 enterprises through policy advantages, aiming to become a core node for RWA cross-border financing pilots (such as the Shenzhen-Hong Kong carbon trading);

Traditional Financial Integration: Institutions like Bank of China Hong Kong and HSBC are accelerating their layouts, exploring scenarios such as tokenized deposits and on-chain clearing.

Unified Legislation Type: Compliance Cost Paradox of the EU MiCA Framework

Regulatory Framework: MiCA (Markets in Crypto-Assets) categorizes RWA tokens into Asset-Referenced Tokens (ARTs), Electronic Money Tokens (EMTs), and hybrid crypto assets, requiring issuers to establish EU entities and submit compliance white papers [15];

Execution Dilemma: Small and Medium Institutions Being Squeezed Out: In the fintech sector, the high compliance costs often lead to the phenomenon of small and medium institutions being squeezed out of the market. Many small platforms are overwhelmed and have no choice but to exit the market. For example, the compliance cost of the Luxembourg Tokeny gold token project reached 2.2 million euros, which is 200% higher than that of sandbox projects, forcing 35% of small platforms to exit the market;

Liquidity Fragmentation: MiCA requires secondary trading to be facilitated by licensed exchanges, resulting in a 35% decrease in average daily trading volume on DeFi platforms (2025 ESMA Report);

Regional Coordination: Relying on the EU Markets in Financial Instruments Directive II (MiFID II) to achieve mutual recognition of member state regulations, but cross-border RWA settlement still depends on the SWIFT network.

Emerging Experimental: Regulatory Arbitrage and Sandbox Effectiveness Boundaries

Dubai Path: The DFSA (Dubai Financial Services Authority) has launched a phased sandbox mechanism, exempting capital adequacy requirements for security tokens during the testing period, but the testing conversion rate is only 22% (2025 data);

Singapore Practice: The MAS exempts private placements (≤50 people) and small fundraising (≤5 million SGD) but requires a KYC coverage rate of ≥95% on-chain, leading to a rise in technology investment proportion to 25%.

Interoperability Dilemma: Technical-Institutional Causes of Compliance Islands

The core contradiction facing the global RWA ecosystem lies in the irreconcilability between the global liquidity of on-chain assets and localized regulation. This is specifically manifested as:

Protocol Layer Fragmentation: The KYC module compliant with Hong Kong's Ensemble sandbox (such as Ant Chain components) lacks interoperability with the EU MiCA's AML protocols, leading to increased development costs for cross-jurisdictional projects;

Jurisdictional Conflicts: The expansive regulation of on-chain dividends by the U.S. SEC has led to the liquidity of revenue-type tokens based on Singapore's exemption clauses dropping to zero in the U.S. (Case: Maple Finance's Southeast Asia credit pool exited the U.S. market in 2025, as its compliant business model in Southeast Asia could not meet the stricter regulatory rules in the U.S. regarding investor protection and anti-money laundering, ultimately choosing a strategic exit to avoid cross-regional regulatory conflict risks);

Liquidity Pool Fragmentation: Stablecoin gateway policies (such as Hong Kong's HKDG and the EU's EMT) force market makers to split funding pools, widening the bid-ask spread for cross-border trading of non-standard assets.

Data Evidence: According to CoinGecko statistics from 2025, only 12% of the global Top 50 RWA protocols support cross-jurisdictional compliance interactions, with average daily cross-border trading volume accounting for less than 5%. This situation sharply contrasts with the ideal scenario of "assets flowing without breaking," necessitating breakthroughs through the following paths: