原文标题:《超级周来袭 未来三天数据将决定加密市场下半年走势?》

原文作者:邓通,金色财经

本周将成为美国「一年中数据最丰富的一周」,未来三天都有哪些值得关注的大事件?加密市场未来走势如何?

一、未来三天值得关注的大事件

1. 美联储议息会议

北京时间 7 月 31 日凌晨 2:00,美联储将公布最新利率决议,鲍威尔将召开货币政策新闻发布会。

当地时间 7 月 28 日,特朗普表示,美联储必须降息。特朗普称,「即使不降息,美国也做得很好,但降息后美国会更好」。美联储主席鲍威尔任期至 2026 年 5 月结束。鲍威尔领导的美联储不愿按特朗普要求,把基准利率从当前 4.25% 至 4.50% 的目标区间下调至 1%,以降低联邦政府借贷成本。特朗普对此不满,多次威胁要让鲍威尔「走人」。

「美联储传声筒」Nick Timiraos 发表文章称:美联储官员预计,他们最终将需要继续降息,只是他们还没有准备好在周三这么做。他们之间的分歧在于,他们首先需要看到哪些证据,以及等待一切变得明朗是否是个错误。官员们现在在是否恢复降息的问题上分裂成三个阵营。焦点将是鲍威尔是否会在新闻发布会上提供任何 9 月降息的暗示,以及他的同事们是否在未来几天和几周内开始为下一次会议的降息奠定基础。

华泰证券研报称:虽然 6 月会议以来特朗普多次施压鲍威尔降息,美联储内部也有委员要求 7 月降息,但考虑到就业市场整体超预期,且关税未来将逐步传导至通胀,预计美联储 7 月会议大概率按兵不动;后续降息决策取决于 7—8 月经济数据,维持就业市场走弱会促使美联储 9—12 月预防式降息 2 次的判断。

瑞士宝盛银行认为:美联储可能会在 9 月份的 FOMC 会议上重启降息周期。经济前景趋弱意味着美联储将在下半年实施更宽松的货币政策。关税上调后围绕通胀的不确定性,以及特朗普总统要求降息的政治压力,都阻碍了本月的降息。7 月以后,私人消费停滞和投资计划减少(表明需求走软)将证明,尽管通胀高于目标,但减少限制性的政策立场是合理的。

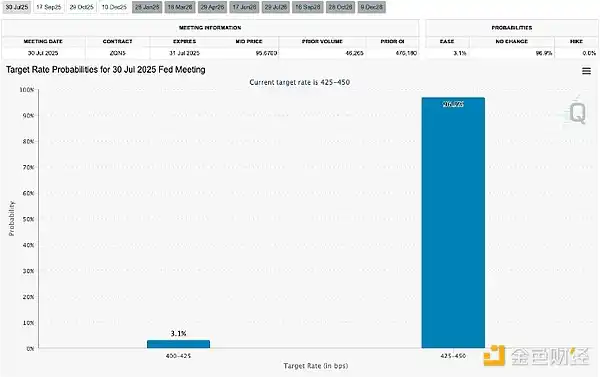

据 CME「美联储观察」:美联储 7 月维持利率不变的概率为 96.9%,降息 25 个基点的概率为 3.1%。美联储 9 月维持利率不变的概率为 35.4%,累计降息 25 个基点的概率为 62.6%,累计降息 50 个基点的概率为 2.0%。

尽管预计不会降息,但鉴于 7 月份持续的中性基调,降息结果可能已基本被市场消化。然而,美联储主席杰罗姆·鲍威尔的任何鸽派言论都可能改变市场情绪。如果鲍威尔暗示 9 月份可能降息,市场可能会领先于预期,推动比特币突破 12.3 万美元并创下新高。

美联储 7 月 FOMC 会议目标利率概率。来源:芝商所

2. 特朗普关税政策

8 月 1 日,特朗普的新关税措施将硬性生效。

7 月 28 日,特朗普表示,预计美国将对那些没有与华盛顿达成贸易协议的国家征收 15% 至 20% 的关税。在苏格兰特恩伯里的高尔夫度假村与英国首相斯塔默会晤后,特朗普对记者说:「我认为这将在 15% 到 20% 之间。」「可能是这两个数字中的一个。」特朗普表示,美国将很快向大约 200 个国家发信,通知他们对美国出口的预期关税税率。特朗普从 4 月起对大多数国家征收了 10% 的额外关税,其他许多国家的关税税率将从 8 月 1 日起上调。钢铁和铝、芯片、烈酒三大关键领域的关税协议仍待定。

特朗普称,欧盟还承诺购买美国 7500 亿美元的能源产品,并在美追加投资 6000 亿美元。此外,欧盟将大规模购买美国军事装备。

美国商务部长卢特尼克表示,特朗普本周将对其他国家做出关税决定。特朗普本周将考虑几项协议,然后确定税率。对于那些提议提供准入的国家,我们的谈判桌已经准备好了。

在与美国总统特朗普宣布欧盟美国达成重大贸易协议后,欧盟委员会主席冯德莱恩对外解释其在对美贸易谈判中的部分决定。冯德莱恩称,欧盟目前仍然过度依赖俄罗斯液化天然气,因此,从美国进口更多价格可承受的液化天然气是非常受欢迎的。在关税安排方面,冯德莱恩确认,协议中对汽车行业的关税统一定为 15%。她表示,在当前形势下,15% 的关税水平是欧委会能够达成的最佳结果。此外,她还证实,欧盟与美国在医药行业也达成一致,将实施 15% 的统一关税税率。冯恩莱恩承认,欧盟与美国尚未就烈酒领域做出决定,当天签署的贸易协定框架的细节将在未来几周内公布。

同日,德国总理默茨表示,他对欧盟与美国之间达成的关税协议并不满意,美国对欧盟商品加征的 15% 关税对出口导向型的德国经济将是很大的负担。但默茨同时承认,目前的美国对欧盟商品征收的关税税率与美国此前宣称的 30% 已经降低了一半,他无法期待更好的结果。

Mosaic Asset 指出:「贸易紧张局势的缓解和流动性的顺风推动标准普尔 500 指数创下新高,而波动性则降至今年年初以来的最低水平。M2 自 2023 年以来触底回升,目前正与主要股指一起创下新高。」在整个加密货币市场历史上,比特币和加密货币的表现与全球 M2 流动性趋势密切相关。

3. 香港稳定币发行人监管制度将生效

8 月 1 日,香港《稳定币条例》将生效。

香港金管局表示将设 6 个月过渡安排,处理之前在香港已有稳定币发行业务的机构,包括向有能力遵守监管规定的发行人,发出临时牌照;若发行人未能在条例生效后 3 个月内符合相关要求,须在法例生效后 4 个月内有序结束在香港的业务;如果金融管理专员未能信纳发行人有能力符合发牌准则及监管规定,发行人要在接获拒绝通知后一个月内有序结束香港业务。

香港金融管理局曾于 7 月 29 日就 2025 年 8 月 1 日起实施的稳定币发行人监管制度发布《持牌稳定币发行人监管指引》、《打击洗钱及恐怖分子资金筹集指引(持牌稳定币发行人适用)》,以及两项指引的咨询总结。两套指引于 2025 年 8 月 1 日刊宪。香港金管局同时发布与发牌制度及申请程序相关的《稳定币发行人发牌制度摘要说明》,以及《原有稳定币发行人过渡条文摘要说明》。香港金管局表示,截至今日尚未发出任何牌照。鼓励有意申请牌照的机构于 2025 年 8 月 31 日或之前联系金管局,让金管局可传达监管期望并适当提供反馈。发牌将是一个持续进行的过程,如个别机构认为已准备充分并希望尽早获得考虑,应于 2025 年 9 月 30 日或之前向金管局提交申请。

稳定币在香港的热度极高,香港金融管理局总裁余伟文曾在 7 月 23 日发布文章《行稳致远的稳定币》,提示应避免过度炒作、严防金融风险。「我们有必要防范市场和舆论过度炒作,最近有一些现象值得我们关注:一是过度概念化,但更值得我们关注的是泡沫化趋势。」

光大证券发布研报称,2024 年全球零售跨境支付市场规模达 39.9 万亿美元,据 FXC Intelligence 预测,2032 该规模将增至 64.5 万亿美元,2024 年-2032 年复合年增长率达 6.2%。在人民币跨境清算、多币种结算等业务层级中,第三方支付机构已深度嵌入支付全链路服务生态,发挥着重要作用。预计稳定币将驱动人民币跨境支付基础设施全球扩展、以及应用场景多元化,则第三方支付公司营收增长空间可期。长远来看,合规稳定币发展空间广阔,有助于稳定币市场规范化,增强投资者信心,促进市场规模扩大。

4. 美国 Q2 GDP 数据将公布

当地时间 7 月 30 日,美国 Q2 GDP 数据将公布。

美国商务部周二公布的数据显示,6 月商品贸易逆差较上月收窄 10.8%,降至 860 亿美元。该数据未经过通胀调整,低于媒体调查的所有经济学家的预测值。

最新的美国 6 月商品贸易数据促使部分经济学家上调了对美国第二季度国内生产总值(GDP)的预估,该数据将在周三公布。分析师们认为,年初拖累美国 GDP 的贸易现象预计将在最新季度得到基本逆转。

根据亚特兰大联储的实时预测,2025 年 Q2 的 GDP 增长率为 2.90% 和 2.38%。

高盛此前将第二季度的 GDP 增长预期从-0.3% 上调至 2.4%,认为第一季度 GDP 数据可能被低估。

Moody's Analytics 预测 2025 年美国全年 GDP 增长 1.5%,但认为第二季度的数据可能会略高,并指出美国经济将处于「弱扩张」状态。

若美国 Q2 GDP 数据优于预期,经济向好促使投资者风险偏好提升,部分资金流入加密市场。

5. 非农数据将公布

当地时间周五,美国非农数据将公布。

周五公布的 7 月非农报告预计将印证企业招聘趋于谨慎。在 6 月教育行业就业激增推高数据后,本月新增就业料将放缓,失业率或微升至 4.2%。美国政府 6 月个人收支报告预计将显示,美联储青睐的核心通胀指标环比略有加速,表明关税只是逐渐转嫁到消费者身上。

花旗分析师在最新研究报告中指出,美国劳动力市场若出现疲软迹象,将引发美联储更为鸽派的预期重估,进而推动美元新一轮下跌,资金寻求新投资渠道,加密货币吸引力提升。花旗预计,7 月份非农就业增长将放缓至 10 万,失业率可能上升至 4.2%。

6. 科技巨头财报季

当地时间周三、周四盘后,微软、Meta、苹果、亚马逊将相继发布财报。

微软、Meta、苹果、亚马逊四大科技巨头将在本周的周三周四相继发布财报,总市值高达 11.3 万亿美元的业绩表现将成为标普 500 指数能否延续涨势的关键考验。据媒体的数据,在已公布业绩的约三分之一标普 500 指数成分股公司中,约 82% 的公司盈利超出预期,有望创下近四年来最好的季度表现。

不过,分析师在过去几个月已大幅下调预期,主要因担忧关税对消费支出和利润率的影响。大型科技公司的盈利预测同样被调低。数据显示,「Mag7」第二季度的盈利同比增长预计为 16%,低于 3 月底时预测的 19%。与此同时,标普 500 指数的盈利年增长率预计为 4.5%,也低于 3 月份预测的 7.5%。

若业绩良好,带动市场整体乐观情绪,资金活跃度提高,流入加密市场的资金或增加。若业绩不及预期,市场信心受挫,资金避险需求上升,可能流向稳定资产,加密货币市场资金流出。

二、未来的加密市场怎么走?

虽然短期市场结构勾勒出看涨复苏的轮廓,但长期格局表明,BTC 的看涨势头可能正在减弱。双顶形态可能在其历史高点附近出现,反映出买家的疲软。如果未能彻底突破 123,200 美元的每日供应区域,将验证这种看跌模式,从而阻碍价格发现。

比特币 12 小时图。资料来源:Cointelegraph/TradingView

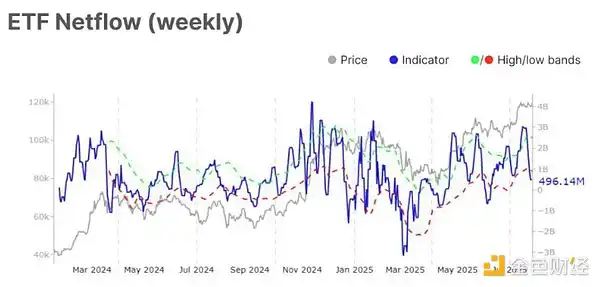

比特币的每日相对强弱指数从 74.4 急剧下降至 51.7,表明现货市场已然疲软,而日交易量则降至 86 亿美元,这两项数据都表明市场参与度正在下降。现货 BTC 交易所交易基金 (ETF) 的资金流也较上周下降了 80%,从 25 亿美元降至 4.96 亿美元,这表明机构投资者的兴趣正在降温。

尽管期货未平仓合约仍保持在 456 亿美元的高位,但多头资金的增加表明市场过度自信正在加剧。此外,96.9% 的供应量仍处于盈利状态,这表明获利回吐的可能性很高。

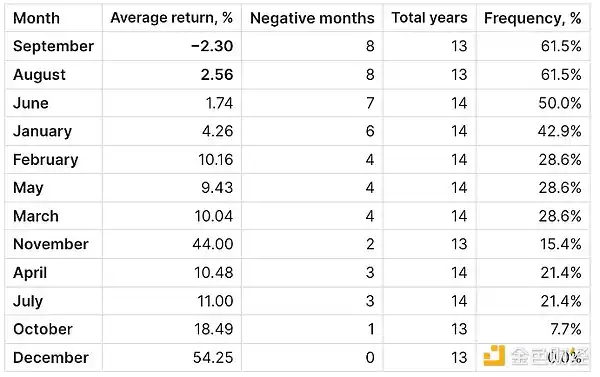

8 月份的历史回报率进一步印证了这一观点。8 月份超过 60% 的资金以亏损收盘,平均回报率为 2.56%,这意味着即将到来的月份将面临季节性的逆风。再加上链上活动的减弱,例如活跃地址和转账量的下降,BTC 价格可能会在未来几周内回调。

BTC 历史月平均收益率。资料来源:Axel Adler Jr.

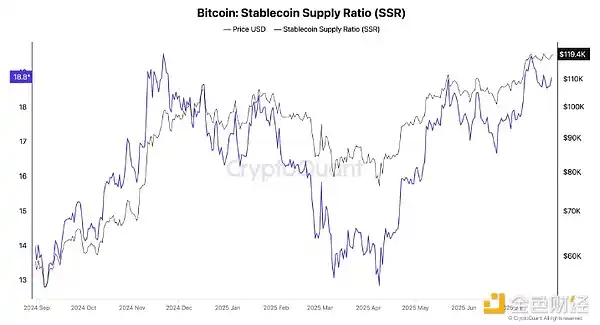

链上分析平台 CryptoQuant 的最新研究认为,稳定币供应比率(SSR)一直与 BTC/USD 同步增长,这可能表明缺乏可供投资的稳定币流动性或「干火药」。

撰稿人 Arab Chain 认为:「该指标的上升表明,与比特币的交易量相比,稳定币的数量很少。换句话说,流动性较弱,因此市场缺乏支撑比特币的高购买力。该指标的上涨,以及比特币价格的上涨,表明这种上涨是在没有新的稳定币以相同速度进入的情况下发生的。该指标的持续上升可能表明,由于流动性低,未来的购买势头可能会减弱。」市场可能正在进入「暂时饱和」时期。 「市场仍然部分受到流动性的支撑,但比特币的持续上涨需要在未来几天大幅增加稳定币储备。」

比特币 SSR 与 BTC/USD 走势图。资料来源:CryptoQuant

交易员 Crypto Tony 预测:「如果比特币能够收紧并保持在 117,000 美元以上,那么我认为我们很快就会创下新的历史新高。」

Rekt Capital 表示:「目前 BTC 需要避免突破牛旗顶部阻力位,否则价格将维持在区间内。」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。