Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

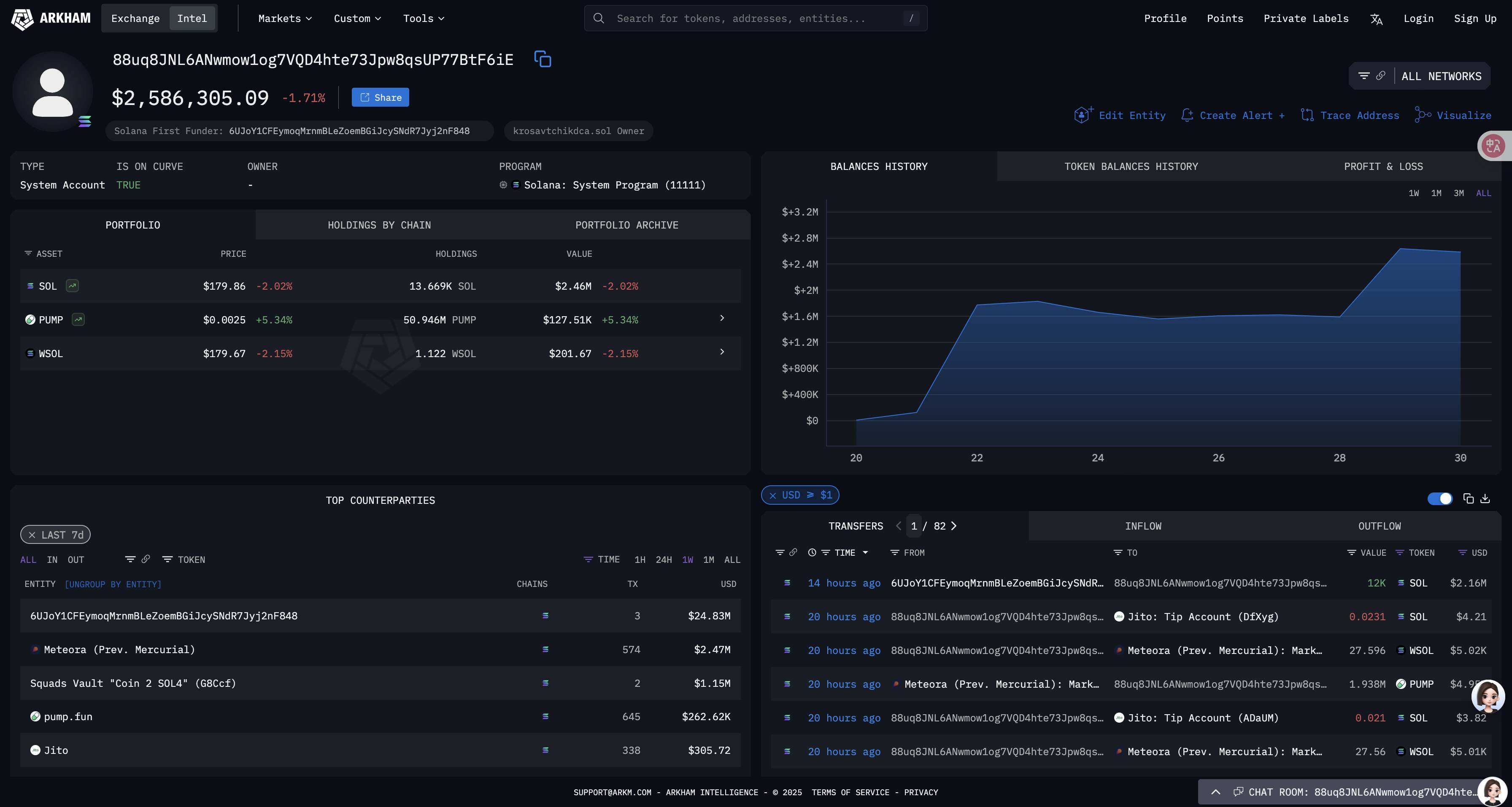

On July 30 at 4:56, on-chain monitoring showed that Pump.fun again transferred 12,000 SOL (approximately $2.16 million) to its "PUMP buyback execution address." This follows a significant transfer of 187,770 SOL from the fee wallet on July 16, marking another large transaction two weeks later.

The official announcement did not disclose a new buyback cycle or burn plan, but the community quickly linked this transfer to the previously circulated slogan of "100% daily buyback." On-chain observers like Dumpster DAO reminded that currently, it is confirmed that only 1 day of income has reached the 100% packaging standard, and the packaged amount has not all been realized in actual transactions; the lack of burn, multi-signature lockup, and other actual deflationary measures means that the "supportive buying" remains at the level of "expectation."

On the other hand, OKX market data showed that the Pump token price yesterday even fell below $0.0023, having retracted over 60% from its peak on the listing day of July 16. As of the time of writing, the current quote is $0.002479, with no significant signs of a rebound.

A seemingly "positive" deposit, coupled with familiar doubts, adds fuel to the ongoing trust crisis for Pump.fun that has lasted for half a month.

Price hitting bottom, buyback doubts: Deposit ≠ Order, transparency determines discount

A "High Valuation - High Retracement" Race

PUMP launched at a public price of $0.004 with a $4 billion FDV, seen as high valuation financing; within hours of opening, it began to decline. Multiple on-chain panels showed that two private placement addresses cashed out $141 million within six days, realizing nearly $40 million in profit, leading to labels of "whale escape" and "retail investors taking over" being applied to Pump.fun.

What does the rumored "100% buyback" slogan say?

- Source of funds: Fee extraction — the platform has charged 1% and accumulated over $600 million;

- Execution path: On July 16 and July 30, 187,770 and 12,000 SOL were transferred to the buyback pool in one go;

- Actual orders: A total of 129,100 SOL on-chain has been converted to market price transactions, with the remaining amount still at the execution address (88uq***F6iE);

- Destination: The buyback proceeds of 3.828 billion PUMP have neither been burned nor entered into a lockup/multi-signature treasury.

In other words, the deposit merely places the "potential buying" under the spotlight, but does not answer the three questions of "when will it be executed, what will be bought, and what will be done with it." The first-day operation with an average purchase price of $0.0056 has instead become a heavy floating loss asset above the market price in the following two weeks.

External Comparison: The "Reflow Flywheel" Pressure of Bonk.fun

On July 8, Bonk.fun (LetsBONK) saw its market share in the new coin issuance rise to 55.2%, while Pump.fun fell to 34.9%; one reason is that Bonk.fun uses 58% of platform income for BONK buybacks and immediate burns, forming a closed loop of "fees → buying → burning → expectation enhancement."

When competitors write "buyback + burn" into on-chain contracts for automatic execution, Pump.fun's "manual orders + undisclosed destination" naturally gets a higher discount factor.

Narrative Impact: Solana Co-founder Calls It "Digital Slop"

Even more awkwardly, the founder of the underlying public chain, Anatoly Yakovenko, in a public conversation with Coinbase, derided meme coins and NFTs as "digital slop" and compared them to mobile game loot boxes. The remarks quickly fermented on social media, directly labeling the narrative of "Meme × Community × Early Fun" as "having no intrinsic value," further exacerbating the price decline.

Founder's Rug History: Old News, Lawsuits, and Regulatory Shadows

The doubts surrounding the team and its history did not start today. To begin with old news — according to a previous investigation by WIRED, Pump.fun's co-founder and current CTO Dylan Kerler was accused of issuing tokens like eBitcoinCash and EthereumCash under his real name or alias in 2017 (at the age of 16), and quickly selling them after inflating their prices. Security company CertiK's analysis reportedly classified this as a "highly suspicious, near Rug Pull" operation, with related profits estimated at about $75,000 (discounted to about $400,000). As of the time of writing, the parties involved in the report and Pump.fun's official representatives have not publicly responded to the details. In other words, this remains a media investigative accusation, but it objectively lays the groundwork for the current trust discussion.

Entering July this year, the legal front has clearly heated up. The collective lawsuit Aguilar v. pump.fun in the Southern District of New York introduced "RICO (Racketeer Influenced and Corrupt Organizations Act)" clauses in the amended complaint submitted on July 22, listing Solana Foundation, Solana Labs, Jito, and others as defendants. The plaintiffs claim that the relevant parties "participated and benefited" in token design, fee extraction, and infrastructure, thus constituting "joint issuance of unregistered securities." The case is currently in the stages of filing and evidence exchange, with no court ruling yet, and all conclusions remain subject to judicial procedures. However, this development has pushed the issue of "responsibility boundaries between public chains and star applications" into a more glaring position.

On December 3, 2024, the UK's FCA listed pump.fun on its warning list of "unauthorized entities," subsequently restricting access for UK users. For a meme factory that relies on "low barriers and strong diffusion" as its growth engine, this serves as both a risk warning and means that its global narrative must face the real costs of regional compliance and business contraction.

What is even more unsettling for the outside world is the reliability of internal governance. A security incident on May 16, 2024 showed that the related losses (approximately $1.9 million) did not stem from a smart contract vulnerability, but rather from former employees abusing their privileges. For a platform that prides itself on "reducing Rug risks," this incident is nothing short of ironic: it technically lowered the barriers to issuance and market-making, yet exposed weaknesses in privilege control and process constraints in management.

From media old news to escalating lawsuits, and then to the intertwined questioning of regulation and internal control, the result of these three threads acting in parallel is: technology can lower issuance costs, but cannot erase trust costs. When the team's background, legal uncertainties, and governance gaps converge, the market will naturally factor in a higher discount into the pricing model of PUMP, and any positive actions of "buyback-support" can only offset this structural discount under verifiable institutional transparency.

Conclusion: The Next Act of the Trust Crisis, Looking for Three Certainty Signals

- Buyback execution rate — Continue to track whether "packaged balance / actual transactions" remains stable, and whether funds are transferred on-chain to DEX or market-making addresses;

- Token destination — Whether the buyback proceeds of PUMP enter burn, time lockup, or multi-signature treasury, accompanied by verifiable contract calls;

- Institutional disclosure — Whether the team publishes relevant documents such as a "Buyback and Governance White Paper" covering source of funds, price range, frequency, and custody methods, and accepts third-party audits.

If all three signals improve simultaneously, Pump.fun still has the opportunity to rewrite the story of "1% fee → community reflow"; otherwise, the logic gap of "deposit ≠ order, order ≠ burn" will only continue to be amplified by the market.

The narrative in the meme world has always been short and quick: price increases rely on emotions, support relies on realization. When the buyback plan lacks transparency, the founder has a shadow of past cases, and lawsuits and regulations are tightening, any new deposit may generate questions rather than exclamations on-chain.

Dousing cold water may be harsh, but it is a rational moment that must be faced on the rapidly iterating Web3 stage. Pump.fun's next step must not only answer "where does the money go," but also "where does trust come from."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。