Latest Sharplink Gaming Ethereum Buy May Push ETH to $3K Soon—See Why?

In a bold and surprising move, SharpLink Gaming (Nasdaq: SBET) just made crypto headlines by acquiring 176,270.69 ETH worth nearly $463 million, making it the largest publicly-traded holder of this cryptocurrency in the world.

This Sharplink ethereum buy has caught the attention of the entire crypto industry. The company announced this massive acquisition through its official Twitter account and confirmed that the average buying price was $2,626 per coin.

Source: X

ETH is Now SharpLink’s Treasury Reserve Asset

Yes, you read that right — The firm is going all-in on this second largest cryptocurrency .

According to the official press release, it is now their primary treasury reserve asset. Their goal? To give shareholders real exposure to this coin’s future potential, driving interest across both sharplink $ETH investment and $ ETH institutional adoption narratives .

“Ethereum is the foundational infrastructure for the future of digital commerce,” said Rob Phythian

Source: Rob Phythian, Sharplink CEO X Account

So, now what does this mean for Ethereum’s price? Let’s break it down in simple terms — whether you’re looking for a short-term Ethereum price prediction , or long-term price forecast.

Current Price Action: A Cooldown Phase

This altcoin had a strong May, but it’s now cooling off a bit as per Coingabbar’s analysis via its TradingView chart. As of June 13:

Source: TradingView

-

It is trading around $2,558, down 3.29% today.

-

The RSI is near 50, which means it's neither overbought nor oversold.

The MACD indicator just flipped bearish, suggesting a possible short-term pullback. -

Volume is okay but not eye-popping.

So, despite the latest Ethereum buy, it hasn’t skyrocketed just yet. Why?

Because whale buys take time to reflect in the price — and most of this company’s token is being staked, not traded, aligning with the currencies yield-bearing nature and strong treasury narratives.

Short-Term Price Prediction: What’s Next for ETH?

Even with all this bullish news, technicals suggest a short-term consolidation phase:

-

Support Zone: $2,400 – $2,450

-

Resistance Zone: $2,800

If the market stabilizes, it could bounce around $2,500 and retest the higher range. But if broader selling continues, a drop to $2,400 isn’t off the table before a potential recovery — keeping an eye on its latest news is key.

Crypto analyst Crypto Fella says,

“ETH support is holding strong. Time for a bounce over here.”

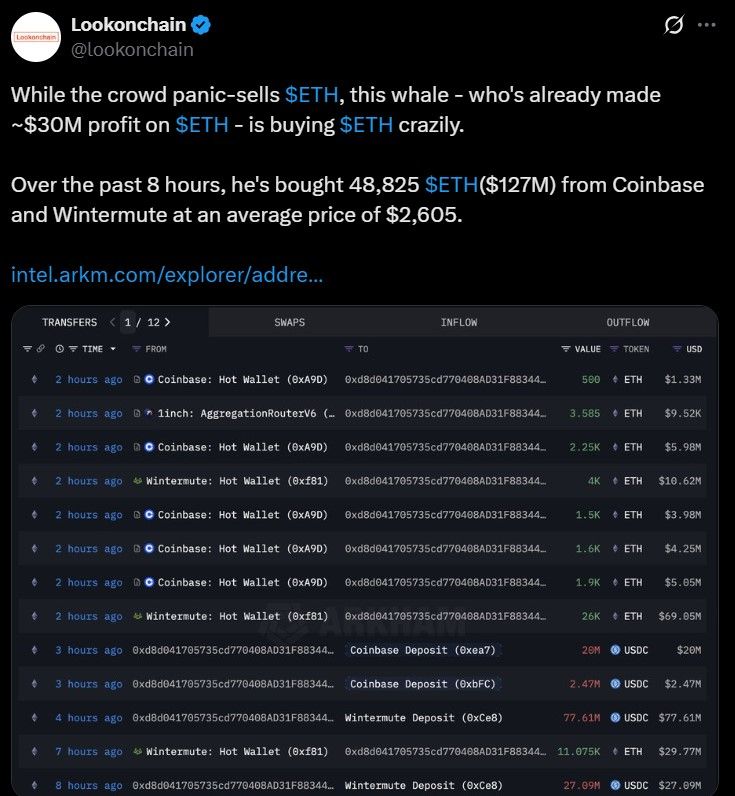

According to Lookonchain, while some investors are panic-selling the altcoin, the whales are buying like crazy. One whale reportedly bought 48,825 token ($127M) in the last 8 hours from Coinbase and Wintermute — at an average price of $2,605, nearly matching SharpLink Gaming Ethereum buy entry .

Source: Lookonchain Data

Why Institutional Moves Like This Matters?

The gaming company’s move isn’t just about making profits — it’s about changing the narrative.

-

They’re the first Nasdaq-listed company to adopt this coin as their treasury reserve.

-

Their decision gives coin's legitimacy in traditional finance, boosting Sharplink gaming news today.

-

This bold purchase may inspire other firms to explore their holdings for long-term growth.

Final Take: The Calm Before the Storm?

The token might be cooling off on the charts, but behind the scenes, big moves are happening. With big institutions getting involved, whales buying in bulk, and staking locking up massive supplies, the foundation is being laid for a potential breakout later this year.

Until then? Watch support levels closely, keep an eye on volume — they often move before the charts do.

Whether you’re tracking the Sharplink Ethereum buy, or major price signals, this news could be a major turning point for more institutional buying.

Also read: Marina Protocol Quiz Answer Today 13 June 2025: Earn Coins免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。