Watching the reshuffling of the landscape, don’t tie your own hands and feet at the starting line.

First, the conclusion: In the G10 gold corridor like USD-EUR, Airwallex's "instant + 0.01% fee" indeed scores almost full marks; however, the financial world is far more than this expressway. Stripe recklessly acquired Bridge, Visa integrated stablecoin settlements into its network, and Circle staged a spectacular IPO on the NYSE—these actions collectively outline a larger map: whoever can clear the "last mile" of money will have the opportunity to rewrite the next round of payment infrastructure.

1. The halo of "0.01% + instant" only covers 15% of the territory

Jack Zhang posted a lengthy article on X, with a core viewpoint that is very straightforward:

Price—Airwallex has reduced the USD→EUR rate to 0.01%;

Speed—Funds settle in real-time; on-chain may not be faster;

Implementation—Stablecoin inflows and outflows are expensive and regulatory hurdles exist, with no hardcore use cases seen in 15 years.

If we limit the stage to London ↔ New York ↔ Frankfurt, he is not exaggerating. The problem is—85% of global cross-border traffic does not travel on this broad highway.

In the eyes of freelancers in Argentina, banks still take 3 days to start and charge a 3% fee;

Kenyan merchants supplying Nigeria have to navigate two correspondent banking "winding roads";

Turkish importers wanting to pay a deposit on Friday night face banks closed for the weekend and can only wait.

In these corners ignored by the "mainstream," the volume of stablecoins has tripled in six months, growing wildly like weeds.

2. Three curves explaining "why it’s stablecoins"

1. Latin America Curve: Dollar scarcity spurs on-chain dollars

In 2021, stablecoins in Latin America had a scale of only $20 billion; by 2024, it surged to $68 billion, and in the first half of this year, it rose to $75 billion. High inflation, dollar scarcity, and weekend downtime have pushed funds onto the chain—not to save 0.01%, but to ensure "it arrives right now."

2. Big Tech Betting Curve: Keep customers in the network, don’t let money escape

Bridge was just acquired by Stripe for $1.1 billion, and Visa immediately laid this route into Ecuador, Peru, and Colombia. What they value has never been the FX spread, but the expansion dividends of "keeping money within their ecosystem"—once money doesn’t need to land in banks, payment companies can simultaneously transform into custodians, wealth management supermarkets, and credit entry points.

3. Wall Street Valuation Curve: Circle can print money just from interest margins

Last year, Circle made a net profit of $780 million solely from USDC position interest; its stock price more than doubled three days after the IPO. What Wall Street is paying for is the cash machine of "on-chain dollars + treasury bond interest spread," as well as the harbinger of network effects that have already been realized: the more companies that accept USDC, the less demand for withdrawals, and the less dispute over fees.

3. Beyond "cheap" and "fast," there are more tricky costs

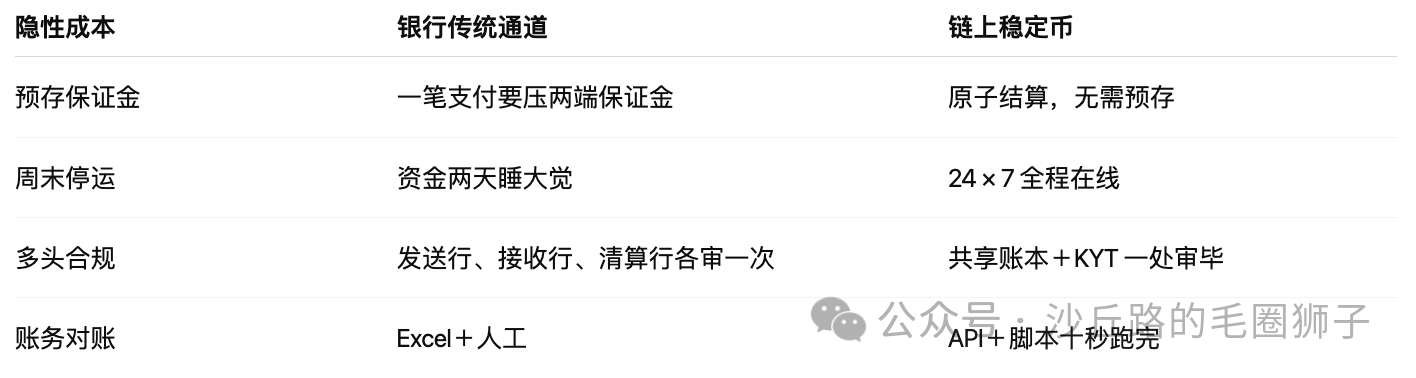

Many people focus on the fee schedule but overlook the T+2 liquidity, Nostro pre-funding, and KYC multi-layer review hidden behind the reports. These are the black holes that consume cross-border profits.

When these frictions are compressed into "code logic," the advantage of a 0.01% fee quickly becomes insufficient.**

4. Three scenarios that can outperform banks right now

USD→ARS Salaries

Bank foreign exchange controls + weekend downtime mean transfers must wait until business days. USDC wallets arrive in 5 minutes, with an actual comprehensive fee rate of ≈ 1%—employers are stable, and employees are willing to receive.KES↔NGN Small and Medium Payments

There is no direct clearing between Kenya and Nigeria; on-chain P2P operates 24 hours, with a fee rate of 1–2%.Weekend Global Liquidity Dispatch

Banks enter sleep mode after hours on Friday, causing funds to be stuck; finance departments can sweep funds to BUIDL on-chain in seconds, safely earning 4% annualized, and immediately transfer out for payroll on business days.

These may not be "sexy," but they are precisely the long tail where profits are thickest and bank services are lacking.

5. How the flywheel will accelerate before 2026

Bank-affiliated issuers: After MiCA takes effect, at least ten regional banks in continental Europe will replicate Société Générale's EUR stablecoin.

Super App Entry: Grab, MercadoPago, and others are already in gray testing for USDC wallets; once defaulted, tens of millions of users will immediately step into the on-chain world.

On-chain closed loop formation: Merchants receive, supply chains pay, employees earn, and wealth management interest is all completed within the same network, naturally driving off-ramp fees to zero.

Corporate finance migration: Deloitte predicts that by 2027, 10% of idle cash in the Fortune 500 will be parked in yield-bearing stablecoin accounts, with banks' demand deposits being drained significantly.

When that time comes, discussing the 0.01% of the G10 corridor will be like telecom giants in 2010 still cutting long-distance fees by a penny, unable to stop WhatsApp from gaining a million new users a day with free calls.

6. The last words left by Circle's IPO

Circle tells the market with a beautiful interest margin ledger and a rapidly expanding network effect: “Cheap remittances” is just the prologue; rewriting the financial infrastructure is the main act.

Airwallex has nearly perfected the G10, representing the champion's posture in a 15% world; but the remaining 85% of the market is changing tracks and scoreboards.

Next stop, money will fly everywhere like emails. By then, who will still care whether the email stamp is 1 cent or 0.1 cent?

Watching the reshuffling of the landscape, don’t tie your own hands and feet at the starting line.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。