Everything is already destined; it is fate, and it is not up to us at all.

Author: Jiangshan Johnson

Source: PR People and PRREN

Introduction: In 2016, Sequoia Capital partner Wang Cen quickly understood Wang Ning and gave him very "on-point" advice: to buy out top IP resources as much as possible. This almost formed the core structure of the current strategy of Pop Mart, and he was willing to invest 100 million for a 15% stake, which would multiply 500 times today, but still missed out because of "it"…

(I)

As of the close on June 11, Pop Mart's stock price was HKD 269.8 per share, with a total market value of HKD 362.3 billion. Founder Wang Ning holds a 48.73% stake in the company, with a net worth of 176.5 billion yuan, further widening the gap with the second place.

Let’s briefly outline the timeline of Pop Mart's development—

2010: Pop Mart was established, and its first store opened in Beijing's Euro-Asia Shopping Center, positioning itself as a channel distributor for trendy toys, sourcing from other brands and selling various fashionable products, but the business was quite mediocre and nearly unsustainable.

(Wang Ning's parents have always run a grocery store, and Wang Ning has been very familiar with the "grocery store" and "selling goods" model since childhood. In 2008, while studying at Zhengzhou University, he started his own business, including a once-popular small store called "Grid Shop." After graduating, Wang Ning was unwilling to work for others and opened Pop Mart's first store in 2010.)

In 2014, Wang Ning went to Japan for research, looking for potential single products, and discovered that the blind box sales model of the Japanese doll "Sonny Angel" was very popular among young people. He quickly found the brand owner, brought it to China, and pioneered the "trendy toys + blind boxes" sales model domestically.

In 2015, the sales of "Sonny Angel" rapidly rose in China, achieving over 30 million in sales that year, accounting for nearly one-third of the company's total annual sales.

However, at this time, Pop Mart was still operating at a loss.

But this year was also one of the two most critical years in Pop Mart's history, as after this year, Pop Mart basically clarified its core strategy, including securing investment in 2016 and acquiring key IPs, thus entering the fast lane of development.

The success of "Sonny Angel" proved that the trendy toy market had great potential. Wang Ning then conducted a survey on Weibo, asking fans which trendy toys they liked to collect, and found that Molly was mentioned frequently in the comments.

Thus, Wang Ning went to Hong Kong and found Molly's designer Wang Mingxin. After three rounds of communication, he became the exclusive authorized distributor and manufacturer of Molly in mainland China, launching the first Molly Zodiac series in July, which quickly sold out.

From then on, backed by the sales myth of Molly, Pop Mart entered the fast lane of development. From 2017 to 2019, the revenue generated from self-developed products based on the Molly image was 41 million, 214 million, and 456 million yuan, respectively. In 2023, MOLLY achieved revenue of 1.02 billion yuan, a year-on-year increase of 27.2%. In 2024, MOLLY's sales reached 2.5 billion yuan. Adding these figures together, from 2017 to 2024, Molly contributed approximately 4.231 billion yuan in sales to Pop Mart.

Then comes the story of today’s flourishing success.

So, 2015 and 2016 were crucial years for Pop Mart's development. What exactly happened in these two years?

(II)

Although Wang Ning had gradually clarified Pop Mart's direction in 2015, the company still incurred a loss of nearly 25 million that year (and in 2014, it lost 14.98 million, and in 2013, it lost 2.77 million).

After three consecutive years of losses, Pop Mart was undoubtedly in dire need of funds, and Wang Ning was at his most anxious.

Fortunately, he had basically figured out the direction—representing quality trendy toy IPs and signing exclusive high-quality IPs under certain conditions. The growth seen from representing Japan's "Sonny Angel" in 2015 had already confirmed the development strategy that "a hit product is the core competitiveness."

However, securing Molly was undoubtedly about "finding money," which was the most important task for Wang Ning in 2016.

In 2015, Wang Ning met Zhou Lixia, chairman of Jinhui Feng Investment.

(Source: China Daily Chinese Network)

In August 2015, Zhou Lixia invested several million in Wang Ning (the exact amount was not disclosed, but several million is my personal estimate. Zhou's venture capital firm is still a small institution with limited funds, and in 2016, when Wang Ning bought out Molly, he still needed to seek financing. After four failed financing attempts, Zhou Lixia gathered 5 million from her investment company's employees to support Wang Ning, which indicates that the first investment of several million was likely accurate).

With insufficient funds, finding money became Wang Ning's most important task in 2016.

Zhou can be considered Wang Ning's benefactor, as she used her connections to help Wang Ning raise funds. Public records show at least four experiences—

Zhou Lixia took Wang Ning to a roadshow at Zhenghe Island. After hearing the presentation, no investors or entrepreneurs understood the business model, and no one was willing to invest.

Zhou Lixia took Wang Ning to Qingdao to participate in a golf tournament sponsored by Jinhui Feng, which involved many investors. Wang Ning continued his roadshow at the event, but still no one invested.

She took Wang Ning to give a speech at a large state-owned enterprise. Although he received recognition from the general manager of the investment department, it ultimately failed to pass the approval of the group headquarters, resulting in a failed financing attempt.

Zhou Lixia took Wang Ning to participate in a program called "Maker China," where several investors evaluated entrepreneurial projects and might invest. This was Wang Ning's closest opportunity to secure significant funding in 2016.

(III)

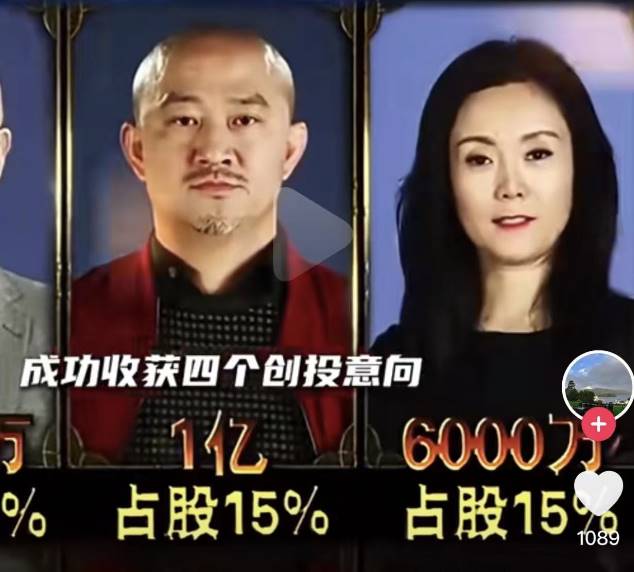

Yes, in the venture capital circle, Wang Cen, a partner at Sequoia Capital known for understanding retail, had a collision with Wang Ning. Looking back at the video from that time today, it is clear that Wang Cen indeed understands retail, accurately pinpointing key points, and his comments to Wang Ning were incisive. He was the investor willing to give Wang Ning the highest valuation and the most money among all present investors.

Let’s review together:

Because of the contact with Wang Ning, Pop Mart can only be perceived as a seller, with a low entry barrier, so the judges asked a pointed question: What is your core competitiveness?

Wang Ning's response—after more than five years of accumulation, the products and services they operate have completed many SOPs, thus receiving dual recognition from many high-end malls and luxury brands, allowing them to open stores next to LV stores in these high-end malls.

This is indeed a very rare core competitiveness.

At the same time, it also helps us understand why top stars like Rihanna and Lisa would attach Labubu to their Hermès bags, because ten years ago, Wang Ning intended to open Pop Mart next to luxury brand stores, meaning "Pop Mart" is the best endorsement for trendy brands, and trendy toy dolls have become natural companions for luxury bags. Buying a bag and then a Pop Mart doll not only showcases the owner's wealth but also maintains individuality and taste.

Returning to the conversation at that time, Wang Ning continued to say that his second core competitiveness was signing creators similar to Kenny, who holds a status in the two-dimensional IP creation world akin to Jay Chou in music, specifically the creator of the Molly IP that truly brought Pop Mart into the spotlight—Wang Xinming.

(Some hand-drawn sketches of Molly created by Kenny)

Wang Cen is indeed knowledgeable about retail and quickly picked up on this—

After receiving Wang Ning's affirmative reply,

he immediately understood Wang Ning.

Then, Wang Cen provided the highest valuation and the largest investment intention from all investors present for Pop Mart—investing 100 million for a 15% stake.

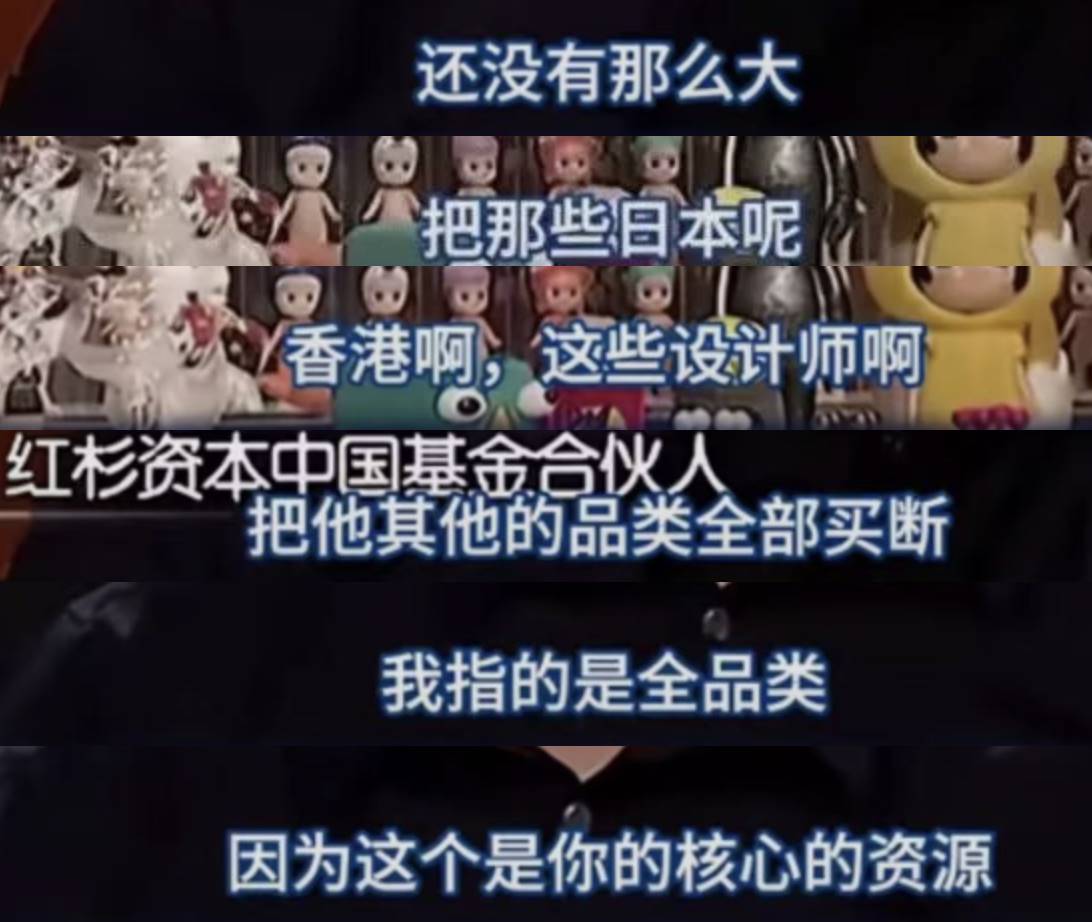

Furthermore, when Wang Ning asked him how he hoped Pop Mart would spend the 100 million if he invested, Wang Cen continued to give very pertinent advice—continue to accumulate top IP resources and buy them out completely.

This is actually the core strategy of Pop Mart today. They have now signed over 200 top designer artists globally. The combination of IP incubation + trendy toy operation + Pop Mart's quality channels ensures that the hottest trendy toy IPs are maintained. In previous years, it was Molly, and this year it is Labubu (see: Why has Pop Mart's Labubu become popular worldwide?)

(IV)

Today, everyone knows the answer,

Yes,

Although Wang Cen understood very well—he even expressed a willingness to invest 100 million for a 15% stake,

This money would be worth 49.6 billion today,

Multiplying nearly 500 times,

It could have been an investment that would allow Wang Cen to retire and achieve legendary status in one go,

But, but, but—

Wang Cen did not invest.

In a recent interview video, he candidly admitted,

He still only understood half of it,

And did not spend much time learning.

(Source: Screenshot from Phoenix Technology video)

I believe he still hasn't fully revealed his true thoughts—

The entire dialogue between Wang Cen and Wang Ning in 2016 clearly shows:

Wang Cen understood Pop Mart very well (two core competitive advantages, instantly grasped)

The advice given to Wang Ning was very incisive and essentially became the core strategy of Pop Mart today.

The real reason is that he did not anticipate that the trendy toy business could grow this large and develop this quickly! If he were to invest 100 million on behalf of the investors, he would have to bear the risks and responsibilities, or say, the opportunity cost compared to other investment projects.

And Wang Ning of Pop Mart also did not foresee that the trendy toy business could grow this large and develop this quickly! But for him, building Pop Mart to one billion, ten billion, or even a trillion, that is his "everything," and he would continue to push forward, thus maximizing his share of the "trendy toy industry's" huge dividends.

But Wang Cen is not, so he missed out.

2017: Pop Mart's revenue was 158 million, with a net profit of 1.56 million.

2018: Revenue was 514 million, with a net profit of 99.52 million.

2019: Revenue was 1.683 billion, with a net profit of 451 million.

Then it just kept getting better, and the money kept rolling in…

It is said that after 2017, Wang Cen stopped looking for investors. After 2017, as Pop Mart became more profitable, more investors sought Wang Ning, including many top investment institutions and major investors, but Wang Ning politely declined them all.

Wang Cen may often sigh in regret late at night…

But everything is already destined,

It is fate,

And it is not up to us at all.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。