US China Trade Talks Sparked a Surge in Crypto Market and Stocks

The US China Trade Talks in London have reached a key agreement after two days of meetings. The deal, which focuses on easing tensions and allowing rare earth exports, is now waiting for final approval from Presidents Trump and Xi Jinping, as per a Reuters report .

US Commerce Secretary Howard Lutnick said both sides have agreed in principle to move forward. China's Vice Commerce Minister Li Chenggang confirmed that the deal is based on recent leader talks and their earlier Geneva meeting.

A big part of this agreement is about rare earth minerals—important materials used in tech products like smartphones and electric cars. The US had blamed the country for slowing exports, while China accused the US of limiting access to semiconductors and AI tools.

Earlier in May, both countries agreed to reduce tariffs:

-

US brought tariffs down to 30%

-

China cut tariffs to 10%

They also gave themselves 90 days to come up with a more permanent solution.

Even though some issues remain—like the US blocking chip software and student visas, and China delaying rare earth shipments—this new deal shows progress. China has already started giving out export licenses, and Trump confirmed that rare earth trade will resume.

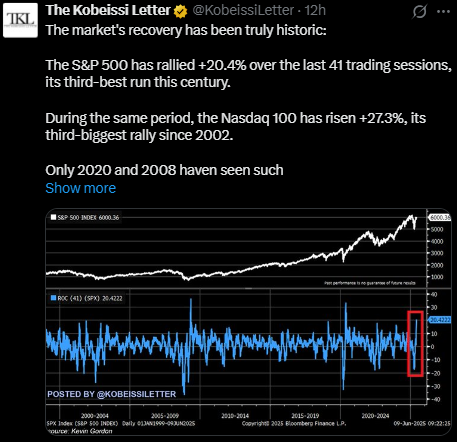

Market Shows Historic Recovery: S&P 500 and Nasdaq Rally

The deal has brought strong positive reactions in global markets. According to The Kobeissi Letter , the S&P 500 today is up +20.4% over the last 41 trading sessions. This is the third biggest rally in over 20 years. The Nasdaq 100 rose +27.3% in the same period, which is also one of its best runs since 2002.

Source: X

On June 9, the S&P 500 Index closed at 6000.36. A technical chart shows the 41-day Rate of Change (ROC) at +20.42, which is very rare. This shows strong bullish energy in the market. Only in 2008 and 2020 has the market seen similar recoveries in such a short time.

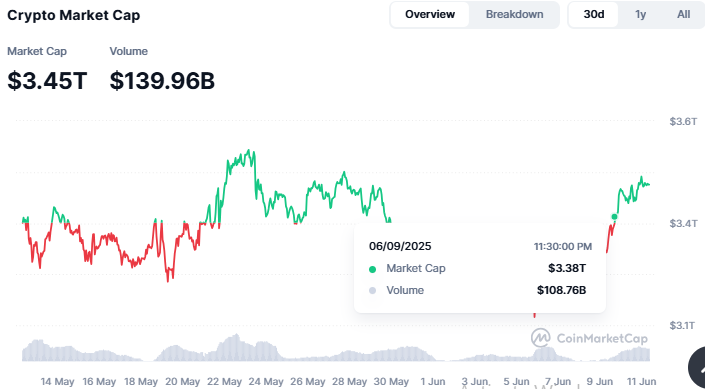

Trade Deal Boosts Crypto Investor Confidence

It wasn’t just stock markets that responded well. The crypto market news also showed a positive reaction. The global crypto market capitalization went up to $3.45 trillion, an increase of 1.23%. The market skyrocketed as US China trade talks have commenced, from $3.36T up to an all-time high of $3.47T, before declining slightly.

Source: CoinMarketCap

Bitcoin price today remains within a bullish region at $109,469.69 and is up 0.16%. Its market capitalization is at $2.17T. Ethereum also went up by 4% and stands at $2,777.97. XRP price today indicates that it went up by 1.50% to $2.31. Solana had the highest increase — a 5% increase — and now stands at $166.26.

These are steps that indicate growing confidence from investors, particularly after the relaxation of trade tensions between China and the US.

What's Next for the Deal and the Market?

Even though the US China news concerning the deal seems to be positive, there remain some pending legal proceedings. A Federal Appeals Court has allowed President Trump’s tariffs to remain for now, but the court will soon decide if they are legally valid.

In another development, the US and Mexico are working on a steel trade deal. This will cut 50% of tariffs on steel imports up to a set volume. This deal is being led by Commerce Secretary Lutnick and could be similar to one from Trump’s first term.

Source: X

Looking forward, all eyes are on the upcoming FOMC meeting. What happens there could shape the next move in both traditional and crypto markets.

Conclusion

The US China trade talks latest update from London has brought some relief for both long-term investors and users of crypto. With breakthroughs in rare earth, increasing optimism within the markets, and potential easing of global tensions, the week was pivotal. But with future court rulings and central bank meetings, the ultimate direction of the market only time will tell.

Also read: XRP News: Guggenheim and Ondo Deal, ETF Hopes, SEC Case Update免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。