The Impact of the Dispute Between Trump and Musk on Risk Markets Including Cryptocurrency

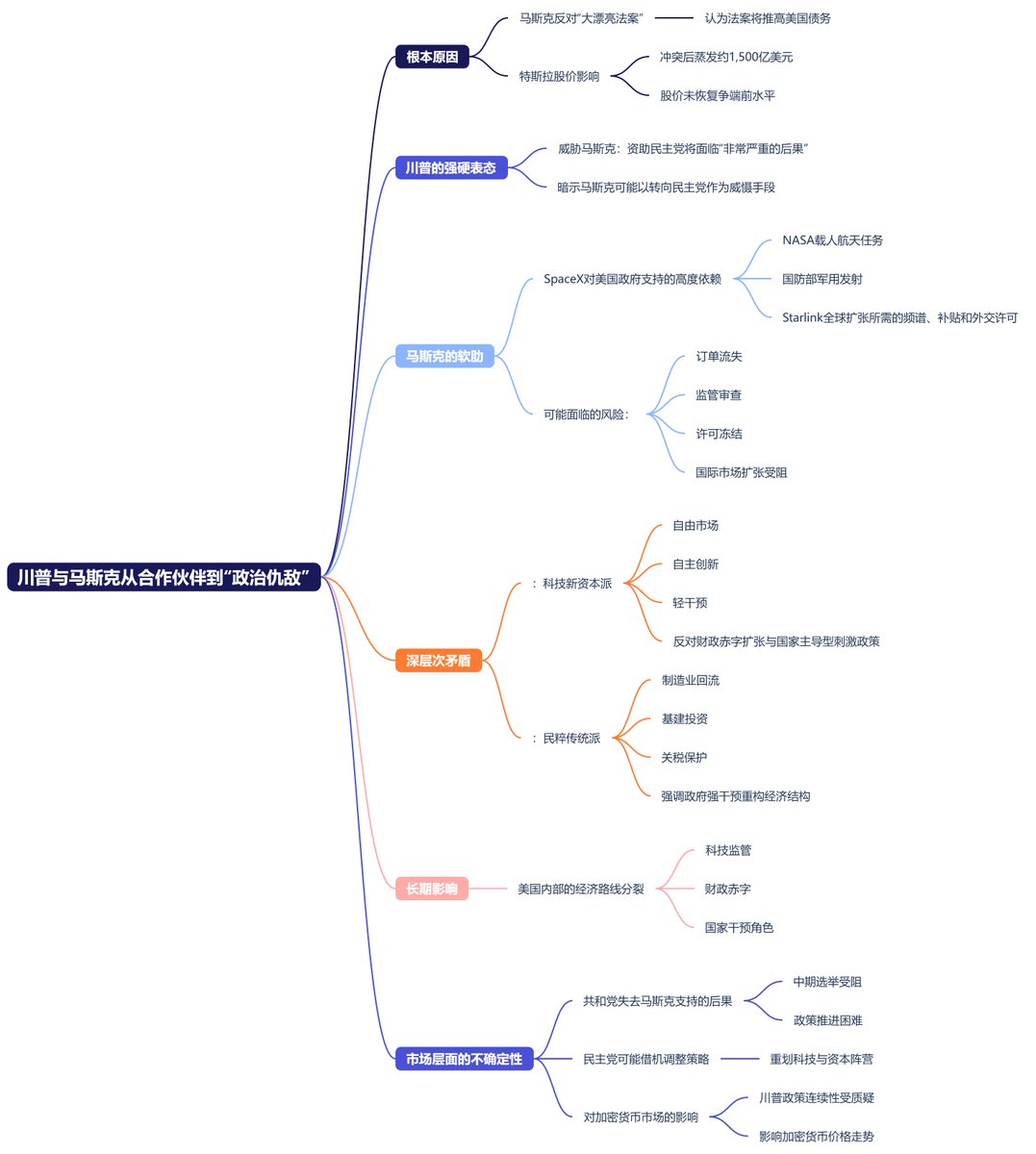

In this conflict, Trump issued a stern warning that if Musk funds the Democrats, he will face "very serious consequences." This statement sends a key signal that Musk likely hinted at a shift towards the Democrats as a deterrent in undisclosed communications.

If the situation escalates, Musk's funding and influence will become a critical variable in the 2026 midterm elections, directly affecting the Republican campaign and policy advancement, which is an unacceptable bottom line for Trump.

Although Musk's side claims that SpaceX can operate without support from the U.S. government, in reality, SpaceX's core contracts heavily rely on U.S. government support, including NASA's manned space missions, military launches from the Department of Defense, and the spectrum, subsidies, and diplomatic permissions needed for Starlink's global expansion.

If Musk breaks with the Republicans and fails to gain support from the Democrats, SpaceX may face not only a loss of contracts but also a series of systemic risks, including regulatory scrutiny, license freezes, restricted funding channels, and obstacles to international market expansion. This is Musk's biggest vulnerability, not to mention the pressure from Tesla's shareholders.

From a deeper perspective, this is not just a conflict between two opinion leaders but a fierce clash between old and new economic routes in the U.S. Musk represents the new capital of technology, advocating for free markets, independent innovation, and minimal intervention, while opposing fiscal deficit expansion and state-led stimulus policies.

In contrast, Trump represents the populist traditional faction, emphasizing the return of manufacturing, infrastructure investment, and tariff protection, advocating for strong government intervention to restructure the economy. If this divergence in routes continues to ferment, it may lead to a long-term internal division in the U.S. on issues such as technology regulation, fiscal deficits, and the role of national intervention.

On a broader market level, this rift also releases significant uncertainty. If the Republicans lose Musk's support, they may face obstacles in the midterm elections and policy advancement, while the Democrats may seize the opportunity to adjust their strategy and redefine the camps of technology and capital.

This uncertainty affects not only the technology industry but also the cryptocurrency market. The recent rise in cryptocurrency prices has been primarily driven by Trump's direct involvement and Republican support, including appointments in the SEC leadership. If the rift between Musk and the Republicans leads to questions about policy continuity, the market may worry about whether Trump's policies can be smoothly implemented after 2026, or even if the Democrats lose power in the House, which could further impact cryptocurrency price trends.

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。