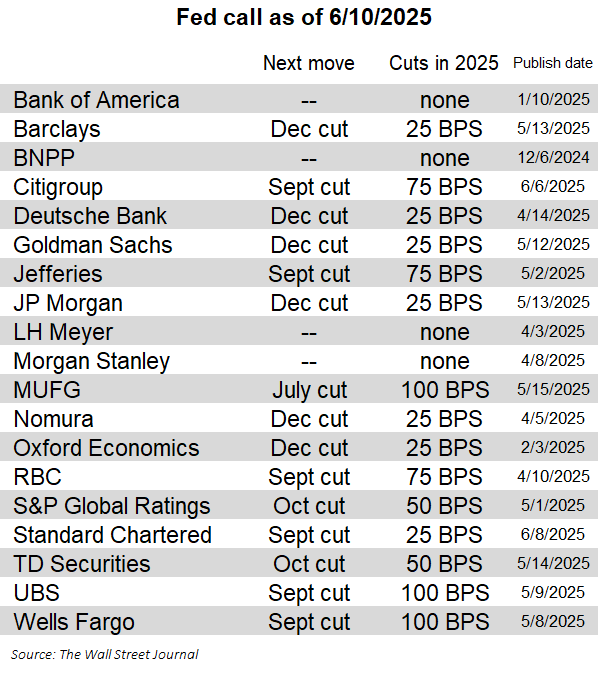

🔔I took a look at Wall Street's latest predictions on interest rate cuts, and it's getting more and more interesting—

1⃣ No Rate Cut Faction: Morgan Stanley, Bank of America → Insist "There will be no rate cuts this year"

These institutions are deeply tied to the traditional credit system; they do not want interest rates to drop too quickly because the debt spread structure and demand for short-term bonds are their fundamental sources of income.

With stable interest rates, they can continue to engage in carry trades and regulatory arbitrage.

2⃣ Moderate Dovish Faction: Goldman Sachs, Deutsche Bank, Nomura → Predict "One rate cut in December"

This faction seems to be making a strategic compromise, betting on a soft landing + policy balance point:

On one hand, they cannot completely deny the downward trend of inflation and must not ignore the political pressure for rate cuts; on the other hand, they cannot bet too quickly on liquidity easing, fearing premature decoupling or backlash from the data.

3⃣ Aggressive Rate Cut Faction: UBS, Wells Fargo → Predict "Four rate cuts starting in September"

Their core logic is not a soft landing, but rather a bet—if there are no cuts, it will explode.

This faction believes:

A massive explosion in U.S. Treasury supply + a continuously expanding deficit

Geopolitical friction and concentrated refinancing pressure on corporate debt

The Federal Reserve's "tough talk without action" is just a temporary way to avoid risks; the storm will eventually break.

Clearly, due to the Federal Reserve's slow actions and passive responses, interest rate divergences are starting to spiral out of control, and the market is entering a phase of "each betting on their own, proving their own path."

Now, with the constant pressure from the former president, the Federal Reserve's passive rate cuts are just a matter of time.

At this point, I suggest everyone reassess their positions and consider whether their current allocation logic is still stable.

Always remember a fundamental logic—

When the system's anchor begins to shake, the market will instinctively seek new pricing benchmarks and value storage consensus.

A true major market movement will not occur when everyone predicts correctly, but rather at the moment when all predictions begin to collectively fail.

And $BTC is one of the biggest natural beneficiaries in this "uncertainty structure"!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。