They sold all their possessions to bet on Bitcoin in 2017 and have since become a "digital nomad" family of five traveling around the world.

Source: CNBC

Translation and Compilation: BitpushNews

The Bitcoin Family poses for a photo during a ski trip in the Sierra Nevada mountains in southern Spain. They sold all their possessions to bet on Bitcoin in 2017 and have since become a "digital nomad" family of five traveling around the world.

After several kidnapping cases targeting crypto celebrities, the entire community is on edge. Many well-known figures have quietly upgraded their security systems, including the "crazy family" (Bitcoin Family) who converted all their wealth into Bitcoin.

Didi Taihuttu, the head of the Bitcoin Family, stated that his family has completely revamped their security plan.

This family sold their house, car, and all their possessions back in 2017, going all in on Bitcoin, which was then about $900 per coin, and embarked on an extreme journey of crypto faith. They travel full-time with their three daughters, completely abandoning the traditional banking system.

In the past eight months, Taihuttu mentioned that they have also given up hardware wallets, opting instead for a hybrid system: part analog, part digital, encrypting and splitting their seed phrases, storing them through blockchain encryption services, or hiding them in physical locations across four continents.

"We've changed everything," Taihuttu told CNBC in a phone interview from Phuket, Thailand. "Even if someone points a gun at me, I can only give them the little assets in my mobile wallet, which isn't much."

CNBC first reported on this family's unique storage system in 2022, when Taihuttu described how they hid hardware wallets across multiple continents, from rented homes in Europe to self-storage units in South America.

During Halloween, the Taihuttu family dressed up for a photo in Phuket, Thailand. They recently moved after their address was exposed in a YouTube video.

As kidnappings targeting crypto holders become more frequent, even this family has begun to reassess their online exposure.

This week, Moroccan police arrested a 24-year-old man suspected of orchestrating multiple violent kidnappings of crypto executives. One victim was the father of a crypto billionaire, who was reportedly held in a house south of Paris for several days and even had a finger cut off.

In another case, the co-founder of French wallet company Ledger and his wife were kidnapped at home, with the gang also targeting another Ledger executive.

Last month in New York, authorities reported that a 28-year-old Italian tourist was kidnapped in a Manhattan apartment and tortured for 17 days, with the kidnappers using electric wires and gun beatings to obtain his Bitcoin password, even tying an Apple AirTag around his neck for tracking.

The common thread in these incidents is the pursuit of keys that can immediately transfer virtual assets.

"It's really unsettling to see so many kidnapping cases," said JP Richardson, CEO of crypto wallet company Exodus. He urged users to strengthen their security measures, adopt self-custody, and store large assets in hardware wallets; for users holding significant crypto assets, he recommended using multi-signature wallets, which are typically used by institutions.

Richardson also suggested diversifying funds across different types of wallets, avoiding storing large assets in hot wallets to reduce risk without sacrificing flexibility.

This growing sense of insecurity has also driven demand for physical protection, with insurance companies accelerating the rollout of "kidnap and ransom insurance" (K&R) for cryptocurrency holders.

But Taihuttu can't wait for corporate solutions to mature. He chose to go fully decentralized—not just financially, but also in personal risk management.

The family is preparing to return to Europe from Thailand, and "safety" has become a frequent topic at the dinner table.

"We've been talking a lot about these issues as a family lately," Taihuttu said. "The kids are also watching the news—especially about that case in France, where the CEO's daughter was almost kidnapped on the street."

Now, his daughters are starting to ask some tough questions: "What if someone tries to kidnap us? What is our plan?"

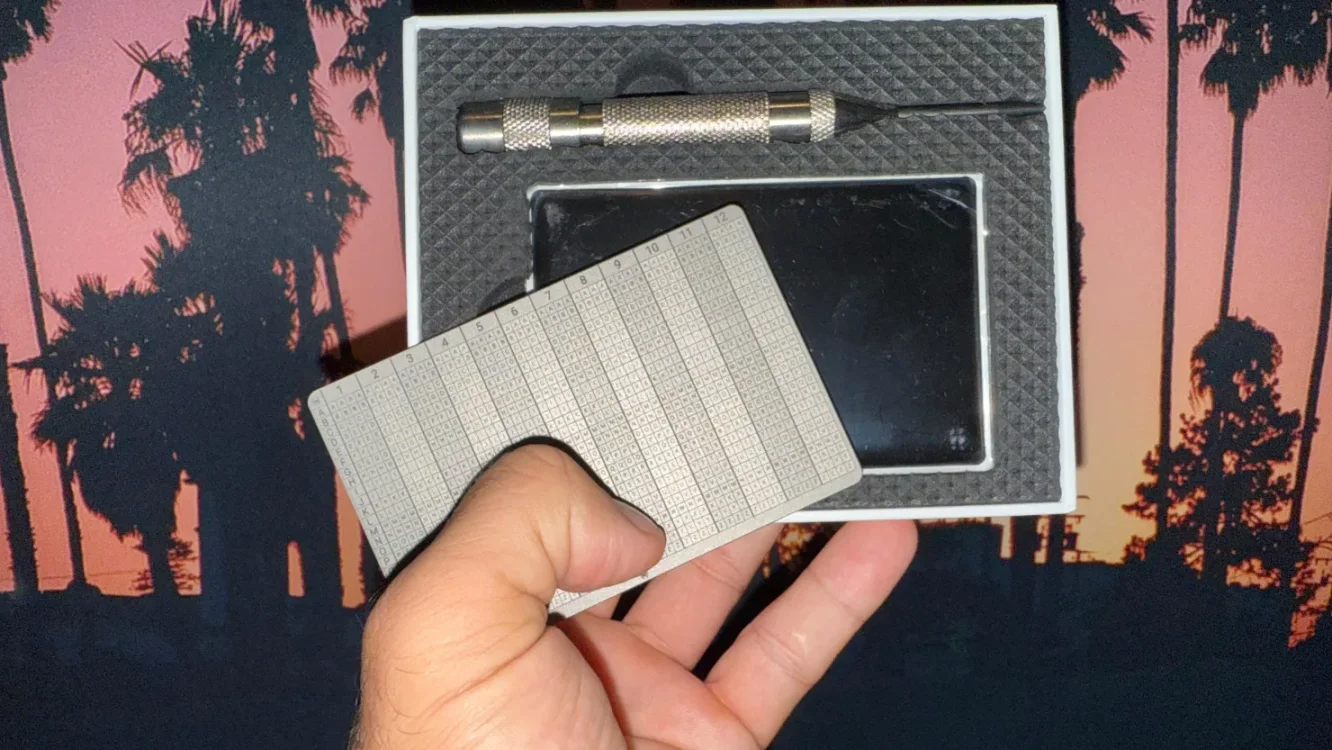

Taihuttu hand-stamps part of the seed phrase onto steel plates using a hammer and letter punches. These plates are hidden across four continents as part of a decentralized storage system.

Although his daughters only hold a small amount of crypto in their wallets, the family has decided to leave France entirely.

"We were only a bit famous in a niche market—but that niche is getting bigger," Taihuttu said. "I think we will see more and more robberies like this. So yes, we definitely won't be going to France anymore."

Even in Thailand, Taihuttu has recently stopped posting travel updates and family photos. He received some harassing messages from strangers claiming they found his home address through his YouTube videos.

"We were living in a very nice house for six months—then I started receiving emails saying they recognized the house. They warned me to be careful and not let the kids outside alone," he said. "So we moved, and now we don't make videos at all."

"The world is strange now," he said, "so we can only take precautions ourselves—and in terms of wallets, we are no longer using hardware wallets at all."

To prevent being robbed, Taihuttu encrypts some words from each group of 24 seed phrase words, then divides them into four groups of six words each, hidden around the world.

The family's new security measure involves splitting a 24-word Bitcoin seed phrase into four groups, each containing six words, stored in different geographical locations. Some are digitally preserved through blockchain encryption platforms, while others are manually engraved on fireproof steel plates and hidden across four continents.

"Even if someone finds 18 of the words, they can't do anything," Taihuttu explained.

He also added a layer of personal encryption: replacing specific seed phrase words to confuse attackers. This method is simple yet effective.

"You just need to remember which words you changed," he said.

One reason they abandoned hardware wallets is their growing distrust of third-party devices. Concerns about backdoors and remote access features were raised, including a controversial update from Ledger in 2023, leading them to completely abandon hardware wallets in favor of paper and steel encrypted backups.

While they still keep a small amount of cryptocurrency in a "hot wallet" for daily expenses and algorithmic trading strategies, this portion of assets is protected by multi-signature approval, requiring multiple signatures to execute transactions.

They use Safe (formerly Gnosis Safe) to manage Ethereum and other altcoins; Bitcoin is secured on centralized platforms like Bybit with similar multi-security measures.

Taihuttu in the Sierra Nevada mountains in Spain. This family's lifestyle—no bank accounts, nomadic living, heavily invested in Bitcoin—is considered unconventional even within the crypto community.

Taihuttu stores about 65% of the family's crypto assets in cold wallets across four continents—this decentralized system is a better choice compared to the centralized vaults used by Xapo under Coinbase in the Swiss Alps. Although the latter offers physical protection and inheritance services, Taihuttu stated that these still require "trusting others."

"What if those companies go bankrupt? Can I still access my assets?" he said. "You are handing your capital back to someone else."

Therefore, Taihuttu chooses to control the keys himself—hidden around the world. He can remotely replenish wallet balances, but withdrawing those funds requires at least one international trip, depending on the location of the needed seed phrase segments. These assets are viewed as a long-term pension, with plans to access them only when Bitcoin reaches $1 million—he expects this to happen by 2033.

Didi, Romaine, and their three daughters live mostly off the grid, managing their crypto assets using decentralized trading platforms, algorithmic trading bots, and a globally distributed cold wallet system.

This shift towards multi-party security is reflected not only in multi-signature wallets but also extends to MPC (multi-party computation) technology, which is gradually gaining popularity as a more advanced security model.

MPC does not store private keys in a single location but encrypts them and divides them into multiple "shared segments," distributed among multiple parties. Transactions can only be executed when a set threshold of signatures is reached, significantly reducing the risk of theft or unauthorized access.

Traditional multi-signature wallets require multiple entities to approve transactions, while MPC takes it a step further by cryptographically splitting the private key itself, ensuring that no single person can hold the complete private key—even their own segment cannot independently complete a signature.

This trend coincides with renewed scrutiny of centralized crypto platforms like Coinbase—Coinbase recently disclosed a data breach affecting tens of thousands of users.

Taihuttu stated that nowadays, 80% of his transactions are completed on decentralized exchanges like Apex. Apex is a peer-to-peer platform that allows users to set buy and sell orders while retaining custody of their funds, dedicated to the original decentralized spirit of cryptocurrency.

Although he did not disclose his total holdings, Taihuttu shared his goal for this bull market: to achieve a net worth of $100 million, with 60% still held in Bitcoin. The remaining assets are distributed among Ethereum, Solana, LINK, Sui, and an increasing number of startups focused on AI and education—one of which is a platform he founded that offers blockchain and life skills courses for children.

Recently, he has also begun to consider whether to step back from the public eye.

"Content creation is truly my passion. I enjoy it every day," he said, "but if it no longer feels safe for my daughters… I really need to reconsider."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。