This is a turning point in the Bitcoin evangelism movement—Saylor is no longer talking about strategies, regulations, or audit hedges, but rather about "how ordinary people can achieve intergenerational leaps through Bitcoin."

Written by: Daii

This is not just a speech, but a wealth manifesto that has already been embedded in the real world.

Saylor presents a set of action systems that integrate mindset, structure, execution, and culture, aiming directly at "how ordinary people can break through new capitalism with Bitcoin," which deserves a re-examination from the perspective of data and facts.

1. Background of the Speech: Data Witnesses the Grounding of Evangelism

- 🗓 Date: May 29, 2025 (Pacific Time)

- 📍 Location: Venetian Expo, Las Vegas, Bitcoin 2025 Conference

- 🎟 Attendance: Over 35,000 industry professionals and Bitcoin enthusiasts

🧾 Market Trends Connect Conference Signals

- Bitcoin has risen over 50% since the end of 2024, currently (June 11, 2025) priced around $109,000.

- It briefly surpassed the historical high of $111,970 (May 22, 2025).

- Momentum has increased at the institutional and policy levels—In March, the U.S. President signed the "National Policy Bitcoin Reserve" ETF, promoting long-term holding; Bitcoin-related ETF inflows have reached billions of dollars.

This speech occurs at a juncture where Bitcoin intersects with "mainstream finance – politics – the public," accompanied by high participation, price breakthroughs, and policy support.

📌 The Significance of This Speech

The speech titled "21 Ways to Wealth" differs from all of Saylor's previous public statements in a significant way:

"This is my first time speaking not for a country, not for a board, and not for institutional investors, but for you—8 billion people on Earth."

This is a turning point in the Bitcoin evangelism movement—Saylor is no longer talking about strategies, regulations, or audit hedges, but rather about "how ordinary people can achieve intergenerational leaps through Bitcoin."

What he wants to convey is:

- How an individual can become a "capitalist" in this era

- How a family can transform a grandfather's pension into a grandson's digital wealth

- How an ordinary person can complete a capital leap from the bottom using AI + Bitcoin + corporate structures

2. Cognition: Bitcoin is Not an Asset, but a Tool for Civilizational Upgrade (Paths 1~4)

1. Clarity: Recognize Bitcoin as "Perfect Capital"

Bitcoin = Programmable + Incorruptible + Unfreezable + Freely Portable Capital. He emphasizes: this is not a currency, but a "perfect form of capital forged by algorithms," which ultimately all smart people, AI, and even enemies will want to possess.

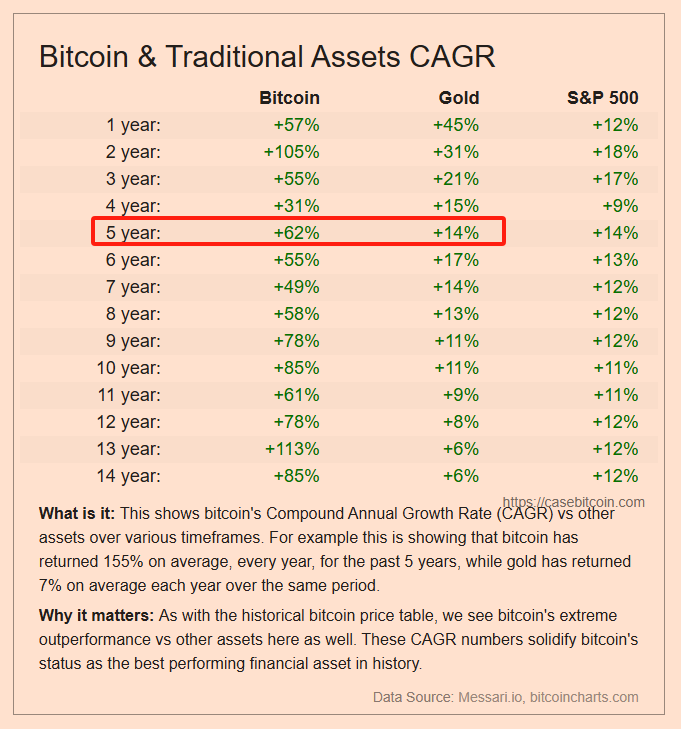

2. Conviction: Bitcoin Rises Faster than Any Asset

Data shows that Bitcoin's annual compound growth rate over the past 5 years has reached 62%, far exceeding gold's approximate 14% growth. This is an "asset structure that proves itself with numbers."

3. Courage: Wealth Favors Those Who Dare to Take "Intelligent Risks"

Satoshi ignited the fire of the network, and what you need to do is "add fuel"—exchange fiat currency, stocks, and real estate for Bitcoin.

4. Cooperation: The Family is the Strongest Unit of Wealth

Using a grandfather's Individual Retirement Account (IRA) to buy Bitcoin for a newborn grandson is the ultimate efficiency of "intergenerational wealth reallocation."

3. Capability: From AI to Law, Build Your "Wealth Execution Engine" (Paths 5~9)

5. Capability: AI is the Strongest Family Office for Ordinary People

Saylor says: "I hire thousands of lawyers, but I first ask AI." Mastering AI = Having the ability to converse with billionaires using the same tools. After 2025, Bitcoin and AI will be the "dual engines" of wealth composition.

6. Composition: Build Your Legal Container

South Dakota's "perpetual trust," IRA leverage, insurance structures… This combination originally belonged to the wealthy, but with AI, ordinary people can also "legally weave a capital shield."

7. Citizenship: Economic Nationality: Hold Bitcoin within the Right Sovereign System

AI can tell you which state is best for holding Bitcoin and which country's tax laws are more favorable—don't just consider this year; plan for your family's century-long path.

8. Civility: Order Awareness: Not to Overthrow the World, but to Leverage Progress

Don't go against the regime, don't challenge the power center, find the "arbitrage opportunities" in every gap of the rule of law.

9. Corporation: A Company Can Go 100 Times Further than an Individual

Saylor proposes a corporate hierarchy pyramid:

Individual Family Private Company Public Company Quarterly Compliant Public Company Mature Issuer in the U.S. Capital Market

What you need to do is climb to the top of this pyramid—"File a registration statement, raise $1 billion in 6 hours."

Saylor's implicit suggestion: he doesn't want everyone to become Microsoft, but rather to transform themselves from "natural persons" to "strategic legal entities" as much as possible. Climbing the pyramid means gaining higher leverage, stronger financing capabilities, and broader capital channels. Even if you are just a dentist, photographer, or designer, as long as you build a corporate structure and operate in compliance, you can rise step by step:

- Transition from an individual to a sole proprietorship;

- Then develop into a financeable growth company;

- Gradually establish a credit record;

- Until one day, you can also raise millions of dollars in 6 hours to increase your Bitcoin or other asset holdings.

4. Structure: Make Capital Circulation and Appreciation a Habit (Paths 10~14)

10. Focus: Stop Chasing the Next "Great Idea"

Bitcoin is already the greatest idea. Don't issue coins, don't create sidechains. What you need is not innovation, but execution.

Saylor suggests concentrating resources on Bitcoin rather than dispersing innovation. Despite the controversy, his logic is based on Bitcoin's annual growth, policy trends, and the historical trajectory of network effects.

11. Equity: Share a Little Equity to Amplify Speed Tenfold

Sell a portion of your dental practice valued at five times, take the money to invest in Bitcoin, using "equity leverage" as your wealth accelerator.

12. Credit: Exchange Certainty for Others' Principal

You offer 8% fixed income, they give you principal, and you use it to match Bitcoin with an annualized return of 30%—you earn the time difference and the cognitive difference.

13. Compliance: Financial Licenses are a Form of "Legal Power"

Banks, brokerages, insurance companies, and trust companies have privileges. As long as ordinary people choose the right market + build the right company, they can also legally obtain "money printing qualifications."

14. Capitalization: Everything That Can Be Financed Should Be Financed

Not financing, not leveraging, and not building a capital structure is the greatest waste of oneself. The game rule of this era is: whoever owns the most Bitcoin wins.

5. Action: Turn Your Beliefs into a System (Paths 15~21)

15. Communication: Repeat, Write, and Speak Frequently

Let all investors, employees, and banks know what you are doing—be straightforward, repetitive, and transparent. Trust comes from expression.

16. Commitment: Focus: Don't Be Misled by Your Own Cleverness

Many people have discovered Bitcoin long ago, but later went on to issue coins, start projects, or go public—resulting in being forced by the board to sell Bitcoin. Don't be a clever traitor.

17. Execution: Precise, Continuous, and Error-Free

"You can make mistakes, but you cannot make the same mistake once"—Saylor quotes DuPont to remind us that this is a zero-tolerance game.

18. Adaptation: No Structure Will Be Eternally Effective

Banks can fail, companies can change. You need to have the ability to plan, document, and conduct regular checks. Reconstruct your life structure once a year.

19. Evolution: Smooth Evolution Based on Your Strengths, Not Mutation

A dentist should run a dental company, a photographer should build a photography brand—leveraging from familiar worlds is your safe and rapid growth path.

20. Advocacy: Your Evangelism is the Consensus of Your Future Assets

The more people you get to use Bitcoin, the stronger the network effect, and the more stable the value of your assets. Bitcoin's success is humanity's success.

21. Generosity: After Success, Spread the Spirit of Bitcoin with Love

Your employees, family, friends, clients, and community—all should feel that you are on the right path. This is the "digital civilization torchbearer."

6. Rational Perspective: Support the Majority, but Retain Controversial Points in a Data-Driven Way

✅ I agree with Saylor's constructed "multi-dimensional + executable + quantifiable" path to wealth leap, which has market and data validation from capital attributes, structural logic to execution paths.

🔍 However, I also maintain a cautious stance on the following two points:

- Focus: Although Bitcoin's growth is rapid (annual growth over 50%, 5-year compound growth reaching 62%), other innovative fields are also accepted by the market. A concentrated strategy is effective, but it should not exclude creativity and diversity.

- Commitment to Focus Strategy: Absolute denial of multi-chain and other crypto explorations overlooks the diversity of the Web3 ecosystem. The best strategy should be holding coins + creating + flexible allocation at all stages, rather than an absolute single path.

✔️ Our attitude is "results are quantifiable + strategies are verifiable + boundaries are clear." The Bitcoin model is worth accepting, but building the future requires parallel investment in rule construction and innovative potential.

7. Conclusion: Everything Begins with a Single Sentence

At the end of the speech, Saylor summarized in 12 words:

It might make sense to get some in case it catches on. (It may be wise to hold some Bitcoin now, just in case the dream really comes true.)

This message from Satoshi has now become a reality.

Bitcoin has come true. And you, have you already boarded this wealth train?

If not, and you don't know how to proceed, please take a look at "Bitcoin: The Ultimate Hedge for Long-Termists."

But remember:

Embrace Bitcoin, while also embracing construction; focus on execution, but retain space for exploration.

This strategy that balances data-driven approaches with flexible thinking is the true path that can go far.

"21 Ways to Wealth" Full Chinese Translation

Michael Saylor: 21 Ways to Wealth

Introduction: A Speech Prepared for 8 Billion People

[Music] [Music] [Applause] [Music]

I… I am very happy to see everyone here today, and the main reason I am happy is that this speech is prepared for you.

I… I have traveled around the world, I have talked about Bitcoin, I have told many countries why they need Bitcoin, I have told institutional investors why they need Bitcoin, I have told boards, companies, and CEOs why they need Bitcoin. I have even told ethereal souls why our descendants' descendants need Bitcoin.

But today’s speech is aimed at the 8 billion people on this planet. This is 21 paths to wealth prepared for every individual, every family, every small business, and every entrepreneur, not for those publicly traded companies worth billions of dollars. This is prepared for everyone.

I have focused on this for quite a long time. So, this is prepared for you.

21 Paths to Wealth

The First Path: Clarity

Clarity is the theme. When you realize that Bitcoin is capital, perfect capital, programmable capital, and incorruptible capital, that mental clarity will come. The significance is that every smart person in the world, every thoughtful individual, will want perfect capital. Every one of your enemies will want incorruptible capital. And all AI will want programmable capital. The demand for it is enormous. How much is it worth? It is worth half of everything. Half of everything.The Second Path: Conviction

It starts with an observation: Bitcoin's appreciation rate will exceed all other assets because it is designed to surpass everything in its engineering. Its growth will outpace the S&P 500 index. Its appreciation will outpace gold. Sorry, Peter. I should say it again. Its growth will outpace gold. Sorry, Peter. Its growth will outpace real estate, collectibles, or anything else you can imagine because it is designed that way.The Third Path: Courage

If you want to create wealth, if you want to get rich with Bitcoin, you will need courage. Courage means that wealth favors those who embrace intelligent monetary risks. Satoshi ignited a fire in cyberspace. When the fearful flee from it, and the foolish dance around it, the steadfast believers add fuel to the flames, dreaming of a better world bathed in the warm glow of cyberspace. What does that mean? It means that many who view Bitcoin will fear it. They will never touch it, never benefit from it, and will be left behind. Then others will just play with it, using fire to perform tricks, create fireworks, and gadgets. But those who truly understand it will add fuel to the fire. How do you add fuel to the fire? You add fuel by buying Bitcoin. Buy it. Exchange your fiat currency, your long-term capital for Bitcoin. Sell your bonds, junk equities, and poor real estate to buy Bitcoin. Add fuel to the fire. What will that result in? The network will experience extraordinary explosive growth, the power of the network will surge, and you will have bought yourself a ticket to prosperity.The Fourth Path: Cooperation

This is very important. As an individual, you are not the strongest, but with the support of your family, when your family aligns with your goals, you become much stronger. If you understand Bitcoin, you can act as an individual. But when your whole family understands Bitcoin, your power becomes much greater. Your parents have credit and capital. You have the ability, conviction, and courage. Your children have time and potential. Your 80-year-old grandfather can extract capital from his Individual Retirement Account (IRA) and borrow money from the bank. The key is to transfer capital to the children. The children have another 80 years ahead of them. When you think from this perspective, about how to transfer and transform past capital into future money, it becomes a matter of intergenerational inheritance. So think about family. In this journey, a family that collaborates together will have extraordinary power. [Applause]The Fifth Path: Capability

In this era, if you want to become wealthy, you need to master artificial intelligence. In 2025, you will have a team of accountants, a team of lawyers, a group of professors and historians, and the collective wisdom of all great entrepreneurs at your fingertips. All you need to do is consult AI, let it enter deep thinking mode, input all your situations, hopes, aspirations, and questions, and then start asking it questions and interacting with it. I tell all my executives, before you ask any expert, first ask AI, let AI think, let it squeeze the silicon-based overlord. This is very important because many of the suggestions I am about to give you were once unattainable for ordinary people. But now, you can find a 95% solution through AI, and then take that solution to your lawyers and management team and ask them to provide an execution plan within two to five days. If they can't do it, replace them. As long as you have the humility to seek help from AI, do not let your arrogance take precedence. Put your interests first. Your family will thank you in the years to come.The Sixth Path: Composition

Build legal entities that can expand your strategy and protect your assets. What I mean is, you can create efficient insurance policies, establish a dynasty trust in Florida that lasts for 300 years, or a perpetual dynasty trust in South Dakota. The usual response would be, "I don't know how to do that," but my observation today is to ask AI and figure it out. You can get a customized answer. You can work hard, or you can work smart. By working smart, you will go a hundred times further. [Applause]The Seventh Path: Citizenship

Choose your economic hub and settle in a place that respects your freedom. What does this mean for you? It depends on who you are. Ask AI: "What are the top 10 states in the U.S. for Bitcoin holders?" or have it rank countries based on your situation. Think deeply about this question; it is not just about this year, it is about this century. Where will you and your family be in the next 100 years? Your grandchildren will thank you.The Eighth Path: Civility

Respect the natural power structures in the world. If you go hunting in the wild, do not fight with lions. If you want to create wealth in the Bitcoin world, think about how the world is structured. You do not need to overthrow governments or change other people's religions. Choose your battlefield, respect social norms, and do not engage in unnecessary struggles, as that only dissipates energy. Strive to find common ground with people of different beliefs, as agitation and distraction will only slow you down. [Applause]The Ninth Path: Corporation

A well-structured company is the most powerful wealth creation engine on Earth. I suggest you consult AI to find ways to create a company. Companies have special advantages: they can access the banking system, enjoy legal exemptions, have permanence, tax efficiency, and higher credibility. Companies can sell equity and finance for the future. In the hierarchy of the world, individuals are at the bottom, families are stronger, partnerships are stronger still, then private companies, public companies, up to the "well-known and experienced issuers" at the top of the pyramid, who can sell a billion dollars in securities in six hours. I hope each of you can realize your full potential, and starting a company is the beginning of achieving that goal.The Tenth Path: Focus

Just because you can do something does not mean you should do it. My 60 years of experience tell me that changing the world on an operational level is a huge challenge, and 99% of operational ideas will ultimately fail. But if you invest in Bitcoin on your balance sheet, it has a 99% chance of success. Do not confuse ambition with achievement. Remember, companies that hold Bitcoin are seeing annual returns of 30% to 60%. You can grow without doing anything. In contrast, getting an operational business to grow 30% annually is extremely difficult. So when you formulate strategies, focus on it and do not get distracted.The Eleventh Path: Equity

Share your opportunities with investors willing to share your risks. Companies can do this, individuals cannot. For example: a dentist with an annual income of $200,000 can buy $200,000 worth of Bitcoin each year. That’s good. But a better approach is to incorporate the practice, value it at $1 million, sell a portion of equity to raise $500,000, and immediately invest in Bitcoin. After the value increases, refinance and reinvest. By collaborating with others, you will become the first billionaire dentist in the neighborhood. This is what Strategy Company and Metaplanet are doing. You can too.The Twelfth Path: Credit

There are many people in the world who want meager but stable returns. You can provide them with certainty: give them fixed coupons or dividends, along with priority in the capital structure. You convert risk into returns, and in return, you get capital. Then, you can invest this low-cost capital into Bitcoin, which compounds at a rate of 30% to 60%. The goal is to accelerate your capital a hundredfold through appropriate financing and invest it in the greatest asset in the world.The Thirteenth Path: Compliance

Create the best company you can within the rules of your market. Compliance is not just a burden; it is a way to create special, efficient enterprises. Public companies, trust companies, insurance companies, banks, etc., all have their own special rights (such as issuing securities, tax savings, and leveraging). By understanding and utilizing these rules, you can create a powerful enterprise that uses its strength to raise capital, invest in Bitcoin, and create wealth.The Fourteenth Path: Capitalization

Your goal is to ruthlessly raise and reinvest capital as much and as quickly as possible. Speed allows wealth to compound. You continuously raise capital: buy with cash flow, buy with inventory assets, sell equity to buy, borrow money to buy. This is a race against time to capitalize Bitcoin. The person who has the most Bitcoin when the game ends wins. [Applause]The Fifteenth Path: Communication

If people do not trust you, no one will give you money. You must speak honestly, act transparently, and continuously repeat using all modern digital channels. You do not need a complicated strategy, just a simple one that everyone else understands. Once they understand, they will support you and help you succeed. So, go communicate.The Sixteenth Path: Commitment

Do not let yourself get distracted. Many people discover Bitcoin and then chase other ideas. Bitcoin is the idea. Do not be distracted by trolls online or your own "good ideas." Satoshi gave you an idea worth half the wealth of the Earth. Do not fight a losing battle; choose your battlefield and avoid dilutive distractions.The Seventeenth Path: Execution

Deliver consistent, precise, and reliable execution. Be persistent and focused like a laser. The world expects you to be perfect. As I heard at DuPont: "You can make mistakes, but no more than one." Those competing with you are laser-focused, and the market will turn to those people.The Eighteenth Path: Adaptation

Over a long enough timeline, every counterparty will fail, including yourself. You need to adapt. A smart person is ready to shed their burdens several times along the road of life. So be prepared, make plans, and continuously monitor. When the road is no longer right, do not be ashamed to change. Have a succession plan to keep your affairs in order.The Nineteenth Path: Evolution

Develop on your core strengths and leverage your most powerful assets. Your goal is graceful evolution, not radical mutation. When you go into a completely random new field to do something, the risk of execution increases a hundredfold.The Twentieth Path: Advocacy

Inspire others to walk the Bitcoin path and become evangelists for economic freedom. The more individuals, companies, governments, and institutions embrace Bitcoin, the more likely you are to succeed, they are likely to succeed, Bitcoin is likely to succeed, and humanity is likely to succeed. [Applause] [Music]The Twenty-First Path: Generosity

When you succeed, and you will succeed, every morning get up, spread joy, share security, and bring hope to those less fortunate than you. You found the path first; you should spread good fortune. Pass this on to your employees, family, friends, customers, investors, and community. They will see that glow, respect, support, inspire, and follow you. This benefits you, benefits the business, benefits Bitcoin, and benefits the world.

Conclusion: The Wisdom of Satoshi

I will end with one last thought.

You know, after 16 years, after $2 trillion of proof, after who knows how many millions of pages of wisdom have been imparted to the world, I am able to give you this speech. But a person much greater than I, Satoshi, said this sentence many, many years ago without any of that information, without any of that proof, without any of that time, the 12 most important words in English:

It might make sense to get some in case it catches on. (It may be wise to hold some Bitcoin now, just in case the dream really comes true.)

Thank you all. Thank you for your support. I stand here because of all of you, and I look forward to seeing everyone again next year.

[Applause] [Music] [Music]

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。