Coinbase released several major updates on June 13. First, Shopify will enable USDC on Base through Shopify Payments and Shop Pay at checkout. Meanwhile, Coinbase has decided to integrate DEX on the Base chain into its main application. Even more surprisingly, the CFTC-regulated Coinbase announced it will launch 24/7 perpetual contracts in the U.S. market.

As the saying goes, "Slowly, then all at once," Coinbase has thrown a lot of positive news at the market in a short period. Whether this series of actions will allow Coinbase to surpass other exchanges and become the largest compliant crypto ecosystem remains to be seen.

When exchanges on the S&P 500 connect to their public chains

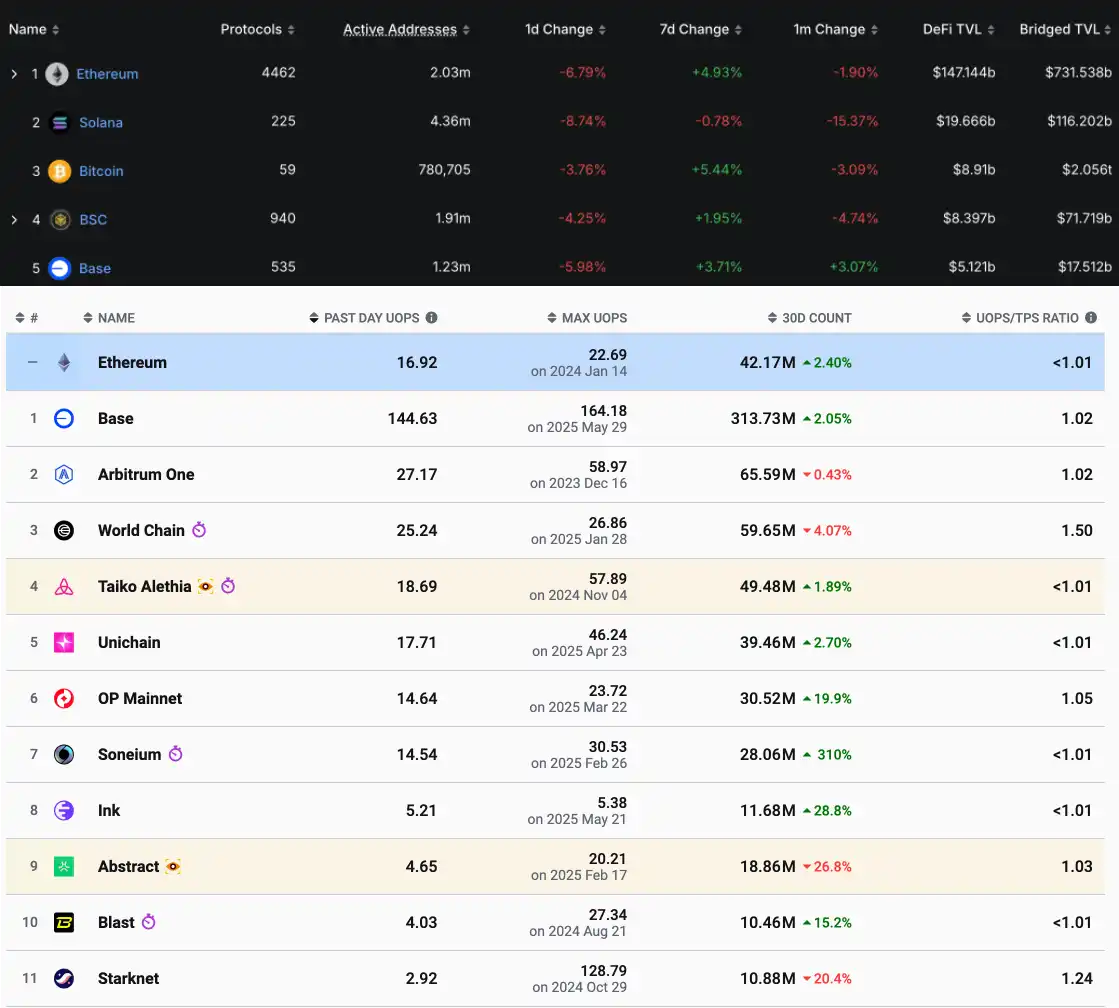

It is worth mentioning that as a Layer 2 solution, Base has achieved impressive results within two years of its launch, with 535 protocols, 1.23 million active addresses, a total DeFi TVL of $5.1 billion, and a total stablecoin volume of $4.1 billion. In addition to its UOPS (User Operations Per Second) far ahead of all Layer 2 solutions, it ranks in the top five among all public chains in terms of the number of protocols, protocol revenue, active addresses, and DeFi TVL and stablecoin volume.

Base is also experimenting with various on-chain business models, from DID to creator economy, from financial social networking to AI. For on-chain players, the frequency of high market cap "hot tokens" is relatively low compared to other DEGEN chains, but for developers and product teams, Base is a land where they can continuously receive "positive feedback," making it one of the favorite public chains for developers.

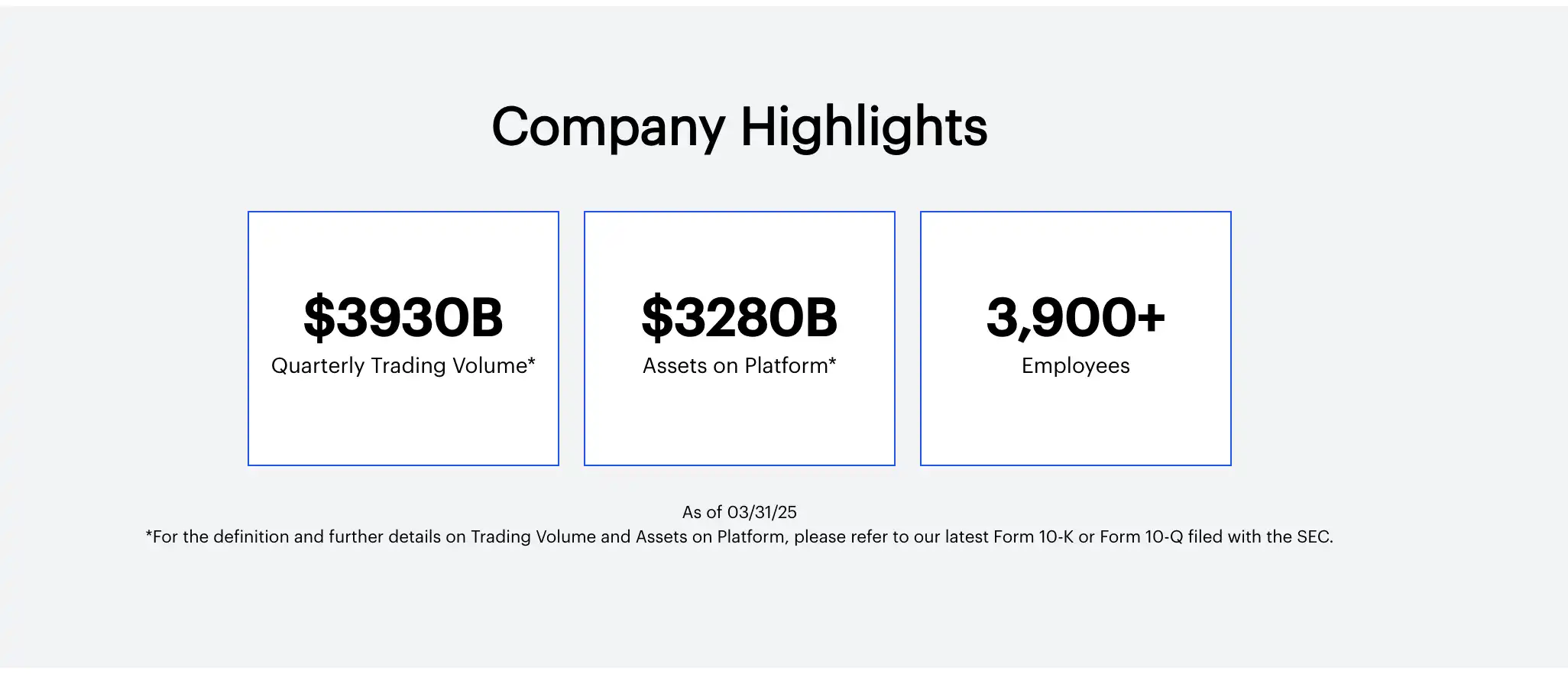

Following in the footsteps of Binance and OKX, at the 2025 Cryptocurrency Summit held yesterday, Coinbase's Vice President of Product Management, Max Branzburg, announced that Coinbase will integrate DEX on the Base chain into its main application, with future applications embedding DEX trading. Coinbase now has over 100 million registered users, with 8 million active trading users monthly. According to Coinbase's investor report, the value of customer assets on its platform is $328 billion.

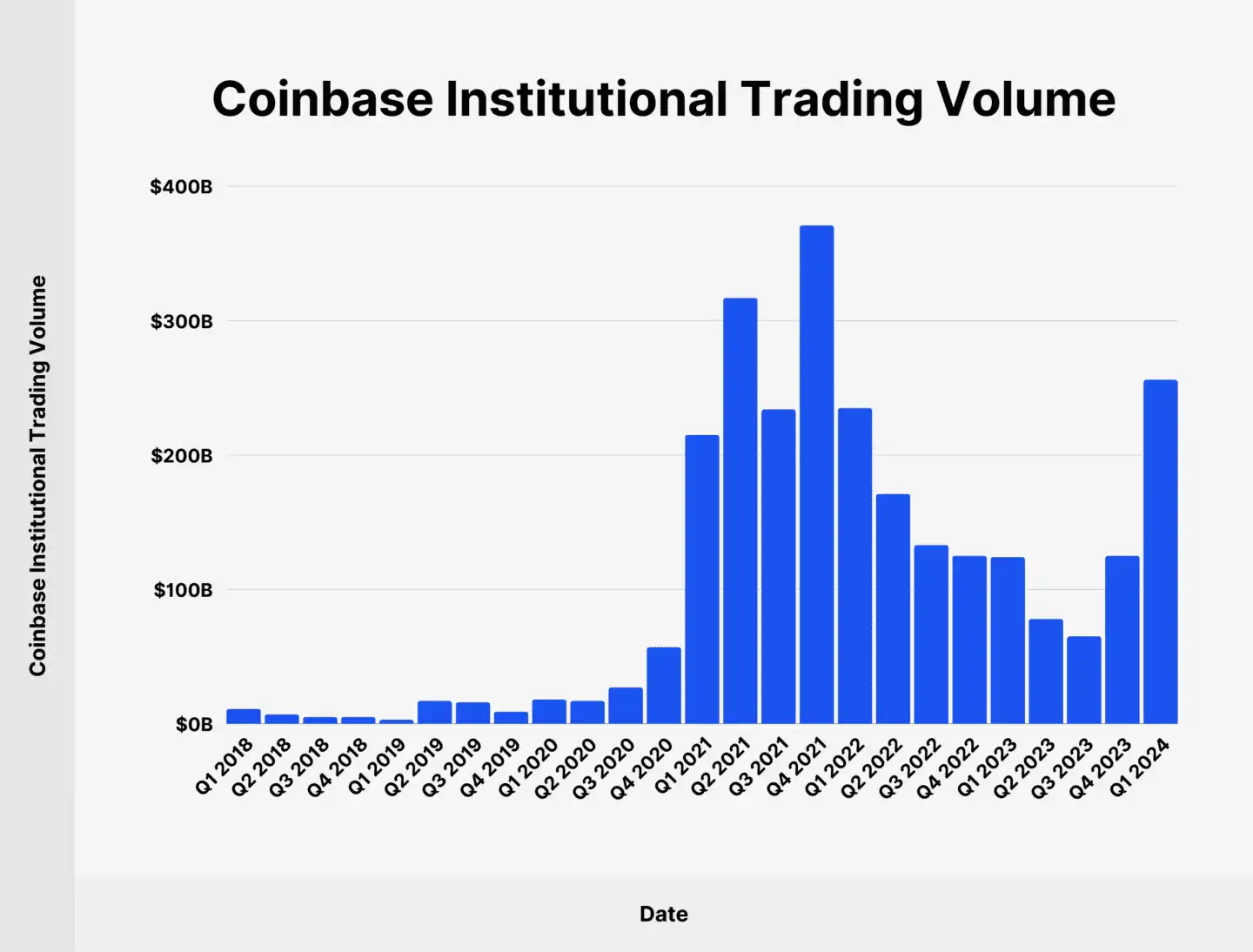

Retail trading accounts for only about 18% of Coinbase's transactions. Starting in 2024, the trading volume of Coinbase's institutional clients has been steadily increasing (with Q1 2024 trading volume at $256 billion, accounting for 82.05% of total trading volume). With the integration of DEX on Base, it should be able to introduce significant liquidity for tens of thousands of tokens on the Base chain. More importantly, many products in the Base ecosystem will have the potential for compliance pathways with the real world through Coinbase.

Coinbase institutional client trading volume, source: Backlinko

The first to respond to this news was Aerodrome, a leading DEX on Base, which announced that its DEX functionality on the Base network will be integrated into the Coinbase main app. Following the announcement, its token $AERO saw a nearly 30% price increase within 24 hours, before slightly retracing to a current price of $0.62.

How will Coinbase open up the stablecoin market for mass application?

Collaboration with Shopify

On June 13, e-commerce platform Shopify announced a partnership with Coinbase and Stripe to support merchants in accepting USDC stablecoin payments issued by Circle. Through this service, consumers can use USDC on the Base chain for payments in 34 countries. This collaboration will open up pathways for millions of merchants to use USDC, allowing them to choose to receive USDC or local fiat currency directly deposited into their bank accounts.

At the same time, Coinbase and Shopify jointly launched the "Business Payment Protocol," aimed at addressing the bottlenecks in the application of cryptocurrency in commercial payment scenarios. The two parties will build a new custodial smart contract on Base, enabling seamless cryptocurrency payments in the e-commerce sector. Authorization, capture, and refunds will be handled in collaboration with Stripe, providing a completely seamless settlement experience for merchants using local currency or USDC. In the future, this protocol will open up APIs that require no knowledge of cryptocurrency, and integrated wallets will allow users to make payments directly through signatures.

As one of the world's most well-known "independent site" e-commerce platforms, Shopify's growth trend in recent years is evident. In 2023, Shopify's GMV (Gross Merchandise Volume) was $235.91 billion, and by 2024, this figure had reached $292.28 billion, with Q1 2025 at $74.75 billion, a 23% increase compared to the same period last year.

Shopify's main customers are in Europe and North America, where compliance and adoption of cryptocurrency are relatively high. The advantages of USDC in cross-border payment transfers will bring significant convenience to merchants operating primarily on independent sites like Shopify. Therefore, the collaboration between the two may drive a certain proportion of merchants to join this payment system.

Collaboration with American Express

On June 13, Coinbase announced a partnership with American Express to issue the cryptocurrency credit card Coinbase One Card specifically for annual subscribers of Coinbase One, marking American Express's first issuance of a cryptocurrency credit card.

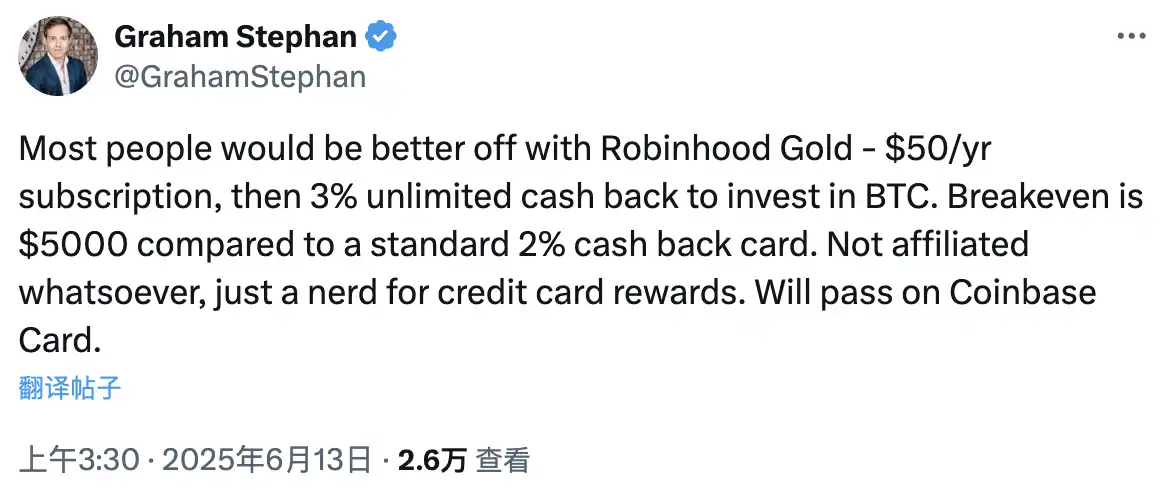

The card offers various benefits, including a $500 monthly fee-free limit and up to 4% Bitcoin cashback on purchases. The more assets held on Coinbase, the higher the reward rate.

Real estate investor Graham Stephan, who has 5 million subscribers on YouTube, stated that he would not choose the Coinbase One credit card but would use the Robinhood Gold card. He explained, "You have to hold a certain amount of assets on Coinbase, which requires at least $10,250 to break even," while "the Robinhood Gold card has a $50 annual subscription and offers 3% unlimited cashback, which can be used to invest in BTC. Compared to the standard 2% cashback card, the breakeven point for the Robinhood Gold card is $5,000."

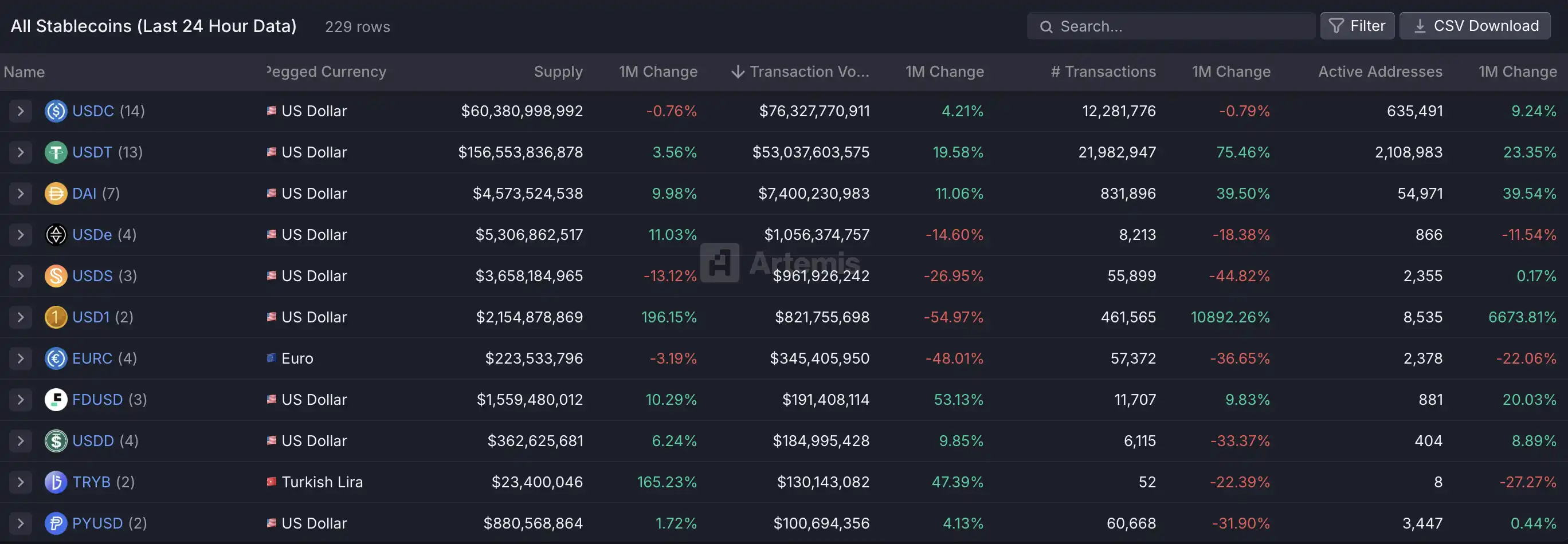

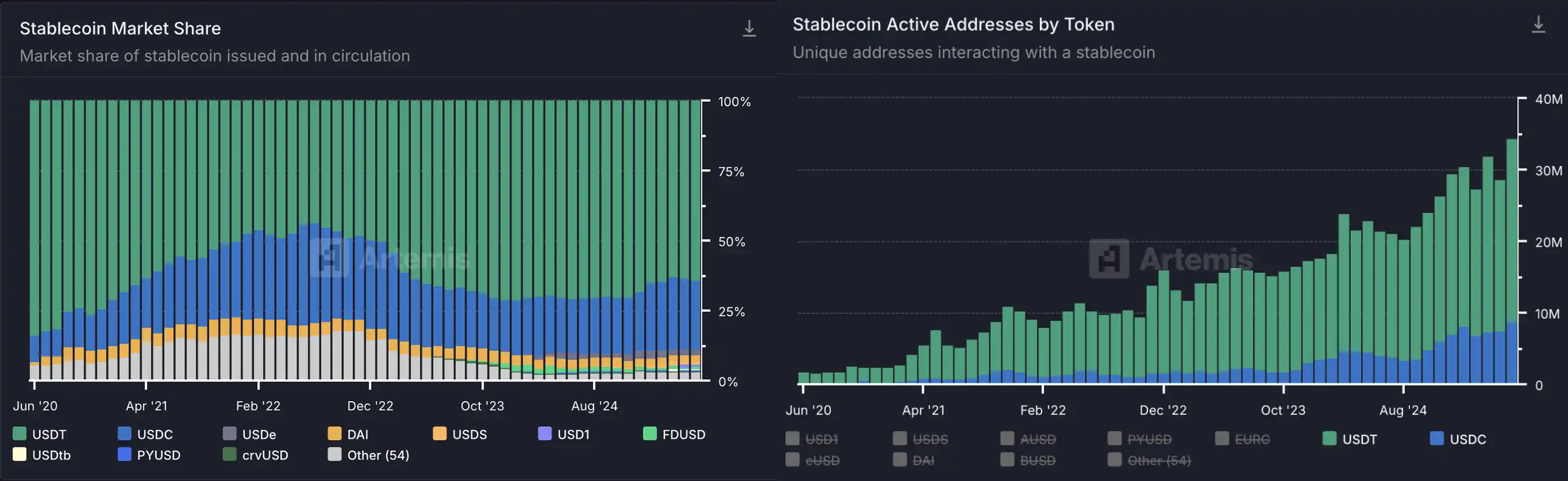

With the excellent performance of USDC's issuing company, CIRCLE, in the recent U.S. stock market listing, USDC's trading volume reached $76 billion this month, surpassing USDT to become the leader in the stablecoin sector.

However, we can see that in terms of supply, active usage addresses, and market share, USDC is only one-third the size of USDT. With Coinbase opening pathways between CeFi and DeFi, online shopping, and physical consumption, the growth of USDC should continue.

Reopening the contract button for Americans

In addition to its efforts in the stablecoin sector, Coinbase has also thrown out a "killer move" in trading. This series of actions is a response to its financial report from the previous quarter, where its earnings per share (EPS), revenue, and platform earnings all saw a collective decline. Compared to spot trading, which is more affected by market fluctuations, contract trading is a more "stable" source of income.

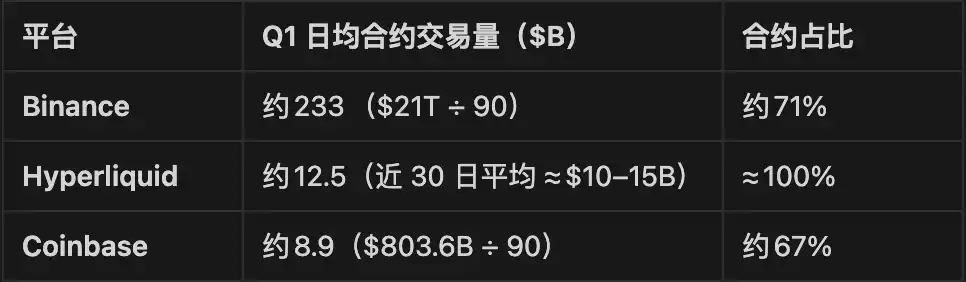

Therefore, Coinbase has taken a series of measures, the most important of which is its recent announcement to launch 24/7 perpetual futures contracts in compliance with the Commodity Futures Trading Commission (CFTC) requirements in the U.S. Prior to this, on May 9, Coinbase had already launched 24/7 Bitcoin and Ethereum futures trading through its CFTC-regulated exchange, Coinbase Derivatives (formerly the CFTC-regulated derivatives trading platform FairX, LLC). In May, Coinbase also completed the acquisition of Deribit, one of the largest cryptocurrency options exchanges globally, marking its entry into the competitive landscape of top derivatives markets.

Deribit has a strong influence in non-U.S. markets, particularly in Asia and Europe. The acquisition allows Coinbase to gain Deribit's dominant position in Bitcoin and Ethereum options trading, which accounts for approximately 80% of global options trading volume, with daily trading volumes exceeding $2 billion. Additionally, 80-90% of Deribit's client base consists of institutional investors, and its expertise and liquidity in the Bitcoin and Ethereum options market are highly favored by institutions. Coinbase's compliance advantages, combined with its already robust institutional ecosystem, make it a better fit to penetrate the derivatives market, allowing it to face pressure from giants like Binance and OKX.

For a long time after the compliance cleanup in the U.S. market a few years ago, no exchanges launched compliant derivatives. The U.S. market has always been seen as a "sweet spot" for exchanges, but for "American players," aside from institutions like CME Group that provide ETH and BTC options, the only options have been on-chain exchanges that circumvent regulations, such as the recently emerging Hyperliquid. Coinbase's unique "monopolistic" market position has created a shortcut for it in the derivatives field.

As various CEXs face slowing user growth in the market at this stage, and continue to seek new revenue streams, whether the simultaneous explosion of multiple measures by Coinbase can reshuffle the existing CEX landscape remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。