Starting from the micro-operational logic of stablecoins, this article deconstructs the mechanisms of stablecoin operation and traces the development history of stablecoins.

Authors: Zhou Junzhi, Tian Yunong, CSC Research Macro Team

CITIC Construction Investment believes that the current total scale of stablecoins is relatively small compared to U.S. Treasury bonds. The market should not expect that stablecoin regulatory policies can significantly increase U.S. dollar assets in the short term (i.e., the market's expectation that stablecoins will save the U.S. dollar and U.S. Treasury bonds).

What the market needs to focus on is whether stablecoins can usher in a new era of development, allowing payment demands that escape the U.S. dollar monetary system and evade into digital currency systems like Bitcoin to return to a centralized monetary system by wrapping themselves in a layer of stablecoin.

Core Viewpoints

Post-pandemic geopolitical games have escalated, and the U.S. government's unchecked fiscal expansion has raised doubts about U.S. credit assets, while tariff wars have ignited concerns about the reshaping of financial order. In recent years, an increasing number of payments have fled the U.S. dollar-dominated centralized monetary system, seeking refuge in digital payment systems (such as Bitcoin).

Stablecoins are "dual-sided" currencies that combine characteristics of both centralized and digital currencies. Policies aimed at promoting the development of stablecoins need to focus on strengthening the stability mechanisms of stablecoins: enhancing market "trust consensus" in stablecoins. This is also the focal point of recent stablecoin regulatory policies.

Looking solely at the current comparison of the total scale of stablecoins and U.S. dollars and Treasury bonds, promoting the development of stablecoins cannot bring about a large-scale increase in funds for the U.S. dollar and Treasury bonds in the short term.

In the medium to long term, the robust development of stablecoins can first allow fiat currencies (such as the U.S. dollar) to ride the wave of Bitcoin's market capitalization expansion; secondly, it can allow fiat currencies to don a layer of stablecoin's digital attire, bridging the divide between centralized credit currencies and digital currencies.

Summary

Recently, the U.S. and Hong Kong have successively introduced policies and regulations related to stablecoins, and Circle's listing on the U.S. stock market has ignited market interest in stablecoins.

This comes at a time when U.S. Treasury bonds are weak, and U.S. credit assets are under scrutiny. A narrative has emerged in the market—stablecoin development is aimed at saving the U.S. dollar and Treasury bonds. Is this narrative true?

1. What are Stablecoins?

Stablecoins have four operational elements.

Stablecoins operate on the blockchain.

Issuers must have a 100% reserve of real assets when issuing stablecoins.

The issuer is a private sector entity, not an official entity like a central bank.

The value of stablecoins remains stable, typically maintaining a 1:1 ratio with the pegged fiat currency.

There are three main types of stablecoins: fiat-collateralized, crypto-collateralized, and algorithmic.

Fiat-collateralized stablecoins are pegged to fiat assets; crypto-collateralized stablecoins are pegged to cryptocurrency assets; algorithmic stablecoins dynamically manage currency supply and value through smart contracts.

2. How are Stablecoins Stabilized?

Stablecoins are inherently digital currencies, and historically, the collapse of stablecoins has stemmed from public distrust in their value stability, with several notable collapse cases. Thus, achieving value stability for stablecoins is not easy.

Currently, mainstream stablecoins are pegged to fiat currencies. For these stablecoins, maintaining value stability hinges on two key points: sufficient reserve assets and transparent information.

The "stability" of stablecoins is not an absolute guarantee established by a perfectly designed stability mechanism, but rather a balanced result of a mechanism that can relatively withstand risks and market trust.

In summary, the key to maintaining "stability" in stablecoins lies in "trust consensus," meaning that holders believe they can always redeem equivalent fiat currency or collateral assets from the issuer. To achieve this, stablecoin issuers must hold high-quality, highly liquid assets and maintain transparency.

3. How do Stablecoins Differ from Bitcoin?

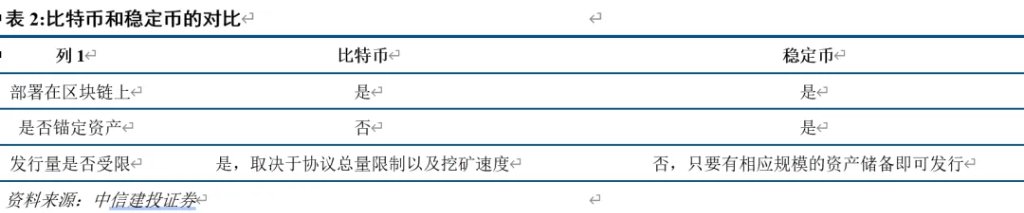

Both stablecoins and Bitcoin are blockchain digital currencies, sharing three common characteristics: virtual assets, privacy, and decentralization.

The biggest difference between stablecoins and Bitcoin lies in whether they are pegged to specific assets at issuance, resulting in different levels of value stability.

First, stablecoins have price stability characteristics (at least issuers strive to ensure value stability), while Bitcoin's price is inherently volatile.

Stablecoins derive their value from pegged external assets, and reserve assets are key to maintaining their value stability. Bitcoin's value depends on market supply and demand; due to limited supply, Bitcoin has seen increased popularity recently, maintaining an upward price trend amid volatility.

Second, Bitcoin is relatively scarce, while stablecoins generally have lower scarcity.

The issuance and total supply of stablecoins depend on the amount of reserve assets and user demand, resulting in weaker scarcity.

Bitcoin has a fixed total supply (21 million coins), and block rewards have undergone four halvings, making its scarcity evident.

Third, stablecoin regulation is moving towards monetary compliance, while Bitcoin regulation is moving towards virtual asset management.

Under strong regulation in various countries, stablecoins have gradually become compliant, with countries defining reserve assets and issuer licenses according to legislation.

Bitcoin, being a decentralized asset, faces inconsistent regulatory attitudes across countries due to differing stances on virtual assets.

4. What Development Drivers are Revealed by the History of Stablecoin Development?

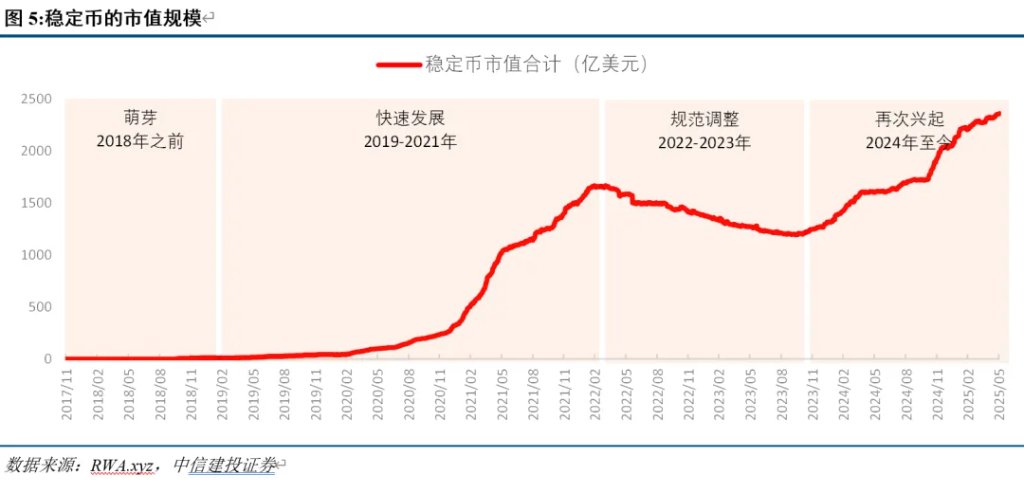

The development of stablecoins can be roughly divided into four stages: before 2018, 2019-2021, 2022-2023, and from 2024 to the present.

Emergence Stage (Before 2018): A nascent phase with limited price increases for stablecoins.

The earliest stablecoins emerged in 2014, with Tether's USDT being one of them.

Rapid Development Stage (2019-2021): Riding the wave of the DeFi ecosystem, stablecoins experienced rapid expansion.

After 2019, the DeFi ecosystem surged, and the "DeFi Summer" of 2020 saw lending protocols like Aave and mining become popular, increasing the demand for stablecoins as pricing and payment tools in the cryptocurrency world.

Regulatory Adjustment Stage (2022-2023): Following collapses and regulatory scrutiny, stablecoins underwent adjustments.

In May 2022, the collapse of TerraUSD (UST) raised concerns about the instability of stablecoins and attracted regulatory attention. Subsequently, the U.S. and Europe proposed the "Stablecoin TRUST Act" and the "Markets in Crypto-Assets Regulation" (MiCA).

Resurgence Stage (2024 to Present): The rise of representative currencies has led to a significant expansion of stablecoins.

After 2023, the cryptocurrency ecosystem rapidly developed, and in early 2024, the approval of Bitcoin spot ETFs by the SEC reignited the cryptocurrency market, leading to a rapid increase in demand for stablecoins as intermediary currencies.

The main development drivers for stablecoins include the growth of the cryptocurrency market, payment convenience, and privacy.

Stablecoins are currently the primary pricing and payment tools in the cryptocurrency market, offering greater payment convenience than other types of cryptocurrencies and fiat currencies, with lower costs. Additionally, their privacy makes stablecoins more in demand in certain scenarios compared to fiat currencies.

The shortcomings in stablecoin development mainly revolve around the risk of bank runs stemming from trust crises.

5. The Direct and Underlying Purposes of Stablecoin Policies

Recently, the U.S. and Hong Kong have successively introduced policies and regulations related to stablecoins, aiming to guide stablecoins towards more stable development, marking the entry of stablecoins into a second development era.

The main direction of policy formulation revolves around the "trust consensus" of stablecoin stability mechanisms.

In detail, the policies primarily provide external credit enhancement for stablecoins, clarifying what constitutes a compliant stablecoin and establishing clear regulations for stablecoins.

First, the policies aim to eliminate conceptual misunderstandings about stablecoins and prevent underlying risks in their development.

Second, they refine the standards for pegged assets of stablecoins, making the core of stablecoins more stable.

Third, they construct a regulatory framework for stablecoins, giving stablecoin development a more official attribute.

6. What Might the Future Development Path of Stablecoins Look Like?

Stablecoins are essentially the adhesive between fiat currencies (mainly the U.S. dollar) and digital currencies (mainly Bitcoin), or a linking bridge.

Thus, the development of stablecoins can bridge the divide between digital currencies and credit currencies.

Understanding the past divisions between U.S. dollar credit assets and digital currencies, and how stablecoins can repair the rift between the two, may be the true intention behind recent policies aimed at stabilizing the regulatory framework for stablecoins and guiding their stable development.

Due to the traditional agency model's flaws—such as low payment efficiency, high transaction costs, limited coverage, and low transparency—combined with the geopolitical games post-pandemic that have led some countries and regions to detach from modern cross-border payment systems, the U.S. has implemented massive fiscal and monetary easing domestically, leading to the abuse of U.S. dollar credit. The trust in the U.S. dollar for cross-border transactions has weakened.

In April 2025, U.S. tariffs disrupted global trade rules, creating uncertainty in the global economic and trade order, and exacerbating fluctuations in the global financial market based on trade, leading to a surge in the development of representative currencies.

The rapid development of Bitcoin reflects a current global loss of trust in the U.S.-centric monetary system, with more payments attempting to escape the U.S. dollar-dominated centralized monetary system. Digital currencies, which offer both privacy and payment convenience, are becoming the primary choice for decentralized currencies.

At this juncture, regulating the development of stablecoins can contribute to the development of fiat assets in two major directions:

First, stablecoins serve as pricing and payment tools in the cryptocurrency market while being pegged to fiat currencies (such as the U.S. dollar). The expansion of Bitcoin requires an increase in stablecoins, which in turn increases the U.S. dollar and Treasury bonds. This is akin to fiat currencies (such as the U.S. dollar) benefiting from the expansion of Bitcoin's market capitalization.

Second, stablecoins possess the typical payment convenience and privacy of digital currencies, yet they are pegged to fiat currencies (such as the U.S. dollar). As stablecoins gain traction in the trading field, fiat assets (such as the U.S. dollar and Treasury bonds) can expand through stablecoins. This is equivalent to fiat currencies (such as the U.S. dollar) donning a layer of stablecoin's digital attire.

The most pressing question in the market currently is how much fiat assets, such as the U.S. dollar and Treasury bonds, stablecoins can ultimately bring in?

Our calculations show that the current total scale of stablecoins is relatively small compared to U.S. Treasury bonds. USDT and USDC together hold approximately $120 billion in short-term U.S. Treasury bonds in their reserves as of Q1 2025, while the current stock of short-term U.S. Treasury bonds is about $6 trillion, meaning $120 billion accounts for only 2%.

In other words, the market should not expect that stablecoin regulatory policies can significantly increase U.S. dollar assets in the short term (i.e., the market's expectation that stablecoins will save the U.S. dollar and Treasury bonds). What the market needs to focus on is whether stablecoins can usher in a new era of development, allowing payment demands that escape the U.S. dollar monetary system and evade into digital currency systems like Bitcoin to return to a centralized monetary system by wrapping themselves in a layer of stablecoin. This may also be the true intention behind the current U.S. and other governments' establishment of a stablecoin development framework.

Introduction

On May 19, the U.S. Senate passed the "Guidance and Establishment of the U.S. National Stablecoin Innovation Act," and on May 30, the Hong Kong Special Administrative Region government published the "Stablecoin Ordinance" in the Gazette, igniting market interest in stablecoins.

On June 5, Circle Internet (the issuer of USDC) listed on the U.S. stock market, closing with a gain of 168.48%, marking the beginning of a new wave of stablecoin development.

The market's interest in stablecoins is accompanied by another voice: the regulation of stablecoin policies signifies that the future development of stablecoins is on the right track, with the vast majority of stablecoins pegged to fiat currencies (mainly the U.S. dollar), and their underlying assets including not only the dollar but also U.S. Treasury bonds (mainly short-term). Does this mean that the ultimate goal of stablecoin policy regulation is to promote the expansion of stablecoins, thereby bolstering the U.S. dollar and U.S. short-term bonds?

This comes at a time when U.S. Treasury bonds are weak, and U.S. credit assets are under scrutiny. A narrative has emerged in the market—stablecoin development is aimed at saving the U.S. dollar and Treasury bonds. Is this narrative true?

We start from the micro-operational logic of stablecoins, deconstruct the mechanisms of stablecoin operation, and trace the development history of stablecoins. Only then can we deeply understand the true intentions behind recent stablecoin policies and ultimately comprehend the future trends and paths of Bitcoin development.

The Main Text is as Follows:

How do Stablecoins Maintain Stability?

(1) The Basic Mechanism of Stablecoins

What are stablecoins? We can summarize them with a few keywords: digital currency (blockchain), pegged reserve assets, private issuance, and stable value.

The issuers of stablecoins are private entities, not official departments (central banks or monetary authorities).

The issuance of stablecoins requires asset reserves. When issuing stablecoins, the issuer must have a 100% reserve of real assets. Real assets generally include government bonds, fiat currencies, precious metals, or cryptocurrencies, and any one or a combination of these can serve as reserve assets.

Stablecoins operate on the blockchain, allowing them to act as a medium of exchange for other cryptocurrencies on cryptocurrency exchanges. For example, one can exchange U.S. dollars for USDT and then use USDT to purchase Bitcoin.

In simple terms, the issuer, a private entity, holds a certain amount of real-world assets, such as U.S. dollars, U.S. Treasury bonds, or gold, as well as cryptocurrencies like Bitcoin and Ethereum. Once the issuer obtains the qualification to issue stablecoins, they can issue corresponding stablecoins at a 1:1 ratio based on their held reserve assets, and these stablecoins are traded on the blockchain.

We can metaphorically say that stablecoins help the cryptocurrency world express prices, serving as a bridge between the real world and the crypto world.

The price volatility of Bitcoin and Ethereum is too extreme for them to serve as stable currencies for transactions and valuations in the long term.

The emergence of stablecoins aims to solve this problem by being pegged 1:1 to real assets, maintaining stable value while operating on the blockchain, facilitating transactions on the blockchain.

(2) Three Types of Stablecoins

Stablecoins can be categorized into three types based on the mechanisms they use to achieve stability and the differences in pegged assets.

- Fiat-Collateralized

These stablecoins maintain a 1:1 reserve of collateral assets, which must be fiat currency or government bonds. For example, U.S. dollars or U.S. Treasury bonds can serve as collateral assets. Representative stablecoins of this type include USDT and USDC.

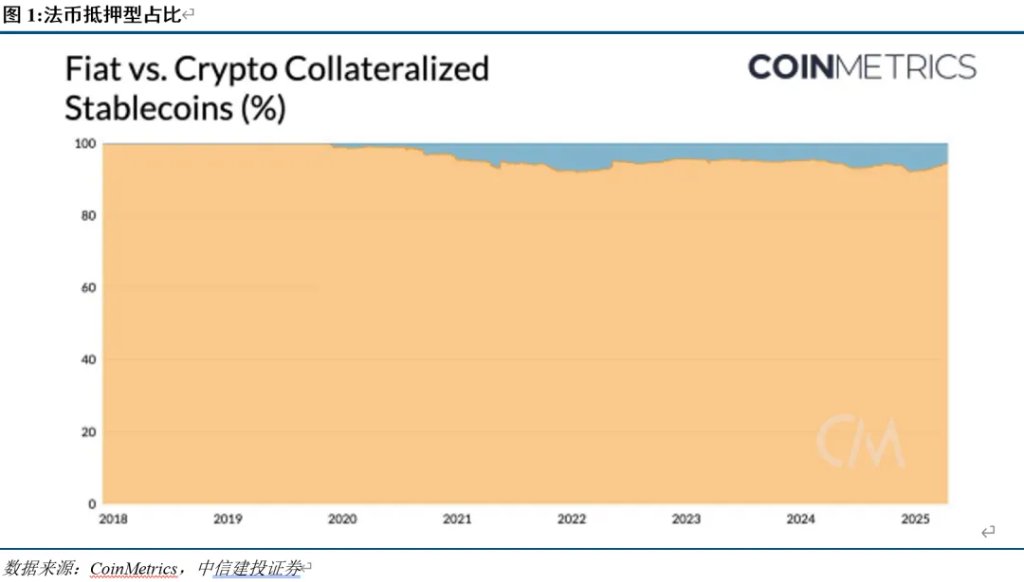

Fiat-collateralized stablecoins are currently the most mainstream type, accounting for over 90% of all stablecoins, with the vast majority pegged to the U.S. dollar.

The issuance of USDT can be roughly divided into two steps: (1) Users deposit U.S. dollars into Tether's bank account; (2) Tether mints an equivalent amount of USDT in the user's account, which the user can then use.

When users redeem U.S. dollars, they first exchange USDT for Tether, which then destroys the USDT and delivers an equivalent amount of U.S. dollars to the user.

- Crypto-Collateralized

These stablecoins are generated by using mainstream cryptocurrency assets as collateral, such as BTC or ETH. A representative stablecoin of this type is DAI.

The issuance of DAI is based on an "over-collateralization" mechanism, where users send their ETH to the MakerDao system. The system issues DAI to the user's account based on the current value of ETH, applying a certain discount.

When the value of the collateral falls below the collateralization ratio (e.g., 150%), users need to promptly add more collateral or repay DAI; otherwise, the system will automatically liquidate.

- Algorithmic

Algorithmic stablecoins dynamically manage the supply and value of the currency through smart contracts. When supply exceeds demand, they buy back stablecoins; when demand exceeds supply, they issue more stablecoins. Reserve assets can be a mix of fiat and cryptocurrencies. Representative stablecoins include FRAX and AMPL.

(3) How do Stablecoins Maintain Value Stability?

The two key points for stablecoins to achieve stability are high-quality reserve assets and transparency.

The "stability" of stablecoins is not an absolute guarantee but relies on a mechanism designed to relatively withstand risks and gain market trust, thereby achieving relative value stability.

In summary, the key to maintaining "stability" in stablecoins lies in "trust consensus." In other words, holders believe they can always redeem equivalent fiat currency or collateral assets from the issuer. To achieve this, stablecoin issuers must hold high-quality, highly liquid assets and maintain transparency.

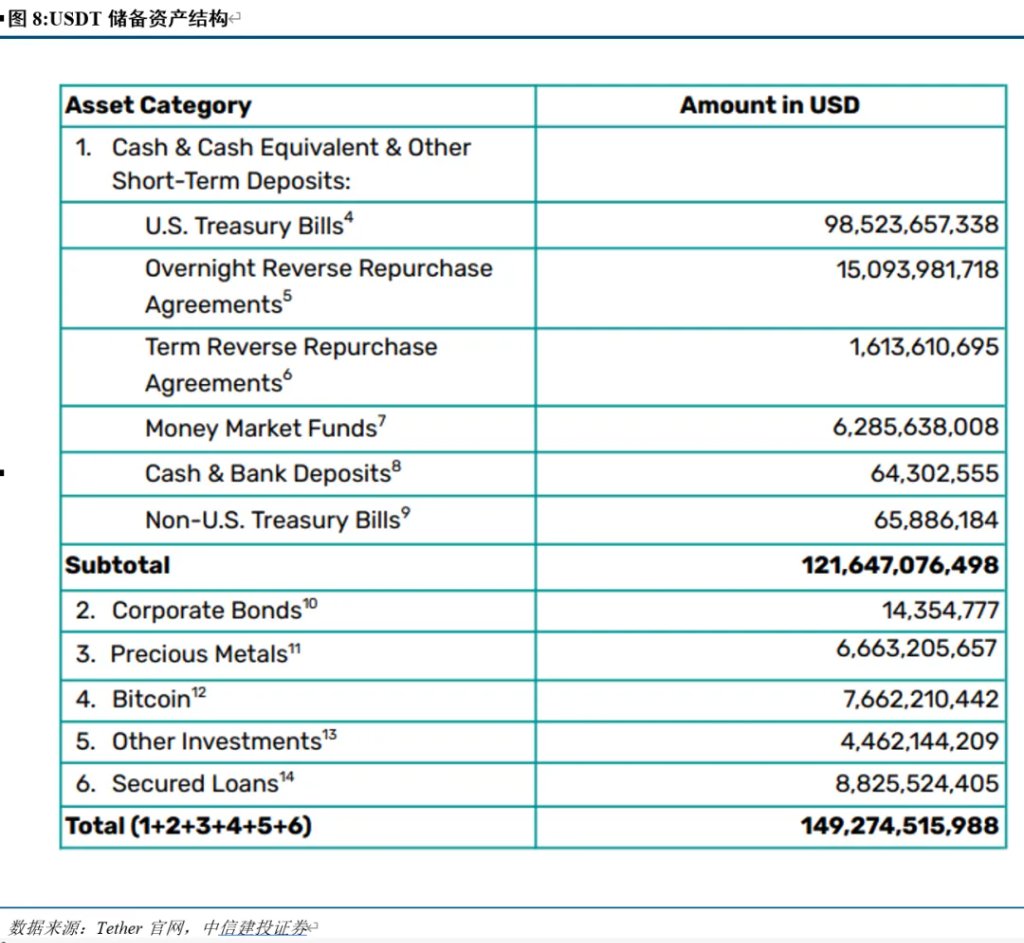

First, most stablecoins' reserve assets primarily consist of short-term U.S. Treasury bonds, along with bank deposits, commercial paper, etc.

Stablecoin issuers utilize a portion of their substantial reserve assets for investment (primarily to earn interest) and charge exchange fees for profit, making stablecoin operations a business reliant on scale for profitability.

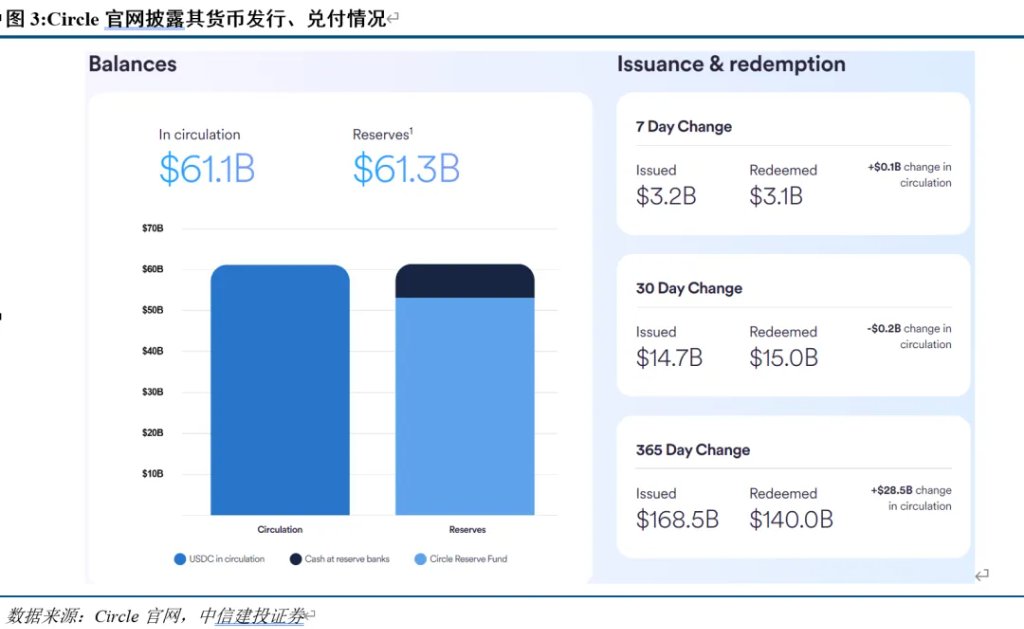

Taking Circle as an example, the current circulation of USDC exceeds $60 billion, with corresponding reserve assets including $50 billion in the Circle Reserve Fund (a money market fund operated by BlackRock, primarily investing in short-term U.S. Treasury bonds, overnight reverse repos, and bank deposits) and over $8 billion in bank deposits.

Interest income is Circle's core revenue source, with Circle's revenue in 2024 reaching $1.676 billion, and interest from reserve assets accounting for 98.6%.

Secondly, issuers regularly disclose the status of reserve assets and the circulation of stablecoins.

Most stablecoin issuers have a "Transparency" section on their official websites, where they disclose the scale and composition of their reserve assets and the current circulation of stablecoins, aiming to assure users that they can always redeem fiat currency from the issuer.

Circle's "Transparency" section provides a direct illustration of this, with the slogan: "USDC is always redeemable 1:1 for US dollars, and EURC is always redeemable 1:1 for euros. Always." (USDC can always be exchanged 1:1 for U.S. dollars and 1:1 for euros, always.)

We can understand this more clearly through the case of USDT once losing its peg and then returning to it.

On March 13, 2023, USDC lost its peg to the U.S. dollar, dropping to 1:0.88. The main reason was that Circle had $3.3 billion (8.25% of total reserves) deposited in Silicon Valley Bank, leading USDC holders to worry about their ability to redeem and sell off their holdings.

Subsequently, Circle's founder quickly stated on Twitter that the $3.3 billion in reserves had begun transferring to other banks, and if they could not recover the full $3.3 billion, they would consider using company resources or bringing in external capital to cover the gap. In short, they promised users that there was no need to worry about USDC being trapped in Silicon Valley Bank.

Afterward, USDC returned to its 1:1 peg.

How do Stablecoins Differ from Bitcoin?

Since the creation and diffusion of digital currencies, discussions about transactional currencies have been categorized into two major types: decentralized digital currencies and sovereign fiat currencies.

From the perspective of digital and decentralized characteristics, stablecoins are undoubtedly digital currencies; however, the vast majority of stablecoins are pegged to fiat currencies (especially the U.S. dollar), giving them certain fiat characteristics.

For this reason, stablecoins possess both the characteristics of decentralized digital currencies and the stable value characteristics of fiat currencies, making them a "dual-sided" currency that lies between decentralized digital currencies and fiat currencies.

(1) Stablecoins and Bitcoin: Both are Decentralized Digital Currencies with Privacy

Stablecoins and Bitcoin share three similarities: virtual assets, privacy, and decentralization.

These three similarities essentially arise because both stablecoins and Bitcoin are blockchain digital currencies, thus both are virtual assets.

Bitcoin is the native coin on the Bitcoin public chain.

Stablecoins, on the other hand, are derivative tokens deployed by developers on public chains (mostly the Ethereum public chain).

Digital currencies and their transactions on the blockchain are all recorded on a distributed ledger.

The so-called distributed ledger records transactions between members of a distributed network, including digital asset exchanges or virtual currency inflows and outflows. In other words, every historical digital asset exchange is precisely recorded and cannot be modified, and every member in the network can view this shared ledger.

This means that when the number of nodes is sufficient, a single sovereign entity cannot control this ledger, thus it is "decentralized."

The distributed ledger only records addresses (not the real social information of the traders), ensuring privacy.

For example, if User A holds 1 dollar stablecoin, it means that the distributed ledger on the public chain records that User A's ledger (address) holds 1 dollar stablecoin.

When User A uses this 1 dollar stablecoin to purchase 1 dollar of ETH from User B, every ledger will record this transaction: a transaction of 1 dollar stablecoin for 1 dollar ETH between User A's address and User B's address. All participants on the public chain do not know the identities of User A and User B (including A and B themselves), only that a transaction occurred at the addresses they operated.

(2) The Biggest Difference Between Stablecoins and Bitcoin: Value Stability

The biggest difference between stablecoins and Bitcoin lies in whether they are pegged to specific assets at issuance.

The supply of Bitcoin depends on the total amount defined by the protocol and block rewards, without pegging to other assets. The relationship between Bitcoin and fiat currencies (such as the U.S. dollar) is not constant. This leads to Bitcoin having stronger asset attributes, resulting in greater price volatility.

To maintain value stability, stablecoins need to peg to the value of fiat currencies in the real world, and most stablecoin issuances under stability mechanisms require the issuer to collateralize corresponding amounts of reserve assets.

(3) Stablecoins and Bitcoin: One Focuses on Transactions, the Other on Investment

The differences in the operational logic of stablecoins and Bitcoin determine their differing attributes.

- Value Depends on the Redemption Ability of Pegged Assets.

Stablecoins derive their value from pegged external assets. For example, fiat-collateralized stablecoins require a 1:1 reserve of U.S. dollars, while crypto-collateralized stablecoins require over-collateralization of ETH.

It is important to note that the reserve assets of stablecoins are key to maintaining their value stability.

When stablecoin issuers have sufficient collateralized reserve assets to support the issuance and redemption of stablecoins, and their reserve asset data is publicly transparent, users know that the issuer's assets can support the issuance of stablecoins, allowing stablecoins to maintain stability.

However, when reserve assets are insufficient to meet redemptions, or in the event of a bank run, the value of stablecoins will fluctuate significantly.

The value of Bitcoin relies on market supply and demand, not backed by other assets.

Therefore, under normal circumstances, the price of stablecoins is relatively stable, while Bitcoin's price experiences greater volatility. In a stable state, stablecoins are more suitable than Bitcoin as a payment tool due to their stable value measurement properties.

However, stablecoins carry the risk of a sudden drop in value due to bank runs in specific situations, which Bitcoin does not.

- The degree of scarcity depends on the pegged assets.

The issuance and total supply of stablecoins depend on the amount of reserve assets and user demand, resulting in weaker scarcity.

Bitcoin has a fixed total supply (21 million coins), and the block rewards have undergone four halvings, making its scarcity evident.

- Compliance (depends on pegged assets and whether regulatory follow-up is needed)

Stablecoins have gradually become compliant under strict regulations in various countries, with regulations specifying reserve assets and licenses for issuers.

Bitcoin itself is a decentralized asset, with blurred regulatory boundaries and is susceptible to policy shocks.

The differences between stablecoins and Bitcoin also determine their core functions diverge, with one serving as a payment tool and the other as an investment tool.

Stablecoins are suitable as payment tools and the infrastructure for DeFi, connecting on-chain finance with real-world assets, becoming the core of payment settlement in the digital world.

Bitcoin, on the other hand, is more suitable as a store of value asset, serving as an investment under the narratives of scarcity and the reconstruction of financial order.

What Development Drivers Are Revealed by the Path of Stablecoin Development?

(1) Four Stages of Stablecoin Development

The development of stablecoins can be roughly divided into four stages: before 2018, 2019-2021, 2022-2023, and from 2024 to the present.

Emergence Stage (Before 2018): A nascent phase with limited scale expansion of stablecoins.

The earliest stablecoins were born in 2014, with Tether's USDT being one of them. USDT is the first large-scale fiat-collateralized stablecoin and is currently the most mainstream stablecoin.

In 2017, MakerDao issued DAI, which became a relatively successful model for crypto-collateralized stablecoins. In the second half of that year, mainstream cryptocurrency exchanges began listing USDT trading pairs.

In 2018, Circle launched USDC. Subsequently, stablecoins like TUSD and GUSD were issued one after another.

Rapid Development Stage (2019-2021): Riding the wave of the DeFi ecosystem, stablecoins experienced rapid expansion.

After 2019, the DeFi ecosystem emerged, and the "DeFi Summer" of 2020 saw the popularity of lending protocols like Aave and mining.

Stablecoins serve as the pricing and payment tools in the cryptocurrency world, so the rapid development of the DeFi ecosystem increased the demand for stablecoins.

Regulatory Adjustment Stage (2022-2023): Following failures and regulatory scrutiny, stablecoins underwent adjustments.

In May 2022, TerraUSD (UST) lost its peg, raising concerns about the instability of stablecoins and attracting regulatory attention.

In 2022, the U.S. proposed the "Stablecoin TRUST Act," requiring stablecoin issuers to have reserve assets equal to the issued value of stablecoins at a 1:1 ratio, and issuers must have licenses to issue stablecoins.

In April 2023, the European Parliament officially passed the "Markets in Crypto-Assets Regulation" (MiCA), clarifying the types of crypto assets covered by regulation and the transparency and disclosure requirements for crypto assets in issuance, public offerings, and trading platforms.

Resurgence Stage (2024 to Present): The rise of the currency era, leading to significant expansion of stablecoins.

After 2023, the cryptocurrency ecosystem rapidly developed, with various new concepts emerging, laying the foundation for the subsequent rapid development of stablecoins.

In early 2024, after the approval of Bitcoin spot ETFs by the SEC, the cryptocurrency market rebounded, leading to a rapid increase in demand for stablecoins as intermediary currencies.

In May 2025, the UK, the US, and Hong Kong successively passed legislation related to stablecoins, stipulating regulations on reserve support, auditing rules, and issuance licenses for stablecoins.

(2) Driving Forces and Defects in Stablecoin Development

The driving forces behind the development of stablecoins mainly include three aspects: the development of the cryptocurrency market, payment convenience, and privacy.

Stablecoins are currently the primary pricing and payment tools in the cryptocurrency market. The development of the cryptocurrency market will drive an increase in demand for stablecoins. For example, when Bitcoin trading is active, the demand for stablecoins as intermediary currencies will also increase.

In the crypto-digital ecosystem, the payment convenience of stablecoins is stronger than that of other types of cryptocurrencies and fiat currencies, with lower costs.

Blockchain-based stablecoins can settle transactions instantly around the clock without manual processing, often completing a transaction in just a few minutes.

The peer-to-peer trading model of stablecoins eliminates the need for central institutions, reducing transaction fees.

The privacy of stablecoins makes their usage demand stronger than that of fiat currencies in certain scenarios.

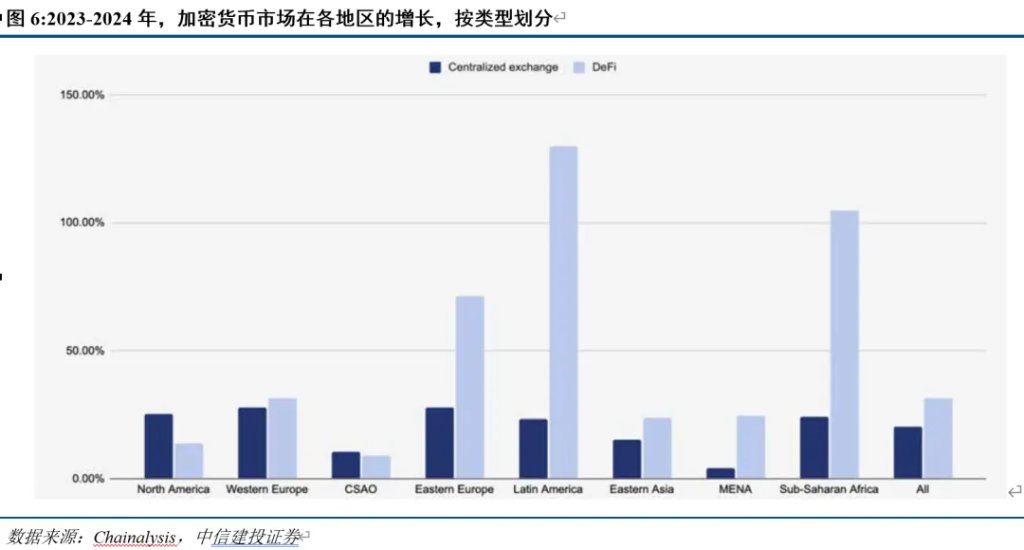

For instance, in recent years, the growth of DeFi activities has been most notable in sub-Saharan Africa, Latin America, and Eastern Europe.

The risks associated with stablecoins mainly focus on redemption risk and the risk of issuing stablecoins out of thin air, both of which could lead to a rapid decline in their value.

When stablecoins face large-scale redemptions, they must sell off reserve assets from the real world, such as government bonds, fiat currencies, and commercial paper. When redemption becomes difficult, the value of stablecoins will decouple, and in severe cases, it will drop significantly.

Due to the lack of transparency regarding the relationship between the reserve assets and collateral assets of stablecoin issuers and the issuance of stablecoins, there is a moral hazard of issuers creating stablecoins out of thin air.

Since 2017, Tether, the issuer of USDT, has repeatedly faced market skepticism regarding its reserve assets due to banking disputes with its affiliated company, Bitfinex, leading to suspicions that Tether was "issuing stablecoins out of thin air" and facing legal investigations.

In March 2021, Tether decided to regularly disclose its reserve asset status after paying a $40 million fine.

The Direct and Underlying Purposes of Stablecoin Policies

(1) Deconstruction of the Latest Stablecoin Policy Content

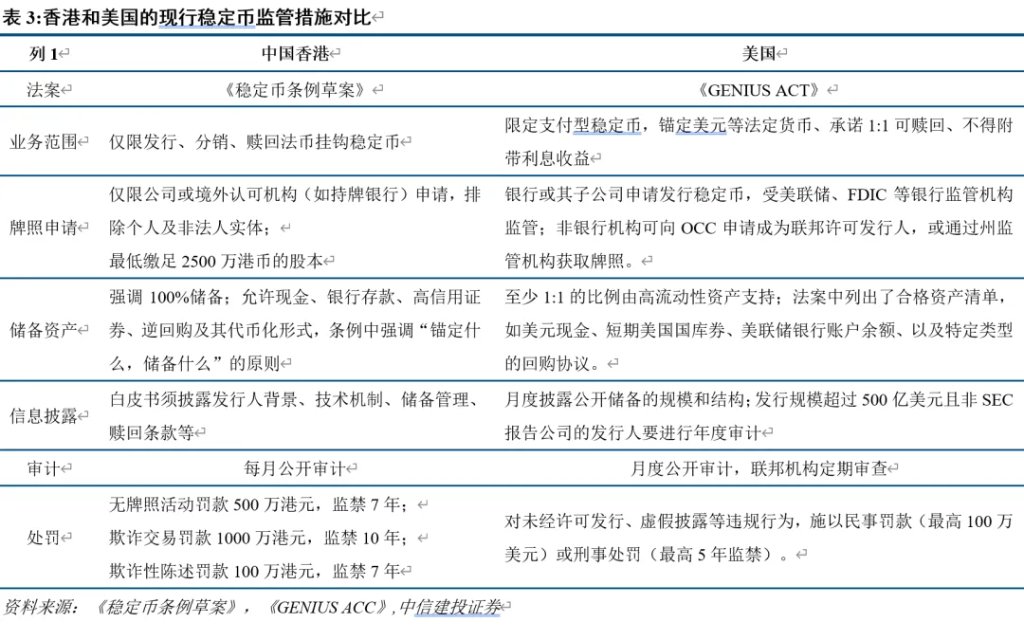

The U.S. Senate passed the procedural legislation for the "GENIUS Act."

On May 19, local time, the U.S. Senate passed the procedural legislation for the "Guidance and Establishment of a National Stablecoin Innovation Act" (referred to as the "GENIUS Act").

Key provisions of the GENIUS Act include three points:

Federal Licensing. Issuers with a circulation exceeding $10 billion must obtain federal licenses and be subject to regulation.

Full Reserve Support. Stablecoins must be backed 1:1 by high-quality liquid assets (such as U.S. Treasury bonds and cash).

Mandatory Audits. Issuers must conduct monthly public audits and disclose reserve assets.

Hong Kong's "Stablecoin Ordinance" officially became law.

On May 30, the Hong Kong Special Administrative Region government published the "Stablecoin Ordinance" in the gazette, meaning the "Stablecoin Ordinance" has officially become law.

Key provisions include three points.

Access System. Issuers (excluding individuals or non-legal entities) must apply for a license, with a minimum registered capital of HKD 25 million; no license means no issuance of stablecoins.

Reserve Management. Reserve assets must exceed the circulation value of stablecoins, emphasizing "what is pegged, what is reserved."

Auditing and Disclosure. The white paper must disclose the issuer's background, technical mechanisms, reserve management, redemption terms, etc., and regular audits must be conducted.

(2) The Underlying Logic and Essential Intent of the Policies

The introduction of regulatory policies marks the beginning of the second development era for stablecoins, as the intention of the policies is to make stablecoins more stable.

In fact, the main direction of policy formulation revolves around the "trust consensus" of the stability mechanism of stablecoins. In addition, the policies also provide external credibility to stablecoins, clarifying what constitutes a compliant stablecoin and establishing clear regulations for them.

The policies aim to enhance the stability of stablecoins through three levels:

First, eliminate conceptual misunderstandings about stablecoins to prevent underlying risks in their development.

The "Stablecoin Ordinance Draft" stipulates that the purpose of stablecoins is for payments, debt settlement, and investment, requiring stablecoins to be pegged to a single asset or a basket of assets, and not issued by central departments.

The regulatory focus of the "GENIUS ACT" is on payment-type stablecoins, which are intended for payment or settlement, and issuers are prohibited from providing interest or returns on stablecoins.

Second, refine the regulations on pegged assets for stablecoins to make their core more stable.

Both the "Stablecoin Ordinance" and the "GENIUS ACT" require that the issuance of stablecoins must have at least 100% backing by real assets and mandate that issuing institutions conduct regular audits and disclosures of their reserve assets, with the redemption mechanism also needing to be disclosed in the issuance white paper.

The goal is to standardize the issuance of stablecoins, improve the transparency of information disclosure, and reduce the risks of bank runs and issuing stablecoins out of thin air. Especially in today's rapidly developing cryptocurrency market, where global stablecoin trading volume has surpassed that of Visa, timely regulation is necessary to mitigate stablecoin risks.

Third, construct a regulatory framework for stablecoins to give them more official attributes.

The "Stablecoin Ordinance Draft" designates the Hong Kong Financial Commissioner as the regulatory authority for stablecoins in Hong Kong, responsible for overseeing their issuance to promote monetary and financial stability.

The "GENIUS ACT" implements a dual-track regulatory system. Issuers with a scale of less than $10 billion can choose state-level regulation, while those exceeding $10 billion must accept federal regulation. The state-level regulatory system and federal regulatory framework are largely similar, with the state regulatory authority being the state payment-type stablecoin agency, and the federal regulatory agencies including the Office of the Comptroller of the Currency (OCC, overseeing non-bank entities) and the Federal Reserve (overseeing deposit-taking institutions).

Can Stablecoins Save the U.S. Dollar and U.S. Treasury Bonds?

Stablecoins are essentially the adhesive between fiat currencies (mainly the U.S. dollar) and digital currencies (mainly Bitcoin), or a linking bridge.

Thus, the development of stablecoins is fundamentally about mending the divide between the U.S. dollar and Bitcoin. For instance, following the recent introduction of equivalent tariffs in the U.S., signs of a restructuring of the financial order have emerged, with more and more people investing in Bitcoin.

To further dissect the above logic and answer the question of "the future development path of stablecoins," we will break down this big question into four smaller questions and attempt to answer them from a basic to a deeper level:

Question 1: What phenomena have occurred regarding the U.S. dollar in international payments in recent years?

The international payment system, which relies on the U.S. dollar as the ultimate currency credit, is loosening. An important piece of evidence is the continuous growth in the volume and amount of cross-border payment business, while the number of active correspondent banks has decreased by about one-fifth.

The main reasons are (1) the traditional correspondent banking model itself has defects such as low payment efficiency, high transaction costs, limited coverage, and low transparency; (2) geopolitical games have led some countries and regions to detach from the modern cross-border payment system; (3) post-pandemic, the U.S. has implemented massive fiscal and monetary easing domestically, leading to the abuse of dollar credit.

The three most important supports of the international payment system are the U.S. dollar, the banking system, and SWIFT. After their vulnerabilities became apparent, the market began to seek alternative cross-border payment solutions.

As a result, the market capitalization of cryptocurrencies (such as Bitcoin) and gold, which are borderless currencies, has continued to expand since the pandemic.

Question 2: What are the driving forces behind Bitcoin's development since 2023?

Since 2023, the global trend of "de-dollarization" has intensified. A landmark event was on April 1, 2022, when Russia began using the ruble to settle natural gas with "unfriendly" countries.

The global binary split and the undercurrents of financial order reconstruction have led to increased attention to cryptocurrencies. Since 2023, new concepts in the cryptocurrency space have rapidly developed, with the emergence of protocols like Ordinals and tokens like Blur, and Bitcoin's price is expected to surpass $100,000 by the end of 2024.

In April 2025, the U.S. introduced "equivalent tariffs," reshaping global trade rules and supply chain orders, exacerbating fluctuations in the global financial market based on economic and trade foundations, leading to a resurgence of Bitcoin against the backdrop of financial order reconstruction.

Question 3: What is the significance of the more stable development of stablecoins for Bitcoin and international payments in U.S. dollars?

Cryptocurrencies are decentralized and inherently stand in opposition to fiat currencies like the U.S. dollar. However, the value of cryptocurrencies like Bitcoin and Ethereum is highly volatile, making them more suitable as investment assets for storing value rather than as common currencies. Stablecoins were created to establish a value measurement in the cryptocurrency world and to stabilize prices by pegging to fiat currencies.

One side of stablecoins is fiat currency, while the other side represents digital currencies like Bitcoin, serving as a bridge between the digital virtual world and the real world.

In the context of the reconstruction of the global financial order, currencies used for international payments are beginning to show a trend toward decentralization. The payment convenience of cryptocurrencies far exceeds that of the banking cross-border payment system, with lower transfer costs and no risk of sanctions, making cryptocurrencies a viable alternative for cross-border payments, while the fiat currency-based international payment system risks losing its status.

Stablecoins thus connect cryptocurrencies in international payments with the U.S. dollar. Although stablecoins are also products of blockchain technology and possess decentralized characteristics, they still need to reserve national credit assets to maintain value stability.

The vigorous development of stablecoins, making them the digital currency vehicle for cross-border payments, presents an opportunity for fiat currencies like the U.S. dollar to firmly maintain their dominant position in the international payment system. This also explains why the U.S. is actively establishing a strategic reserve for cryptocurrencies and implementing encouraging regulatory policies to standardize stablecoin issuance.

Question 4: What is the supporting role of stablecoins in relation to U.S. Treasury bonds in the future?

Currently, the total scale of stablecoins is relatively small compared to U.S. Treasury bonds.

Most mainstream stablecoins are pegged to the U.S. dollar, and to cope with redemption pressures and earn interest income, their reserve assets primarily consist of short-term U.S. Treasury bonds.

USDT and USDC account for over 85% of the total market capitalization of stablecoins, collectively holding $120 billion in short-term U.S. Treasury bonds.

The audit report for USDT in the first quarter of 2025 shows that approximately $100 billion of its reserve assets are in short-term U.S. Treasury bonds, accounting for about two-thirds of its total assets.

At the end of the first quarter of 2025, USDC's reserve assets included about $20 billion in short-term U.S. Treasury bonds, making up 40% of its total assets.

Currently, the stock of short-term U.S. Treasury bonds is approximately $6 trillion, meaning that $120 billion only accounts for 2%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。