Organized by: Jerry, ChainCatcher

Last Week's Cryptocurrency Spot ETF Performance

US Bitcoin Spot ETF Net Outflow of $131 Million

Last week, the US Bitcoin spot ETF experienced a net outflow over three days, totaling $131 million, with a total net asset value of $12.558 billion.

Five ETFs were in a net outflow state last week, with outflows primarily from FBTC, GBTC, and ARKB, which saw outflows of $167 million, $40.6 million, and $24.5 million, respectively.

Data Source: Farside Investors

US Ethereum Spot ETF Net Inflow of $281 Million

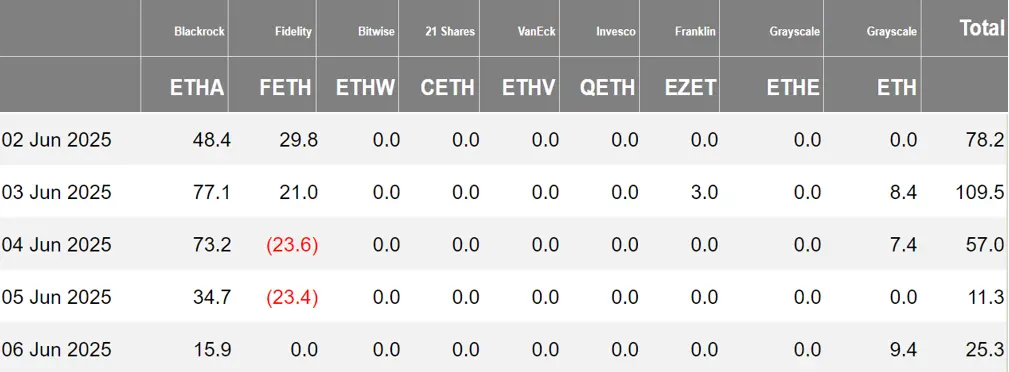

Last week, the US Ethereum spot ETF saw a continuous net inflow for five days, totaling $281 million, with a total net asset value of $9.4 billion.

The inflow last week primarily came from BlackRock's ETHA, with a net inflow of $249 million. A total of five Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Outflow of 85.26 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net outflow of 85.26 Bitcoins, with a net asset value of $489 million. The holdings of the issuer, Harvest Bitcoin, decreased to 301.76 Bitcoins, while Huaxia's holdings dropped to 2820 Bitcoins.

The Hong Kong Ethereum spot ETF had a net inflow of 306.66 Ethereum, with a net asset value of $5.562 million.

Data Source: SoSoValue

Cryptocurrency Spot ETF Options Performance

As of June 5, the nominal total trading volume of US Bitcoin spot ETF options was $1.04 billion, with a nominal total long-short ratio of 1.97.

As of June 5, the nominal total open interest of US Bitcoin spot ETF options reached $16.9 billion, with a nominal total open interest long-short ratio of 1.89.

The market's short-term trading activity for Bitcoin spot ETF options has slightly decreased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 46.92%.

Data Source: SoSoValue

Overview of Last Week's Cryptocurrency ETF Developments

ETF issuers like VanEck urge the US SEC to approve applications in order of submission

According to Cointelegraph, ETF issuers VanEck, 21Shares, and Canary Capital have written to the US SEC urging the restoration of the "first-come, first-served" principle for approving ETF applications submitted to the regulatory body. These companies argue that the SEC has failed to adhere to the "first-come, first-served principle" (the default application approval process before the listing of cryptocurrency ETFs), undermining healthy competition and hindering financial innovation.

US SEC officially accepts Nasdaq 21Shares SUI ETF listing application

The US Securities and Exchange Commission (SEC) officially announced on June 4, 2025, that it has accepted the listing application for the 21Shares SUI ETF submitted by the Nasdaq stock market.

According to the announcement, Nasdaq submitted this application to the SEC on May 23, intending to list and trade this commodity trust share-based ETF product under Nasdaq Rule 5711(d).

Global X launches Bitcoin covered call ETF

According to PR Newswire, asset management company Global X announced the launch of a Bitcoin covered call ETF (code: BCCC).

This actively managed fund implements options strategies on Bitcoin ETF products to achieve returns without directly holding the underlying asset.

Leftist candidate Lee Jae-myung was elected as the new President of South Korea with 49.42% of the vote, defeating right-wing opponent Kim Moon-soo, who received 41.15%. Lee Jae-myung has pledged to vigorously develop South Korea's cryptocurrency industry, with key policies including: allowing local adoption of spot cryptocurrency ETFs, establishing a won stablecoin market, improving the regulatory framework for digital assets, and reducing blockchain regulation in specific areas to promote innovation.

South Korea is one of the largest cryptocurrency markets globally, with 9.7 million trading users, accounting for about 20% of the total population. Unlike the previous president Yoon Suk-yeol's unfulfilled promises of being crypto-friendly, Lee Jae-myung is expected to push for the implementation of his cryptocurrency policies against the backdrop of a shift in the Financial Services Commission's attitude.

Jacobi Bitcoin ETF lowers entry barriers, opens to European retail investors for the first time

According to CoinDesk, Jacobi Asset Management announced that its Bitcoin ETF has lowered entry barriers and is now open to European retail investors for the first time.

This ETF was originally launched in 2023 on Euronext Amsterdam, previously limited to professional investors. Following approval from the Guernsey regulatory authority, the ETF has now removed restrictions on professional investors and minimum investment requirements, allowing investors to participate through regulated brokerage and investment platforms.

Jacobi CEO Peter Lane stated that this move is not only a milestone for the company but also solidifies Guernsey's position as a forward-looking digital asset jurisdiction. The fund continues to receive institutional-grade custody services from Zodia Custody.

Truth Social registers Bitcoin and Ethereum ETFs in Nevada

Truth Social submits Bitcoin ETF S-1 registration statement

US SEC delays decision on Canary Capital's spot SUI ETF application

JPMorgan plans to offer financing services for cryptocurrency ETFs to clients

Views and Analysis on Cryptocurrency ETFs

Analyst: A large number of active cryptocurrency ETFs will emerge in the winter of 2025

Bloomberg senior ETF analyst Eric Balchunas posted on platform X that the likelihood of actively traded meme coin ETFs appearing at some point in the future is very high. First, the market will see a large number of active cryptocurrency ETFs (expected in the winter of 2025), but active meme coin ETFs may not appear until 2026, potentially giving rise to the next star fund management company.

Bloomberg senior ETF analyst Eric Balchunas stated on social media: "I predict that IBIT (BlackRock Bitcoin Spot ETF) is likely to surpass Satoshi Nakamoto by the end of next year, becoming the world's largest Bitcoin holder. This also reflects the advantages of ETFs in terms of convenience, low cost, high liquidity, and credibility."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。