This is not just a formula; it is a thinking model that leads the next wave of cryptocurrency trends.

Written by: Ignas

Translated by: Luffy, Foresight News

You may have spent countless hours trying to capture the next hot narrative in the crypto space. If you judge correctly, you will make a fortune; if you enter too late, you will become the bag holder.

In the crypto market, the highest investment returns come from:

- Identifying narratives early

- Mapping out capital rotation routes before others

- Exiting when the anticipated bubble peaks

- Locking in profits

Then think: Will the next wave of narratives come? Narratives will cycle, and speculative waves will return under the following conditions:

- There is real technological innovation supporting the narrative, allowing it to rebound even after the first wave of hype fades

- New catalysts emerge

- After the hype fades, a strong community continues to build

I elaborate on my thoughts in the article below:

https://x.com/DefiIgnas/status/1757029397075230846

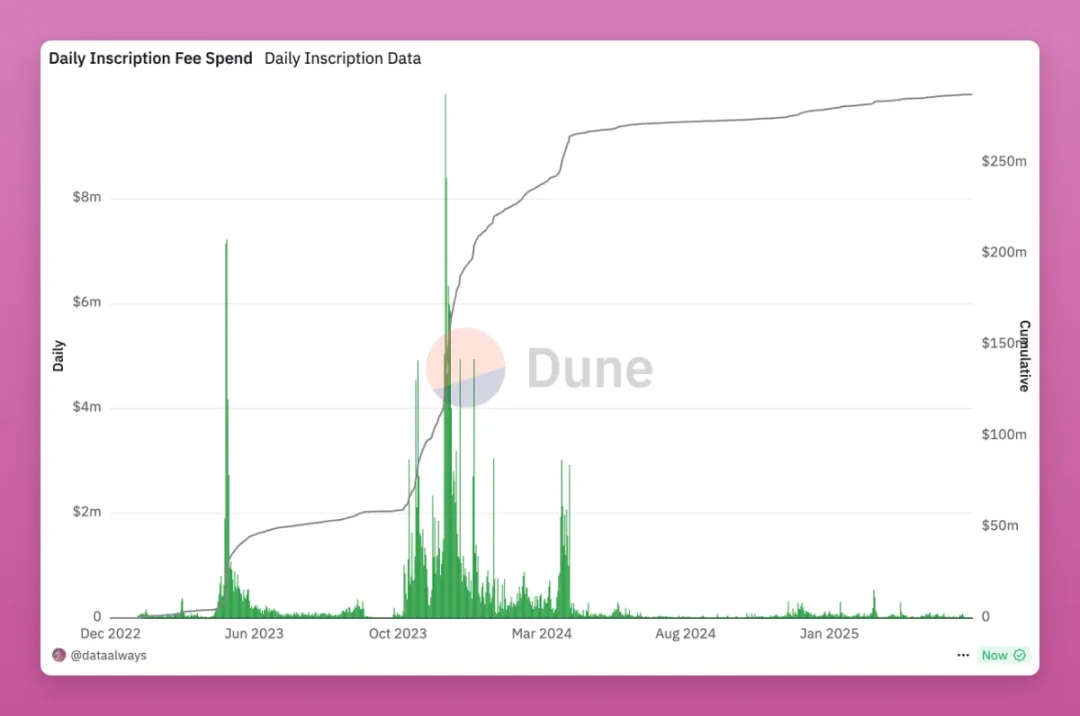

Taking Ordinals on Bitcoin as an example, we can clearly see four waves of speculative hype in the chart below.

- December 2022: The Ordinals theory is published, with little on-chain activity.

- March 2023: The BRC-20 standard triggers the first wave of hype; activity cools for six months.

- Late 2023 - Early 2024: Ongoing development sparks the second and third waves of hype.

- April 2024: Runes launch, prices soar, and then fade weeks later.

Ordinals provided months of setup time and multiple exit opportunities, while Runes only offered a brief single exit window. The field is now silent.

Will Ordinals (including Runes), NFTs, or other new forms make a comeback? Perhaps. It depends on my narrative scoring.

Analysis Framework

This is a framework for identifying hot new narratives and assessing whether subsequent speculative waves will persist. This is a version still being refined; here is my 1.0 formula:

Narrative Score = [(1.5× Innovation × Simplicity) + (1.5× Community × Simplicity) + (Liquidity × Tokenomics) + Incentive Mechanism] × Market Environment

This formula is not perfect, but it shows which factors are important and how they are weighted. Let's break it down one by one!

Innovation

Here, innovation refers to the crypto-native technological innovations that I focus on.

The most powerful catalysts are innovations that go from 0 to 1. They can appear in new fields (DeFi, NFTs, RWAs, etc.), new tokenomics models (like veToken), or even new ways of token issuance (fair launches, Pump.fun).

I previously wrote: Innovations that go from 0 to 1 have a uniqueness that can change the trajectory of the industry, and their originality can spawn new crypto subfields.

Due to cognitive biases, identifying such innovations can be quite challenging. When new things emerge, they may receive little attention (like Ordinals) or even be seen as noise. Therefore, maintaining an open mind and trying every new trend (especially controversial ones) is key to gaining an edge.

Without real technological innovation, narratives are merely fleeting speculative bubbles.

This cycle is unique because its innovation (AI) comes from outside. Thanks to AI, we have seen innovations like Kaito InfoFi and AI agents.

Some examples from this cycle include:

- Ordinals

- Restaking

- AI agents

- InfoFi

- SocialFi

- ERC404

My goal is not to list all cases but to establish a thinking model for recognizing them. The degree of innovation can be scored from 0 to 10.

Simplicity and Meme Potential

Not all innovations have the same virality. Some are easy to understand, while others are not.

Complex narratives (like zero-knowledge proofs, restaking) spread slowly, while simple or meme-like narratives (like WIF) spread quickly. Can you explain this concept in 5 seconds? Is there a meme?

For example:

- High simplicity (10/10): AI, Memecoin, XRP as a blockchain bank

- Medium simplicity (5/10): SocialFi, DeFi, NFTs, Ordinals

- Low simplicity (3/10): Zero-knowledge proofs, modular chains, restaking

Complex narratives need time to ferment, and price increases are slower. Additionally, simplicity can drive community growth.

Community

Bitcoin is the greatest innovation from 0 to 1, but without a community, it is just a piece of code. The value of Bitcoin comes from the story we assign to it.

People still do not understand why Cardano or XRP performs well despite limited innovation; the reason lies in their loyal communities.

Or to put it more radically: Memecoins.

They have no technological innovation, but Memecoins have now become a $66 billion sector, thanks entirely to a group of people rallying around the token.

The tricky part is calculating the size of the community: Should we look at the number of fans on X platform, the trending topics on X, or the number of Reddit subscribers and posts?

Some communities are hard to identify because they communicate in different languages or on different channels, like Korean users discussing XRP on local forums.

Kaito's concept of "Mindshare" is an excellent indicator, but the Loudio experiment shows that having a large mindshare does not necessarily mean a real community has been built.

https://x.com/DefiIgnas/status/1929511567768363174

To identify a real community, especially in the early stages, the best approach is to immerse yourself: buy tokens or NFTs, join Discord or Telegram groups, and observe who is discussing it on X (non-paid promotions). If you feel a genuine sense of belonging and connection, that is a strong bullish signal.

In my view, Hyperliquid is the fastest-growing community. Attacks on HYPE from Binance and OKX have instead strengthened its cohesion, giving the community a mission and purpose to support the team and protocol. Hyperliquid has become a movement.

https://x.com/DefiIgnas/status/1904923406325473286

I believe innovation and community are the most important factors, so I assign a weight of 1.5 to both.

Like innovation, I have included the same simplicity variable in the community factor: the simpler the narrative, the easier it is to spread.

Memecoins (like PEPE) are easy to understand, while Hyperliquid, though not as simple, has still successfully united a community.

Runes and Ordinals both brought technological innovation (allowing the issuance of fungible tokens on Bitcoin, which was once thought impossible) and have strong communities. But why did prices drop?

Because there is a third factor to consider.

Liquidity

Innovation ignites the narrative, the community builds the story and belief, but liquidity is the fuel that allows you to ride the wave and exit safely at the peak. This is the key to distinguishing between a "sustainable wave" and "being the last bag holder when the music stops."

Casey Rodarmor, the creator of Runes, excelled in building the fungible token model, but perhaps he should have also built an AMM pool similar to Uniswap on Bitcoin to maintain the heat of Runes.

Runes Memecoin struggles to compete with Solana or Layer2 Memecoins because they lack passive liquidity pools. In fact, Runes is more like an NFT traded on Magic Eden: while there is decent buy-side liquidity, there is insufficient sell-side liquidity for large exits. Low trading volume fails to incentivize listings on top-tier CEXs.

NFTs also face liquidity issues. That is why I once had high hopes for the ERC404 NFT fragmentation model, which could have provided passive sell-side liquidity and annual yields through trading volume. Unfortunately, it failed.

I believe liquidity is the main reason why DeFi options have struggled to rise for years.

https://x.com/kristinlow/status/1929851536965873977

In the recent market volatility, I wanted to hedge my portfolio with options, but the on-chain liquidity was terrible. I had high hopes for the crypto options platform Derive, but its future is now filled with uncertainty.

Liquidity does not only refer to deep order books, continuous inflows of new funds, CEX listings, or high locked value (TVL) in liquidity pools, although these are important. The liquidity in the formula also includes protocols that achieve exponential growth with increasing liquidity or projects with built-in liquidity guiding models, such as:

Hyperliquid: More liquidity means a better trading experience, attracting more users, which in turn brings more liquidity.

Velodrome's ve3.3 DEX: Building liquidity through bribery mechanisms.

Olympus OHM: Protocol-owned liquidity.

Virtuals DEX: Pairing the release of new AI agents with VIRTUAL tokens.

Tokenomics

Tokenomics is as important as liquidity. Poor tokenomics can lead to sell-offs. Even with deep liquidity, the continuous selling pressure from unlocks poses a significant risk.

Good examples: High circulation, no large VC/team allocations, clear unlock plans, burn mechanisms (like HYPE, well-designed fair launches), etc.

Bad examples: Malicious inflation, large cliff unlocks, no revenue (like some Layer2 projects).

A narrative with an innovation score of 10/10 but a tokenomics score of 2/10 is a ticking time bomb.

Incentive Mechanisms

Incentive mechanisms can make or break a protocol, or even an entire narrative.

The restaking narrative relies on the performance of Eigenlayer, but a failed token issuance (possibly due to a complex narrative or weak community) has stalled that narrative.

Assessing liquidity in the early stages of a narrative is challenging, but innovative incentive mechanisms help build liquidity.

I am particularly interested in new token issuance models. If you have read my previous articles, you will understand what I mean: when tokens are issued in innovative ways, the market often undergoes a transformation.

BTC hard forks → Bitcoin Cash, Bitcoin Gold

ETH → Ethereum Classic

Initial Coin Offerings (ICOs)

Liquidity mining, fair launches, low circulation with high fully diluted valuation (FDV, suitable for airdrops but detrimental to secondary markets)

Points narratives

Pump.fun

Private-public sales on Echo/Legion

As the market changes, token issuance and incentive mechanisms also evolve. When an incentive model is overused and its patterns are widely known in the market, it indicates that the market has entered a saturation phase and a peak of speculation.

The latest trend is cryptocurrency treasuries. Publicly traded companies are buying cryptocurrencies (BTC, ETH, SOL), and their stock valuations exceed the value of the cryptocurrencies they hold.

What is the incentive mechanism here? Understanding this is crucial to avoid becoming a bag holder.

Market Environment

The best narratives launched in a brutal bear market or during macro risk events (like the early tariff wars) can also be drowned out. Conversely, in a liquidity-rich bull market, even ordinary narratives can soar.

The market environment determines the following multipliers:

0.1 = Brutal bear market

0.5 = Range-bound market

1.0 = Bull market

2.0+ = Parabolic frenzy

Case in point: Runes (April 2024) had innovation, community, initial liquidity, and some incentive mechanisms, but its launch coincided with a significant market correction after the Bitcoin halving hype faded (market environment multiplier ~0.3). The result: mediocre performance. If it had launched three months earlier, it might have performed better.

How to Use the Formula

Score each factor on a scale of 1-10:

Innovation: Is it a breakthrough from 0 to 1? (Ordinals: 9, Memecoin: 1-3)

Community: Are they true believers or speculators? (Hyperliquid: 8, VC-led projects: 3)

Liquidity: How is the market depth? (Quickly listed on top-tier CEX: 9, trading like NFTs Runes: 2)

Incentive Mechanism: Is it attractive and sustainable? (Hyperliquid airdrop: 8, no incentives: 1)

Simplicity: Can it form a meme? ($WIF: 10, zkEVM: 3)

Tokenomics: Is it sustainable? (BTC: 10, 90% pre-mined: 2)

Market Environment: Bull market (2.0), bear market (0.1), neutral (0.5-1)

Scoring is subjective. I gave Runes an innovation score of 9, but you might give it a 5. This formula is merely a suggestion of factors to consider.

Calculating for Runes as an example:

Innovation = 9, Community = 7, Liquidity = 3, Incentive Mechanism = 3, Simplicity = 5, Tokenomics = 5, Current Market Environment = 0.5

Plugging into the formula:

1.5× Innovation × Simplicity = 1.5×9×5 = 67.5

1.5× Community × Simplicity = 1.5×7×5 = 52.5

Liquidity × Tokenomics = 3×5 = 15

Incentive Mechanism = 3

Subtotal = 67.5 + 52.5 + 15 + 3 = 138

Multiply by the market environment (0.5):

Runes narrative score = 138×0.5 = 69

In contrast, Memecoin scores higher in my subjective assessment (116 points):

Innovation = 3 (due to the innovative issuance model of Pump.fun, not a complete zero)

Community = 9

Liquidity = 9 (integrated AMM, high trading volume = high LP yields, CEX listings)

Incentive Mechanism = 7

Simplicity = 10

Tokenomics = 5 (100% circulation upon issuance, no VC, but small group risk / speculation, no revenue sharing)

Market Environment = 0.5

Conclusion

Scan narratives early: Use tools like Kaito, Dexuai, etc., to focus on innovation and catalysts.

Score strictly: Assess honestly. Poor tokenomics? In a bear market? Lack of incentives? Market conditions can change at any time, and new native innovations in emerging fields may revive narratives (like Runes' AMM DEX).

Exit before incentive mechanisms decline: Sell at the peak of token releases or when airdrops land.

Respect trends: Do not fight macro trends. Hoard cash in bear markets, deploy funds in bull markets.

Keep an open mind: Try protocols, buy popular tokens, participate in community discussions… Learn through practice.

This is just my 1.0 version of the formula, and I will continue to refine it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。