The great power competition has not yet begun.

Author: Lu Aifang

On June 5, Circle, the issuer of the world's second-largest stablecoin USDC, went public on the New York Stock Exchange, with its stock price soaring 168% on the first day, becoming the new darling of the capital market.

Just at the end of May, the United States and Hong Kong passed stablecoin legislation, proposing clear regulatory policies for stablecoins, giving fiat-backed stablecoins, which have long existed in a gray area, a chance to gain legal status and integrate with traditional finance.

Marginalized stablecoins have finally gained acceptance in mainstream society, rightfully stepping onto the global economic stage; the era of stablecoins has truly arrived!

This article will discuss: What is the current development status of global stablecoins and the reasons for their rapid rise? What are the differences between the two stablecoin bills in the United States and Hong Kong, and what development ideas do they reflect? How will they compete?

An important metric for measuring stablecoins is trading volume, but different institutions report varying data:

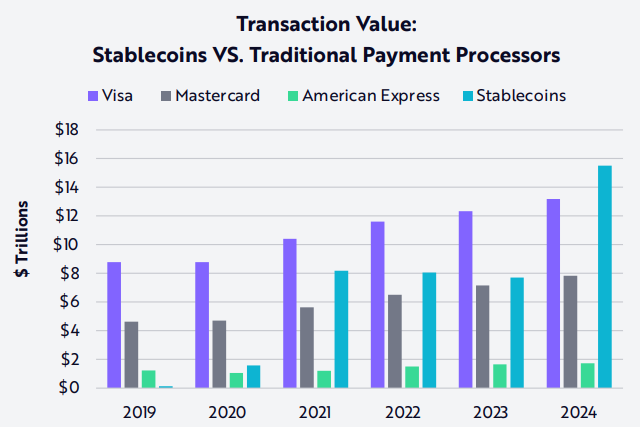

ARK Invest's "Big Ideas 2025" report released in February this year shows that the total trading volume of stablecoins will reach $15.6 trillion in 2024, which is 119% and 200% of the trading volumes of Visa and Mastercard, respectively.

However, the head of Visa mentioned in a public speech that Visa's trading volume for 2024 is projected to be $16 trillion, which at least suggests that the trading volume of stablecoins is already comparable to that of Visa.

Additionally, a joint report released by analysis firms Dune and Artemis indicates that from February 2024 to February 2025, the total trading volume of stablecoins will exceed $35 trillion. However, if we exclude wash trading and bot activity, the stablecoin trading volume is $5.6 trillion, close to 40% of Visa's trading volume.

Regardless of which set of data is considered, it is sufficient to prove the rapid development of stablecoins. After all, it has only been ten years since Tether invented the world's first dollar-pegged stablecoin, USDT. In contrast, Visa, as a global payment network, has been established for nearly 70 years, with over 20,000 partner banks worldwide.

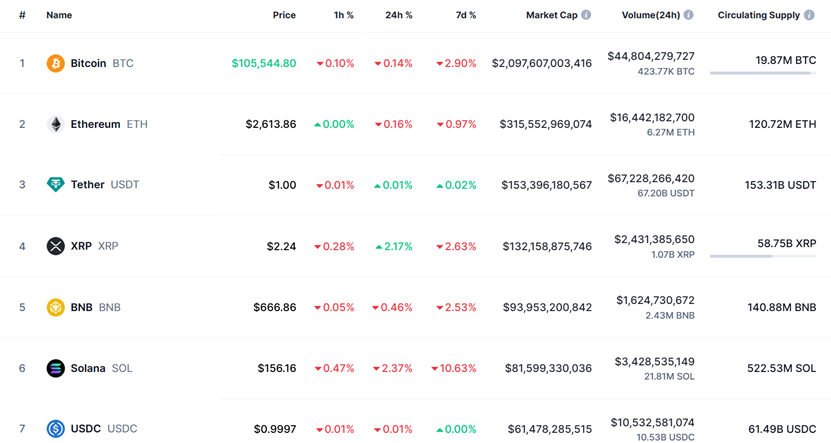

USDT is currently the largest stablecoin in the world and the third-largest cryptocurrency, following Bitcoin and Ethereum. As of June 4 at 11 AM, the global circulation of USDT was $153.3 billion, with a trading volume of $67.2 billion in the past 24 hours, ranking first among cryptocurrencies.

USDT can be described as a money-printing machine, with fewer than 200 employees and projected profits of $13.7 billion in 2024. However, it has been controversial due to the lack of transparency regarding its reserve assets and the absence of audits.

The second-largest stablecoin is the newly listed USDC issued by Circle, with a global circulation of $61.5 billion and a trading volume of $10.5 billion in the past 24 hours, ranking seventh among cryptocurrencies.

USDC has consistently followed a compliance route, using US dollars and US Treasury bonds as reserve assets, and adheres to KYC, anti-money laundering, and auditing regulations, but its profitability is far inferior to that of USDT. Circle's revenue in 2024 is projected to be $1.676 billion, with a net profit of $156 million, while it was still operating at a loss in 2021-2022.

USDT and USDC together occupy 95% of the stablecoin market, while other fiat-backed stablecoins lag significantly behind, including:

USD1 issued by the Trump family in April this year, with a circulation of $2.18 billion and a trading volume of $219 million in the past 24 hours.

FDUSD issued by Hong Kong's First Digital in July 2023, with a circulation of $1.59 billion and a trading volume of $4.59 billion in the past 24 hours.

PYUSD launched by PayPal at the end of 2023, with a circulation of $979 million and a trading volume of $8 million in the past 24 hours.

A report by Investing.com in 2025 pointed out that the number of active on-chain addresses for stablecoins has exceeded 300 million, indicating that stablecoins have deeply integrated into the global financial system.

What accounts for the rapid rise of stablecoins? Here’s a true story to help you understand the value of stablecoins for ordinary people: A few years ago, during the civil unrest in Lebanon, the government imposed financial controls, allowing people to withdraw only $200 from banks each day. Some individuals, needing large sums of money for family emergencies, were forced to hold guns to demand their own money from banks.

Your money in the bank is just a number; to use it, you need the bank's permission. This is a flaw of traditional finance, while cryptocurrencies exist on-chain, allowing for free access anytime as long as there is internet access. This is one of the attractions of stablecoins.

What other benefits do stablecoins offer? In countries like Argentina and Nigeria, where inflation rates soar to tens or even hundreds of percent, currency can become worthless overnight. For locals, holding dollar-pegged stablecoins is one of the options to combat inflation and devaluation.

In fact, in Latin America, stablecoins have become a primary currency for everyday payments and savings. In the projected $30 trillion trading volume of stablecoins in 2024, Latin America accounts for about 10%, reaching $3 trillion.

Another important reason for the rise of stablecoins is cross-border payments. Traditional cross-border remittances go through SWIFT, which is time-consuming and costly. In contrast, stablecoins facilitate peer-to-peer transactions without intermediaries, significantly reducing costs. For example, cross-border payments through Visa typically take 1-3 days and incur an average fee of 6.35% of the transaction amount. In contrast, USDC transactions settle in seconds, with fees as low as 0.1%-0.3%.

Sub-Saharan Africa and Latin America have become the main regions for stablecoin remittances.

Research by Chainalysis found that in Ethiopia, where strict capital controls are in place, demand for USDC and USDT surged after the local currency depreciated in 2023, with an annual growth rate of 180% for retail stablecoin transfers.

From July 2023 to June 2024, Latin American countries received a total of $415 billion in cryptocurrency, a year-on-year increase of about 42.5%. In Mexico, over $60 billion in remittances from the United States are received annually, with the scale of stablecoin remittances growing increasingly larger. Some institutions predict that in the next 3-5 years, about 30% of remittances from the U.S. to Mexico will be completed through stablecoins.

A very important trend is that to reduce the costs of cross-border payments, more and more businesses in Latin America and Africa are using stablecoins. In Brazil, the proportion of businesses using stablecoins for cross-border payments has significantly increased, with large transactions over $1 million growing by about 29% by the end of 2023.

Some institutions predict that by the end of 2026, the trading volume of stablecoins for use cases such as trade finance and payment processing will reach $1 trillion, accounting for over 1% of the global cross-border B2B payment market.

Moreover, with the rapid development of AI, stablecoins, as programmable currencies, will further reshape payments and finance with the support of AI. In future global economic activities, stablecoins will play an increasingly important role. For this reason, stablecoins have also become the focus of innovation, regulation, and geopolitical competition among countries.

In 2024, the European Union will begin implementing the Markets in Crypto-Assets Regulation (MiCA), prohibiting the issuance or provision of stablecoins in the EU without authorization. The stablecoin bills in the United States and Hong Kong propose more specific regulatory measures for stablecoins.

The similarities are that both regions require stablecoin issuers to maintain a 1:1 peg to fiat currency, publicly disclose the composition of reserve assets monthly, and undergo audits; both also require strict compliance with anti-money laundering (AML) and know your customer (KYC) requirements.

The differences are: 1. The U.S. is stricter: For dollar-pegged stablecoins that do not hold U.S. Treasury bonds as reserve assets or do not comply with U.S. AML/KYC regulations, the U.S. government will establish a non-compliance list and restrict trading in the U.S. market.

In 2024, the North American market will account for 40% of stablecoin trading volume, making this restriction quite impactful. The most affected will be USDT, as 2024 may be Tether's most profitable year, given that upcoming compliance will significantly increase its costs.

Hong Kong's focus is on regulating Hong Kong dollar-pegged stablecoins; any stablecoin linked to the Hong Kong dollar, whether in Hong Kong or abroad, will fall under regulation. However, it is more lenient towards non-Hong Kong dollar stablecoins: in the Hong Kong market, applying for a license from the Financial Management Authority allows them to be offered to retail investors, while unlicensed offerings can only be made to institutional investors.

Hong Kong requires stablecoin issuers to have a registered capital of no less than HKD 25 million, while the U.S. does not have a specific capital requirement but must meet bank-level regulatory standards, which is extremely disadvantageous for small and medium-sized issuers considering compliance costs.

Hong Kong places greater emphasis on protecting investor interests, instituting mandatory redemption provisions.

The stablecoin legislation reflects the differing strategic visions of China and the U.S.: the U.S. views stablecoins as an extension of dollar hegemony in the virtual world, linking dollar-pegged stablecoins to the U.S. dollar to reinforce the dollar's status as the global reserve currency and ensure that stablecoins become "U.S.-centric" global financial tools.

The requirement for reserve assets for stablecoins has increased the demand for U.S. Treasury bonds. On May 23, U.S. Treasury Secretary Janet Yellen candidly stated in a media interview: "Stablecoins could increase the demand for $2 trillion in Treasury bonds and short-term Treasury bills in the short term; as a reference, this number is currently about $300 billion."

While China has strictly prohibited cryptocurrencies on the mainland, it is using Hong Kong as a testing ground for stablecoin innovation, actively exploring and laying out stablecoin strategies. The Hong Kong dollar-pegged stablecoin serves as infrastructure for developing the Web3 ecosystem in Hong Kong and aims to bypass the traditional financial system dominated by the West to establish new payment channels.

Alongside stablecoin legislation, the Hong Kong Monetary Authority launched a stablecoin sandbox program in March 2024, with six companies including JD Technology, Yuan Coin, and Standard Chartered Bank participating. Currently, these projects are still in the sandbox testing phase, and the trading volume of Hong Kong dollar-pegged stablecoins remains limited, with USDT and USDC still dominating the market.

Moreover, stablecoins are just one part of Hong Kong's Web3 ecosystem. On October 31, 2022, the Hong Kong Financial Secretary released a policy declaration on the development of virtual assets in Hong Kong, demonstrating the goal and determination to make Hong Kong a global Web3 capital. Over the past few years, the Hong Kong government has been quietly focused on building this vision.

2023:

Hong Kong issued the world's first tokenized government green bond;

The Hong Kong government allocated HKD 50 million (approximately $6.4 million) to develop the Web3 ecosystem, supporting certain enterprises, technology research and development, and community activities.

The Securities and Futures Commission officially implemented a regulatory framework for virtual asset trading platforms, with platforms like HashKey receiving licenses, increasing the number of compliant exchanges.

2024:

The Hong Kong Stock Exchange listed six virtual asset spot ETFs in Asia, including Bitcoin and Ethereum ETFs, making it the largest in Asia.

The Securities and Futures Commission approved seven virtual asset trading platforms (including OSL, HashKey, HKVAX, etc.) and expanded regulation to include virtual asset over-the-counter (OTC) trading, custody services, and staking.

The Monetary Authority launched the "Ensemble" tokenized asset sandbox project to support real-world asset (RWA) tokenization experiments, attracting institutions like Ant Group and Standard Chartered Bank to participate.

Efforts are being made to promote collaboration between public chain platforms like Zetrix and Web3Labs, Summer Capital to advance blockchain infrastructure development and support government and enterprise-level applications.

2025:

The Securities and Futures Commission released the "ASPIRe" roadmap, focusing on market access, protective measures, products, infrastructure, and relationships, aiming to promote transparency in the Web3 market through information disclosure and simplified securities issuance processes.

Hong Kong will host the "Consensus Hong Kong 2025" conference, focusing on the integration of AI and Web3, exploring emerging fields such as decentralized AI networks and AI agent platforms, attracting Web3 practitioners globally.

Hong Kong's Cyberport has attracted over 270 Web3 demand enterprises, covering blockchain gaming, DeFi, infrastructure, and decentralized science (DeSci).

The Monetary Authority is deepening the e-HKD policy, exploring cross-chain payments and cross-border trade applications of central bank digital currencies and Web3.

Although Hong Kong has not yet achieved dazzling results in building a Web3 capital, it has largely completed its layout and has a clear roadmap.

Overall, the U.S. seeks financial hegemony in the virtual world, while Hong Kong's strategic focus is on the Web3 industry, with the Hong Kong dollar-pegged stablecoin still in its infancy. The great power competition has not yet begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。