Has the Ethereum Foundation Finally Woken Up?

On June 2, the Ethereum Foundation (EF) announced a change in the operational approach of its internal protocol research and development team, renaming the original R&D team "Protocol R&D" to simply "Protocol." It also stated that "some members of PR&D will no longer continue to work at the Ethereum Foundation" — the Ethereum Foundation has begun layoffs.

According to the details released in EF's announcement, the goal of this restructuring is to make the team more focused and efficient. Additionally, the announcement mentioned that while some employees are being laid off, the foundation encourages them to continue contributing to the Ethereum ecosystem.

How Did It Come to Layoffs?

The Foundation's Controversial Moves Have Left the Community Unhappy

The layoffs at the Ethereum Foundation may not come as a surprise to anyone.

As early as March, the Ethereum Foundation underwent a "leadership change." The controversial executive director of the Ethereum Foundation, Aya Miyaguchi, was promoted to chair of the EF after serving for seven years, moving from a position of real power to a "figurehead" role.

The leadership change at EF sparked discussions in the market at the time: the market generally believed that Aya's departure from a position of power was the first step for EF to move from being theoretical to practical. (See the Deep Tide TechFlow article: Where Will the Ethereum Foundation Go After the Power Transition?)

Over the past year, dissatisfaction with EF has been building up in the market. In addition to the continuous selling of $ETH, various actions by the foundation have repeatedly become the focus of market attention.

After the Cancun upgrade in March 2024, transaction fees for Layer 2 were significantly reduced. Technically, this is an absolute good thing, but data from Token Terminal shows that shortly after the Cancun upgrade, Ethereum Layer 1 network revenue dropped by 99% in the summer of 2024. Ethereum, which has not balanced technological advancement with the economic health of the ecosystem, has greatly disappointed investors and the community.

In May 2024, a major scandal broke involving the EF, as several central members of Ethereum were found to have connections with the EigenLayer Foundation. Senior researchers at the Ethereum Foundation, Justin Drake and Dankrad Feist, both served as paid advisors to EigenLayer and received millions of dollars in token incentives. This collaboration, which has obvious conflicts of interest, has sparked ongoing controversy within the community, making it difficult to predict the impact of introducing EigenLayer's proof-of-stake protocol into Ethereum on the entire ecosystem. Some community members lamented, "Foundation members have staked themselves again." It wasn't until November of the same year that Justin Drake and Dankrad Feist announced their resignation from their advisory roles at EigenLayer.

In August 2024, the lack of transparency regarding the Ethereum Foundation's expenditures once again became a focal point of public concern. On August 24, it was revealed that the Ethereum Foundation transferred 35,000 $ETH (worth $94 million at the time) from the foundation's treasury to the Kraken exchange. Even though the then-executive director Aya clarified that the transfer of funds was part of the foundation's "normal financial management" activities and did not necessarily "equate to a sale," the lack of notification and "no comment" attitude still sparked dissatisfaction among most people. Coupled with the foundation's ongoing practice of publicly selling $ETH to cover its operational costs, it inevitably led to a plummeting impression of the foundation in the market.

Ethereum Has Become Too Detached from the Community

In addition to various unsatisfactory actions such as selling off assets, scandals, and lack of transparency, the direction of the Ethereum Foundation itself has also been disappointing.

In this cycle, the price of $ETH has disappointed almost everyone. The slogan "BTC breaks 100,000, ETH breaks 8,000" has embarrassingly only achieved half of its promise, which is closely related to the development direction of the Ethereum Foundation in recent years. The overly idealistic vision and style of the foundation's leadership may support the realization of a small portion of people's visions, but for the community and the market, this construction of castles in the air cannot sustain itself.

X user Chen Jian Jason (@jason_chen998) mentioned in a tweet: "The early OGs of Ethereum have reaped too many benefits, showing no signs of financial hunger. In fact, anyone who expresses a desire to make money is looked down upon and rejected by others. This atmosphere, top-down, has made the entire Ethereum ecosystem's developers very 'halal.' Yes, that word makes my head hurt every time I hear it with those halal folks."

The ongoing internal issues and external dissatisfaction have persisted into this year, and with the market seemingly not optimistic about further price increases, the Ethereum Foundation may finally be feeling the pressure.

This round of layoffs may be a preliminary treatment for the long-standing ailments of the Ethereum Foundation.

Is the Project Team Taking Action?

A New Pragmatic Strategy

Returning to the Ethereum Foundation's new resolution, the core logic of the entire plan is very clear: less research, more delivery.

Not only are they laying off (possibly) those who have been engaged in theoretical research without practical results, but they are also increasing accountability mechanisms and making ecological development KPI-driven. In the future, the focus will primarily be on the following three strategic directions:

Scaling Ethereum's Base Layer: Improving the performance and throughput of the mainnet.

Expanding Blobspace for Rollups: Increasing the data space required for Rollups to support the development of Layer 2 solutions.

Improving User Experience: Optimizing the usability and accessibility of the Ethereum network.

Regardless of how the implementation progresses in the future, this strategy finally presents a problem-solving orientation, with "pragmatism" having a concrete manifestation. (Note: Especially regarding the performance improvement of the Ethereum mainnet, the last time Binance Alpha launched $PFVS airdrop, the mainnet transaction fees skyrocketed to $70-80 per transaction, which was quite embarrassing.)

Vitalik Starts Buying Coins, Foundation Seeks Investors

On June 4, according to Decrypt, Consensys CEO and Ethereum co-founder Joe Lubin revealed that the company is in talks with a "major power" sovereign wealth fund and bank about the possibility of building infrastructure in the Ethereum ecosystem.

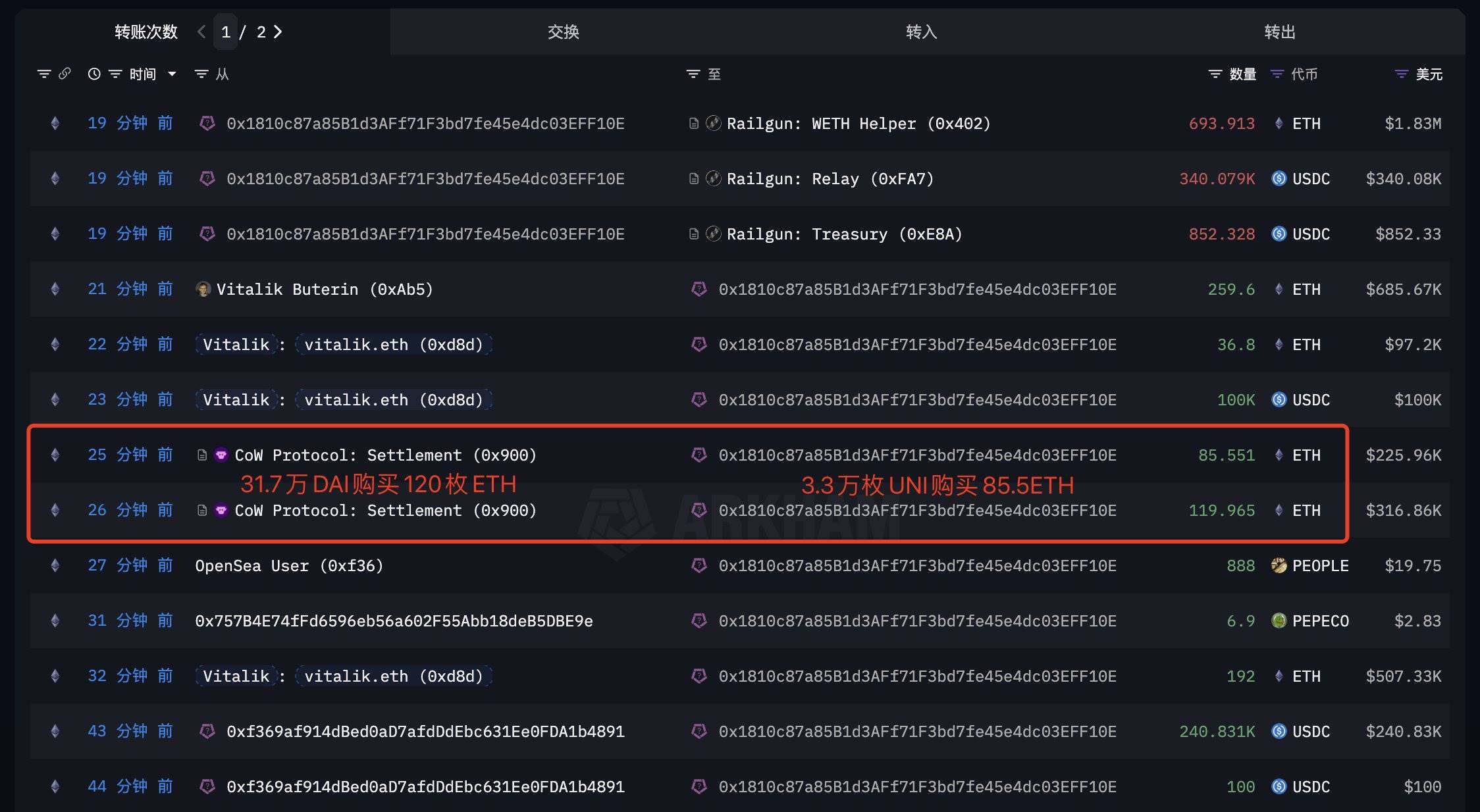

On the same day, X user Yu Jin (@EmberCN) reported that Vitalik Buterin @VitalikButerin actively used 317,000 DAI + 33,000 $UNI to purchase 205.5 $ETH and transferred a total of 693.9 ETH ($1.83M) and 340,000 USDC through the 0x1810 address using Railgun.

Facing the Future, Ethereum Still Has More Problems to Solve

Whether it is the foundation's self-rescue or the inevitable result of the Ethereum Foundation's impractical development, this restructuring reflects that pragmatism has become the foundation for various projects moving into the future. Even a large entity like Ethereum cannot escape the law that castles in the air will eventually collapse, let alone the various public chains and applications with less solid follower bases. The latest strategy clarifies the foundation's own attitude and development direction, but whether it can be executed effectively remains the most critical step.

Moreover, while emphasizing pragmatism, finding a balance between transparency in information disclosure and the decentralized development philosophy versus centralized management remains an unavoidable issue in the development of the Ethereum ecosystem.

To change the market's attitude, in addition to price increases, Ethereum may also need to undergo profound "surgical procedures" repeatedly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。