For companies that are heavily reliant on debt, there is a greater systemic threat.

Written by: Breed Investment Partner Nick D. Garcia

Translated by: BitpushNews

Key Points

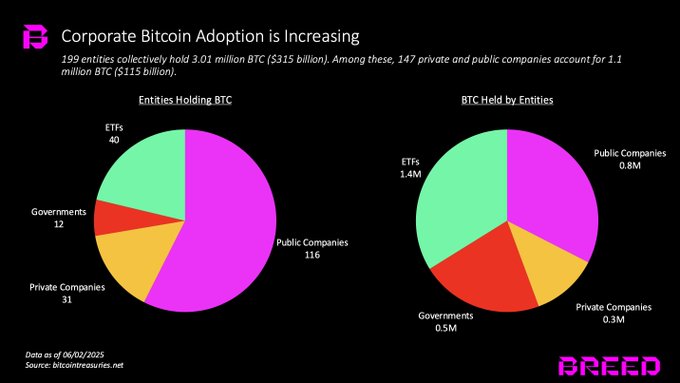

The next phase of Bitcoin's development has arrived: companies are adopting Bitcoin on their balance sheets. As of May 2025, a total of 199 entities hold 3.01 million BTC (approximately $315 billion), and this number continues to grow rapidly.

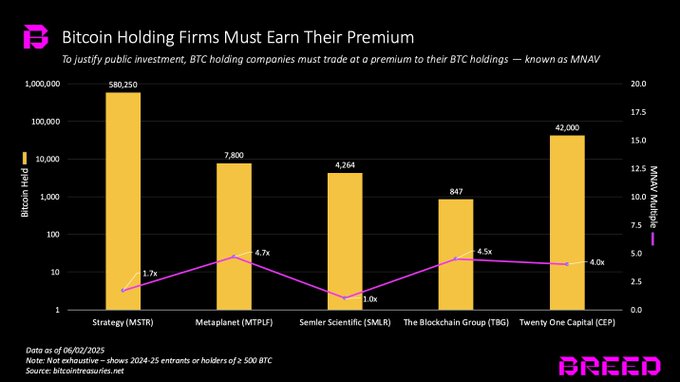

Companies that primarily hold Bitcoin will be viewed as Bitcoin holding companies, with valuation methods similar to the largest Bitcoin company, Strategy. To survive, these companies must pay attention to a key premium indicator, the "Multiple on Net Asset Value" (MNAV) — this is the most critical metric.

The MNAV premium depends on the market's trust in the core team and their execution capabilities. These teams must execute Strategy's strategy: increasing the per-share Bitcoin holdings through debt financing, stock issuance, and cash flow reinvestment. Currently, new entrants are expanding this approach.

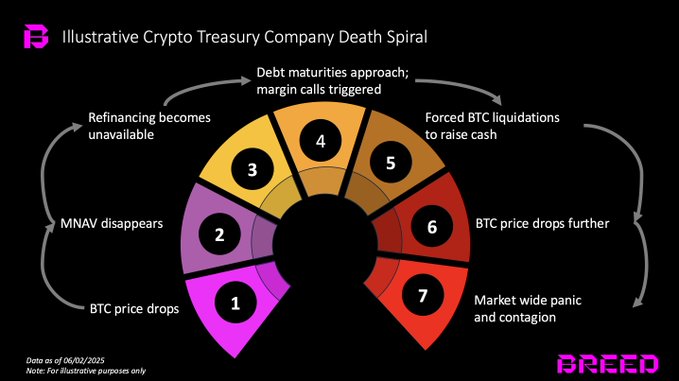

The biggest threat is a prolonged bear market that weakens the MNAV premium, coinciding with debt maturities. Newly established Bitcoin treasury companies face greater risks because they have stricter conditions for capital raising and higher leverage.

Once failures begin to emerge in the industry, the strongest players may acquire struggling companies and consolidate them. Fortunately, since most financing is equity-based, contagion risk is limited; however, companies that are heavily reliant on debt pose a greater systemic threat.

A New Phase: Companies Competing to Adopt Bitcoin

We have witnessed the rise of Bitcoin in recent years. Not only has the price increased, but its adoption and recognition have also crossed a chasm. Key milestones include:

In September 2021, El Salvador recognized Bitcoin as legal tender;

In January 2024, BlackRock launched the IBIT ETF;

The U.S. President has made Bitcoin a strategic economic focus;

And in the summer of 2025, the adoption of Bitcoin on corporate balance sheets surged.

According to data from Bitcointreasuries.net, there are currently 199 entities holding a total of 3.01 million BTC (worth $315 billion). Among them, 147 private and public companies hold 1.1 million BTC (worth $115 billion).

Recently, a wave of companies announced new Bitcoin treasury strategies. These companies include those diversifying their balance sheets and those specializing in Bitcoin treasury management, covering different countries and industries, and led by trusted teams.

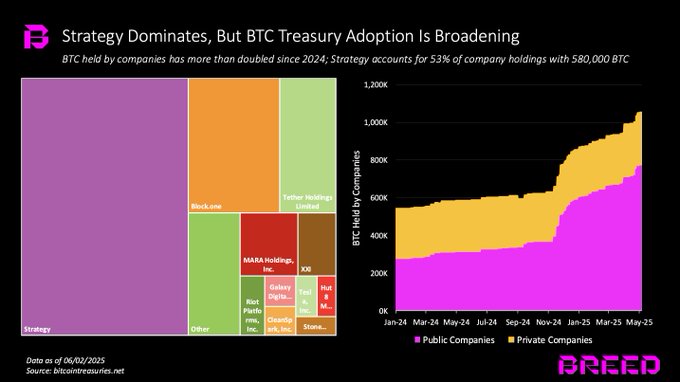

Since the beginning of 2024, the amount of Bitcoin held by companies has more than doubled. Strategy holds over 580,000 BTC, accounting for 53% of total corporate holdings. Other companies holding more than 10,000 BTC include:

Block.one (164,000 BTC)

Tether (100,500 BTC)

MARA Holdings (49,140 BTC)

Twenty One (31,500 BTC)

Riot Platforms (19,200 BTC)

Galaxy Digital (12,800 BTC)

CleanSpark (12,100 BTC)

Tesla (11,500 BTC)

Hut 8 (10,300 BTC)

With its scale, reputation, and counter-cyclicality, Strategy is essentially destined to continue being the leader among Bitcoin holding companies. But more notably, Strategy's model is being imitated. An increasing number of companies are incorporating Bitcoin into their balance sheets, and new companies specializing in Bitcoin treasury management are emerging, which has far-reaching implications for Bitcoin.

Operational Mechanisms and Valuation Methods

Companies that add Bitcoin to their balance sheets while maintaining their core business are still primarily valued based on their main operations. However, once a company's sole purpose is to hold Bitcoin, its valuation will primarily rely on the Bitcoin it holds.

To attract investors to buy their stock instead of directly holding Bitcoin, these companies must achieve excess returns that outperform Bitcoin itself. This excess return is referred to as the "Multiple on Net Asset Value" (MNAV).

For example, Strategy holds 580,250 BTC, valued at approximately $60 billion, while its market capitalization is $104 billion, resulting in an MNAV of 1.7 times.

The fluctuation of MNAV depends on various factors, including company size, market experience, and other businesses. However, the historically maintained 2 times MNAV by Strategy is the long-term gold standard.

The market will not assign an MNAV premium solely because a company holds Bitcoin, provided that investors believe the company's management can consistently and steadily grow the "per-share Bitcoin" quantity.

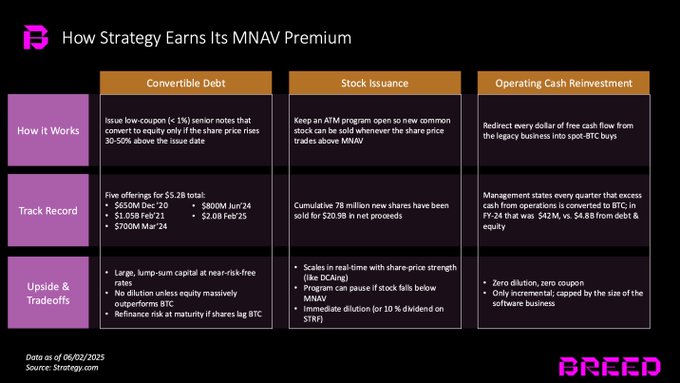

Since 2020, Strategy has demonstrated its capabilities through three capital leverage methods:

Convertible Bonds: Issuing low-interest convertible bonds that only convert to equity when the stock price rises 30-50% above the issue price, allowing for large financing at a lower cost without easily diluting equity.

At-the-Market Stock Issuance (ATM): Continuously issuing new shares through the ATM program when the stock price is above MNAV, effectively using the average cost method to continuously acquire Bitcoin.

Reinvesting Operating Cash Flow: Using all free cash flow generated from traditional business operations to purchase spot Bitcoin.

Latecomer companies are also adopting and innovating this strategy. Some innovative methods include:

Allowing Bitcoin holders to convert to stock through share swaps, avoiding triggering capital gains tax;

Acquiring companies below net cash value and converting their value into Bitcoin;

Acquiring distressed Bitcoin-related litigation claims;

Leveraging media and events to increase influence;

Financing through PIPE (Private Investment in Public Equity);

Utilizing regulatory arbitrage.

Who Are the Participants?

As of the first half of 2025, over 40 companies have publicly announced plans to adopt Bitcoin on their balance sheets, collectively raising hundreds of billions of dollars to execute these strategies. These companies vary in industry, region, execution model, and listing path.

Notable examples include:

Metaplanet (Japan): One of the earliest international participants, leveraging Japan's ultra-low interest rate environment;

Semler Scientific and GameStop (USA): Their Bitcoin treasury strategies have attracted mainstream media attention;

Twenty One Capital: A specialized enterprise supported by Tether and Cantor;

Strive and Nakamoto: Rapidly going public through reverse mergers.

Please refer to the chart above for more companies that have announced Bitcoin treasury strategies as of May 2025.

Is the Model Sustainable?

No strategy in finance is foolproof — Bitcoin treasury companies are no exception.

Strategy faced significant tests during the bear market of 2022-23:

Bitcoin plummeted 80%, the MNAV premium disappeared, and new sources of capital dried up. Nevertheless, the company survived, although Saylor may have experienced some sleepless nights.

The greatest survival risk is a prolonged bear market that erodes the MNAV premium while debts come due. If the stock price falls to or below net asset value, and lenders refuse to refinance, the company may be forced to sell Bitcoin to repay debts — triggering a vicious cycle of price declines and sell-offs.

Newly established treasury companies face higher risks. Without the scale, reputation, and passive index fund flows of Strategy, they have worse financing conditions and higher leverage. In a down market, these structures could quickly trigger margin calls + fire sales of Bitcoin, further exacerbating market declines.

Future Directions

The expansion of Bitcoin treasury companies is still in its early stages; however, this model has begun to extend to other crypto assets —

For example: Solana: DeFi Development Corp (market cap $100 million, holding over 420,000 SOL), Upexi, and Sol Strategies; Ethereum: SharpLink Gaming raised $425 million in financing led by Consensys.

More companies worldwide are expected to adopt this model, covering more assets and using higher leverage in pursuit of success.

Most companies will fail. Fortunately, since most financing is equity-based, contagion risk is lower. But companies that are heavily reliant on debt pose a systemic threat.

Ultimately, only a few companies will be able to maintain the MNAV premium in the long term, relying on strong leadership, rigorous execution, savvy market operations, and unique strategies, enabling them to continuously drive the growth of Bitcoin's per-share value regardless of market fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。