Due to the low correlation of Bitcoin with stocks and bonds, historically, adding it to a portfolio can enhance returns without significantly increasing risk.

Written by: Matt Hougan, Chief Investment Officer of Bitwise

Translated by: AIMan@Golden Finance

Bitcoin is a highly volatile asset. Measured by the most common volatility metrics, its volatility is about three to four times that of the S&P 500 index.

However, this does not mean that adding Bitcoin to a portfolio will significantly increase the portfolio's volatility.

As Bitcoin supporters like me often point out: due to the low correlation of Bitcoin with stocks and bonds, historically, adding it to a portfolio can enhance returns without significantly increasing risk.

A typical way researchers demonstrate this is by taking a traditional 60/40 portfolio (60% stocks, 40% bonds) and gradually reallocating a small portion of funds into Bitcoin.

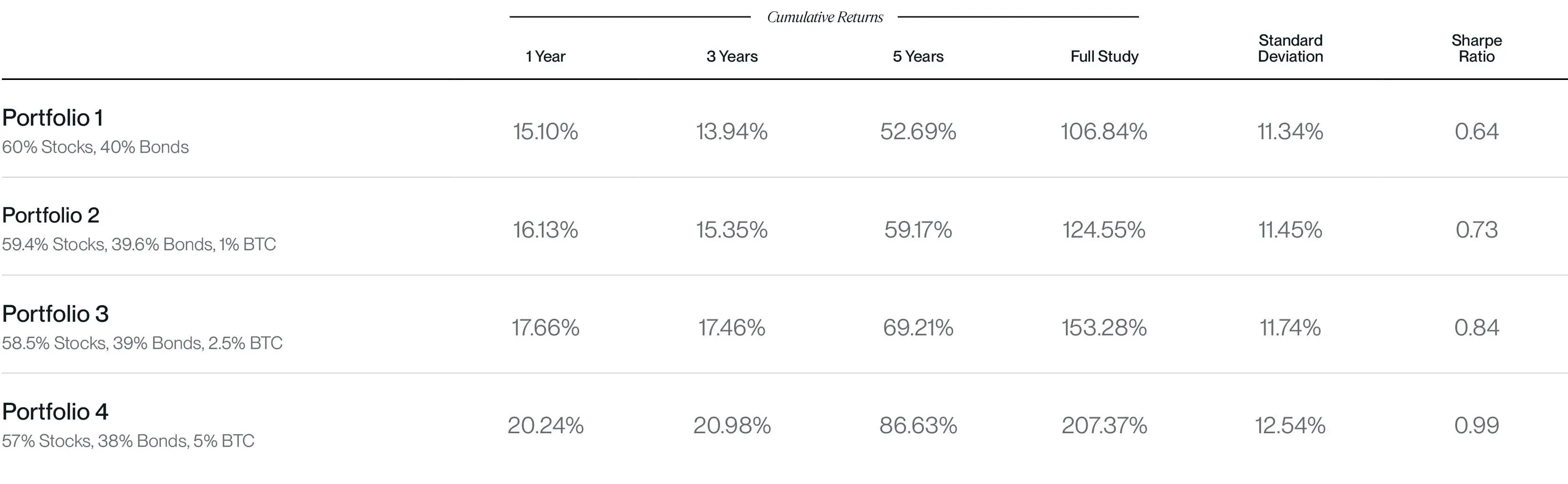

The table below compares the risk and return metrics of portfolios with Bitcoin allocations of 0%, 1%, 2.5%, and 5% from January 1, 2017, to December 31, 2024. I used the free portfolio simulation tool provided in the Bitwise expert portal for the calculations.

Portfolio performance metrics by Bitcoin allocation, source: Bitwise Asset Management, data from Bloomberg. The data range is from January 1, 2017, to December 31, 2024. "Stocks" are represented by the SPDR S&P 500 ETF Trust (SPY). "Bonds" are represented by the iShares Core US Aggregate Bond ETF (AGG). Bitcoin is represented by the spot price of Bitcoin. Taxes or transaction costs are not considered. Past performance is not indicative of future results. Nothing in this article is intended to predict the performance of any investment. The historical performance of the sample portfolio is generated and maximized based on hindsight. Returns do not represent actual account returns and do not include fees and expenses related to the purchase, sale, and holding of funds or crypto assets. Performance information is for reference only.

For example, note that by allocating 5% of funds to Bitcoin, your total return rate increased from 107% to 207% (an increase of 100 percentage points)! Meanwhile, the standard deviation of your portfolio (a measure of its volatility) only slightly increased from 11.3% to 12.5%.

I find this type of research quite compelling. It aligns with the idea that most investors have about allocating Bitcoin. But recently, I've been wondering if there are better methods.

Can you achieve higher returns while reducing risk?

People in the cryptocurrency industry have a secret: their personal portfolios often differ from the ones I listed above. In my experience, cryptocurrency enthusiasts' portfolios tend to be leveraged—having a large allocation to cryptocurrencies, a significant amount in cash (or money market funds), and very little in between. (My portfolio is roughly half cryptocurrencies, half stocks, and cash; I haven't gone crazy enough to suggest others do the same. But hey, let's put it out there.)

Reflecting on this made me think: does it make sense to compensate for the addition of Bitcoin to a portfolio by managing risk elsewhere in the portfolio?

In the example above, we made room for a 5% Bitcoin exposure by proportionally reducing the 60/40 stock/bond portfolio, taking 3% from stocks and 2% from bonds.

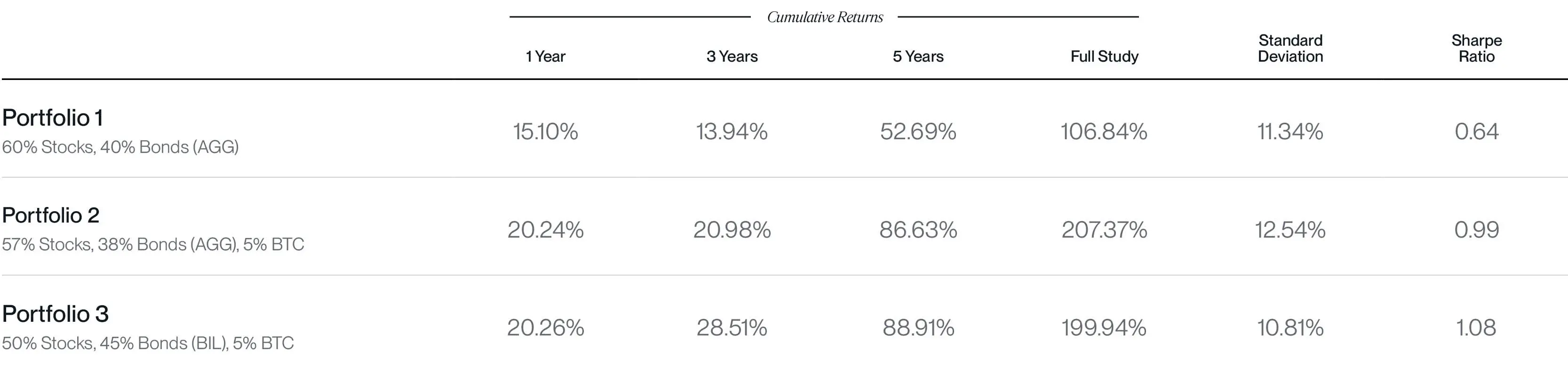

What if we could do the following:

Invest 5% of funds in Bitcoin and increase the bond allocation by 5%, theoretically reducing stock risk;

Rotate exposure from broad bonds to short-term treasuries, theoretically reducing bond risk?

Portfolio 3 shows the results:

Source: Bitwise Asset Management, data from Bloomberg. The data range is from January 1, 2017, to December 31, 2024. "Stocks" are represented by the SPDR S&P 500 ETF Trust (SPY). "Bonds" are represented by the iShares Core US Aggregate Bond ETF (AGG). Bitcoin is represented by the spot price of Bitcoin. Taxes or transaction costs are not considered. Past performance is not indicative of future results. Nothing in this article is intended to predict the performance of any investment. The historical performance of the sample portfolio is generated and maximized based on hindsight. Returns do not represent actual account returns and do not include fees and expenses related to the purchase, sale, and holding of funds or crypto assets. Performance information is for reference only.

Interesting, right? Portfolio 3 has higher returns than Portfolio 1, is roughly the same as Portfolio 2, and has lower risk than both.

This makes you wonder: what if we pushed further?

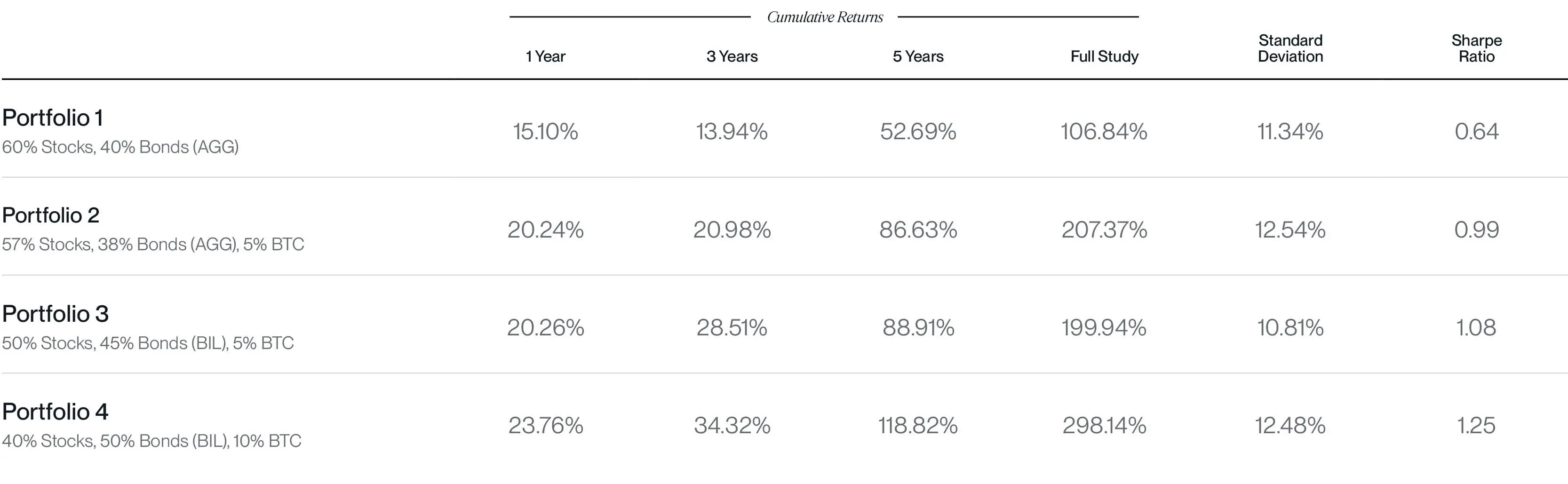

The table below adds a fourth portfolio, reducing stock exposure to 40%, increasing the bond allocation to 50%, and increasing Bitcoin to 10%.

Source: Bitwise Asset Management, data from Bloomberg. The data range is from January 1, 2017, to December 31, 2024. "Stocks" are represented by the SPDR S&P 500 ETF Trust (SPY). "Broad Bonds" are represented by the iShares Core US Aggregate Bond ETF (AGG). "Short-term Treasuries" are represented by the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL). Bitcoin is represented by the spot price of Bitcoin.

Compared to Portfolio 2, you can achieve higher returns with lower risk.

Of course, no one can guarantee that this will continue in the future—Bitcoin's early returns have been outstanding, and future returns may not match those during this study period.

But the data emphasizes one point: when considering adding Bitcoin to a portfolio, do not do it in isolation. Consider it in conjunction with your overall risk budget. You might be surprised by the results.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。