SharpLink的持续扩张策略购买了143,593个以太坊

SharpLink Gaming,第二大以太坊企业持有者,显著增加了其以太坊(ETH)储备,目前总计达到740,760 ETH。这在短短四天内增加了11,956 ETH。该公司的收购包括上周以平均价格4,648美元购买的143,593个代币。

来源:X

截至撰写时,ETH的价格超过4,100美元,因此SharpLink的持有价值超过30亿美元。这一增长巩固了其作为以太坊储备公司中的重要角色,仅次于控制超过150万ETH的BitMine Immersion。

SharpLink的持续扩张策略

SharpLink的ETH积累是近期融资突破的结果。该公司通过市场融资工具筹集了1.465亿美元,并通过注册直接发行筹集了3.9亿美元,该交易于8月11日结束。这些SharpLink的收益预计将使其在以太坊销售中成为更大的参与者。

该公司报告称手头有超过8400万美元的现金。凭借这笔巨额现金,SharpLink可以在未来几天内购买更多的ETH。这一积累似乎是SharpLink在蓬勃发展的以太坊生态系统中建立更大影响力的更大目标的一部分。

詹姆斯·温在以太坊上采取25倍杠杆头寸

与此同时,一位知名投资者詹姆斯·温在任何投资者对加密货币未来升值的信心中开设了25倍杠杆的多头头寸。当温进入时,销售价格为4,227.5美元,头寸面临4,239.5美元。

与可能的利润相比,温所承担的风险相当大,因为市场下跌可能会给他带来无法弥补的损失。目前,该头寸亏损1,342.53美元,证明了该山寨币价格的波动性。这些发展突显了在波动市场中高杠杆交易所带来的风险。

以太坊衍生品市场洞察

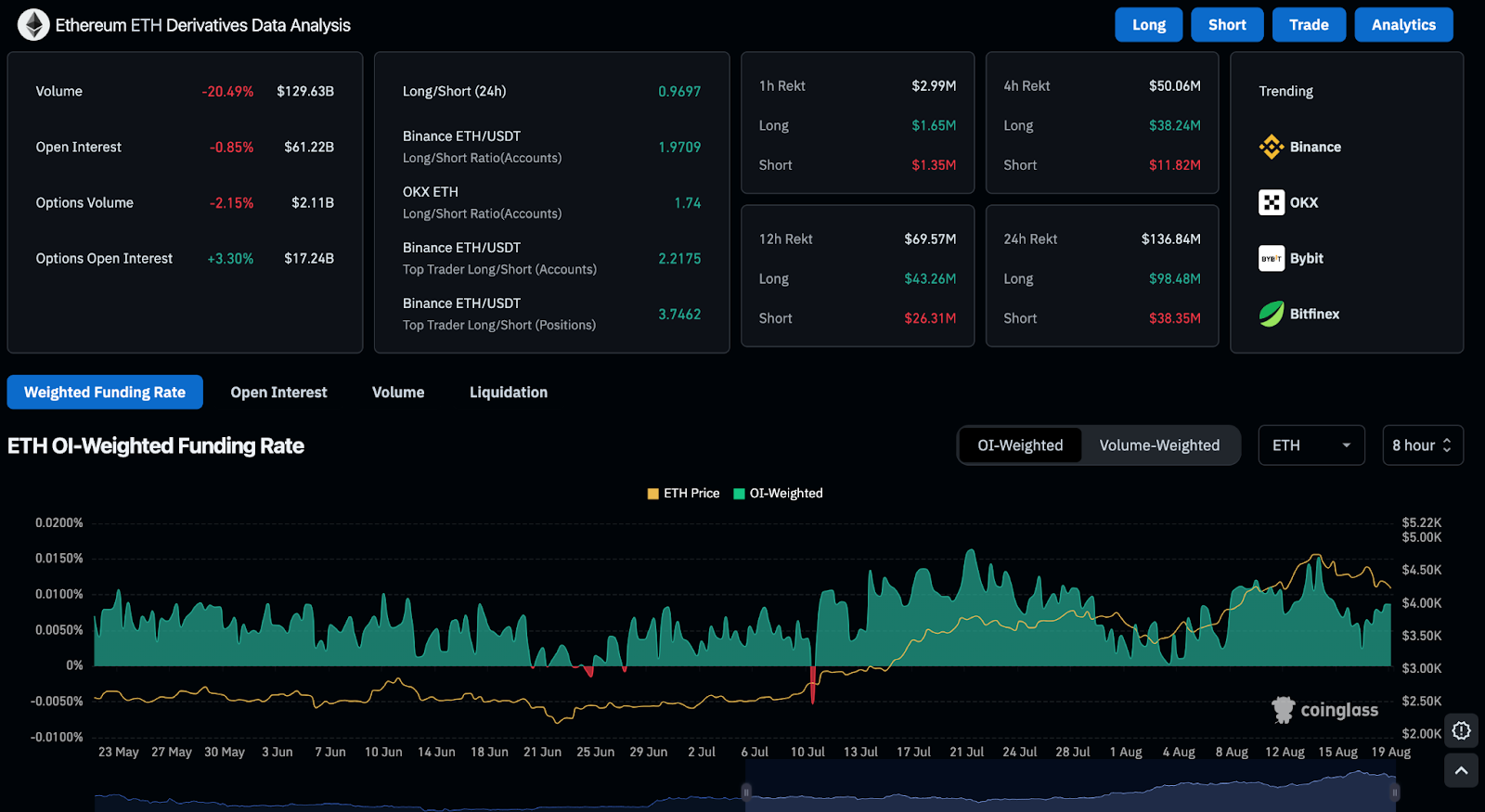

根据CoinGlass的数据,可以明显看出山寨币衍生品市场的整体情绪是中性的。交易量约下降了20.49%,触及1,296.3亿美元。同时,未平仓合约略微下降约0.85%,降至612.2亿美元。

来源:Coinglass

这表明我们正进入一个市场参与度降低的时期,这可能是交易者谨慎情绪的迹象。然而,长期投机头寸的兴趣仍在增长,山寨币期权的未平仓合约上升了3.30%。这表明,尽管短期波动可能构成担忧,但对山寨币的长期看法仍然看涨。

在过去几个月中,山寨币期货合约的资金费率出现波动,正值7月中旬时出现正向峰值。这些正向读数开始减弱,并在8月期间变得相当中性,反映出市场中多头和空头交易者之间的平衡。

在像Binance和OKX这样的主要交易所上,尤其是在1小时到12小时的时间段内,做多的主导地位进一步支持了大多数交易者对以太坊上涨趋势的预期。然而,短期波动性作为一个竞争者则显得尤为突出。

另请阅读: Xenea钱包测验答案2025年8月20日:玩游戏赚取$Gems

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。