The crypto market has no rest button, only a constantly changing narrative rhythm and market testing. As the holiday comes to an end, BlockBeats has compiled noteworthy events and signals to pay attention to during the Dragon Boat Festival.

The "Fleeting Moment" of LOUD Token

The SocialFi project Loudio (LOUD) completed its Initial Asset Offering (IAO) on May 31 through HoloworldAI's HoloLaunch platform, with a total issuance of 1 billion tokens, of which 45% was allocated for this round of crowdfunding, raising approximately 400 SOL. The project was initiated by developer @0x_ultra, who previously participated in the DeFi protocol Jones DAO, and its construction idea heavily relies on Kaito AI's on-chain social scoring system.

What caught the most attention during its initial launch was the extremely low initial Fully Diluted Valuation (FDV) of only $150,000, coupled with a low entry threshold of just 0.2 SOL to participate in the IAO, which sparked significant speculative enthusiasm within the Solana community.

LOUD evaluates the originality and dissemination power of posts on platform X through Kaito AI, returning 72% of transaction fees to the top 25 posters weekly based on a leaderboard, with an additional 18% allocated to KAITO stakers and 10% to the creator fund. To compete for leaderboard positions, some users posted a large volume of homogeneous content on platform X, even using clickbait techniques to attract interactions, which caused some resentment within the community.

As of the time of writing, LOUD's total market capitalization was $6.57 million, down 80% from its market cap peak.

Labubu Craze Sparks Meme Coin Copyright Controversy

During the holiday, the Solana-based meme coin $LABUBU, inspired by the Pop Mart toy IP, saw its market cap surpass $70 million, setting a new historical high.

Looking back at the success of the Labubu token, the most intuitive reason is its IP foundation and the out-of-circle effect of community dissemination. Labubu is a popular toy IP under POP MART, officially recognized by the Tourism Authority of Thailand, and has received multiple endorsements and promotions from celebrities, further enhancing Labubu's global recognition and sparking worldwide enthusiasm. The official promotion and airdrop opportunities were also creatively designed, requiring participants to post cute LABUBU photos and original tweets, encouraging friends to like and retweet, which accelerated Labubu's out-of-circle promotion.

Related: "The New Consensus Among Young People: Labubu, CSGO, and Meme Coins"

Thus, the rise of $LABUBU benefits from Labubu's strong cultural influence as a globally popular IP. However, some in the community have expressed concerns about copyright risks, believing this could limit its long-term development, such as being unable to list on regulated trading platforms.

Entering the "MicroStrategy" Game via Shell Acquisition

Another hot topic during the holiday was SharpLink Gaming, a Nasdaq-listed company aiming to become the Ethereum version of "MicroStrategy." On May 27, SharpLink Gaming announced a $425 million financing agreement through a private equity investment (PIPE), with Consensys Software Inc. as the lead investor, joined by well-known crypto venture capital firms such as ParaFi Capital, Electric Capital, Pantera Capital, and Galaxy Digital, aimed at advancing its Ethereum financial strategy.

Related: "Ethereum Version of 'Strategy Moment'? SharpLink Gaming's $425 Million Bet on ETH Reserves"

Subsequently, SharpLink Gaming submitted Form S-3 ASR to the U.S. SEC and signed an At-the-Market (ATM) sales agreement with A.G.P., allowing it to issue and sell up to $1 billion in common stock through A.G.P. The majority of the proceeds from the issuance will be used to purchase the native cryptocurrency ETH on the Ethereum blockchain, with plans to use the funds for working capital needs, general corporate purposes, and operating expenses.

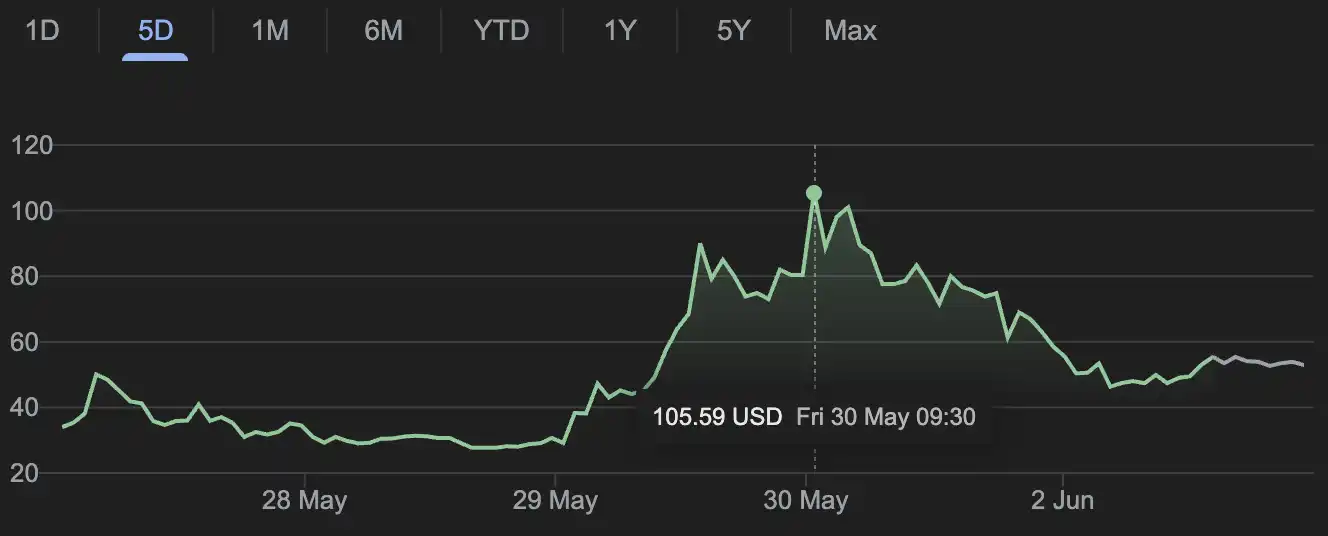

However, on June 2, SharpLink Gaming's stock price fell over 20% in pre-market trading, with a 5-day increase of 1,918.26%.

Whale James Wynn Starts "On-Chain Begging"

On the day before the Dragon Boat Festival holiday, James Wynn was liquidated due to high-leverage BTC long positions, with his $100 million position being forcibly closed. According to Lookonchain data, his cumulative losses reached as high as $9.36 million, with total losses amounting to $17.72 million. Subsequently, James Wynn closed all positions and transferred the last approximately 460,000 USDC from his HyperLiquid account, completely clearing it out.

Just one day after closing his positions, James Wynn redeemed 126,116 HYPE tokens (worth about $4.12 million) that he had previously staked, selling them at an average price of $32.7 to realize a profit of $1.05 million. This transaction was seen as his "last hope," but shortly after, he returned to the battlefield.

On June 2, James Wynn opened another 40x leverage BTC long position, holding 944.93 BTC, with an opening price of $105,890.3 and a liquidation price of $104,580, leaving very little risk space below. As the market fluctuated downward, he continuously supplemented his margin on-chain, adjusting the liquidation price to $104,360 and $104,150, eventually pushing it to around $103,610, leaving only about $20 of space from the actual market price.

As the leverage approached the liquidation threshold, Wynn initiated a fundraising request on social media, publicly stating: "If you want to fight against the market-making group and support me, please transfer USDC to the designated address." He promised that if the trade was successful, he would return the crowdfunding funds at a 1:1 ratio. This move quickly sparked controversy, with even Liangxi expressing in James's comment section that such behavior was "infringement."

Related: "Who is Directing James Wynn's Liquidation?"

Circle Raises Valuation Before IPO

Recently, Circle announced it would expand its Nasdaq IPO scale, raising its valuation from $5.4 billion to $7.2 billion. The company and some shareholders will issue 32 million shares, with a pricing range of $27 to $28 per share, potentially raising up to $896 million. This valuation increase reflects the capital market's high attention to stablecoins and the RWA narrative.

As a result, several on-chain projects have become the focus of capital chasing, mainly including:

ONDO: Collaborating with BlackRock to issue OUSG U.S. Treasury tokens, currently valued at $2.6 billion;

KTA: An RWA project on the Base chain, which has increased over 10 times in recent months;

ENA: A stablecoin sentiment concept stock, already listed for Coinbase;

B: A meme stablecoin on the BSC chain, possibly gaining market attention due to Circle's transfer of USDC to Binance.

Related: "Circle's Upcoming IPO: What Assets Can Be Speculated?"

Circle's IPO is seen as a landmark event for crypto-native enterprises to once again challenge the Nasdaq capital market, following Coinbase and Antalpha. Behind it lies not only the validation of the stablecoin infrastructure business model but also an important signal that the on-chain dollar and RWA narrative have gained mainstream capital recognition once again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。