原文作者:Bright,Foresight News

「我从三月份开始交易合约,在此之前我没有交易过合约,事实上以前也没有真正交易过(任何衍生品),我只是交易 Meme。」

「在一个月内,我把大约 300 万美元变成了 1 亿美元,然后在 HyperLiquid 上一周内全部输掉了。」

「 我只是在做我自己的事情,但人们开始注意到我,我的账户炸开了锅,有几十万粉丝,因为这一切都是链上可追踪的。」

「总之,随着所有这些新的关注,交易失控了。我基本上是在赌博,只是想把失去的收益追回来,同时又不想因为赚了 1 亿美元却又输掉而看起来像个白痴。我变得贪婪了。我没有认真对待屏幕上的数字。」

6 月 6 日,James Wynn 将自己的头像换成了麦当劳版 Wojak。翻译成喜闻乐见的中文就是,我输了,我再次加入了美团大军。至此,James Wynn 已经亏损了超 2000 万美元本金。

仓位与推文时间线梳理

超级「赌狗」James Wynn 对自己的每一单合约都会表态,所以在 HLP 上其地址公开的每一单开关、盈亏,都有 James Wynn 这位当下「市场第一赌狗」的心路历程。

5 月 30 日,James Wynn 在巨额亏损后陷入了「贤者模式」。

在一周内亏损超 9600 万美元,账户整体亏损 1403 万美元后,他在社交媒体上发文表示:「做一个合约赌徒非常有意思,一点也不后悔。把 400 万美元翻到 1 亿美元,再跌回 1300 万美元,真是刺激极了。大多数人不敢或不敢做这种交易。他们做不到,没钱这么做,也没胆量公开承担这种风险。也许下一次我会尝试赚 10 亿美元,我会回来的。」

对此,曾参与爆料 LIBRA 代币内幕的加密 KOL scooter 直接上嘴脸嘲讽道:「James Wynn 就是一个典型的例子,这解释了为什么大多数骗子和 ruggers 最终都会失去一切。他们从未体会过诚实赚钱的价值,也从未真正体会过赚钱需要付出的努力。来得容易去得也容易。」知名交易员 Eugene Ng Ah Sio 也在个人 TG 频道发表了类似的观点,「当你使用了过大的杠杆,easy come easy go」。

5 月 31 日,James Wynn 通过多个地址归集 325 万美元并开多 BTC 和 PEPE,在多轮清算和止损后,其真实仓位价值(非头寸名义价值)仅剩 80 万美元。对此,James Wynn 在社交平台上表示,「我会卷土重来,我喜欢这场游戏。金钱,本质上是一种心态。我依然比 99.9% 的加密推特用户更富有。我下了一个巨大且经过深思熟虑的赌注,目标是赚数十亿美元。我的被动收入每月都比你们大多数人一年赚的还多。」

当日,James Wynn 还发文表示,「1 亿美元并不是很多钱。对那些被枷锁禁锢思维的人来说,也许是。但对一个自由的灵魂而言一切皆有可能,这点钱微不足道。不过是 1 亿美元罢了,金钱世界里的沧海一粟。可笑的是,多少人终其一生都未曾见过甚至听说过这个数字。自由意志比穷鬼思维更重要。」

6 月 1 日,James Wynn 再次发文表示自己将卷土重来,他慷慨激昂道:「你们有些人表现得像神一样,觉得你们会在 1 亿时套现。你们有没有想过,我压根没打算在 1 亿时落袋为安?为什么要落袋?对我来说,要么全赢,要么一无所有。」目前 James Wynn 未持有任何仓位,总亏损达 1772 万美元。

随后,James Wynn 直接发文表示多个 CEX 无故封禁账户,称事件源于其反对腐败、支持去中心化立场。他强调自己从未参与抛压、资金干净,长期专注于链上 meme 币和 HyperLiquid 交易,未接受过代币推广费用或参与拉盘。James Wynn 表示若账户持续被封,将考虑与 Moonpig 团队合作推出新平台反击中心化操控:「我为战争而生,律师准备好,我将公开这场对抗。」

6 月 2 日,高挥加密自由、透明大旗的 James Wynn 在社交媒体上发文宣布决定暂停进行合约交易。

但宣布暂停还没热乎,赌徒又压上了筹码。没超 4 小时,James Wynn 就发布其比特币多单持仓图,并矛头直指 Wintermute。他@Wintermute 官方账号称,「我回来了 」。

不过,这一单,James Wynn 多单仓位曾浮亏超 135 万美元。

对此,James Wynn 显得有些「上头」,他振臂高呼,「如果你想支持这个事业 / 对抗腐败,现在就买 BTC。我刚一做多,就被瞬间狙击。这里肯定有某种阴谋,我不知道是什么。不可能只是因为我的多单,可能是因为我只是个小鱼在玩大鲸鱼的游戏,或者是因为我引起了大家对 HyperLiquid 的关注。不管怎样,试着通过买 BTC 来支持吧!」

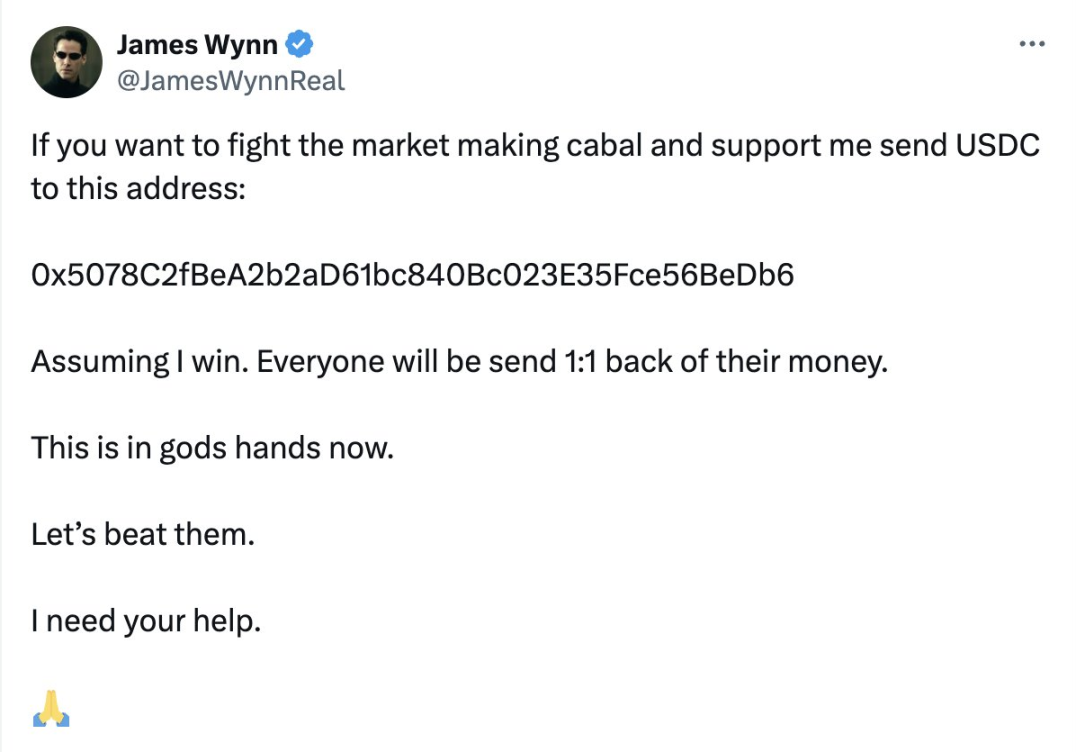

随着 BTC 价格不断下探,巨鲸 James Wynn 明显有些慌了。他紧急在社交媒体发文表示,「如果你想对抗做市集团、支持我,请将 USDC 转账至特定链上地址。假设我赢了,所有人都会按照 1:1 的比例收回他们的钱。让我们打败他们。我需要你的帮助。」随后,James Wynn 将累计捐赠所得到的 39345.11 枚 USDC 存入 Hyperliquid,降低了清算价。

这一 0 成本募资推文瞬间引起热议,目前加密市场最有流量的男人也开始「乞讨」了吗?事实上,以往动辄高杠杆开仓超 10 亿美元的 James Wynn 已经跌落了「版本之子」的神坛,在近一周的时间内亏掉了约 1 亿美元,搭上盈利还倒赔约 1750 万美元。

对此,BitMEX 联合创始人 Arthur Hayes 发文表示,「我开始觉得这(指巨鲸 James Wynn 试图 0 成本募资)可能会成为加密圈史上最成功的交易平台营销活动之一。HYPE 必将获胜。另外,这家伙很可能就是在另一个匿名地址进行对冲交易,专门为了薅 Hyperliquid 下一轮空投。」

而 6 月 3 日,James Wynn 在其总价值约 1 亿美元的 BTC 多单扭亏转盈之后,已悄然将昨日 22 时公开的「乞讨」推文删除。目前,其多单盈利超 40 万美元。而昨夜最惊险时,比特币价格距离 James Wynn 多单仓位的清算价只差 20 美元的空间,浮亏超 135 万美元。

最终,幸运女神眷顾了他,其多单最终扭亏为盈。James Wynn 的赌徒生涯得以延续。但是好景不长,随着特朗普与马斯克的一次「撕逼」,一夜过后,James Wynn 又失去了一切。

然而,James Wynn 一路走来,腰包鼓了又空,谁成为了最大的赢家?不断冲击历史新高的 HYPE 币价,或许已经说明了一切。此前被 James Wynn 指名道姓的 Wintermute,其创始人 wishful_cynic 发文称,「总的来说,我认为「wynn」只是一个执行得很出色的 HL(Hyperliquid)营销活动,干得漂亮。他很优秀。他的推文也很棒」事实上,James Wynn 平均三条推特帖子就会提及一次 Hyperliquid,并不断强调去中心化、反腐败、反操纵,并模糊提及其他中心化交易所的未证实「封禁账户」丑闻。从传播角度而言,James Wynn 获取了今年以来加密市场的最大成功。

而高举公开透明旗帜的 James Wynn 是否以匿名地址对冲自己的明牌巨额仓位,Hyperliquid 是否与 James Wynn 有着直接利益关系。这一切的黑箱,我们都不得而知。而在悲催的推文背后,James Wynn 也不忘推销 Hyperliquid,「总之,如果你想像个白痴一样赌博和交易合约,那么至少使用我下面的链接(将为你节省交易费),并使用代『WYNN』 」。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。