Original Author: Michael Saylor, Founder of Strategy

Translation by: Odaily Planet Daily (@OdailyChina)

Translator: CryptoLeo (@LeoAndCrypto)

Michael Saylor delivered a speech titled "21 Ways to Wealth" at the Bitcoin conference, which outlines 21 ways to acquire wealth, but essentially emphasizes the importance of buying Bitcoin now. The content also touches on the inheritance of Bitcoin, the ease of corporate-level Bitcoin operations, and its wealth effects.

Saylor uses 21 words to describe what is needed to pursue wealth today, with the core idea being the circular compounding of funds obtained through corporate-level Bitcoin reserves and corporate valuations. This is somewhat aggressive, but Bitcoin as a legacy for future generations is also a great approach. For reference, see Saylor's previous speech: "Michael Saylor's Crypto Summit Speech: Bitcoin as a Strategic Reserve, the Source of Permanent Prosperity for Future Generations in America".

Below is the full text of the speech, translated by Odaily Planet Daily.

I am very pleased to meet everyone today at Bitcoin 2025, and I am especially happy because this speech is meant for you. Over the past few years, I have traveled around the world discussing Bitcoin, explaining to many countries why they need Bitcoin, and clarifying to institutional investors, boards, companies, and CEOs the reasons for needing Bitcoin.

I have had soul-searching conversations about why our descendants need Bitcoin (a rhetorical phrase with a somewhat religious tone, emphasizing the importance of Bitcoin in a surreal environment). But today’s speech is aimed at the 8 billion people on Earth. This is a way for everyone, families, businesses, and entrepreneurs to create wealth. Bitcoin is not only suitable for billion-dollar public companies but will also benefit everyone. I have focused on Bitcoin for a long time, so today I am here to present to you "21 Ways to Wealth".

1. Clarity

Bitcoin has the characteristics of transparency and immutability. When you realize that Bitcoin is perfect capital, programmable capital, and anti-corruption (human manipulation is impossible), your mind becomes clear. This means that every intelligent person, no matter where they are, wants to possess perfect capital. Every one of your enemies needs anti-corruption capital, and all AI will want programmable capital. The demand for this is enormous. What is Bitcoin worth? It is worth half of the global economy.

2. Conviction

Bitcoin will appreciate faster than any other asset because it is designed to outperform other assets; it will grow faster than the S&P index and gold. Sorry! Peter (Peter Schiff), it must grow faster than gold, real estate, collectibles, or anything else you can imagine because it is designed that way.

3. Courage

This leads us to the third way to acquire wealth. If you want to get rich with Bitcoin, you need courage, which means that wealth favors those who accept the risks of cryptocurrency. Satoshi Nakamoto ignited a "fire" (Bitcoin) on the internet; the fearful stay away from it, fools fumble around Bitcoin without ever taking action, while only the loyal ignite the flame, dreaming of a better world under its glow. This means that many who pay attention to Bitcoin fear it; they will never buy it and will not benefit from it. They will be left behind. They create derivatives around the "fire," making fireworks and creating trinkets.

But those who truly understand it will ignite this fire. How to ignite the fire? By buying Bitcoin. By selling fiat currency, long-term capital, bonds, subpar equity, real estate, etc., to buy Bitcoin. Use it to ignite the fire; what will happen? Under the explosive and communicative power of the network, you will buy a ticket to prosperity.

4. Cooperation

Cooperation is very important. You will become stronger with the support of your family. If you understand Bitcoin, you can act as an individual, but when the whole family understands Bitcoin, you become even stronger. Your parents have credit and capital, you have capability and belief, perhaps even courage. Your children have enough time and potential. Your 80-year-old grandfather can withdraw funds from his retirement account, borrow money from the bank, and have an investment portfolio; the secret is to transfer capital to the children. Your next generation will encounter wealth earlier than your previous generation. When you transfer capital from the past and convert it into future funds, it is a generational matter. So, think about family and work together.

5. Capability

In this part, I could list many technologies to illustrate, but I think the most important thing today is that you need to master artificial intelligence. If you want to become wealthy by 2025, you want to connect with a group of accountants, lawyers, professors, historians, and possess collective wisdom. You want to have all the knowledge that great entrepreneurs need to know, so go find AI, put it in deep thinking mode, introduce all your situations, hopes, visions, and questions, and then start interacting with it. I tell all my executives to consult AI before asking lawyers, bankers, or any experts; ask AI, let it think, and break through technological barriers through effort.

This is very important because many of the suggestions I will give next go beyond the capabilities of ordinary employees, even beyond the capabilities of middle management.

You might say, yes, those complex trusts or complicated legal structures are great, but I don’t have money. I can’t afford to spend hundreds of thousands on lawyers. I’ll let you in on a secret: I have dozens of lawyers working for me, and they also spend money hiring other lawyers. When I encounter a problem, the first thing I do is ask AI. I argue with it; it tells me No, then I try another way—threatening it, demanding it provide a solution. I find 95% of the solutions, then I confirm the solution and send the link to my management team and lawyers, “Look, I solved the problem; this is what I want to do.” Then I give them 2 to 5 days to determine the execution plan. If they cannot solve the problem within the specified time, they will be replaced from my team, and I will change lawyers and everything.

The road to wealth depends on capability. That’s how it is in 2025; everyone is not a super genius, but a combination of 100 super geniuses. AI has read everything published by humanity; if you humbly seek help from AI, putting interests first rather than self-interest, your family will thank you in the coming years.

6. Composition

Build scalable strategies and legal entities to protect assets. This means you can borrow money from your 401k, perhaps invest in an IRA, maybe you can build an effective insurance policy, or perhaps you want to establish a dynasty trust in Florida, which will benefit your descendants for the next 300 years. You might find that South Dakota's "Perpetual Dynasty Trust" is an ideal choice because it can exist permanently, protecting family wealth across generations.

Odaily Note: Section 401(k) of the U.S. Tax Code is a type of employer-sponsored retirement savings plan that allows employees to save a portion of their paycheck in a tax-advantaged account for future retirement.

The normal reaction is that you might not know how to operate, so ask AI to clarify the process. By the way, I won’t give you very specific answers because if you live in Dubai or Singapore, the situation is completely different. If you live in North Dakota, the situation is also completely different. You will get different answers based on who you are. But what I can tell you is to go online, start AI, and begin asking it. It will give you a customized answer so you can work hard and work smart.

This is much easier than before. Ten years ago, someone would say it was too difficult, requiring a year, and that lawyers were too slow and expensive. And this year, everyone should be as smart as the most complex billionaire families. Perhaps you can get the same legal advice as them and have the same efficiency.

7. Citizenship

Citizenship is important; choose a residence with economic ties where sovereignty respects your freedom. What does this mean for you? Everyone's situation is different, but I’ll give you a simple tip: ask AI which are the 10 states in the U.S. that are most friendly to Bitcoin holders?

Now go find some AI and ask: “Why not rank every country in the world based on my intention to hold or invest in Bitcoin?” Then describe your situation, and it will give you an answer. I encourage everyone to think about this because living in Florida is different from living in other states. We like Wyoming; we have a Bitcoin senator, Cynthia, from Wyoming.

But you must figure out what the attitudes toward Bitcoin are at the state, county, city, and national levels, and think deeply. This is not just about this year; it is a question for the century. What will you and your family look like in the next 100 years? Your descendants will thank you.

8. Civility

The eighth point is civility; respect the natural power structures of the world. For example, when you go to a wildlife park, don’t fight with lions. Don’t try to go against market trends or economic realities. Don’t take selfies while hiking and fall off a cliff. Respect the power of nature. I think everyone understands this. Besides that, I want to say that if you want to create wealth in the Bitcoin universe, think about how the world is constructed. Remember, you don’t have to overthrow governments you don’t like, nor do you need to change other people's religious beliefs; you don’t have to overturn any specific system that exists in the world.

You need to choose your battlefield, right? Respect social norms. Avoid unnecessary arguments; that only drains energy. Every time I look at this world, I can think of 100 things I want to change. Then I think the world only cares about my opinion on one of those things, and the chances of successfully changing the other 99 are low, right? If you want to create wealth, you need to figure out what you want to do, focus on it, and do it civilly.

Typically, you will encounter people with different religious beliefs, political beliefs, economic beliefs, and cultural beliefs. These people will work with you to find common ground and move forward because stimulating conflict and distraction will only slow you down as you move toward the future. So civility benefits you.

9. Corporation

The ninth way to acquire wealth is through corporations. A well-structured company is the most powerful wealth creation engine on Earth. And you are an independent individual; my advice is to ask AI how to create a company, whether it’s a small company or multiple companies. Companies have special access to the banking system and special rights in every business. Companies enjoy legal immunity.

A company can sustain growth, has tax efficiency, various efficiencies, and is more credible. A company can sell equity, and businesses can finance for the future. A company can outline projects for the next 30 years and then bring the economics back to the present for investment. Individuals cannot do this. Therefore, while being an independent individual is commendable, there is no shame in being a sole proprietorship or a family business.

If you examine the hierarchy of the world and rank it, individuals are at the bottom, family businesses and partnerships are more powerful, small and medium-sized private enterprises are stronger. Large private enterprises rank next. Following them are small public companies listed on the OTC market.

Companies listed on larger capital markets are larger than those listed on NASDAQ or the NYSE. Then, in the U.S. capital markets, there are experienced issuers. At the top of the pyramid are those well-known seasoned issuers. Globally, there are only a few hundred such companies. When you climb to the top of the pyramid, submit a registration statement, and sell a billion dollars in securities within six hours, you can achieve this. This is something each of you can do, and I hope you all can reach your full potential. Establishing a company is the first step toward this goal.

10. Focus

The tenth point is focus. The path to wealth lies in focus; just because you can do something doesn’t mean you should. I have done many things. I am 60 years old this year.

One reason I embrace Bitcoin with religious fervor and passionate ideology is that I had the opportunity to do so in my 20s, 30s, 40s, and 50s. You will find that changing the world from an operational level is very challenging. I once thought many of my great ideas were flawless, but the results did not turn out as I wished.

In fact, if you invent a new product, service, or thing, there is a 90% chance it will fail within five years. But if you invest in Bitcoin on your balance sheet, there is a 90% chance of success within five years, and if you look at a 30 or 40-year time frame, the chance of success rises to 99%. Every operational-level idea has a 99% chance of failing, while every Bitcoin-based financial idea has a 99% chance of succeeding.

So do not confuse ambition with achievement; remember that companies holding Bitcoin have an annual return on assets between 30% and 60%. You are growing at a rate of 30%, 40%, or 50% each year. If you do nothing now, think about every operating business, your restaurant, your hotel, or any store you opened at the beginning of the year, and then imagine growing the business by 30% each year for the next 20 years. Seven companies have achieved this, and we call them the "Magnificent Seven." But in fact, more companies have tried this. So in this case, when you formulate strategies, be sure to focus and not get distracted.

11. Equity

The eleventh point is through equity. This means sharing your opportunities with investors who are willing to share the risks with you. Companies can do this, but individuals cannot. Metaplanet has done this; Metaplanet grew its market value from $10 million to $5 billion through collaboration with equity investors. Without these equity investors, they would be nothing. My company grew from a $1 billion enterprise to a $100 billion enterprise, also with the help of our equity investors.

If you are a dentist with an annual cash flow of $200,000, you could buy $200,000 worth of Bitcoin each year for 20 years. That’s not a bad idea. You would become the richest dentist in your neighborhood, but you could register your dental practice as a company, valuing it at $1 million based on five times cash flow, and sell 33% of the shares for $500,000. Use that $500,000 to invest in Bitcoin, and a year later, raise another $500,000 for investment at two, three, or four times the market value. Wait another year and raise $3 million for investment. You would become the first billionaire dentist in your neighborhood. What special thing did you do? You collaborated with others and shared a portion of the benefits. This is what Strategy does, what Metaplanet does, and what many companies are doing.

12. Credit

The twelfth point is through credit. What does this mean? Many people in the world fear the future. Many want to protect their money or seek meager returns. The yield on Japanese corporate bonds is 50 basis points, while the yield on U.S. investment-grade bonds is 400/500 basis points. As a company, providing certainty to creditors, offering them fixed coupons and dividends, and placing them in a priority position in your capital structure transforms risk into reward. You give them a certain, safe return, and you receive capital.

There are people like this everywhere in the world. I am a retiree; I want a guaranteed 8% return. I don’t want to lose my money. If you make them such a proposal, you can obtain funding, and it will compound at a rate of 30% to 60%. In the worst-case scenario, you can achieve a 22% spread, but all the funds are upfront, so credit can sometimes be a bad word.

But ultimately, as an individual starting a company, you can create credit. If I want to become the billionaire dentist in the neighborhood, I establish a company and sell some equity. I sell a portion of future earnings, let the stock rise, and then borrow money or sell preferred stock, or sell some financial instrument to those who want lower risk, lower returns, and more certainty. Repeat this process; the goal is not to obtain $200,000 or $50,000 in cash flow each year and invest over 20 years, but to use appropriate financing methods to enable my company to access 100 times the capital right now and invest it in Bitcoin.

13. Compliance

13 is not always a lucky number; I use the word "compliance." You should create the best company you can within the rules of your market. Every market is different. For example, public companies have special rights; they can issue stocks and bonds. Trust companies have other special rights; they are more efficient in terms of taxes. Insurance companies have special rights. They can reinvest annuities, take on risks, and create very efficient tax tools. Brokerage firms have special rights. Exchanges have special rights. Banks have special rights. Banks can print $20 million in legal tender with $1 million in capital, operating with 20 times leverage; that’s the advantage.

Although compliance sounds like a complex word, if you create a company and understand the rules of the market you are in, you can operate normally and create a very efficient, highly productive enterprise. Then you can leverage the power of this enterprise to raise funds, invest in Bitcoin, and create wealth. So it’s more complex. But if you have this talent, you know it will help you go faster and further.

14. Capitalization

The fourteenth point is capitalization; your goal is to persistently raise funds and reinvest, quickly and at scale, to compound wealth. For example, if you establish a small hotel, sell 10% of the equity, and then buy Bitcoin.

As the price of Bitcoin rises, the value of the hotel also increases. You then sell 20% of the equity to buy more Bitcoin. The value of the business continues to rise, and you borrow a little money to buy Bitcoin. The value of the business continues to rise, and you keep raising funds, using cash flow to buy Bitcoin, and using government bonds to buy Bitcoin. You have a house without a mortgage; for you, if you can borrow at a 6% interest rate to invest in Bitcoin, which has risen 80% in the past year, even if you see a 30% or 20% annualized return, you borrow at 6% and invest at a 20% return, you can capture the spread, which is compounding growth.

This is a race to leverage Bitcoin; the person who has the most Bitcoin when the game ends will win.

15. Communication

The fifteenth point is communication; if they don’t trust you, no one will give you money, and creditors won’t lend to you. They won’t accept or give you loans, won’t buy your bonds or preferred stock. Equity investors won’t buy your shares.

No one will do business with your employees, and suppliers won’t trust you. You must be candid and transparent, frequently utilizing all modern digital channels to reiterate this. In the world of Bitcoin, there is no need for complex strategies to accumulate wealth. You just need a simple and clear strategy; once others understand what you are trying to do, they will support you, and then you will succeed.

16. Commitment

The sixteenth point is commitment; do not let yourself get distracted.

Many people before me discovered Bitcoin. From 2011 to 2014, people found it, then they went off to explore other coins, then other concepts, playing around with Bitcoin. Then they wrote books bragging about how smart they were to discover Bitcoin.

Then they started companies and boards, and the boards made them sell their Bitcoin. So, stick with Bitcoin; the idea of Bitcoin is great. When someone mocks you online for being foolish, ignore those trolls. Don’t argue with them. By the way, don’t get distracted by your good ideas; don’t chase your good ideas. Satoshi gave you something worth half the global economy.

The most common mistake entrepreneurs make is falling in love with their ideas and then trying to implement them. You possess the greatest thing in human history; Bitcoin is right there, and you live in a time when most people on this planet do not understand Bitcoin. All you need to do is find a way to leverage it now. There may be countless other ideas in the future, but don’t get involved in those destined to fail. Firmly choose your battlefield; do not try to solve problems beyond your capabilities. You may have your opinions on this and that, which may make you feel angry, and you think it’s terrible. That’s the reality; I agree with your view, but the fact is that the world may not care how you think. Unless you can stop the "war," if you can stop the "war," then go ahead. But if you can’t, don’t take your success for granted; avoid those distractions.

17. Competence

Execute consistently, precisely, and reliably. Do not take customers for granted, do not take safety for granted, do not take success for granted. Be laser-focused. The world expects you to be perfect. When I first arrived at DuPont (Saylor previously worked as an internal consultant at DuPont), they said, “You can make one mistake at most, but you cannot make a second mistake.”

You may think you can multitask, but your competitors can focus like a laser, and the market will ultimately turn to those who can focus like a laser.

18. Adaptation

Over a long enough timeline, every counterparty will fail, including you. Within 100 years, everyone, including every bank you trust, every company, everything, and every currently functioning structure will fail. You need to adapt; wise people will be prepared to let go of burdens multiple times along life’s path, so be ready. Make a plan. Start executing now, and monitor it quarterly and annually.

At some point, when that path is no longer correct, do not be ashamed to change course; have a succession plan and keep things organized.

19. Evolution

Leverage your core strengths and utilize your strongest assets. Your goal is to grow gracefully, not to undergo radical mutations. If you happen to have expertise in a certain culture, capital market, or field, then the business you want should develop based on that expertise. When you lose balance or decide to venture into a completely unfamiliar new area, the execution risk increases a hundredfold.

20. Advocacy

Advocacy is also an important point; call on others to engage with Bitcoin and become evangelists for economic freedom. The more individuals, businesses, governments, institutions, cities, and leaders embrace Bitcoin, the greater your chances of success, the greater their chances of success, the greater Bitcoin's chances of success, and the greater humanity's chances of success.

21. Generosity

The final point is generosity. When you succeed, spread joy and hope every morning. For those who are less fortunate than you, you have already walked this path. You should spread goodwill. Ensure that you pass this on to your employees, family, friends, customers, investors, and community. They will see your brilliance and respect and support you. They will be inspired by you and follow you, which benefits you, benefits the business, benefits Bitcoin, and benefits the world.

Conclusion

I want to conclude my speech with this statement:

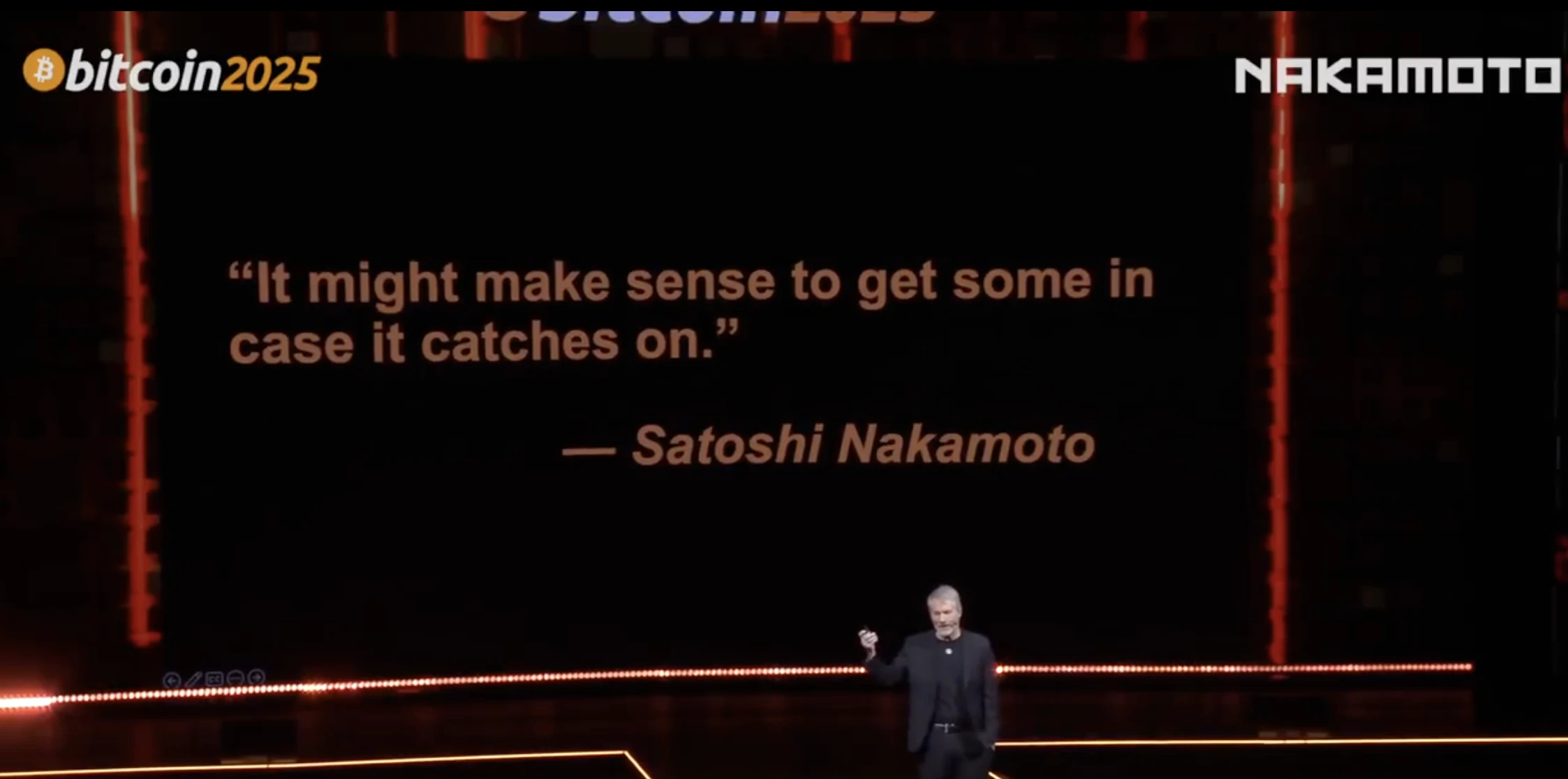

“It has been 16 years since Bitcoin was born in 2009, and $2 trillion proves its value. Who knows how much wisdom has been passed on to the world? I can give you this speech here, but many years ago, Satoshi, who is far greater than I am, said these 12 most important English words without any of this information, proof, or so much time: It might make sense to get some in case it catches on.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。