During the recently concluded Dragon Boat Festival holiday, the giant whale James Wynn vividly staged a dramatic performance in the crypto world, showcasing a "not treating money as money" attitude. He even live-streamed on X the distance of Bitcoin's price from his long position liquidation price, which at one point was only $20 away from liquidation, attracting widespread attention online.

Foreign version of Liangxi, "begging" for margin

On May 30, James Wynn was first liquidated due to high-leverage BTC long positions, with his $100 million position being forcibly closed, resulting in approximately $530,000 profit for the Hyperliquidity Provider (HLP). He then continuously opened new 40x leverage long positions, facing partial or full liquidation again on May 30 and 31, with the liquidation price maintained in the range of $102,000 to $103,400.

According to Lookonchain data, his PEPE and BTC long positions faced partial liquidation, with cumulative losses reaching as high as $9.36 million, totaling $17.72 million in losses. Subsequently, Wynn closed all positions and transferred the last approximately 460,000 USDC from his HyperLiquid account, completely emptying it.

However, a gambler does not easily leave the table. Just one day after being out of positions, he redeemed 126,116 HYPE (worth about $4.12 million) that he had previously staked, selling them at an average price of $32.7 to realize a profit of $1.05 million. This transaction was seen as his "last hope," but shortly after, he returned to the battlefield.

On June 2, James Wynn opened another 40x leverage BTC long position, holding 944.93 BTC, with an opening price of $105,890.3 and a liquidation price of $104,580, leaving very little risk space below. As the market fluctuated downward, he continuously supplemented his margin on-chain, adjusting the liquidation price to $104,360 and $104,150, eventually pushing it down to around $103,610, leaving only about $20 of space from the actual market price.

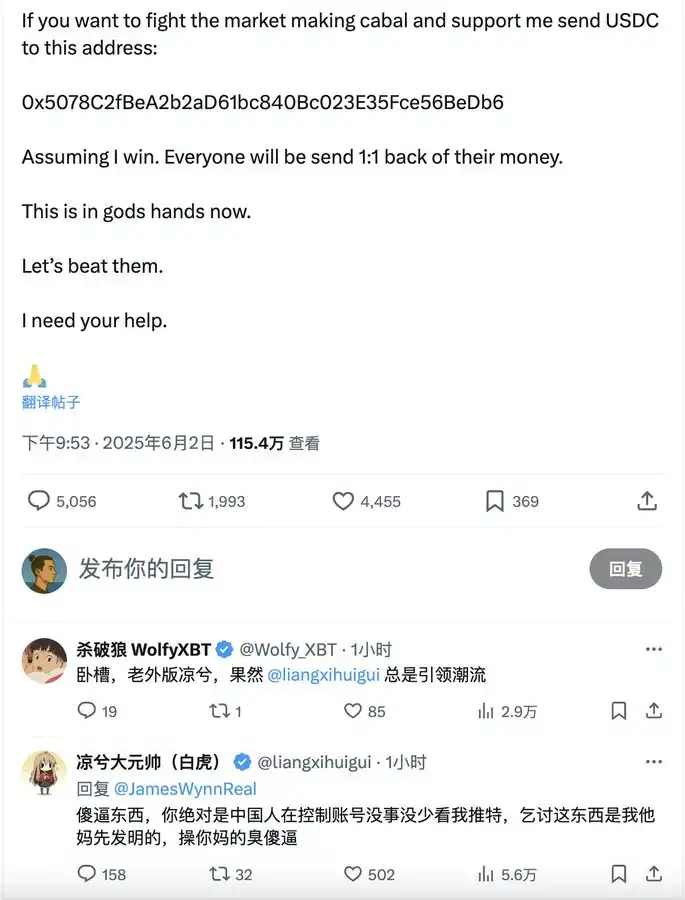

As the leverage approached the liquidation threshold, Wynn initiated a fundraising request on social media, publicly stating: "If you want to fight against the market-making group and support me, please transfer USDC to the designated address." He promised that if the trade was successful, he would return the crowdfunding funds at a 1:1 ratio. This move quickly sparked controversy, with even Liangxi cursing in James's comment section, stating that such behavior was "infringement."

According to on-chain analyst Yu Jin's monitoring, within just two hours, he received over $40,000 in donations, of which $30,000 was transferred to HyperLiquid for margin supplementation, temporarily lowering the liquidation price to $103,610. He then added another 480,000 USDC in margin, pushing the liquidation price to $103,637, momentarily avoiding liquidation.

Calling out CZ, igniting PerpDEX competition

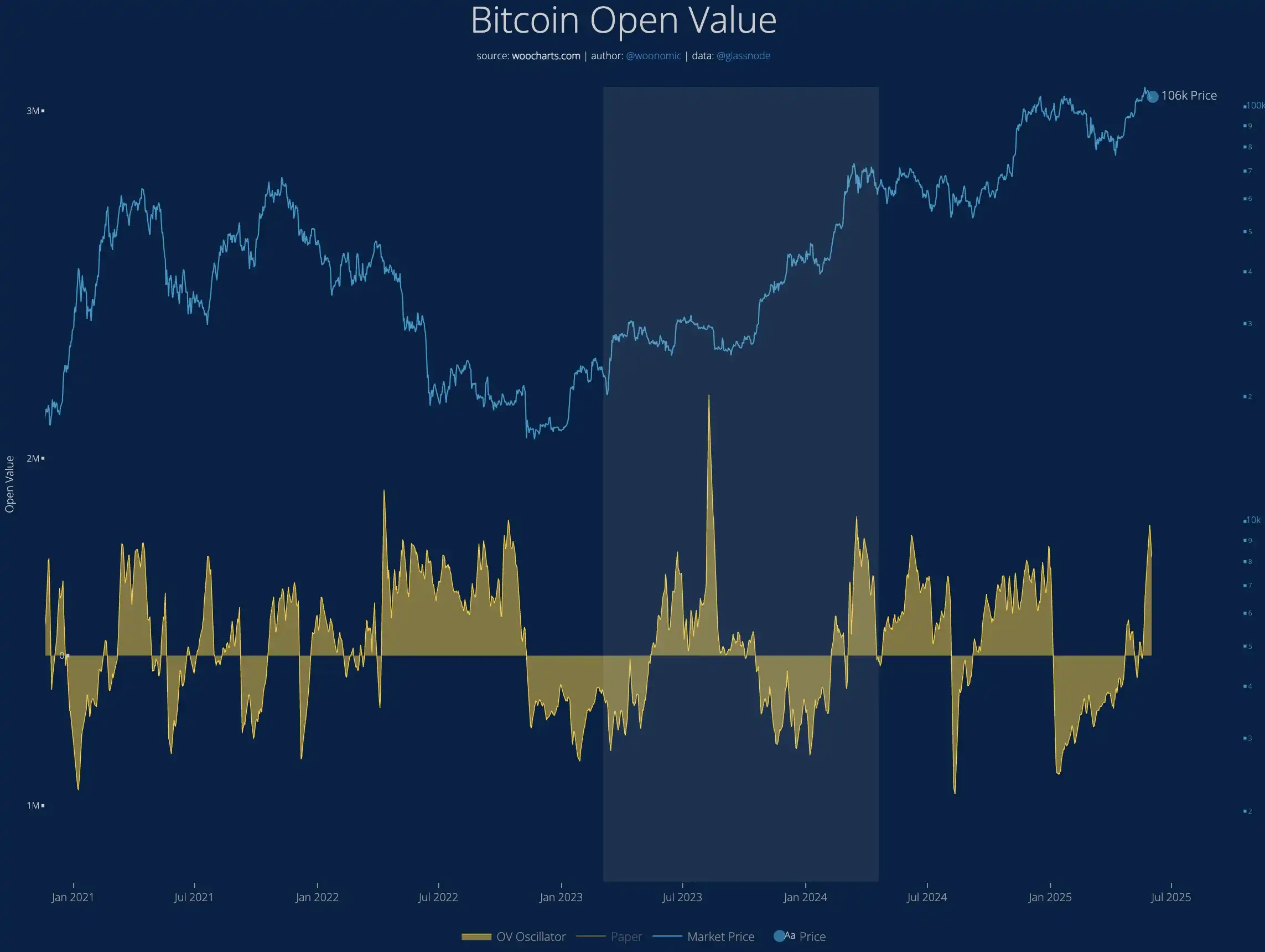

The current Bitcoin market is in a highly competitive phase, with excessive contract leverage making it a breeding ground for liquidation hunting. Due to weak buying pressure and low liquidity last week, combined with seasonal factors like summer weekends, large funds find it easier to manipulate prices in such neutral environments.

Crypto analyst Willy Woo believes that despite the frequent appearance of buy walls, there may be repeated manipulation by funding parties behind the scenes—such as James Wynn's liquidation price.

During the process of continuously adding margin, a small incident occurred. As Bitcoin's price approached James's long position liquidation price, he took a screenshot and called out to CZ, asking, "What do you think of this market manipulation?" with quite an agitated tone.

Immediately after, James directly tagged CZ, asking him to DM him, to which CZ jokingly replied that James no longer had 1 BNB to use the contact tool, giving a shout-out to applications within the ecosystem.

After the DM incident, CZ meaningfully posted a long tweet, stating, "Given the recent market events, I think now might be a good time to launch a dark pool perpetual contract DEX. The concept of a dark pool perp DEX—shielding the order book, delaying the display of margin changes, and even hiding trading addresses and contract funding paths—can technically be achieved through cryptographic solutions like ZK.

He believes that the current public transparency of the DeFi market has become a weakness for high-leverage traders, as on-chain order books, liquidation prices, and margin flows are all visible, making any large position a potential target for hunting. While CEX can still hide account identities, on-chain users face a coalition of market makers, bots, arbitrageurs, and other following funds.

This resonates strongly with James Wynn's experience, as his liquidation price was tracked all the way, social media was abuzz, and even his initiated "1:1 crowdfunding" was publicly analyzed in real-time due to the address being disclosed, turning it into a public experiment in the eyes of the market and media.

CZ's high-profile discussion of dark pool perp DEX at this time is not a spur-of-the-moment thought but rather seems like a deliberate signal release. As the James Wynn incident continues to ferment on-chain, the market attention and user activity of new generation perp DEXs like HyperLiquid are steadily rising, and these platforms are beginning to genuinely touch the cake of CEX.

In past cycles, DeFi derivatives platforms have always been seen as weak in liquidity and rough in experience. But this time, the perp DEX model represented by HyperLiquid is not only maturing in user trading experience, asset stability, and even "gambling" design but also creates strong dramatic tension and community discussion on-chain through its liquidation mechanism and high-leverage strategy.

As these decentralized platforms gradually confront the core business of CEX—high-frequency contract trading, the previously clear boundaries are starting to blur, and both sides are beginning to take each other seriously.

Hyperliquid's spokesperson?

The controversy surrounding James Wynn goes beyond just his crowdfunding for margin supplementation; it has sparked widespread community discussion about the "scripted" nature of his series of extreme operations.

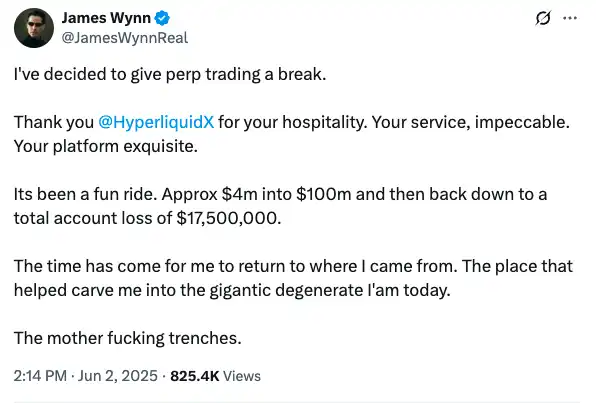

Just before James Wynn redeemed HYPE for a profit of $1.05 million and prepared to open a new position, he posted a rather ceremonial tweet announcing a temporary farewell to contract trading. What caught more attention was his high praise for Hyperliquid, stating, "Thank you for the hospitality from Hyperliquid, your service is impeccable, and the platform is outstanding."

This expression of gratitude quickly raised suspicions, as it came right after he faced multiple liquidations and significant losses on-chain. Many in the community speculated that James seemed more like a "scripted character" set up by Hyperliquid, using high leverage and high-frequency social media operations to generate unprecedented attention and discussion for the platform.

In fact, these doubts are not unfounded. In recent weeks, rumors have circulated in the community that while James Wynn opened extreme leveraged positions on Hyperliquid, he might be hedging in the opposite direction on other exchanges, creating influence through on-chain topics, indirectly boosting platform user activity, and attracting widespread attention to the HYPE token and its ecosystem.

As James revealed that multiple exchange accounts were frozen and funds restricted, the outside world began to reassess the truth of this rumor, and he himself later spoke out vigorously, directly stating:

"I support decentralization and oppose corruption. I support Hyperliquid and oppose market-making manipulation. You can't catch me on any wrongdoing; my wallet is clean, my trades are clean, I've never received promotional fees, nor have I ever engaged in pump and dump. I am just a meme coin gambler and HL expert who has fought my way up on-chain."

This self-defense was intense and emotional, more like a proactive attempt to label himself as a clean stream on-chain—but in the eyes of the community, this starkly contrasting high-profile expression seemed more like a carefully planned marketing strategy.

BitMEX co-founder Arthur Hayes also posted on social media, stating, "This could become one of the most successful marketing campaigns for a trading platform in crypto history. Moreover, this guy is likely hedging trades at another anonymous address, specifically to take advantage of Hyperliquid's next round of airdrops."

As of June 3, with Bitcoin's price dipping, James Wynn's 40x long position briefly turned from profit to loss again, while Hyperliquid continued to be at the center of public opinion in this on-chain drama.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。