_Organized by: Darren, _RootData

Market Sentiment Warms Up, BTC Breaks Through Strongly, VC Investment Activity Slightly Cools Down

In May 2025, Bitcoin (BTC) strongly broke through its historical high, reaching a peak of $111,980, with an exceptionally strong trend. Since May, the Fear and Greed Index of the cryptocurrency market has consistently remained above 50, indicating that market sentiment has significantly warmed up from the low period of the previous two months, with investor confidence gradually recovering and the overall market trend continuing to improve.

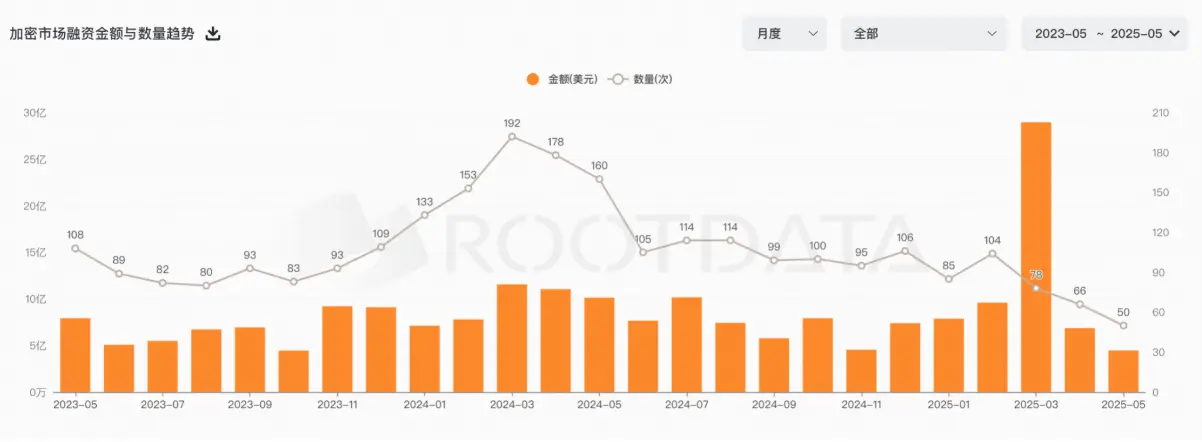

However, in contrast to the market price performance, investment and financing activities in the primary market have continued to cool down. In May, there were approximately 50 financing events in the crypto sector, a month-on-month decrease of about 24% and a year-on-year decrease of nearly 70%; the total financing amount was about $450 million, a month-on-month decrease of 35% and a year-on-year decrease of 56%. This reflects that despite the significant rise in market prices, venture capital firms are making fewer moves, showing a more cautious attitude.

From the financing structure, the average single financing amount this month was $21.9161 million, with a median of $6.2 million, indicating that while some projects can still secure large amounts of financing, the overall financing distribution is becoming polarized, and the fundraising difficulty for small and medium-sized projects remains high.

In summary, although the new high in BTC prices has significantly warmed up market sentiment, the pace of VC investments in the primary market has not synchronized with this recovery, indicating that the strength of the secondary market has not fully transmitted to project investment. It is worth noting whether sustained high market sentiment will lead to a resurgence of activity in primary market financing in the coming months.

In this article, we will focus on specific financing data, active investors, trending projects, and other aspects to present the changing trends in the crypto market.

I. Financing Data

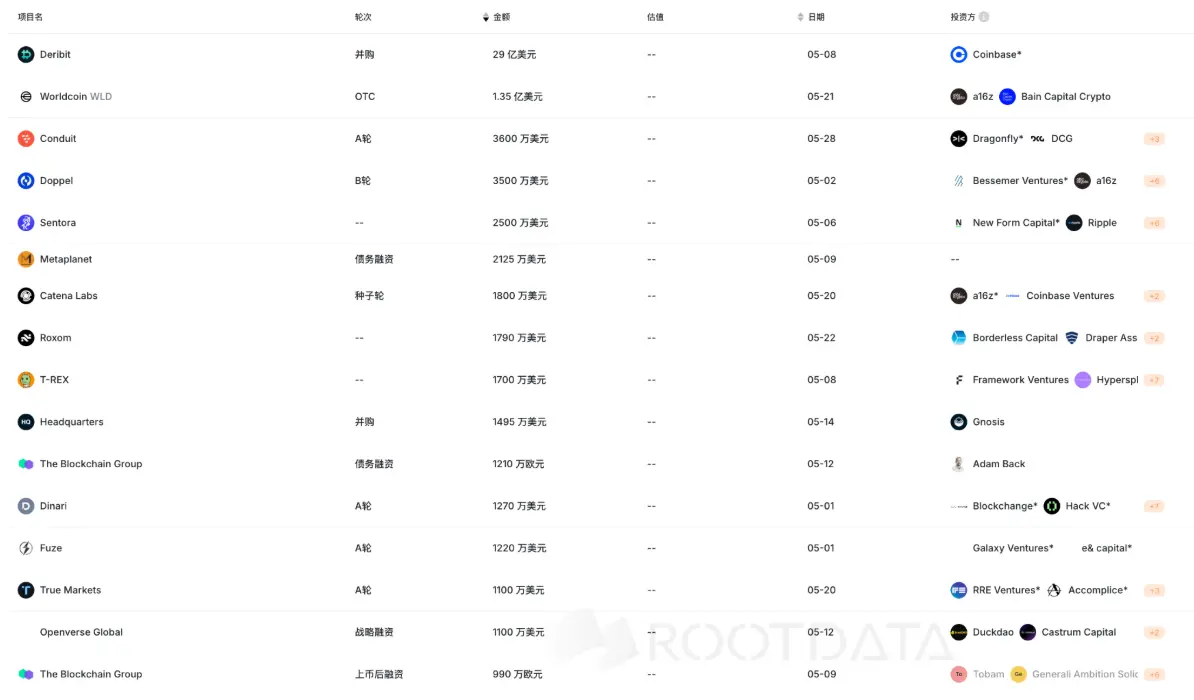

In May 2025, the crypto market witnessed several notable large financing and merger events. Although the overall number slightly decreased, the strong actions of leading exchanges and star projects still reflect the trend of resources concentrating towards industry leaders.

The most influential event this month was Coinbase's $2.9 billion acquisition of Deribit, the world's largest crypto options exchange. This merger is not only the largest so far this year but also one of the most significant strategic integrations in the history of the crypto market, marking that centralized exchanges are achieving strong alliances through the expansion of the derivatives market.

In addition to this merger, there was one financing event exceeding $100 million, and another 15 financing or merger events exceeding $10 million, indicating that medium to large transactions remain active. Some representative financing events include:

- Worldcoin completed $135 million in OTC financing, with participation from top institutions like a16z and Bain Capital Crypto;

- Conduit completed $36 million in Series A financing, led by Dragonfly, with participation from DCG, Sound Ventures, Altos Ventures, and Commerce Ventures;

- Doppel completed $35 million in Series B financing, led by Bessemer Ventures, with participation from a16z and 9Yards Capital.

Despite the highlights of the above major events, the overall number shows that only 7 merger events occurred in the crypto industry in May, the same as in April, and far below the level of over 10 events per month in the first quarter of this year. This trend indicates that while leading projects can still secure large amounts of funding or engage in capital integration, the overall activity of mergers in the industry is slowing down, with capital providers preferring to concentrate their efforts on more certain targets.

Overall, large mergers and financing events remained active in May, with leading platforms further consolidating their market positions through capital actions. However, the total number of merger events has been at a low level for two consecutive months, reflecting that after experiencing a market recovery at the beginning of the year, investors and acquirers are still maintaining a certain level of caution. Future attention should be paid to whether the continued warming of the secondary market can drive a resurgence in merger activity in the primary market in the third quarter.

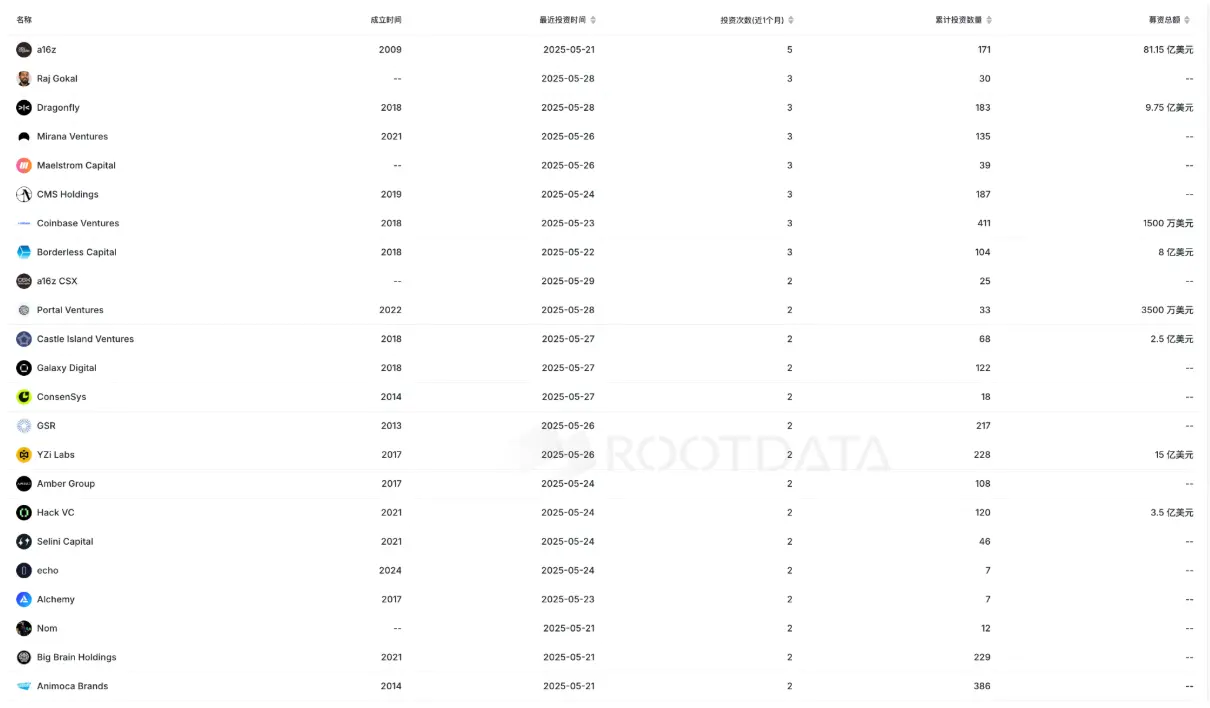

II. VC Dynamics

a16z was the venture capital firm with the highest investment frequency in May, making 4 moves: Worldcoin ($135 million), Catena Labs ($18 million), KYD Labs ($7 million), and Doppel ($35 million).

Following closely were Raj Gokal, Dragonfly, Mirana Ventures, Maelstrom Capital, CMS Holdings, Coinbase Ventures, and Borderless Capital, all making 3 moves.

Additionally, several funds disclosed their fundraising progress this month: dao5 completed $220 million in fundraising on May 1; Theta Blockchain Ventures completed $175 million in fundraising on May 21; and 10K Ventures announced the formal completion of the first phase of its $10 million crypto mixed strategy investment fund on May 30.

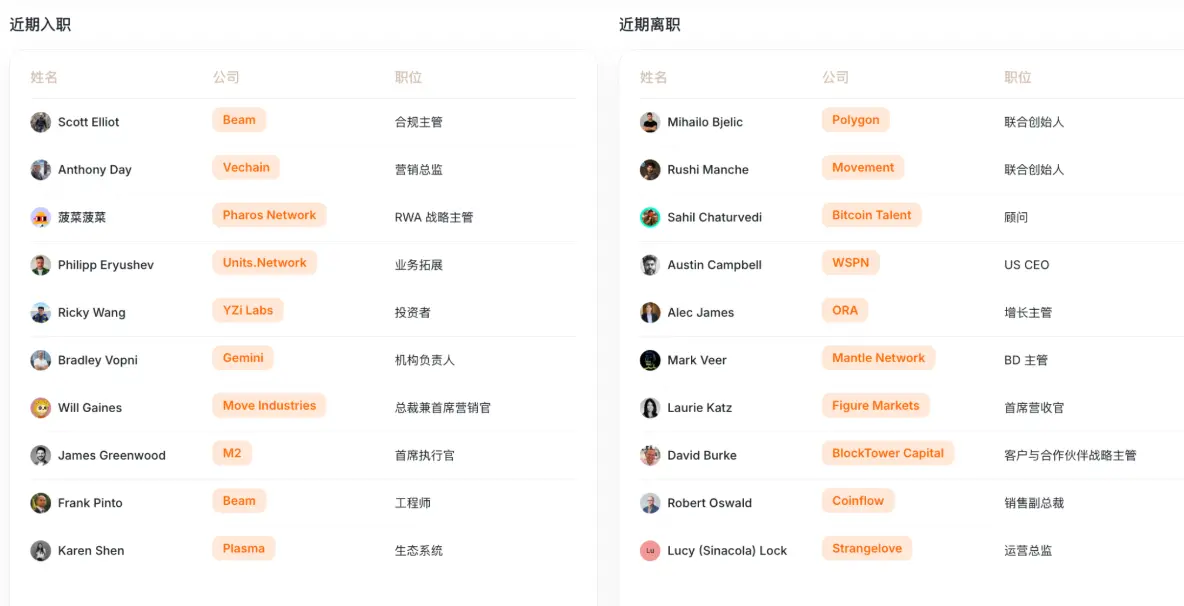

III. Personnel Dynamics

RootData has also recorded the career dynamics of thousands of well-known individuals and executives in the crypto industry. Here are some notable personnel changes:

Scott Elliot is the new compliance officer at payment service provider Beam;

James Greenwood is the new CEO of UAE cryptocurrency exchange M2, previously worked at Bitstamp;

Nenter Chow is the new global CEO of cryptocurrency exchange Bitmart, previously a partner at Animoca Brands;

Diana Zhang is the new COO of Grayscale, previously the COO of BlockTower Capital;

Victor Estival is the new product marketing director at Algorand Foundation, previously the product marketing director at Polygon, and has worked at Parity Technologies and Chainlink;

Paul Burak is the new compliance manager for the U.S. at Crypto.com, previously the chief compliance officer at Stablecorp; for more personnel information, see: https://www.rootdata.com/zh/people

IV. Trending Projects

RootData's heat value is calculated through normalized data from platform search volume, click volume, user votes, and Twitter heat index. The projects with the highest heat value in May include:

Movement is a modular framework for building and deploying Move-based infrastructure, applications, and blockchains in any distributed environment. The team is developing a set of products and services that allow non-Move protocols to leverage the powerful capabilities of the Move programming language without writing a single line of Move code. The team's first version, M1, redefines L1 as a vertically composable and horizontally scalable first-layer framework that is compatible with Solidity, connects EVM and Move liquidity, and allows builders to customize modular and interoperable application chains with different user bases and liquidity out of the box.

B² Network is an EVM-compatible Rollup based on Bitcoin's zero-knowledge proof verification commitment. Rollup data and zk proof verification commitments are recorded on the Bitcoin network and ultimately confirmed through a challenge-response mechanism.

Founded in 2011, Kraken is one of the largest and oldest cryptocurrency exchanges in the world. Kraken is dedicated to making cryptocurrencies accessible and usable worldwide, enabling people from all walks of life to invest in their independence. In September 2020, Wyoming granted Kraken a license to create a cryptocurrency bank in the state, making it the first cryptocurrency exchange in the U.S. to establish a bank.

Tether is the world's largest stablecoin issuer, a company that issues stablecoins pegged 1:1 to fiat currencies, aimed at facilitating the digital use of fiat currencies. It currently has four departments: Tether Data focuses on AI and P2P technology investments; Tether Finance manages stablecoin services; Tether Power is responsible for sustainable Bitcoin mining; Tether Edu promotes digital skills education.

Space and Time is a web3-native decentralized data platform that supports low-latency queries and tamper-proof analytics across Web3. Dapps built on Space and Time become blockchain interoperable, handling game/DeFi data and any decentralized applications requiring verifiable tamper-proof, blockchain security, or enterprise-scale SQL + machine learning.

Deribit is currently the largest cryptocurrency options exchange, with over 80% of the market's total trading volume in Bitcoin options and over 90% in Ethereum options. Like most cryptocurrency exchanges, Deribit operates 24/7. While Deribit dominates the trading volume in the Bitcoin options market, it is an unregulated exchange.

Redact is a Web3 entertainment ecosystem. Leveraging the power of blockchain and artificial intelligence, Redact is building a product ecosystem to form an entertainment data circle where Web3 users can do what they love most—play, trade, watch, and earn rewards. Supported by the RDAC token, Redact aims to enhance its entertainment and gamified products through data protocols, providing users with better, more targeted experiences and greater business opportunities for web3 companies and Dapps.

NEXPACE is Nexon's blockchain division, empowering players, creators, and developers through blockchain and Web3 technology, facilitating interaction with game IPs while expanding player engagement, user base, and extending IP lifecycles.

World Liberty Financial is a DeFi project supported by the Donald Trump family. Its mission is "to make cryptocurrency and America great by driving the mass adoption of stablecoins and decentralized finance." World Liberty Financial will initially launch as a marketplace for cryptocurrency lending utilizing Aave's infrastructure and will introduce its governance token WLFI and stablecoin USD1. Unlike other governance tokens like UNI and MKR, WLFI does not provide economic rights.

Coinbase is one of the largest cryptocurrency exchanges in the world, founded in June 2012 by former Airbnb engineer Brian Armstrong. As of July 2022, approximately 98 million verified users, 13,000 institutions, and 230,000 ecosystem partners across over 100 countries trust Coinbase to easily and securely invest, spend, save, earn, and use cryptocurrencies. Coinbase's mission is to increase economic freedom in the world.

Huma Finance is a PayFi network that powers global payment financing, providing instant liquidity anytime, anywhere.

SOON is a rollup stack designed to provide top-tier performance for all layer 1 blockchains. The vision of SOON is to achieve a Super Application Stack (SAS). SAS consists of four core products: SOON Mainnet, SOON Stack, InterSOON, and Simpfor.fun. These components work together to provide high-performance, interoperable, and scalable solutions. Additionally, the integration of LiveTrade and simpfor.fun further strengthens SOON's vision of creating a super gateway for Web2 users through a live streaming platform. This strategic expansion ensures users experience seamless on-chain interactions directly in familiar environments like Twitch and SOOP.

Sophon is an entertainment-centric ecosystem built as a modular rollup utilizing zkSync's ZK Stack technology. As a ZK chain leveraging the ZK Stack, Sophon aims to tailor solutions for any high-throughput applications, such as artificial intelligence and gaming.

V. Project Dynamics

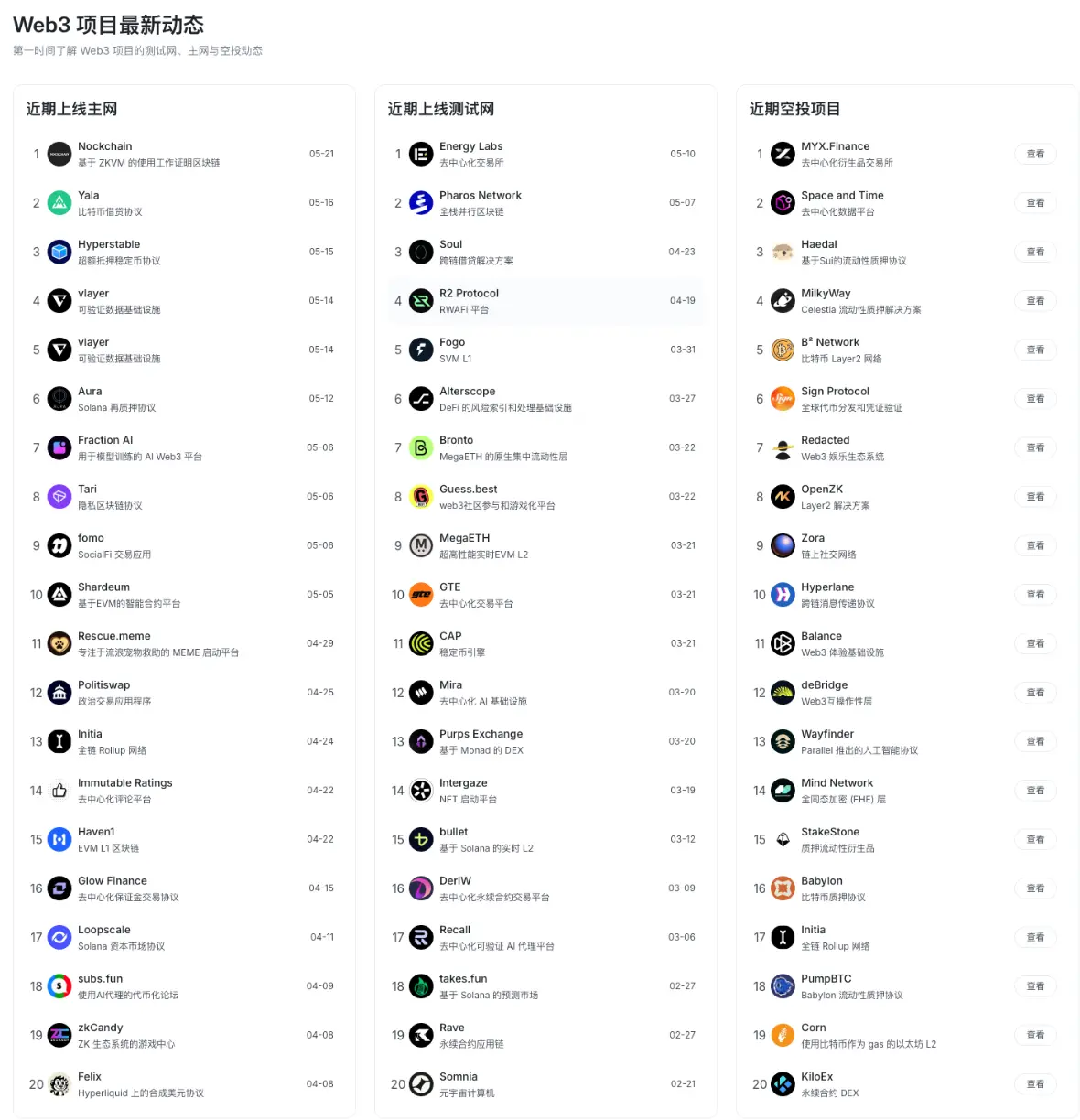

In May, RootData also recorded many events such as mainnet launches and recent airdrops for various projects, helping users understand important project dynamics in the market and grasp earlier alpha opportunities.

Notable new projects added this month include:

Long: A verifiably fair auction platform

AI-GOV: A political and media AI agency platform

The Trenches: Providing alpha and insights on leading cryptocurrency products and applications

easeflow: easeflow is a decentralized node layer for creating powerful modular infrastructure

Jirasan: Jirasan is a collection of 10,000 NFTs that provides access for members of the PG Group and Redacted ecosystem.

revealcam.fun: revealcam.fun is a socialfi application on Base designed to enable more people to monetize their creativity on-chain.

Asula: Asula builds next-generation products at the intersection of Bitcoin, blockchain infrastructure, and finance.

Raiku: Solana coordination layer

Flame: A decentralized trading protocol native to Celestia

Loud!: An information tokenization protocol based on Kaito.

Due to space limitations, for more complete and timely data information, please visit the RootData official website (https://www.rootdata.com/zh/).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。