On the road of imitation, it is crowded with latecomers.

Written by: Deep Tide TechFlow

On May 27, in the trading hall of Nasdaq, an obscure small stock created huge waves.

SharpLink Gaming (SBET), a small gambling company with a market value of only $10 million, announced it had acquired approximately 163,000 Ethereum (ETH) through a $425 million private equity investment.

Upon the news, SharpLink's stock price skyrocketed, with an increase of over 500% at one point.

Buying coins may be becoming a new wealth code for US-listed companies to boost stock prices.

The story naturally begins with MicroStrategy (now renamed Strategy, stock code MSTR), the company that first ignited the flames, boldly betting on Bitcoin as early as 2020.

In five years, it transformed from an ordinary tech company into a "pioneer of Bitcoin investment." In 2020, MicroStrategy's stock price was just over $10; by 2025, it had soared to $370, with a market value exceeding $100 billion.

Buying coins not only inflated MicroStrategy's balance sheet but also made it a darling of the capital markets.

In 2025, this trend intensified.

From tech companies to retail giants, and now to small gambling enterprises, US-listed companies are igniting a new engine of valuation with cryptocurrency.

What are the secrets behind the wealth code of increasing market value through buying coins?

MicroStrategy: The Textbook of Coin-Stock Integration

It all started with MicroStrategy.

In 2020, this enterprise software company was the first to kick off the coin-buying craze in the US stock market. CEO Michael Saylor stated that Bitcoin is "a more reliable store of value than the dollar."

While the faith recharge was exciting, what truly set this company apart was its approach in the capital markets.

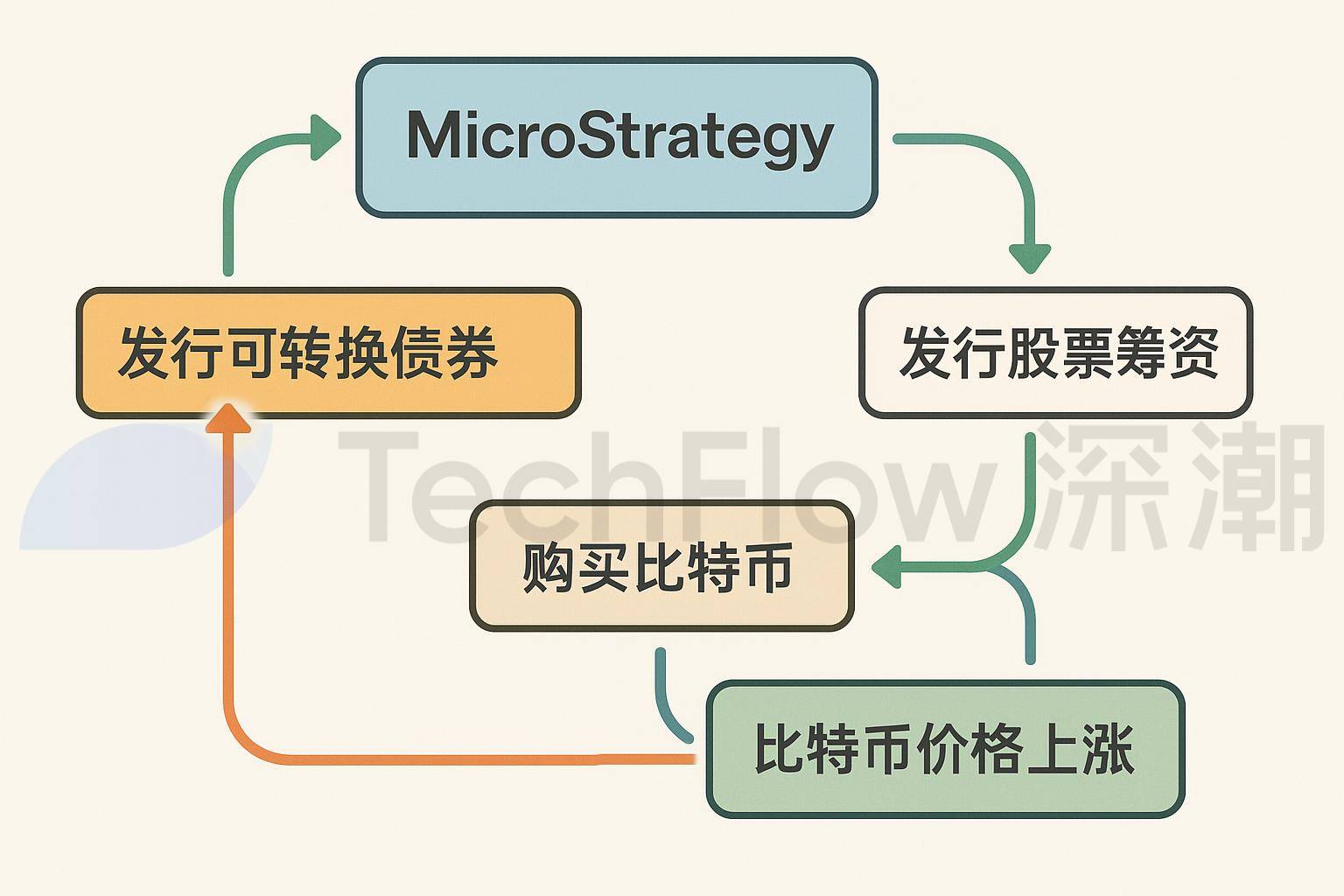

MicroStrategy's strategy can be summarized as a combination of "convertible bonds + Bitcoin":

First, the company raised funds by issuing low-interest convertible bonds.

Since 2020, MicroStrategy has issued such bonds multiple times, with interest rates as low as 0%, far below the market average. For example, in November 2024, it issued $2.6 billion in convertible bonds, with almost zero financing costs.

These bonds allow investors to convert them into company stock at a fixed price in the future, effectively giving investors a call option, while allowing the company to obtain cash at an extremely low cost.

Second, MicroStrategy invested all the raised funds into Bitcoin. Through multiple rounds of financing, it continuously increased its Bitcoin holdings, making Bitcoin a core component of the company's balance sheet.

Finally, MicroStrategy leveraged the premium effect brought by the rising Bitcoin prices to initiate a "flywheel effect."

As Bitcoin's price rose from $10,000 in 2020 to $100,000 in 2025, the company's asset value significantly increased, attracting more investors to buy its stock. The rise in stock prices allowed MicroStrategy to issue bonds or stocks again at a higher valuation, raising more funds to continue purchasing Bitcoin, thus forming a self-reinforcing capital cycle.

The core of this model lies in the combination of low-cost financing and high-return assets. By borrowing money at nearly zero cost through convertible bonds, buying volatile but bullish Bitcoin in the long term, and then amplifying valuations through market enthusiasm for cryptocurrencies.

This approach not only changed MicroStrategy's asset structure but also provided a textbook example for other US companies.

SharpLink: The Shell Game

SharpLink Gaming (SBET) optimized the above strategy, using Ethereum (ETH) instead of Bitcoin.

But behind this, there is a clever combination of the crypto world and the capital market.

Its strategy can also be summarized as "shell acquisition," focusing on leveraging the "shell" of a listed company and the crypto narrative to quickly amplify valuation bubbles.

SharpLink was originally a small company struggling on the verge of delisting from Nasdaq, with a stock price that once fell below $1 and shareholder equity of less than $2.5 million, facing immense compliance pressure.

But it had a trump card—the Nasdaq listing status.

This "shell" attracted the attention of crypto giants: ConsenSys, led by Ethereum co-founder Joe Lubin.

In May 2025, ConsenSys, along with several venture capital firms in the crypto space (such as ParaFi Capital and Pantera Capital), led the acquisition of SharpLink through a $425 million PIPE (private investment in public equity).

They issued 69.1 million new shares (at $6.15 per share), quickly taking over more than 90% of SharpLink's control, bypassing the cumbersome processes of an IPO or SPAC. Joe Lubin was appointed as the chairman of the board, and ConsenSys clearly stated it would collaborate with SharpLink to explore the "Ethereum treasury strategy."

Some say this is the ETH version of MicroStrategy, but in reality, the strategy is more sophisticated.

The true purpose of this transaction is not to improve SharpLink's gambling business, but for it to become a bridgehead for the crypto world to enter the capital market.

ConsenSys plans to use the $425 million to acquire approximately 163,000 ETH, packaging it as the "Ethereum version of MicroStrategy," and claiming ETH is a "digital reserve asset."

The capital market is about "story premium," and this narrative not only attracts speculative funds but also provides institutional investors who cannot directly hold ETH with a "public ETH proxy."

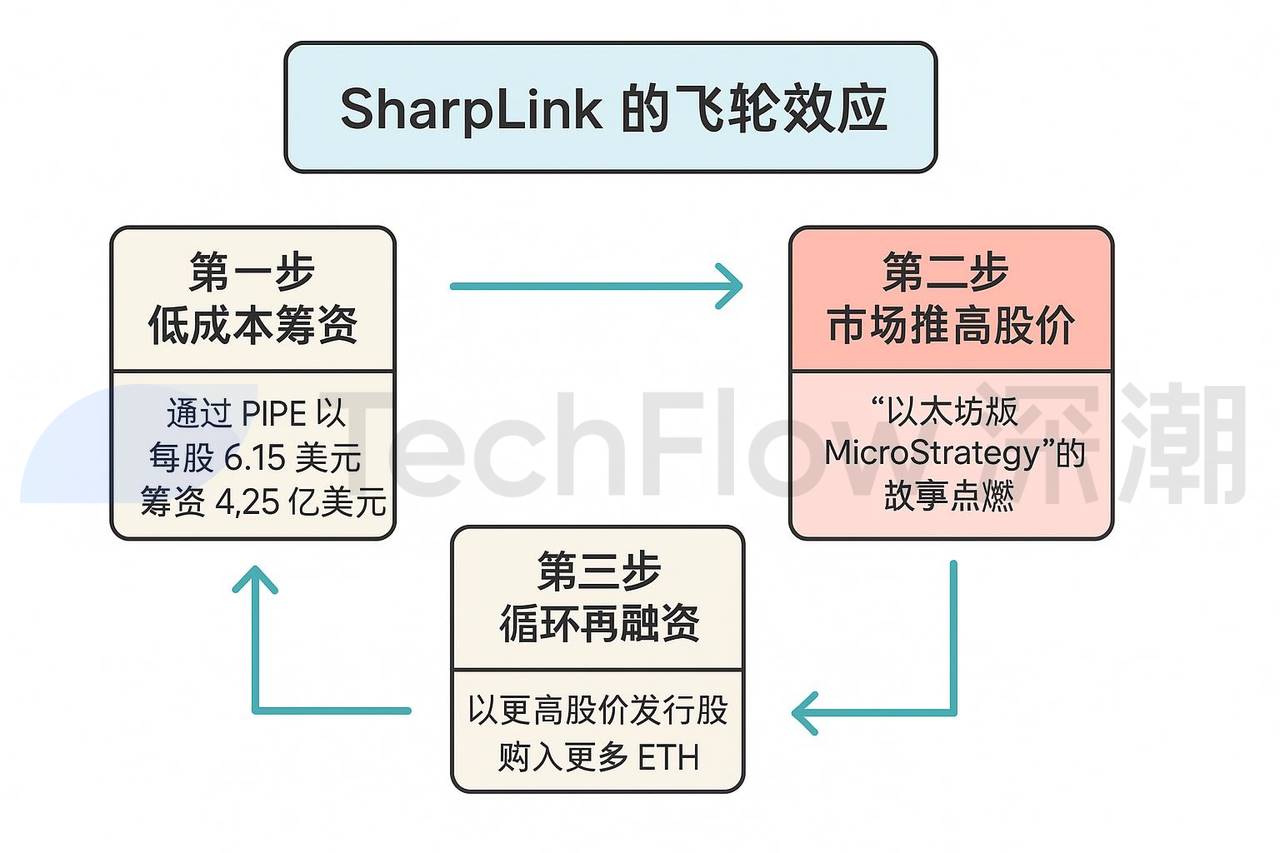

Buying coins is just the first step; SharpLink's real "magic" lies in the flywheel effect. Its operations can be broken down into a three-step cycle:

First step: low-cost fundraising.

SharpLink raised $425 million through PIPE at a price of $6.15 per share, which, compared to an IPO or SPAC, requires no cumbersome roadshows and regulatory processes, making it cheaper.

Second step: market enthusiasm drives up stock prices.

Investors are ignited by the story of the "Ethereum version of MicroStrategy," and the stock price rapidly soars. The market's enthusiasm for SharpLink's stock far exceeds its asset value, with investors willing to pay far above its net ETH holding value, creating a "psychological premium" that rapidly inflates SharpLink's market value.

SharpLink also plans to stake these ETH tokens, locking them in the Ethereum network, earning an annual yield of 3%-5%.

Third step: cyclical refinancing. By issuing stocks again at a higher price, SharpLink can theoretically raise more funds to buy more ETH, repeating the cycle and causing valuations to snowball.

Behind this "capital magic" lies the shadow of a bubble.

SharpLink's core business—gambling marketing—has almost no interest, and the $425 million ETH investment plan is completely disconnected from its fundamentals. Its stock price surge is more driven by speculative funds and the crypto narrative.

The truth is, capital from the crypto world can also quickly inflate valuation bubbles through the "shell + coin-buying" model, utilizing the shells of some small and medium-sized listed companies.

The intention is not in the wine; it is good if the listed company's business is related, but it is not important if it is not.

Imitation is not foolproof

The coin-buying strategy seems to be a "wealth code" for US-listed companies, but it is not foolproof.

On the road of imitation, it is crowded with latecomers.

On May 28, GameStop, the game retail giant that once gained fame for retail investors banding together against Wall Street, announced it would purchase 4,710 Bitcoins for $512.6 million, attempting to replicate MicroStrategy's success. However, the market reacted coldly: after the announcement, GameStop's stock price fell by 10.9%, and investors were not convinced.

On May 15, Addentax Group Corp (stock code ATXG), a Chinese textile and apparel company, announced plans to purchase 8,000 Bitcoins and Trump's TRUMP coin through the issuance of common stock. Based on the current Bitcoin price of $108,000, this purchase cost would exceed $800 million.

However, in contrast, the company's total stock market value is only about $4.5 million, meaning its theoretical coin-buying cost is over 100 times the company's market value.

Almost simultaneously, another Chinese US-listed company, Jiuzi Holdings (stock code JZXN), also joined the coin-buying craze.

The company announced plans to purchase 1,000 Bitcoins within the next year, with a cost exceeding $100 million.

Public information shows that Jiuzi Holdings is a Chinese company focused on new energy vehicle retail, established in 2019. Its retail stores are mainly located in third- and fourth-tier cities in China.

Yet, the total stock market value of this company on Nasdaq is only about $50 million.

The stock price is indeed rising, but the key is the matching of the company's market value with the coin-buying cost.

For more latecomers, if Bitcoin prices fall and they actually buy in, their balance sheets will face immense pressure.

The coin-buying strategy is not a universal wealth code. Lack of fundamental support and overly leveraged coin-buying gambles may just lead to the risk of a bubble burst.

Another way out

Despite the numerous risks, the coin-buying craze still has the potential to become the new normal.

In 2025, global inflationary pressures and expectations of dollar depreciation continue, and more companies are beginning to view Bitcoin and Ethereum as "anti-inflation assets." Japan's Metaplanet has enhanced its market value through a Bitcoin treasury strategy, while more US-listed companies are rapidly following in the footsteps of MicroStrategy.

Under this major trend, cryptocurrencies are increasingly making their presence felt in global political and economic arenas.

Is this what people in the crypto world often refer to as "breaking out"?

A comprehensive observation of current trends indicates that the paths for cryptocurrencies to break into the mainstream mainly include two: the rise of stablecoins and the crypto reserves on company balance sheets.

On the surface, stablecoins provide a stable medium for payments, savings, and remittances in the crypto market, reducing volatility and promoting widespread adoption of cryptocurrencies. However, their essence is an extension of dollar hegemony.

Taking USDC as an example, its issuer Circle has close ties with the US government and holds a large amount of US Treasury bonds as reserve assets. This not only reinforces the dollar's status as a global reserve currency but also further penetrates the influence of the US financial system into the global crypto market through the circulation of stablecoins.

The other path to breaking out is the aforementioned buying of coins by listed companies.

Coin-buying companies attract speculative funds through crypto narratives, driving up stock prices. However, aside from a few leading companies, it remains a mystery how much improvement in the fundamentals of their main businesses can be achieved by later imitators, aside from increasing market valuations.

Whether it is stablecoins or crypto assets entering company balance sheets, crypto assets appear more as a tool to extend or reinforce the existing financial landscape.

Whether it is about harvesting or financial innovation, it resembles two sides of a coin, depending on which side of the table you are sitting on.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。