U.S. Court Halts Trump Tariff Policy; Surge in BTC Whale Addresses!

Macro Interpretation: The net inflow trend of Bitcoin spot ETFs in the U.S. continues to strengthen market liquidity. As of May 28, IBIT (under BlackRock) has seen no outflows for 33 consecutive trading days, accumulating $4.09 billion, with a total management scale of $72 billion, ranking among the top five ETFs in the U.S. for inflows this year. Ethereum ETFs have also maintained eight days of net inflows ($394 million). This phenomenon indicates a significant increase in institutional investors' willingness to allocate to crypto assets, especially under a compliant framework, where the standardized attributes of ETFs enhance market trust. Notably, the increase in holdings by large investors shows a surge in the number of addresses holding 1,000-10,000 BTC, further corroborating the substantial improvement in investor confidence. Historical experience shows that such behavior typically signals upward price momentum.

Former CFTC Chairman Rostin Behnam pointed out that there is currently a legal vacuum in cryptocurrency regulation. Under existing laws, mainstream tokens like BTC are classified as commodities rather than securities, but the SEC cannot regulate the commodity market, and the CFTC can only oversee derivatives. Without granting the CFTC regulatory authority over the spot market, crypto assets will face risks of fraud and manipulation. This controversy echoes the comments of Moody's analyst Katrina Ell—while the court ruling against Trump's tariff measures alleviates short-term tensions, policy uncertainty still keeps investors on the sidelines. The ambiguity of the regulatory framework could become a catalyst for market volatility, especially during the policy window, where regulatory dynamics may directly impact capital flows.

Although crypto mining stocks (such as Riot Platforms and Clean Spark) fell due to economic concerns released in the Federal Reserve's meeting minutes, the overall market was not significantly impacted. Data shows that the value of the top 20 cryptocurrencies held in the U.S. reached $20.9 billion, with Bitcoin accounting for 97.6% ($20.4 billion), and the remainder derived from dark web transactions totaling $493 million. This data reveals the high leverage characteristics and risk exposure of crypto assets. Meanwhile, U.S. Treasury yields soared due to the tariff ruling (30-year yields surpassed 5%), the dollar index rose to 100, while BTC and gold remained flat, indicating a tug-of-war between safe-haven demand and speculative sentiment.

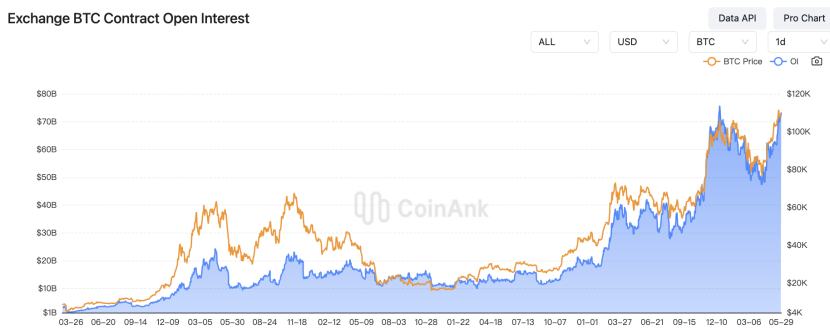

CoinAnk data shows that the open interest in BTC contracts reached a new high of $46.2 billion, increasing by $25.8 billion from historical lows, far exceeding the futures market. This phenomenon reflects a surge in market participants' demand for complex hedging tools, especially under a bullish strategy led by institutional investors, where the expansion of short positions may exacerbate short-term volatility. Additionally, the STH SOPR indicator shows that short-term investors have realized profits, but have not yet reached the previous price peak's frenzy level, indicating that the market is still within a rational range. Notably, the decline of exchanges like Coinbase (down 4.55% on May 28) contrasts with the selling pressure on mining stocks, highlighting the differentiated risks among asset classes.

The biggest variable facing the current market is the final determination of the regulatory framework. If the CFTC gains regulatory authority, the compliance of crypto assets will significantly improve, potentially attracting more institutional capital. Conversely, if regulation tightens, the market may face short-term adjustments. On a technical level, the expansion of BTC options and the increase in on-chain trading activity may provide price support. However, attention must be paid to the potential threat of illicit funds (such as from dark web transactions) to market stability. Investors should closely monitor the June Federal Reserve meeting and the final ruling on CFTC regulatory authority, as these events will profoundly impact the long-term trajectory of the crypto market.

The current crypto market is at a critical point of policy restructuring and technological iteration, with the multidimensional interaction of ETF inflows, regulatory games, criminal activities, and technical indicators collectively shaping the future path of BTC. In the short term, the market may experience a volatile upward trend driven by both policy implementation and technological breakthroughs; in the long term, the stability of the regulatory framework and the continued participation of institutional investors will need to be observed. For BTC, improvements in compliance and the refinement of technical tools will be key variables in breaking through significant resistance.

BTC Data Analysis:

CoinAnk data shows that the total open interest in BTC contracts has climbed to $64.8 billion, with the Chicago Mercantile Exchange (CME) leading with a position of $14.04 billion, an increase of over 300% from the low point of the 2024 cycle. This data far exceeds the cautious performance of the futures market during the same period—mainstream platform futures positions are still 10%-15% lower than historical peaks, and leverage usage has not reached previous highs, indicating that this round of market activity is primarily driven by spot demand. The expansion of the options market reflects the urgent need for risk management among institutional investors, especially against the backdrop of increasing divergence in long and short strategies, where a large number of call option positions coexist with short hedging positions, potentially amplifying short-term price volatility.

Market indicators convey complex signals; while the short-term holder profit ratio (STH SOPR) has not reached historical frenzy levels, the rebound in the number of active addresses on-chain and the increase in large transaction frequency indicate that capital is being repositioned. Notably, the derivatives market has shown structural differentiation—short positions in futures have risen to 45%, an increase of 12 percentage points from the 2024 bull market, reflecting an enhanced willingness among institutional investors to hedge risks at high price levels. This intensification of the long-short game, combined with record open interest in the options market, suggests that the crypto market may enter a high-volatility cycle. From a macro perspective, expectations of a shift in Federal Reserve monetary policy and geopolitical risks are driving more capital to view Bitcoin as a hedge against the traditional financial system, and this positioning may reshape the valuation logic of digital assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。