Trump Media Group Denies Raising $3 Billion to Buy Cryptocurrency, Yet Pre-Market Surges 7%! BTC Long-Term Holders Have Achieved Record Market Value!

Macro Interpretation: Today's closed-door meeting between the U.S. SEC and institutions like Nasdaq and Plume Network has released key signals: regulators are beginning to acknowledge the compliance path for public chain security tokenization. In what crypto practitioners are calling a "regulatory paradigm shift," three core proposals have emerged—Nasdaq has proposed the establishment of a new trading venue called "ATS-Digital," allowing digital assets to be listed alongside traditional commodity tokens; Plume Network is dedicated to adapting securities law provisions to the DeFi ecosystem; Etherealize is pushing for blockchain technology to gain legal status in shareholder registration systems. Although no party has challenged the SEC's principles of investor protection, the introduction of a modular regulatory framework and phased testing mechanisms marks the first systematic acceptance of the technical characteristics of the crypto market by regulators.

The warmth of regulatory thaw has not yet fully transmitted to the market, but the tidal wave of institutional funds has already stirred ripples. According to the latest data from Bank of America, a net inflow of $2.3 billion into the crypto market in a single week has set a historical peak, and BlackRock's IBIT has recorded 30 consecutive days of net inflows, highlighting the determination of traditional asset management giants to position themselves. This siphoning effect of funds is particularly evident in the derivatives market: the skew indicator for Bitcoin options has plummeted to -10%, and the implied volatility premium for call options has reached a new high since the 2021 bull market. Some market analysts warn that such extreme conditions often signal short-term correction risks, but events like Japan's Metaplanet company increasing its Bitcoin holdings by $104 million and Michigan's crypto-friendly legislation are building a solid value support.

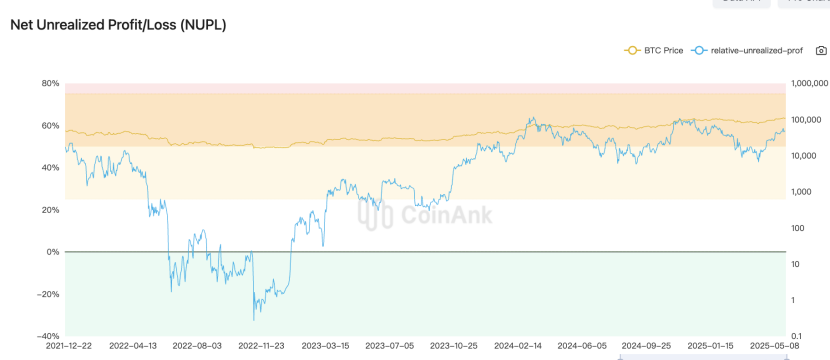

On-chain data reveals a deeper capital game. CoinAnk's data monitoring shows that 99% of Bitcoin UTXOs are in profit; this historic level of holding gains should have triggered massive sell-offs, but what has actually emerged is that long-term holders (LTH) have achieved a market value exceeding $28 billion. Amid the volatility of Bitcoin prices dropping below $109,000, short-term leveraged traders faced a wave of liquidations, while the proportion of long-term holders increased against the trend to 63.7%. This "de-retailization" trend contrasts interestingly with the divergence of miner income curves: current daily miner income remains stable at $50 million, although it has shrunk by 37.5% from historical peaks, the overall network hash rate remains stable, suggesting that the miner community is hedging volatility risks through financial instruments.

Behind the evolution of market structure, macro variables are quietly changing the rules of the game. Some altcoins experienced significant pullbacks on the eve of the core PCE data release, exposing the fragile link between crypto assets and traditional financial markets. Although the flow of funds into Nasdaq ETFs has become cautious, the average daily fund settlement of $350 million in Bitcoin spot ETFs is reshaping the asset correlation matrix. More intriguingly, the exposure of Trump Media Technology Group's $3 billion cryptocurrency investment plan, although denied, suggests that the convergence of political power and crypto capital may give rise to new dimensions of regulatory games.

At this current juncture, Bitcoin's resilience test has entered a critical phase. The Alpha report reveals that since breaking the historical high of $111,800, the market has maintained a net capital growth curve at a 45-degree angle, with the cost basis for short-term holders solidly above $95,000. This strong technical position creates a delicate balance with the $11.4 billion in unrealized profits in the derivatives market; any macro black swan could trigger a profit-taking wave. However, the on-chain chip distribution map shows that over 72% of the circulating supply is controlled by wallets holding for more than a year, significantly compressing the price downside potential due to this "diamond hands" effect.

Looking ahead to the third quarter, the crypto market may witness the ultimate showdown between bullish and bearish forces. The progress of the regulatory sandbox mechanism, the timing of the Federal Reserve's interest rate policy shift, and the policy games in the U.S. constitute three variables affecting the market. It is worth noting that the "smile curve" characteristic presented by the implied volatility surface in the options market suggests that the market has not fully priced in tail risks. For rational investors, under the backdrop of the ETF fund support effect and miner holding costs forming dual support, utilizing tools like the volatility index (DVOL) for risk hedging may offer more strategic value than mere directional bets.

As Wall Street incorporates Bitcoin into its "global liquidity barometer" observation framework, this digital asset, born just over a decade ago, is completing its transformation into a mature financial instrument. From the SEC's regulatory sandbox to Metaplanet's balance sheet revolution, from the miner hash rate game to volatility trading in the options market, the complexity of the crypto ecosystem has far exceeded the imagination of early speculators. This journey of value discovery, driven by regulatory breakthroughs, institutional entry, and on-chain games, will ultimately validate whether Bitcoin can leap from being a "belief asset" to a "reserve asset."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。