宏观解读:灰度基金最新推出的AI加密行业板块标志着加密资产分类体系的进一步细化。该板块涵盖20种资产,总市值约200亿美元,仅占加密市场总市值的0.67%,成为当前最小的细分领域。这一数据与金融板块5190亿美元形成鲜明对比,凸显出AI领域仍处于早期发展阶段。值得注意的是,该板块的扩容并非简单的资产归类,而是通过重新定义行业边界,为新兴技术应用开辟了新的估值框架。这种结构性调整可能对传统金融板块形成压力,但同时也为AI赛道的长期价值发现提供了制度空间。

与此同时,市场波动率的显著下降,全球金融市场进入"平静期",表明投资者风险偏好正在发生转变。美国国债收益率在"漂亮法案"引发的财政担忧后回落至4.5%以下,日本10年期国债收益率也降至3%以下,但仍未脱离历史高位。这种"低波动高利率"的组合特征,客观上为加密资产提供了避险属性的支撑,但同时也考验着市场对新兴资产的定价能力。

特朗普政府的加密货币政策动向成为近期市场关注的焦点。白宫AI与加密货币顾问David Sacks透露,若能以"预算中立"方式获得资金,政府可能通过商务部长或财政部长渠道购买更多比特币。这一表态虽未形成具体方案,但其潜在信号意义不容忽视,当政治人物将加密资产纳入其政策议程时,往往预示着监管框架的实质性调整。正如贝莱德高管在Bitcoin 2025大会上提出的2%比特币配置建议,专业机构的配置决策正在加速与政策导向的同步。

然而,政策红利的兑现仍需时间。CFTC主席候选人Brian Quintenz的加密资产申报340万美元揭示了监管机构与市场参与者之间的微妙平衡。其在政府道德办公室的资产申报要求(90天内剥离加密资产、两年内回避a16z事务)实际上为监管套利设定了明确边界。这种"监管-市场"的动态博弈,既可能推动合规化进程,也可能因政策不确定性而引发短期波动。

波场TRON创始人孙宇晨在Bitcoin 2025大会上的观点极具前瞻性。他指出,WBTC作为比特币的"智能合约入口",正在重塑区块链金融的底层逻辑。通过将比特币引入以太坊、波场等公链,WBTC不仅解决了流动性问题,更通过"储备证明"机制确保了资产安全。这种技术突破的意义在于,它将比特币从单纯的支付工具升级为可编程资产,为DeFi生态的繁荣提供了基础设施。据测算,WBTC的链上交易透明度已达到98.7%,其安全系数与传统金融资产的差距正在缩小。

值得注意的是,这种技术演进与市场情绪形成正向循环。当更多机构通过WBTC参与DeFi套利时,链上交易量的激增又反过来推动了BTC的流动性溢价。这种"技术-市场"的良性互动,使得比特币在保持价格稳定的同时,获得了更广泛的金融应用场景。

CoinAnk最新数据显示,自4月低点以来,比特币期货未平仓合约激增,尽管Solana等其他链的热度有所回落,但BTC的持仓量持续扩张。这种"风险偏好"与"避险"双重属性的体现,使得BTC在市场震荡中展现出独特的抗跌性。然而,当前合约持仓量的边际放缓(趋于平稳)可能预示着交易者正在完成获利了结,为后续的结构性配置预留空间。这种"多空博弈"的市场状态,既考验着机构投资者的配置耐心,也考验着散户投资者的择时能力。

当前加密市场的核心矛盾正在从"叙事驱动"转向"实质验证"。当WBTC等技术解决方案开始兑现价值时,当政府购买比特币的可行性方案逐步清晰时,市场对BTC的长期叙事将从"炒作"转向"基建"。这种转变需要时间,但正如孙宇晨所言,"永远不要做空比特币"的行业共识正在形成。未来,随着更多国家的监管框架趋同,BTC有望在全球金融体系中扮演更核心的角色。

然而,挑战依然存在。CFTC监管框架的不确定性、地缘政治风险的反复、以及传统金融体系的惯性,都可能成为市场波动的催化剂。投资者需保持清醒认知:加密货币的长期价值在于其技术革新能力,而短期波动则源于市场情绪的周期性。唯有在理解底层逻辑的基础上,才能把握住这场正在发生的金融革命。

加密市场呈现出"技术突破-政策催化-市场验证"的三重驱动模式。BTC作为这场变革的核心载体,既受益于技术进步带来的流动性提升,也直接受益于政策环境的优化。但真正的价值创造,仍需在去中心化与中心化监管的平衡中寻找答案。对于投资者而言,关键在于把握"技术落地"与"政策落地"的双重节奏,在波动中寻找确定性。

BTC数据分析:

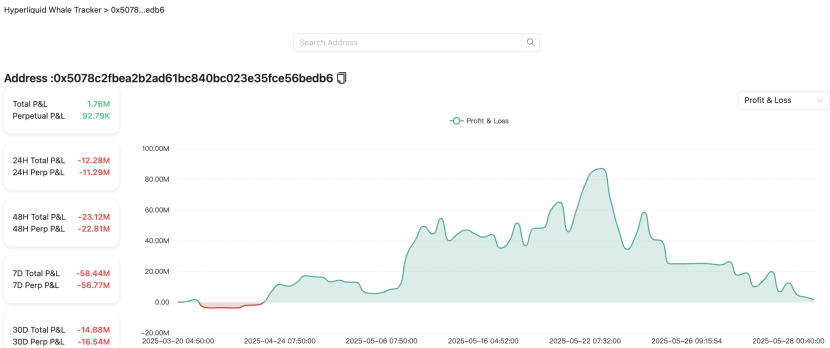

CoinAnk链上数据显示,根据Hyperliquid鲸鱼数据实时统计,截止2025年5月28日,知名交易员James Wynn的BTC多头仓位显示其40倍杠杆操作已出现显著波动。当前其持仓为4,792枚BTC,价值5.2亿美元,开仓价109,782美元,清算价107,419美元,剩余利润约300万美元。对比5天前的8,700万美元利润,期间因高频高杠杆交易损失约8,400万美元,反映出其仓位调整策略的高风险性。

值得注意的是,此前5月27日其曾通过加仓至7.9亿美元(7,227枚BTC)试图扩大收益,但随后因价格下跌被迫减仓至5,782枚,浮亏达2038万美元。这种频繁的仓位增减与高杠杆操作,不仅加剧了市场波动性,也凸显了加密市场对巨鲸级交易者的敏感性。当大额多空头寸频繁介入时,可能引发连锁爆仓风险,例如5月25日其12亿美元多仓单次亏损1339万美元,尽管整体仍盈利845万美元,但短期资金压力已显现。此类行为可能进一步推高市场波动率,促使散户投资者调整策略,同时对主流币种如BTC的短期价格形成扰动。对此类高杠杆操作的潜在风险也需持续关注,以防范系统性风险。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。